Even if you’re an expert on something, it’s always nice to get a second opinion. When it comes to money, getting help is especially important. A financial advisor can help you build a budget, plan for retirement, save for a goal like buying a house, or just give you an assurance that you’re on the right path.

However, choosing the right financial advisor can be incredibly difficult. You have to consider your own needs and how an advisor can help you reach them, then make sure that the advisor you choose meshes with your personality.

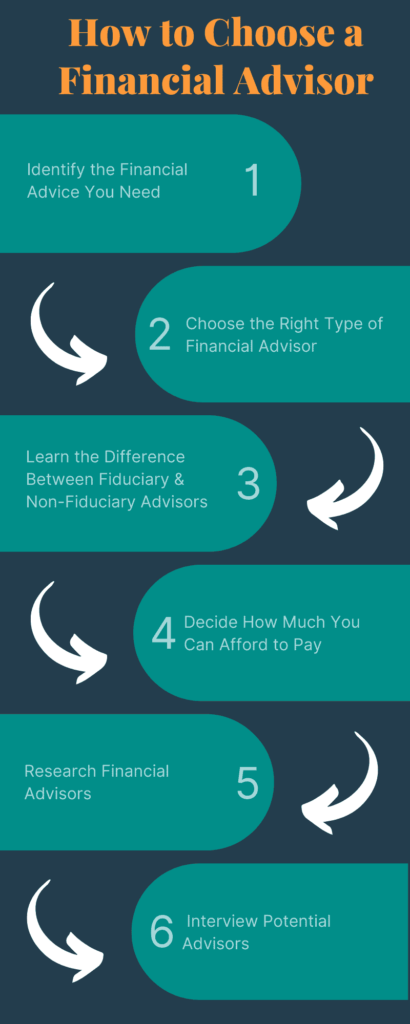

How to Choose a Financial Advisor

Your relationship with your financial advisor should last for the long haul. At least, you should start with the expectation that it will.

Your advisor should be able to help you plan for important life events like buying a home, having children, and retiring on your own terms. Ideally, you’ll work together over the course of years or decades to reach your goals.

That makes choosing a financial advisor very important. Follow these steps to find the best advisor for your needs.

1. Identify the Financial Advice You Need

The first thing you need to do when choosing a financial advisor is to figure out the type of financial planning and advice that you need. Different advisors have different skill sets and services.

Think about your goals and why you’re looking for advice. If you’re thinking mainly about retirement, you’ll want to work with someone who has experience with retirement planning. If your financial goals are more short-term, such as buying a home, you’ll want a different type of advice. You might even be looking for immediate personal finance advice such as how to build a budget rather than investment management services.

Or you might have a bunch of different goals — some near-term, some long-term, some in-between. Whatever your goals and time horizon, identifying the financial advice you need and your goals gets the process off on the right foot.

2. Choose the Right Type of Financial Advisor

Once you know what type of guidance you need, you’re ready to start thinking about the type of financial advisor you should work with. There are many different types of advisors and professional designations out there.

For example, certified financial planners (CFPs) have received a professional designation that shows their ability to offer long-term financial planning for their clients. They have to abide by rules and regulations determined by the CFP board.

On the other hand, registered investment advisors (RIAs) provide a variety of financial advice but are often more focused on investing and wealth management services.

Many financial advisors have multiple professional designations, which means they can help with multiple facets of your financial life. If you work with a larger financial firm, you’ll likely have access to several different types of advisors.

If you simply want someone who can manage your investment portfolio for you, that will require a different type of financial advisor than one that offers estate planning and tax services.

3. Learn the Difference Between Fiduciary & Non-Fiduciary Advisors

One of the most important things to know about a financial advisor is whether they are a fiduciary or not.

If an advisor is held to a fiduciary standard to you, that means that they must act explicitly and solely in your best interest. They cannot make recommendations based on factors other than your benefit, such as whether an investment they recommend will earn them a commission.

On the other hand, non-fiduciary advisors are held to a lower standard known as the suitability standard. They must make recommendations that are suitable for your needs, but they’re also allowed to consider other factors and can act in their own self-interest by recommending products that earn them sales commissions.

It’s not hard to see how the suitability standard creates conflicts of interest. If a non-fiduciary advisor recommends a financial product that earns them a commission over a superior product that doesn’t, are they really doing right by you?

In general, you should always ask an advisor if they are a fiduciary to see how they answer. Some professional designations, such as RIA and CFP, require that the holder always act as a fiduciary to their clients.

All else being equal, choose a fiduciary advisor over a non-fiduciary advisor. You can be more certain that their recommendations are in your best interest.

4. Decide How Much You Can Afford to Pay

Nothing in life comes free and financial advice is much the same. You’ll need to think about how much you can pay financial professionals for the help they provide.

Different advisors use different fee structures. Some operate solely on a commission basis, earning money based on selling financial products like life insurance or annuities to you. There are also advisors that charge an annual fee that is either a flat fee or based on a percentage of your invested assets.

Others charge an hourly rate, especially if you’re looking for help with reviewing specific investment products or financial decisions you want to make.

Ask any advisor you’re thinking about working with for a copy of their fee schedule. Also, ask about the various income streams they receive to make sure they’re not selling products that earn them commissions or kickbacks, even if they’re technically a fiduciary.

Before you choose who to work with, think about your budget and make sure you can afford any advisor fees that you’ll have to pay. Keep in mind that even seemingly small fees can have a big impact on your overall returns.

5. Research Financial Advisors

Researching financial advisors is important because you’ll be trusting them with your money and making sure it is managed properly.

Many people find an advisor through a recommendation from a friend or colleague. A recommendation can give you insight into how the advisor works and gives you a good reference for the quality of their work.

Still, you should always do your own due diligence on every would-be advisor, no matter how highly others speak of them. Start with BrokerCheck, a free advisor database maintained by the Financial Industry Regulatory Authority (FINRA). BrokerCheck advisor listings include their professional designations, work history, financial licenses, and any regulatory or disciplinary action taken against them.

XY Planning Network is another good source for advisors that act as fiduciaries. It doesn’t vet advisors as heavily as BrokerCheck, but it’s a good place to find independent advisors you probably wouldn’t have heard about otherwise.

You might also consider working with a robo-advisor. These are programs that manage your investments for you. They base their investment strategy on your goals and risk tolerance, typically constructing a portfolio for you by using low-cost mutual funds and ETFs.

However, many robo-advisors don’t have any human component and don’t offer customized financial planning services. If you want that human touch or have really complex financial needs, choose a robo-advisor that employs human financial planners or stick with an independent human advisor.

6. Interview Potential Advisors

Before you commit to working with a financial advisor, interview a few potential candidates.

You want to make sure that you find a good financial advisor who meshes with your personality and who understands your goals. The last thing that you want is to work with someone who prioritizes different aspects of your financial life than you do or has a fundamentally different investing philosophy than you.

You should feel comfortable asking potential financial advisors about their philosophy for helping people reach their goals, whether they offer comprehensive financial planning or more focused services, and any other questions that you may have about how they operate.

Final Word

Choosing the right financial advisor for your needs is incredibly important. Consider your needs, think about the type of professional who could help you, try to find one who follows the fiduciary standard, consider their fee structure, and talk to them to make sure they’re a good fit.

By following this process, you give yourself a good chance of finding an advisor you can stick with for the long term. And once you’ve found that advisor, you’ll be ready to tackle long-term financial goals like saving for retirement or growing your kids’ college fund.