Pros

No monthly maintenance fee on the savings account

Eligible for joint account status

Easy to set up automated and recurring transfers from checking to savings

Access to a network of bank branches and ATMs

Cons

Requires an HSBC Premier Relationship (with strict eligibility requirements)

Requires a linked checking account (can't open by itself)

Standard yield is not competitive

The HSBC Premier Online Savings Account is an online savings account built for consumers who want to do all their banking under the same roof. That’s HSBC’s roof, to be clear.

HSBC Premier Savings has a modest yield on eligible balances, no monthly maintenance fee with a qualifying customer relationship, and automatic transfers between your linked checking and savings account.

You do need to open an HSBC Premier Online Checking Account before opening your savings account. But that doesn’t mean the HSBC Premier Online Savings isn’t worth a closer look. It very much is — so here’s what you need to know about it.

How HSBC Premier Stacks Up

The HSBC Premier Online Savings Account isn’t the only place to park your money online. Here’s how this product stacks up against another big-bank digital savings account: Chase Savings.

| HSBC Premier Online Savings | Chase Savings | |

| Monthly Fee | $0, but must maintain a qualifying Premier Relationship to remain in good standing | $5, but waived with a qualifying minimum daily balance ($300) or autosave transfer ($25/month) |

| Standard Yield | 0.01% APY on balances below $25K, 0.10% APY on balances between $25K and $100K, 0.15% on balances above $100K | 0.01% APY on all balances |

| Potential for Higher Yield? | Yes, with qualifying activities — up to 1.75% APY | No |

| Automatic Savings Transfers | Yes | Yes |

Key Features of the HSBC Premier Online Savings Account

These are the most important features of the HSBC Premier Online Savings Account.

Linked Checking Account

To open an HSBC Premier Online Savings Account, you first need to open and link an HSBC Premier Online Checking Account. If you don’t have one when you apply, you can add one to your application and apply for both at the same time.

HSBC Premier Relationship

In combination, your HSBC Premier Online Checking and Savings Account constitute your HSBC Premier Relationship.

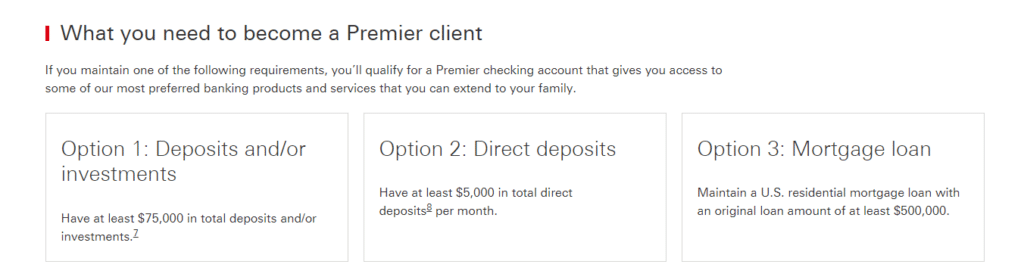

To maintain your relationship in good standing, you must have at least one of the following:

- A recurring direct deposit from a third party (such as an employer or government benefits provider) to an HSBC Premier checking account at least once per calendar month totaling at least $5,000 per month

- A minimum balance of $75,000 in combined balances in eligible deposit and investment accounts

- An existing HSBC U.S. residential mortgage loan with an original balance of at least $500,000

There’s no minimum deposit required to open this account. But if you decide to validate your relationship using the minimum balance test, you will need to keep at least $75,000 on hand with HSBC. That’s a tall order for many consumers.

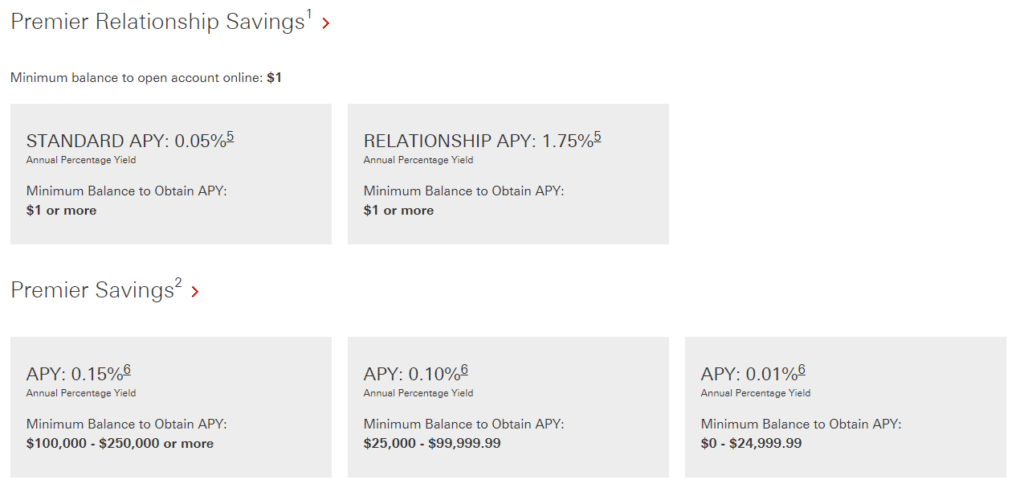

Yield on Eligible Balances

The HSBC Premier Online Savings Account has a low standard yield on all balances. Yields are subject to change with prevailing rates and at HSBC’s sole discretion.

Standard yield tiers are as follows:

- Balances Under $25,000: 0.01% APY

- Balances Between $25,000 and $100,000: 0.10% APY

- Balances Above $100,000: 0.15% APY

There’s a big and potentially beneficial exception to this yield rule, however. When you do one of the following in a statement cycle, you qualify for Premier Relationship status, which entitles you to what HSBC calls its Premier Relationship Yield — currently 1.75% APY on eligible balances:

- Spend at least $500 in eligible debit card purchases in your linked HSBC Premier Checking account

- Receive at least $5,000 in eligible direct deposits into your linked account

- Have an existing HSBC U.S. residential mortgage with an original balance of at least $500,000

Note that the direct deposit and mortgage requirements are identical to those above. So if you have a relatively high-paying job or a nice-sized mortgage with HSBC, you automatically qualify for the higher rate.

Automatic Transfers Between Accounts

You can set up and customize automatic transfers between your HSBC Premier checking and savings accounts. For example, you can set up a recurring transfer of part of your paycheck from your checking to your savings account, ensuring you’re putting away a portion of every dollar you earn.

Important Account Fees

The HSBC Premier Online Savings Account doesn’t have a monthly maintenance fee. However, to remain in good standing, you do need to meet at least one of the Premier qualifications each statement cycle.

Other possible fees on this account include:

- $5 per statement copy

- $12 per incoming wire

- $10 per cashier’s check

- $10 per chargeback and nonsufficient funds transaction

Advantages of the HSBC Premier Online Savings Account

The HSBC Premier Online Savings Account has some key benefits, such as:

- Automatic Transfers Between Accounts to Boost Your Savings Rate. HSBC makes it easy to boost your savings rate with an automatic transfer feature. No more excuses for not depositing a portion of your paycheck directly into your savings account.

- No Monthly Maintenance Fee. The HSBC Premier Online Savings Account has no monthly maintenance fee. That doesn’t mean it’s fee-free, but it’s nice not to have to worry about a maintenance fee on the account that’s supposed to be earning you a nice return on your savings.

- Eligible for Joint Account Status. Under normal circumstances, you can structure this account as a joint account. That’s useful if you manage finances jointly with a spouse or domestic partner.

- Access to HSBC’s U.S. Branch and ATM Network. Although this is an online account, your HSBC Premier Relationship entitles you to access to HSBC bank branches and ATMs where they exist. After the transition to Citizens Bank, you’re likely to have preferred access to Citizens’ bank branches and ATMs as well.

- Potential for a Very Good Interest Rate. If you can consistently qualify for HSBC Premier Relationship status, you can earn a legitimately high yield on your savings — currently 1.75% APY. That’s on par with the top high-yield savings accounts, many of which are backed by online banks that don’t have HSBC’s branch network or value-added services.

Disadvantages of the HSBC Premier Online Savings Account

The HSBC Premier Online Savings Account has some notable drawbacks, including:

- Requires a Linked HSBC Premier Checking Account. If you’re looking for a pure online savings account experience, you won’t find it here. Your HSBC Premier Online Savings Account requires a linked HSBC Premier Checking Account as well.

- Requires an Qualifying Active Direct Deposit Relationship, HSBC U.S. Residential Mortgage Loan, or $75,000 Minimum Combined Balance. Don’t think a linked checking account is a big deal? It might not be, but only if you can swing a combined recurring direct deposit (at least monthly) of $5,000 or more, maintain an average daily balance of $75,000 or more in eligible deposit and investment accounts, or have an active U.S. residential mortgage with HSBC with an original balance above $500,000. Otherwise, you’re not going to maintain your Premier status very long

- Won’t Be With HSBC Indefinitely. It’s likely that your new HSBC Premier Online Savings Account won’t remain an HSBC account for long. In February 2022, many HSBC accounts will transition to Citizens Bank. If you’re interested in maintaining a relationship with HSBC specifically, you’ll need to upgrade to an HSBC Premier Relationship.

- Low Yield Without Qualifying Activities. The HSBC Premier Online Savings Account has a lackluster standard yield: 0.01% APY on balances below $25,000 and just 0.15% APY on balances above $100,000. That’s many times lower than the best high-yield online savings accounts and money market accounts. So if you don’t think you’ll qualify for the Premier Relationship rate, this account might not be worth it at all.

Is the HSBC Premier Online Savings Account Legit?

Yes, the HSBC Premier Online Savings Account is legitimate. It’s one of the best online savings accounts offered by a “traditional” brick-and-mortar bank, one that serves hundreds of thousands of people across the United States.

The HSBC Premier Online Savings Account further distinguishes itself with the potential — though not the guarantee — of an excellent yield. You do have to meet at least one fairly strict requirement to qualify for that yield, but if you can, you’ll earn a great rate on your savings.

As noted below, “best online savings account” offered by a traditional brick-and-mortar bank does not mean “best online savings account” overall. But if you’re interested in deepening an existing relationship with HSBC or starting a new one, Premier Online Savings is worth a look.

Final Word

The HSBC Premier Online Savings Account is not the best online savings account on the market. It has some notable drawbacks that keep it out of the conversation, including a low yield and the requirement to link a checking account, which many online banks waive.

Still, if you enjoy banking with a recognizable institution that has plenty of ATMs in the real world, and can qualify to waive the monthly maintenance fee on the linked checking account, you could do worse.

Pros

No monthly maintenance fee on the savings account

Eligible for joint account status

Easy to set up automated and recurring transfers from checking to savings

Access to a network of bank branches and ATMs

Cons

Requires an HSBC Premier Relationship (with strict eligibility requirements)

Requires a linked checking account (can't open by itself)

Standard yield is not competitive