Pros

Excellent sign-up bonus

Great airport and in-flight benefits

Solid partner hotel benefits

Cons

Has a $95 annual fee after the first year

Slow mile earnings for infrequent travelers

No redemption bonus

The information related to the Chase United Explorer Card has been collected by Money Crashers and has not been reviewed or provided by the issuer of this card.

The United Explorer Card from Chase is an airline credit card with a $95 annual fee after a fee-free first year. It earns an unlimited 2 United MileagePlus miles per $1 spent on all United Airlines airfare purchases, purchases at hotels, and restaurant purchases, and an unlimited 1 mile for every $1 spent on everything else. Miles can be redeemed for United Airlines airfare with no blackout dates, seat restrictions, or other limitations.

The Explorer card’s biggest competitors are other airline rewards credit cards, such as the Chase British Airways Visa Signature Credit Card, Gold Delta SkyMiles Credit Card from American Express, and Citi AAdvantage Platinum Select Mastercard. It’s also comparable to general-purpose travel rewards cards, such as Capital One Venture Rewards Credit Card, though those cards tend to have more versatile reward redemption options.

Want to learn more? Find out how this card — which boasts the latest contactless tap-to-pay tech — can get you a free United flight faster than you ever thought possible.

How the United Explorer Card Stacks Up

The United Explorer Card is a solid entry-level airline credit card with a reasonable annual fee and a rewards program built with frequent travelers in mind. (And, specifically, United loyalists.)

Is it the right airline card for you? Let’s see how it stacks up against a more generous option for frequent United flyers: the United Club Infinite Credit Card.

| United Explorer Card | United Club Infinite Credit Card |

| $95 annual fee after the first year | $525 annual fee |

| Two free United Club passes every year — up to $100 value | Complimentary United Club membership (airport lounge access) every year — $650 value |

| 2x miles on eligible United purchases | 4x miles on eligible United purchases |

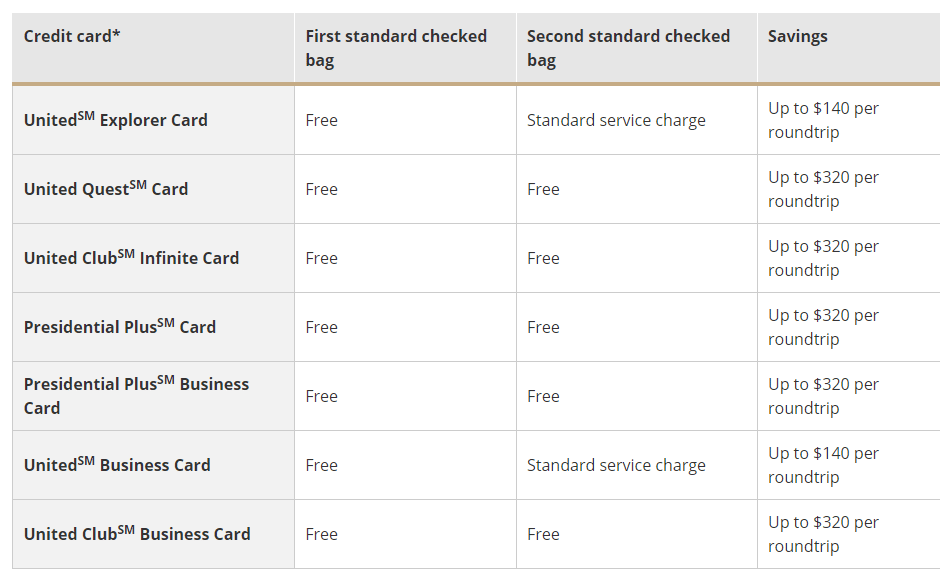

| Free first checked bag — up to $140 value per fare | Free first and second checked bag — up to $320 value per fare |

Key Features of the Chase United Explorer Card

What can you expect from the United Explorer Card? Look for a solid sign-up bonus, a nice rewards program that (no surprise) favors United Airlines purchases, and some potentially valuable perks for frequent United flyers.

Sign-up Bonus

Earn 60,000 bonus miles when you spend at least $3,000 on purchases in the first 3 months from account opening.See terms for important restrictions and limitations.

Airline Rewards & Redemption

Every $1 you spend with United Airlines earns 2 miles, with no caps or restrictions. Purchases of hotel accommodations made directly with the hotel and restaurant purchases also earn 2 miles per $1 spent. All other purchases earn an unlimited 1 mile per $1 spent. There’s no limit to the number of miles you can accumulate, and miles never expire as long as your account is open.

The best way to redeem accumulated miles for United Airlines airfare. The number of miles needed to redeem for full award flights depends on the underlying dollar cost of the fare, which is itself a function of origin and destination airports, fare class, refundability, and other factors. You can also redeem for partial award flights (discounts to full fare).

Travel Benefits

The United Explorer card comes with a raft of travel benefits. These include:

- Free first checked bag for the primary cardholder when you use your card to purchase the ticket (save up to $140 per fare)

- 25% back on eligible in-flight purchases with your card

- Complimentary Premier upgrades (where available) when the primary cardholder has United Premier status and is traveling on an award flight

- Priority boarding prior to general boarding

- 2 complimentary United Club airport lounge passes per year (a $100 value)

- Complimentary room upgrades when available, free breakfast, and extended check-in/check-out hours at more than 1,000 partner hotels worldwide in the Luxury Hotel & Resort Collection

- Access to exclusive or VIP events, such as private cooking classes and musical performances

- Up to $100 back as a statement credit on your TSA PreCheck or Global Entry application fee (once every four years)

Travel and Purchase Benefits

This card has a nice lineup of travel and purchase benefits. They’re included at no extra charge, though some require out of pocket spending if and when they’re invoked:

- Lost luggage reimbursement up to $3,000 per passenger

- Baggage delay insurance up to $100 per day for three days

- Trip cancellation and trip interruption coverage up to $1,500 per person and $6,000 per trip

- Auto rental collision damage waiver (complimentary rental car insurance, subject to conditions)

- Trip delay insurance up to $500 per ticket

- Purchase protection against damage or theft for 120 days up to $10,000 per claim and $50,000 per year

- Extended warranties on certain eligible items purchased with the card

Important Fees

The $95 annual fee is waived for the first year. There is never a foreign transaction fee. Balance transfers cost the greater of $5 or 5% and cash advances cost the greater of $10 or 5%.

Credit Required

United Explorer requires excellent credit. Any credit blemishes of note are likely to be disqualifying.

Advantages of the United Explorer Card

The United Explorer Card has a lot going for it, from a strong sign-up bonus to a slew of airport and in-flight benefits. Are they worth the $95 annual fee after the first year?

- Attainable, Valuable Sign-up Bonus. The Explorer card has an attainable, valuable sign-up bonus when you exceed a reasonable spending threshold in the first 3 months. The total value of this combined bonus depends on the dollar value of the flights the accumulated miles are redeemed for, but it can reliably rise to $1,000.

- Airport and In-Flight Benefits. The Explorer card has a nice lineup of benefits and perks that reduce the cost and stress associated with airline travel: two complimentary United Club lounge passes per year, first checked bag free (up to $100 value, round-trip), priority boarding, and the ability to choose any seat in your selected fare class. Capital One Venture Rewards and the American Express Gold Card don’t offer priority boarding, complimentary lounge access, or free checked bags.

- Benefits at Partner Hotels. The Explorer card has some nice hotel benefits, including extended-hours check-in and check-out, complimentary room upgrades whenever available, free breakfast, and location-specific perks such as free or discounted spa services. The American Express Gold Card doesn’t offer anything similar.

- Miles Never Expire. As long as your account remains open and in good standing, the MileagePlus miles you accumulate with this card never expire. Many airline and hotel rewards credit cards require you to earn or redeem points at least once per year to keep them from winking out of existence.

- No Foreign Transaction Fees. This card doesn’t charge extra for foreign transactions – great news for frequent overseas (or north- and south-of-the-border) travelers. Citi Hilton Honors Visa Signature and Citi Expedia+, both popular travel rewards cards, charge 3% foreign transaction fees.

Disadvantages of the United Explorer Card

This card isn’t perfect. The annual fee is an issue, as is the slow mile-accumulation pace for infrequent travelers.

- Comes With an Annual Fee. After the first year, the United Explorer Card carries a $95 annual fee. This is higher than some other comparable airline and travel rewards cards.

- Miles Accumulate Slowly for Infrequent Travelers. The Explorer card earns 1 mile per $1 spent on most purchases, excepting restaurant, hotel, and United Airlines purchases. If you don’t purchase United airfare very often, you’re not going to accumulate miles at a breakneck pace. For faster points accumulation on a wider range of spending categories, look to the Chase Sapphire Preferred Card, which earns up to 5 total points per $1 spent on eligible purchases and offers one-to-one points transfer to several frequent flyer programs (including United Airlines).

- Inflexible Redemption Options. You can only redeem your accumulated MileagePlus miles for United Airlines airfare purchased direct with the airline. This isn’t a problem if you live near a United hub and regularly fly with the airline, but it’s a drag if you prefer a more expansive menu of redemption options. The U.S. Bank FlexPerks Travel Rewards card lets you redeem for cash equivalents, such as gift cards and statement credits.

- No Redemption Rebate. The Explorer card doesn’t give you a rebate when you redeem your accumulated miles for airfare. Many other travel rewards cards, including Citi AAdvantage Platinum Select Mastercard (10% redemption bonus), offer this extra show of gratitude.

Final Word

The United Explorer Card is one of many airline-specific credit cards. Just about every major U.S. carrier, from Alaska Airlines and Southwest Airlines, to American and Delta, has at least one rewards card that rewards loyalty with accelerated miles accumulation on airfare and/or in-flight purchases.

Since it’s not practical to apply for and use every single airline-specific rewards card out there, you need to give some thought to which card is the best fit for your particular situation. This consideration usually comes down to your spending patterns, how you prefer to redeem your rewards, and whether you live close enough to an airline or partner hub to take full advantage of the rewards program.

Pros

Excellent sign-up bonus

Great airport and in-flight benefits

Solid partner hotel benefits

Cons

Has a $95 annual fee after the first year

Slow mile earnings for infrequent travelers

No redemption bonus