Some scams are easy to spot. I like to think if I connected with The Tinder Swindler on a dating app, I’d realize something was up the first time the so-called heir to a diamond fortune hit me up for money.

Other scams are a bit harder to detect. If Frank Abagnale, Jr. was as charming as Leo DiCaprio portrayed him in “Catch Me If You Can,” there’s a good chance I’d believe he was a pilot/doctor/lawyer, especially with no Internet to fact-check him.

Bank scams run the gamut from the clearly fraudulent to the deceptively convincing, and even the best of us can be fooled. Protect your hard-earned cash by knowing what to look for.

Types of Bank Scams & How to Avoid These Frauds

Keep your money safe by knowing these common bank scams and how to avoid falling for one.

1. Check-Cashing Scams

A distraught stranger is waiting outside your bank as you head inside. They tell you they have a check they really need to cash, but they can’t because they don’t have an account with the bank or don’t have their ID on them. They ask you to deposit the check in your account and withdraw the same amount for them in cash.

Do you give in to your desire to help a fellow human?

If you do, you’ll learn the check is a fraud. But since banks have to make funds available before a check officially clears, it could be days before it bounces. By then, the stranger is long gone with your money. Plus, the bank could charge you an insufficient funds fee or returned check fee.

How to Avoid Check-Cashing Scams

No matter how much someone tugs at your heartstrings, don’t cash a stranger’s check for them. There are legitimate ways to cash a check without a bank account. Feel free to share them with the stranger if you’re feeling generous.

2. Unsolicited Check Fraud

You get a check in the mail for a product rebate or account overpayment. You weren’t expecting it, but free money is free money, so you happily cash it. No harm, no foul, right?

Wrong. If you took a closer look at the check and any letter that came with it, you’d realize that by signing it, you’re authorizing a recurring payment to your bank account.

In another scenario, you get a check for a sweepstakes you’ve supposedly won. It’s yours to cash as long as you send a bit back to the sweepstakes company for “taxes” or “processing fees.” You’ll soon learn the check isn’t real, but the money you’ve sent to the company is.

How to Avoid Unsolicited Check Fraud

Don’t get too excited if you receive a surprise check in the mail. If it’s from a company you’ve never heard of and never done business with, it’s likely a fraud. If it comes with instructions to cash it and refund the difference to the check writer, it’s definitely a fraud.

If the check seems to be from a trusted source like your bank, but you weren’t expecting it, verify its authenticity. Call the bank or company’s customer service line — the one on your account statements or the back of your card, not the number provided with the check. Ask if the check is valid and why you received it before you even think about cashing it.

3. Overpayment Scams

Overpayment scams target online vendors, such as small businesses that sell products online and people selling items on platforms like Craigslist and Facebook Marketplace. The scammer sends you a check for more than the purchase price, and when you tell them they’ve overpaid, they ask you to just deposit the check and send the difference back to them.

By the time the check bounces, you’ve already sent money from your bank account to the scammer. You’re out those funds plus the cost of any items you sent them.

How to Avoid Overpayment Scams

Don’t accept checks for more than the amount someone owes you, period. Contact the buyer and ask them to send a new payment for the correct amount.

If they’re for real and made an honest mistake, such as transposing numbers, they’ll be happy to send you the right amount so the purchase goes through. If they’re not, you won’t hear from them again, and you can sell the item to a legitimate buyer.

4. Automatic Withdrawal Scams

Automatic withdrawal scams lure you in with the promise of something enticing.

You get an unsolicited offer for a credit card, which asks you to provide your banking details to qualify.

Or you sign up for a free trial, which requires your banking information, although the company says it won’t charge you if you cancel before the free trial ends. You cancel in time, but scammers have already gotten your data and can charge you whatever they want each month moving forward.

This could be because the free trial was a scam or because they stole your data from a legitimate subscription service with an unsecured website.

How to Avoid Automatic Withdrawal Scams

Don’t give your checking account information to anyone who contacts you out of the blue. You don’t need to provide it to claim a legitimate prize or freebie or to sign up for a credit card.

Install security software on your computer, such as antivirus and anti-spyware software, to protect information you enter online and alert you to suspicious sites.

Before entering your bank account or debit card information online, look closely at the site. Does it look professional? Does it look trustworthy? Is it secure? If the URL starts with “https,” that means it encrypts your data to keep it safe from third parties. If it starts with “http,” it doesn’t.

Finally, review your bank statements monthly. If there’s a charge you don’t recognize, immediately contact your bank to dispute it and revoke authorization for future charges.

5. Phishing Scams

You receive an official-looking letter or email from your bank telling you your account has been suspended due to unusual activity. It may even have the official bank logo on the letterhead. There’s a number to call or a link to click to “re-verify” your account and restore access. If you don’t do this within a short period, the communication says, your account will be deactivated.

The sender isn’t your bank but a scammer trying to get your information. They can have a field day with your funds if you provide it.

How to Avoid Phishing Scams

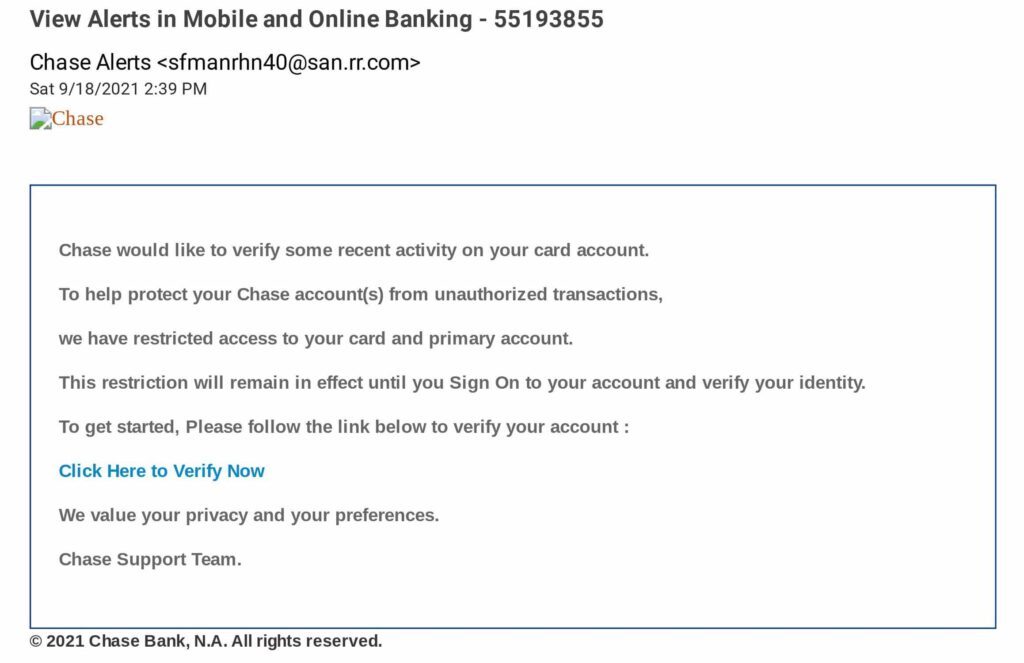

If you receive an email purportedly from your bank, do some due diligence. Double-check the sender’s email address.

Take this email I received. In the messages list in my inbox, the sender’s display name was “Chase Alerts.” But open the email (or open it up and hover your mouse over the sender name, depending on your email provider), and you’ll see it came from “sfmanrhn40@san.rr.com.” Call me crazy, but I don’t think that’s an official Chase email address.

If you receive a letter with a number to call to re-verify your account, don’t call it. Find your bank’s official customer service number on its website, the back of your debit card, or your account statements and call that to ask about your account status.

6. Employment Scams

You answer a Craigslist ad for a personal assistant. The employer sends you a check so you can buy some gift cards for them. As soon as they receive the cards, they use them before you can figure out you’ve been scammed.

Or, a secret shopping company hires you to evaluate a wire transfer service like Western Union. They send you a check to deposit in your bank account and ask you to wire a portion of the funds back to them so you can tell them how the experience went.

If you’ve read this far, you know what happens next: The check is fake, but by the time you realize this, you’ve already given the scammer your money.

How to Avoid Employment Scams

Unless you’re working on retainer, an employer won’t send you money before you start working for them. They certainly won’t send you money with the caveat that you must send some of it back to them. If a potential employer asks you to do this, say goodbye.

7. ATM Scams

Scammers also target ATMs, using the following tactics.

Card Skimming

A scammer places a device on an ATM card slot or the card reader that unlocks the doors to the ATM lobby after hours. When you swipe your card, the device reads and copies your card information.

False ATM Fronts

The ATM eats your card, but you can’t do anything about it because it’s after business hours. So you leave, planning to call your bank when you get home. Little did you know a scammer placed a false front over the ATM designed to capture your card. Once you leave the ATM, they detach the false front and take your card.

Spying Strangers

ATM etiquette says you should give the person at the machine space to conduct their transaction in privacy. If someone is too close for comfort, it may be because they’re trying to get a glimpse of your PIN, which they can use with a card skimmer to access your account.

How to Avoid ATM Scams

Examine an ATM before using it. Look for these signs of a card skimmer or false front:

- A bulky or unusually wide card slot

- A loose card slot or slot that sticks out at a weird angle

- A blocked card slot

- A card slot that’s a different color from the rest of the machine

- A loose PIN pad

- Oddly placed stickers

- Ripped security tape

If you notice any of these after hours, find an ATM elsewhere and call your bank to report what you saw. If you notice these when the bank is open, go inside and speak to a teller.

Also, be aware of your surroundings when using an ATM. Stand close to the machine and cover the keypad with your hand as you enter your PIN. If someone is standing too close to you, don’t hesitate to politely ask them to take a few steps back. If they get annoyed with you, then you have a stranger annoyed at you for a few minutes. That’s better than losing money to a scammer.

Red Flags of a Bank Scam

Bank scams come in many forms but often share the same characteristics. Watch for these common red flags to steer clear of one.

It Sounds Too Good to Be True

You’ve heard this one before: If something sounds too good to be true, it probably is.

Don’t let yourself be blinded by a seemingly golden opportunity. Ask yourself common-sense questions like:

- Why would a company randomly send you money you’re not expecting?

- Why would an employer send you a large check and trust you to use it for a designated expense?

- Why would you need to give your bank account number to claim a prize?

If your gut says something feels off, listen to it.

There’s Pressure to Act Now

There’s a reason stores run limited-time-only sales. “Act now” tactics can make you do things you wouldn’t normally do if you had more time to think about them.

Don’t let a deadline pressure you to do something rash. Take the time to carefully review the situation and think it over rationally.

They Contact You Out of the Blue

I wish we lived in a world where money-making opportunities and sweepstakes prizes materialized from nothing. But in reality, free money is rarely free. If you get a check you weren’t expecting, be suspicious of it.

There Are Typos, Bad Grammar & Weird Formatting

Some scammers are pretty lax about looking professional. Their communications have typos, grammatical errors, randomly capitalized words, and clunky language. Your actual bank would never send you an email that reads:

You don’t need to be a professional editor to spot the many ways that email looks janky. (I am a professional editor, and it hurts both my eyes and my soul.)

It Plays on Your Emotions

The check-cashing scammer hooks you with a sad story. Unsolicited check fraud and employment schemes exploit your eagerness (or desperation) to make money. When your emotions are high, rational thinking can go out the window, and scammers know it.

Don’t let visceral reactions cloud your judgment. Look at the situation logically and ask yourself if you see any of the red flags we’ve covered.

Final Word

If you’ve sent money to a scammer, you might be able to get it back by doing the following.

- If you deposited a check that bounced: Chances are you’re out of luck for any money you’ve already withdrawn from your account. But your bank might be willing to waive any fees they’ve charged you if you contact them.

- If your information has been stolen: Contact your bank and the Federal Trade Commission (FTC).

- If you sent money through the mail: Contact the United States Postal Inspection Service.

- If there are unauthorized automatic withdrawals from your account: Contact your bank to stop them.

- If you wired money: Contact the wire transfer service to see if they can reverse the transfer.

- If you sent a money order: Contact the money order company and ask them to stop payment.

- If you sent a gift card: Contact the gift card issuer and ask if they can refund your money.

If you take action immediately, there’s a chance you’ll be able to get your money back. But be prepared to hear that it’s too late and chalk it up to a lesson learned.

If you suspect you’ve come across a bank scam, report it promptly to:

- The FTC

- Your state attorney general

- The United States Postal Inspection Service (for checks sent through the mail)

- Or email spam@uce.gov (for phishing emails)

You might not have fallen for the scam, but there’s a good chance someone else will. Reporting it can keep it from reaching new victims.