If you’ve made any big purchases in your life – including a car or a house – you know all too well the importance of having a good credit score. Or perhaps you’ve even experienced the negative effects of a bad credit score.

Unfortunately, there are far too many companies that want to charge you money to find out what your credit score is and help you improve it. While I remain steadfast in the fact that I absolutely refuse to pay for what I believe I have a right to know, these companies continue to prey on those who are unaware of the channels available to them to obtain this information.

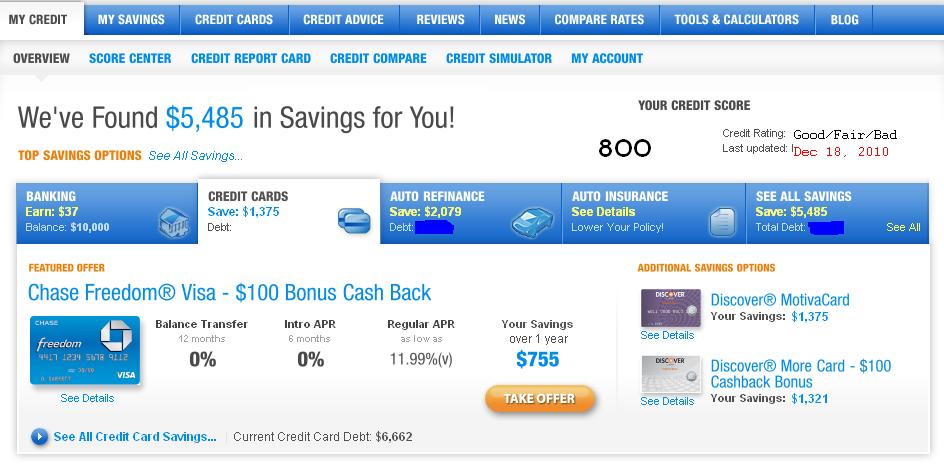

That’s why I like Credit Karma, a website dedicated to helping you maintain a good credit score for free. It allows you 24/7 access to your VantageScore 3.0 from Equifax and TransUnion, as well as your Equifax credit report. You can choose from credit card, auto refinance, auto insurance, banking, mortgage, and personal loan offers that are intended to help you save and improve your credit score. There is also a blog, a discussion forum, and a tools & calculators section to help with all of your financial questions.

How It Works

First off, Credit Karma is 100% free to use. Setting up an account requires minimal personal information, and using their service will not affect your credit score one bit. Once logged in, you will be able to update your credit score, view prior scores (for as long as you have had an account), explore offers designed to improve your credit, and review personalized recommendations just for you.

Useful Features

1. Credit Scores

Credit Karma provides VantageScore 3.0 credit scores from Equifax and TransUnion, two of the three major consumer credit reporting bureaus.

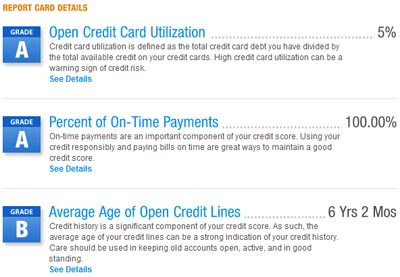

2. Credit Report Card

The report card is a newer feature at Credit Karma that I absolutely love. The report card is divided into multiple sections that include an overall grade, utilization of open credit cards, percentage of on-time payments, average age of open credit lines, total accounts, hard credit inquiries, total debt, and debt-to-income ratio. If you can’t get your actual credit reports, the credit report card at Credit Karma is easily the next best thing.

3. Credit Compare

The credit compare tool allows you to view your profile, compared to other Credit Karma users, others in your home state, others in your age range, and even by those who use the same e-mail domain that you do. This feature is really just to show how you do compared to most of the public, but beware, the credit comparisons may just surprise you!

4. Credit Score Simulator

Of all Credit Karma’s improvements over the past few years, this one is my favorite. The score simulator allows you to see an estimate of what will happen to your score if you get a new card (e.g. Discover More credit card), a new loan, have more credit inquiries, increase a credit line, transfer balances to a new card, or close your oldest account. This is a great tool to see first hand what hurts and affects your credit score.

Drawbacks to Using Credit Karma

Even if Credit Karma were a pay service, I’m not sure I would stop visiting there. The fact that they provide all of these services at no cost is just the icing on the cake. That said, I have four issues with the service.

1. No Comprehensive Credit Scores

VantageScore 3.0 is a great resource to understand your credit, but should not be the only information you rely on for that purpose. It is not intended to replace the scores offered by each of the three major credit reporting agencies, as these scores may contain different information that may require attention.

2. Potential Inaccuracies

I have seen a few complaints about scores and information being inaccurate at Credit Karma. The bottom line is, Credit Karma obtains information from TransUnion, so if there are any discrepancies, you will probably have to take it up with the reporting agencies directly.

3. Protection of Personal Information

I realize that many people are wary about giving personal information to a third party, and rightfully so. I can only speak of my own experience with Credit Karma, but I have never had any issues whatsoever. They do not send spam emails nor do they send junk mail to your house (i.e. they do not sell your information). All in all, you will have to weigh the benefits and risks, and decide whether this service will offer enough for you to provide your personal information. For me, this service provides too much valuable information for me to ignore.

Final Word

Credit Karma will not serve as a replacement for your credit report. Because they cannot provide you with account history, payment history, and the in-depth information that is contained within your credit report, it is still your financial responsibility to obtain your credit report, which you can get for FREE at AnnualCreditReport.com.

But even though it won’t replace a credit report, I still highly recommend Credit Karma. If you do plan to open an account, use it as a tool to help improve your credit score rating. I have had an account with them for a few years now, and while I can’t definitively say that Credit Karma is responsible for my financial improvement over the past few years, it certainly didn’t hurt. Try it for yourself and let us know what you think.

What have your experiences with Credit Karma been like? What are your favorite features that are most useful to you?