The No. 1 key to building wealth is your savings rate. Your savings rate is the percentage of your income that you save, invest, or put toward debts. The higher your savings rate, the faster you build wealth. Sure, it’d be nice to earn $300,000 per year. But if you spend $300,000 in that same year, you’re no wealthier at the end of the year than when you started.

Unfortunately, schools don’t teach budgeting, personal finance, or investing. They don’t prepare us for managing our money and building wealth. And this knowledge is more important now than ever. Pensions have largely disappeared, and retirement has fundamentally changed. Today, Americans are increasingly on their own to plan their retirement and manage things like asset allocation, sequence of returns risk, and safe withdrawal rates. There’s no cavalry coming, no bailouts, and no freebies.

And while we all know we should save more money, most of us still struggle with it. No one likes feeling like they need to sacrifice month in and month out. And discipline fails all of us sooner or later. White-knuckling your savings just doesn’t work, at least not for long.

So stop relying on discipline to save. Instead, try these ways to trick yourself into saving money.

Money Tricks to Save More Money

Some of these tricks involve automation, others rely on fundamental human psychology, but all serve the same purpose: growing your wealth without feeling like you’re living in austerity.

1. Increase 401(k) Deductions From Your Paycheck

If you never see it, you never miss it, and you aren’t tempted to spend it.

Ask your company’s HR department to increase the 401(k) or 403(b) contributions automatically deducted from your paycheck. You’ll not only reduce your taxable income and save on taxes, but you’ll also build wealth on autopilot without even noticing it.

These contributions grow out of sight and out of mind while you live on the remainder of your paycheck. If the idea of turning over more of your paycheck into savings and living on less scares you, think back to previous jobs and salaries. You’ve lived on far less take-home pay in the past; you can figure out how to make it work.

Pro tip: If your employer offers a 401(k), check out Blooom, an online robo-advisor that analyzes your retirement accounts. Simply connect your account, and you’ll quickly be able to see how you’re doing, including risk, diversification, and fees you’re paying. Plus, you’ll find the right funds to invest in for your situation. Sign up for a free Blooom analysis.

2. Split Your Direct Deposit

Not everyone is lucky enough to have a 401(k) or 403(b) account through their job. And even if you do, you may not want all of your savings going into it. For example, if you have debts to pay off, or if you want to reach financial independence and retire early, at least part of your savings should go toward these goals.

Most employers can split your paycheck’s direct deposit into multiple accounts. The majority of your paycheck continues going into your checking account for you to live on, but part of it goes into a savings account or brokerage account. From there, you can use it to pay off debts or invest as you see fit, without the temptation you might feel to spend it if it were in your checking account.

As a final thought, ask your HR department to set the savings deposit as a percentage of your income rather than a fixed dollar amount. That way, when you get a raise, your savings rate remains the same.

3. Make Your Savings Account Hard to Access

I keep my savings and emergency fund at a separate bank (CIT Bank to take advantage of their yield) from my checking account. That way, I don’t see it when I log into my online banking to pay bills or manage my checking account.

To withdraw money from my savings account, I have to log into a completely different bank account. I make it difficult to access this account by having it at a bank with no nearby branches and setting a long, impossible-to-remember password for online banking. I don’t save this password in a password manager. So to log in, I have to go out of my way to look up the login credentials.

These may seem like small barriers, but they’re surprisingly effective. I can’t just take a peek on a whim while bored and playing around on my phone. It feels like a pain to access my savings account, so I don’t unless there’s a real emergency. When combined with direct deposits from your employer, this strategy makes your savings or investments effortless to build but difficult to withdraw from.

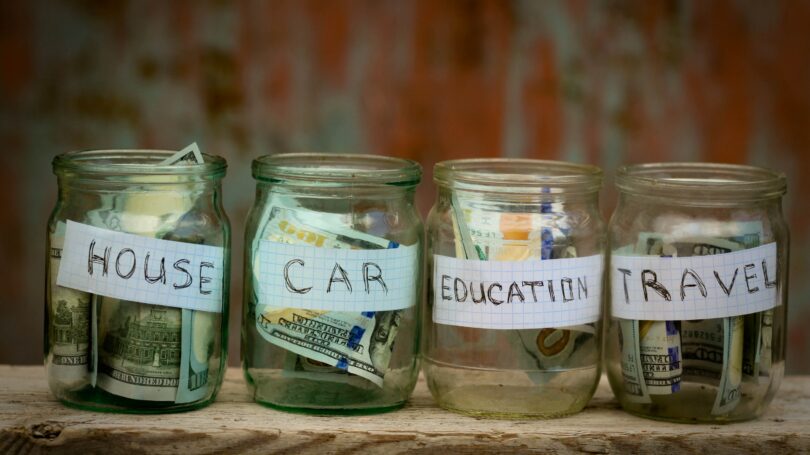

4. Name Your Savings Accounts After Specific Goals

Calling your account a “savings account” is no fun. It’s tedious and boring and doesn’t inspire you to contribute to it.

But imagine you’re saving up a down payment for your dream home, and you name your savings account “Dream Home Fund.” Suddenly, your savings goals are far more tangible, exciting, and inspiring. The account name serves as a constant reminder of why you’re denying yourself that $5 daily latte or why you pack your lunch every day instead of going out with your work buddies.

Open separate accounts for each savings goal, and name them something that inspires you to funnel money into them faster. If “Retirement Account” doesn’t inspire you, then call it “Screw You, I Quit” or “Never Work for a Jerk Boss Again.”

The clearer the connection is between reaching your goal and saving more money, the more money you’ll save.

5. Use Automated Savings Apps

Technology is good for more than just cat videos and wasting time on social media. Several services now exist that can help you automate your savings without you having to think about it.

These automated savings apps work in a variety of ways. Some slip a certain amount of money out of your checking account and into your savings account regularly, being careful not to leave you too close to $0. Others, like Acorns, round up your purchases to the nearest dollar and invest the extra money automatically. Some can even invest your money automatically for you.

6. Automate Investments Through a Robo-Advisor

Another relatively recent phenomenon to help automate your wealth building is the rise of robo-advisors. These algorithms help you choose the best investments for your age, wealth, retirement horizon, and risk tolerance, serving as a financial advisor without charging the hefty fees.

They even rebalance your portfolio automatically to keep it in line with your investing goals.

Acorns offers an inexpensive robo-advisor service that’s fully integrated with your automated savings. But it’s not the only option available, and many of the best robo-advisors are even free. I’ve had a great experience with Schwab Intelligent Portfolios, which is free if you have more than $5,000 invested.

7. Automate Specific Investments

I also diversify my investments, both by directly investing in rental properties and investing in real estate crowdfunding platforms. For example, I have some money invested in Fundrise, which lets you set up automated recurring investments. You can set these based on your pay schedule or budget, whether that’s weekly, biweekly, or monthly.

It all happens in the background – I don’t have to lift a finger. I get to simply watch as my dividend payments grow each month, earning more and more passive income for me.

Your brokerage account may or may not allow you to set up automated recurring investments for specific funds or stocks. But most allow you to at least set up recurring automatic transfers into your brokerage account, and you can always sign up with a robo-advisor to set up recurring automated investments.

8. Automatically Reinvest Dividends

When you buy stocks or funds that pay dividends, you can set your brokerage account to reinvest those dividends automatically.

This helps your investments compound. Every time you receive a dividend, it’s reinvested right back into buying more shares of the stock or fund. Over time, these dividend reinvestment plans can compound into exponentially higher returns and wealth.

Even alternative investments like Fundrise and other real estate investing platforms often let you reinvest your dividends automatically. Take advantage of this automation to let your wealth compound quietly in the background with no effort required on your part.

9. Work With an Accountability Partner

A study reported in Entrepreneur Magazine found that people who committed to another person that they would reach a goal were 65% more likely to achieve it. If they scheduled regular check-ins with their accountability partners, their chances of success increased by 95%.

Long-term goals are difficult to reach by their very nature. Stamina and staying power are difficult to maintain on your own. So don’t try to go it alone.

Find someone you like and trust, and form an accountability partnership with them. Check in with each other for 15 minutes every week, at the same time on the same day. By simply sharing your progress and results, you’ll nearly double your odds of reaching your financial goals.

10. Keep the Change

Many of the strategies above use technology to make your savings invisible and automated. For this tactic, try the opposite by going old-school.

Put a change jar on the table by your front door. Label this jar with your savings goal in huge letters. Remember, the more specific and inspiring your goal, the more likely you are to keep putting money toward it. Every time you walk into the house, empty your pockets of spare change.

When you visit the bank, take the jar with you and deposit it into your savings account. Easy peasy.

11. Start a Fun Project That Reminds You of Your Goal

Do you like jigsaw puzzles? Legos? Some other relaxing diversion you can work on for a few minutes every night over a glass of wine?

Say you’re saving for a down payment on your dream house. Buy a thousand-piece jigsaw puzzle or Lego set with a house design to work on in your downtime. Every time you work on this project, it will remind you of your goal, keeping it front of mind.

12. Get a Credit Card With Better Rewards

Credit cards are dangerous for those who abuse them by failing to pay their balances in full every month. But for those with the discipline to use credit cards responsibly, they can be a powerful tool for reaching your financial goals.

If your savings goal is to travel, get a credit card with outstanding travel rewards. If you’re saving for a home or retirement, consider cash-back credit cards instead.

But getting the right rewards card is only half the battle. The other half is actually redeeming the rewards and putting them toward your goal. Set a rotating reminder on your calendar to log in and redeem your rewards. In the case of cash-back rewards, transfer that cash directly to your savings or brokerage account.

13. Delete Saved Payment Information From E-Commerce Stores

Online businesses design their websites to separate you from your money. One way they do that is by minimizing the friction involved in buying from them.

They want to move you from browsing to purchase confirmation in the fewest possible steps so you have less opportunity to change your mind. So they offer to store your payment data, such as your credit card information, on your account for fast checkout the next time you visit.

Your goal is the exact opposite of theirs: to spend as little money as possible. Don’t play into their hands by making it easy to spend your money. Delete your saved payment information from your accounts on e-commerce websites to give yourself more opportunity to rethink impulse purchases and slow your proverbial roll.

14. Enforce a 24-Hour Buying Delay

Another way to minimize impulse buys is to institute a 24-hour delay on all purchases. The next time you see something you want to buy, force yourself to set it aside and sleep on it. After 24 hours, if you still want it badly enough, go ahead and buy it.

Expect to be surprised at just how many purchases you rethink. In most cases, you don’t really need another shirt, jacket, or pair of shoes. By implementing a 24-hour buying delay, you can separate what you truly want or need from impulse purchases.

15. Delete Shopping Apps From Your Phone

Along similar lines, online retailers want to make it fast and easy for you to buy, and one way they do that is by providing mobile apps.

You see these apps every time you pull out your phone. They alert you with constant notifications. And every time you open the app, the retailer tracks what you look at, so they can tempt you with similar products later on. Plus, they encourage you to save your payment data for faster checkout.

By downloading and installing retailers’ apps on your phone, you play their game by their rules. Instead, re-introduce friction into the process of handing over your hard-earned money. Force yourself to actually go to a website and browse anonymously when you need to buy something, rather than using an app.

16. Use the Envelope System

An oldie but goodie, the envelope budgeting system requires you to budget all expenses in cash.

It sounds inconvenient, and that’s the point. By forcing you to separate all your expenses into different envelopes and put physical cash in each, it makes your budget and expenses tangible and visceral. You think twice before spending anything because you can physically see it drain cash from your budget.

If carrying all that cash sounds too dangerous or inconvenient in today’s digital world, there are online apps like NeoBudget that replicate the envelope budgeting system digitally.

17. Calculate All Purchases in Hours, Not Dollars

Time is money, but money is also time. When you evaluate purchases based on their dollar cost, companies try to reframe the purchase as “cheap” by using tricks like fake discounts and comparisons. Instead, calculate each purchase in the number of hours of work it costs you.

If you earn $25 an hour, and the jacket you’re eyeing costs $400, that comes to 16 hours of work. Is it worth working 16 hours of your life to buy yet another jacket? More accurately, if only 10 cents of every dollar you earn goes toward discretionary spending like new jackets, and the rest goes toward living expenses like housing and groceries, then it would actually cost you 160 working hours to buy that jacket.

Reframing purchases like this is yet another way to stop yourself from buying things you don’t need and make sure you truly want something before paying for it.

18. Keep Budgeting for Loans You Already Paid Off

In the debt snowball and debt avalanche methods of paying off debt, you funnel your entire savings rate into one debt until it’s paid off. Then you take the same amount of money and put it toward your next debt, in addition to whatever you usually pay toward that debt. Because you no longer have the first debt, you can put even more money toward your next debt and pay it off even faster.

When the second debt is paid off, you can put even more money toward the next debt, and so on. It’s an excellent strategy for paying off debts quickly – but you shouldn’t stop when you’ve paid off all your debts.

When your final unsecured debt is paid in full, keep budgeting the same savings rate. But instead of putting it toward debts, put it toward your emergency fund and investments. You can grow your wealth quickly by continuing to budget aggressively, rather than easing off the gas and letting yourself splurge just because you’re debt-free.

19. Track Your Net Worth Automatically

Building wealth, saving for retirement, and other long-term financial goals can feel distant and nebulous. You need to make them feel real to inspire yourself to keep putting money toward them.

One way to do that is to start tracking your net worth and watching it grow each month. There are many tools to help you do that, such as Personal Capital. You connect them to your financial accounts – such as your bank accounts, brokerage account, retirement accounts, and mortgage account – to sync in real time. At any given moment, you can log in and look at a complete breakdown of your net worth, updated automatically for you.

Saving money feels a lot better when you watch your wealth grow in real time.

20. Use Rewards & Penalties

Everyone knows the story of Pavlov and his dogs, in which he documented his use of classical conditioning to train responses and behaviors. The concept is simple and intuitive enough: If you consistently reward good behaviors and penalize bad behaviors, you see more good behavior and less bad behavior.

You can do the same in your own life to modify your financial behavior. Find ways – that don’t involve spending more money – of rewarding yourself for good financial behaviors. For example, if buying clothes is your kryptonite, set a rule for yourself that if you go a week without buying any clothes, you get to enjoy your favorite unhealthy meal on Saturday.

Likewise, do the same with bad behaviors. If you do spend money on clothes, then you’re stuck eating kale salads all weekend.

Your actions have consequences for your finances. The problem is that those consequences are rarely obvious at the moment. For example, if you invest $100 instead of $500 toward your retirement account this month, you don’t have to live with the consequences right now. You defer them to the distant future.

The trick is to implement immediate consequences for your actions so you feel the impact now. Do that, and you’ll start making better financial decisions on a daily basis.

21. Match Your Discretionary & Gift Spending Dollar for Dollar

Another way to create consequences for your spending is to match your spending dollar for dollar with savings.

Every time you buy a new gadget, a new piece of clothing, or eat out at a restaurant, transfer that same amount into savings. You’ll find yourself paying far more attention to what you spend when you’re on the hook to match it in savings.

Do the same thing with buying gifts to keep your holiday spending and gifting manageable. You must match every dollar that goes out with a transfer to savings.

It’s a simple, effective way to get your spending under control and force yourself to pay more attention.

22. Round Up Your Recurring Mortgage Payment

One argument for homeownership is that a mortgage forces you to “save” money each month, as part of your payment goes toward paying down your principal balance. With each payment, you grow the equity in your home and expand your net worth.

You can accelerate the process of building home equity by simply rounding up your payment to the nearest hundred dollars. For example, if your payment is $1,053, round it up to $1,100. You probably won’t notice the extra $47 in your budget, but over time, it helps you skip some of the initial high-interest phase of your loan and dramatically reduces the total interest you pay on the loan.

Plus, of course, you’ll pay off your mortgage faster for a free-and-clear home.

23. Switch to Biweekly Mortgage Payments

You can also trick yourself into paying your mortgage faster by switching to biweekly mortgage payments.

Take your monthly mortgage payment and split it in half. Schedule recurring payments for that amount to be automatically deducted from your bank account every two weeks on the same day you get paid. You’ll end up paying 26 half-month payments each year, the equivalent of one extra monthly payment every year.

You won’t notice the difference in your monthly budget since most months have only four weeks’ of income payments.

24. Budget Based on Four Weeks’ Income & Save the Bonus Paycheck

You can use the same logic on your income. Most people get paid weekly or biweekly, not monthly, yet most bills are due monthly.

In most months, you’ll earn four weeks’ income, so your monthly budget should be based on four weeks’ income. Occasionally, you’ll get a month with a bonus paycheck. Since this paycheck is outside your regular monthly budget, put it directly toward savings.

It’s an easy, pain-free way to save more money while keeping your budget regular.

25. Set a Spending Budget for All Bonuses

Some employees receive occasional bonuses, such as holiday or performance bonuses. These are separate from your regular income and aren’t included in your monthly budget.

Ideally, the entire bonus should go toward savings. But we’re human, and that feels too austere for most of us. Instead, commit to giving yourself a certain portion for play money and saving the rest.

This portion could be a percentage or dollar amount, but however you structure it, make sure most of the bonus goes toward savings.

26. Fight Lifestyle Inflation With Savings Inflation

Most people are quick to say, “Sure, I’d save a lot more if I earned more, but I can’t save any more on my current income.” Yet there was a time when they earned a lot less, and their current income would have seemed like a fortune.

What happened? Why aren’t they saving more today than they did 10 years ago when they earned half as much?

The reason is simple: lifestyle inflation, also called lifestyle creep. You get a raise, and the first thing you want to do is go out and buy a new car, move into a fancier apartment, or start eating out at restaurants more. Soon, your spending has risen just as much as your income, and you never even noticed.

It’s one reason why you should set a savings rate, a percentage of your income that goes to savings. As your income rises, so will your savings.

You can fight lifestyle inflation even more aggressively by freezing your spending at its current level. If you get a raise, great! You can grow your wealth even faster by pumping all of your additional income into investments.

If that’s too harsh for you, split the difference: 50% of your pay raise can go toward spending more, but the other 50% must go to savings and investments. No excuses, no justifications – just faster wealth accumulation.

27. Live on One Income

The beauty of this option is its simplicity.

If you share living expenses with a partner, agree to live on one partner’s income and invest the rest. My wife and I do this; we live entirely on her teacher’s salary and invest all of my income. Every time my wife wants to do something that’s outside our budget, I simply point to our checking account balance.

My income never touches our checking account. It goes straight into our brokerage account, retirement accounts, and other investing accounts. It’s out of sight, out of mind, and off-limits for spending.

Reframe what you think you can and can’t afford by removing one partner’s income from the table and putting it all away to build wealth fast.

Final Word

There’s a saying that personal finance is not a math problem; it’s a behavior problem.

People spend money because they can and because credit card companies and retailers make it as easy as possible. Your mission, should you choose to accept it, is to fight back by making it easier to save than spend.

Sometimes that means reframing how you think about spending, automating your savings and investments, or adding barriers between you and spending money. Do whatever works best for you, and combine as many of the tactics above as you can to maximize your savings rate.

Do it right, and you won’t even notice you’re spending less and saving more each month.