Expert investors dive deep into technical analysis, looking for that perfect predictor of market turns. But most of us don’t have a Ph.D. in economics and simply look for maximum returns with minimum time spent.

The good news: You can earn strong returns with a completely automated investment strategy.

The bad news: Your emotions fight you tooth and nail along the way, damaging your returns if you surrender to them.

A 2018 study published in the Journal of Financial Planning found that investors who use a behavior-modified approach to investing that removed emotion saw returns up to 23% higher over 10 years. Yet with more adults responsible for their own retirement planning than ever before, self-managed investing has become a critical life skill.

That means we all need to learn how to manage our financial emotions if we ever hope to retire.

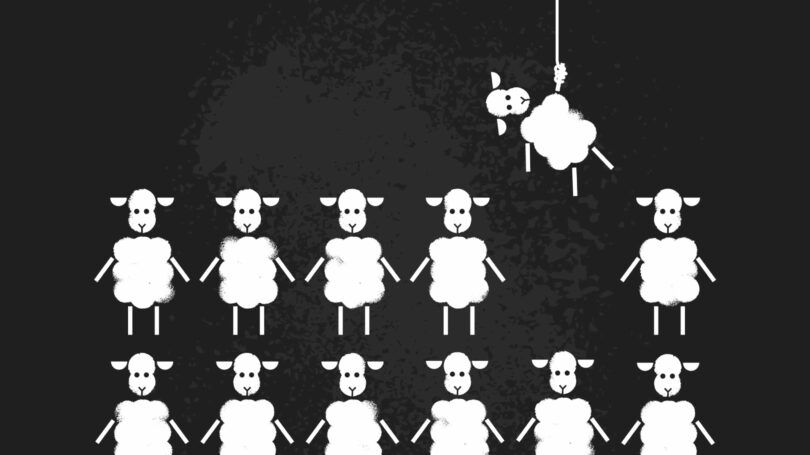

Resisting Herd Psychology

You know the old trope: buy low and sell high. But apply logic to that for a moment: to do so successfully, it means buying when the herd is selling (driving prices lower), and selling when the herd is exuberant (driving prices higher).

Warren Buffett put it elegantly: “Be fearful when others are greedy, and greedy when others are fearful.”

Easier said than done. As herd animals, humans mirror the emotional response of the crowd. It served us on the savannah — when the alarm went up about an incoming predator, communal fear kept all members of the community alive. But as with so many vestigial impulses, it doesn’t serve us today, at least not in investing.

The first step to separating emotions from your investments simply involves recognizing the decision-making risk. Acknowledge that you are a herd animal, like all of us, and therefore subject to powerful emotional impulses based on those around you. Then acknowledge that those emotions and biases push you in the opposite direction of sound investing principles.

Emotions That Negatively Impact Sound Investing

In both winning and losing years for stocks, the average investor earns lower returns than the stock market at large.

They underperform because they sell during downturns and only buy after financial markets show a strong recent history of gains rather than investing consistently for the long term.

That’s emotional investing. Three primary emotions negatively impact your returns: fear, greed, and frustration or impatience.

Fear

Consider an analysis of 2018 returns by Dalbar. In 2018, the S&P 500 lost 4.38%. The financial analytics firm found that the average individual investor lost more than double that, at 9.42%. They lost money because they panic-sold when the market declined — they sold low.

For another illustration, look at a memorable buying opportunity in living memory: the March lows of 2009. That trough offered investors an incredible opportunity to buy shares of large household names for pennies on the dollar.

Companies like Bank of America, General Electric, and Wells Fargo were all trading in the single digits. Many of these companies went on to grow 500% or more over the following years.

Yet fear pushed many middle-class workers out of stocks entirely. Nearly two-thirds (63%) of Americans owned stocks in some form — including employer-sponsored plans like 401(k)s or SIMPLE IRAs — in the mid-2000s, according to a 2019 Gallup poll. After the Great Recession, that number dropped to roughly half of Americans.

Those who shied away from stocks missed out on the longest bull market in history, from 2009 to 2020. They let their fear and loss aversion get in the way of building wealth.

In contrast, the wealthy continued participating in the stock market. The wealthy think differently about money, and they leave their money invested long-term rather than panic-selling.

Fear is the enemy of investing because it keeps you from taking advantage of rare “fire sale” opportunities. The best time to invest in an asset is when the herd panics and prices plummet.

Greed

The same logic applies to the buying side of the equation. Too many would-be investors sit on the sidelines in the early stages of market upturns out of fear then start seeing dollar signs as they watch the stock market climb.

After waiting for a track record of growth before they feel comfortable investing, suddenly, they see those gains and want in on it.

But by the time they witness enough growth to feel green with envy and greed, much of the bull market may have passed entirely. In fact, the best weeks and months of a recovery tend to be the first ones.

In the first month after the S&P 500’s low in October 2002, it rose 15.1%. After the S&P 500’s low in March 2009, it leaped 26.6% over the next month.

Investors who waited for greed to drive them into the market missed out on much of the recovery.

In good markets and bad, the average investor underperforms the market itself. In the 20 years from 1996 to 2015, the S&P 500 generated an annualized return of 9.85%. Yet Dalbar found that the average investor earned roughly half that: 5.19%.

There’s an old saying on Wall Street that “bears make money, bulls make money, and pigs get slaughtered.” “Pigs” are the wafflers, the investors who invest based on the emotion of the herd.

Frustration or Impatience

Have you ever sold an investment because you felt frustrated by its performance only to see it surge after you did?

Anger and frustration can make you dump fundamentally sound investments just because you get tired of waiting for them to show progress. Yet overreacting in frustration and impatience often robs you of your best investments and ideas.

Granted, sometimes, new information comes to light that changes your fundamental analysis. By all means, stay flexible and don’t cling to bad investments out of stubbornness.

But if the fundamentals for an investment remain sound, don’t dump it just because other investors haven’t noticed it yet.

Always remain calm in investing and business. As long as your underlying thesis for your investment hasn’t changed, neither should your emotions.

Strategies for Avoiding Emotional Investing & Maximizing Returns

Intellectually, you get it: Emotion hurts your returns. But that doesn’t make it easy to resist those emotions while in the grip of a stock market correction or bear market.

Avoiding emotional investor behavior starts with a mindset shift. You must stop thinking of your investments as short-term assets and stop dwelling on the daily fluctuations in your net worth.

Your investments, particularly stocks and mutual funds, will rise and fall, but in the long term, stock and real estate markets have always risen in value.

Take a long-term view of your wealth. Don’t think in terms of “I lost $20,000 in my stock portfolio today.” Think in terms of long-term averages and your long-term financial and lifestyle goals.

Use strategies like dollar-cost averaging and wide diversification to help divorce your investments from your emotions.

Take steps to automate your savings, and then automate your investments with robo-advisors. They not only invest based on best practices but also automatically rebalance your portfolio.

For more details and ideas, read up on these ways to prevent emotional investing.

Final Word

Emotion has no place in your investment decision-making process.

Data ranging from the 2018 Journal of Financial Planning study to the reports by Dalbar reinforce what investment advisors have been telling us all along. Check your emotions at the door before making any financial decisions, much less major ones involving thousands of dollars in assets.

Form an investing strategy based on your own unique financial goals and needs. Then automate it to continue operating regardless of the herd mentality and investor sentiment of the moment.