Your debt-to-income ratio compares what you owe against what you earn. In its simplest form, it’s the percentage of your monthly income that goes toward debt payments.

Your debt-to-income ratio is one of the most important factors the lender considers when you apply for a loan or line of credit, right up there with your credit score. If your debt-to-income ratio is too high, meaning you have too much debt compared to your income, you’ll struggle to qualify for all types of credit, including mortgages and credit cards, or find your choices limited to those with high interest rates and fees.

Before you apply for a loan, you should understand what qualifies as a good debt-to-income ratio and how to calculate yours. There’s some math involved, but don’t worry; it’s pretty simple.

How to Calculate Debt-to-Income Ratio

To calculate debt-to-income ratio, add all your monthly debt payments, divide the total by your total monthly income before taxes, and multiply the result by 100 to turn the results into a percentage.

The formula is:

Debt-to-Income Ratio = (Debt ÷ Income) x 100

or

R = (D ÷ I) x 100

Still confused? That’s OK. Just take it step by step.

1. Add Your Monthly Debt Payments

The most common debt payments lenders use to calculate debt-to-income include:

- Mortgage payments, including taxes and insurance if they’re bundled into a single monthly payment

- Payments on home equity loans and lines of credit

- Rent payments

- Car loan payments

- Student loan payments

- Other payments on installment loans in your name, such as unsecured personal loans

- Payments on any loans you’ve co-signed, even if someone else is currently making them

- Alimony and child support payments

- Minimum required credit card payments

Every lender is different, but debt-to-income calculations usually exclude some recurring payments you might think of as “debt.” Common examples include utility bills, most types of insurance premiums, cellphone bills, and most types of taxes other than escrowed property taxes.

Debt-to-income calculations also leave out variable but essential expenses like groceries and transportation.

If you’re unsure about which debts your lender includes and excludes in the calculation, ask your loan officer. It’s their job to prepare you for the loan application process.

2. Divide by Your Gross Monthly Income

Next, calculate your monthly income before taxes.

Assuming your income hasn’t changed significantly and you hold a traditional job, the easiest way to do so is to find your gross income on your most recent paycheck stub (look for gross income, not net).

If you don’t have one handy or you’re a freelancer or small-business person, you can also find your latest tax return and divide the number you find by 12. You can also look at your most recent W-2 (traditional job) or 1099s (for freelancers) and divide your gross income by 12.

If your income has changed significantly, you may have to do the math. Just remember that it’s the number before taxes. That should make it easier to calculate.

Now that you have your total monthly income, plug it into the formula.

3. Multiply by 100

The final step is also the quickest and easiest. To express your debt-to-income ratio as a percentage, multiply the number you got in the previous step by 100.

Example Debt-to-Income Calculation

If you’re still lost, perhaps an example will be helpful.

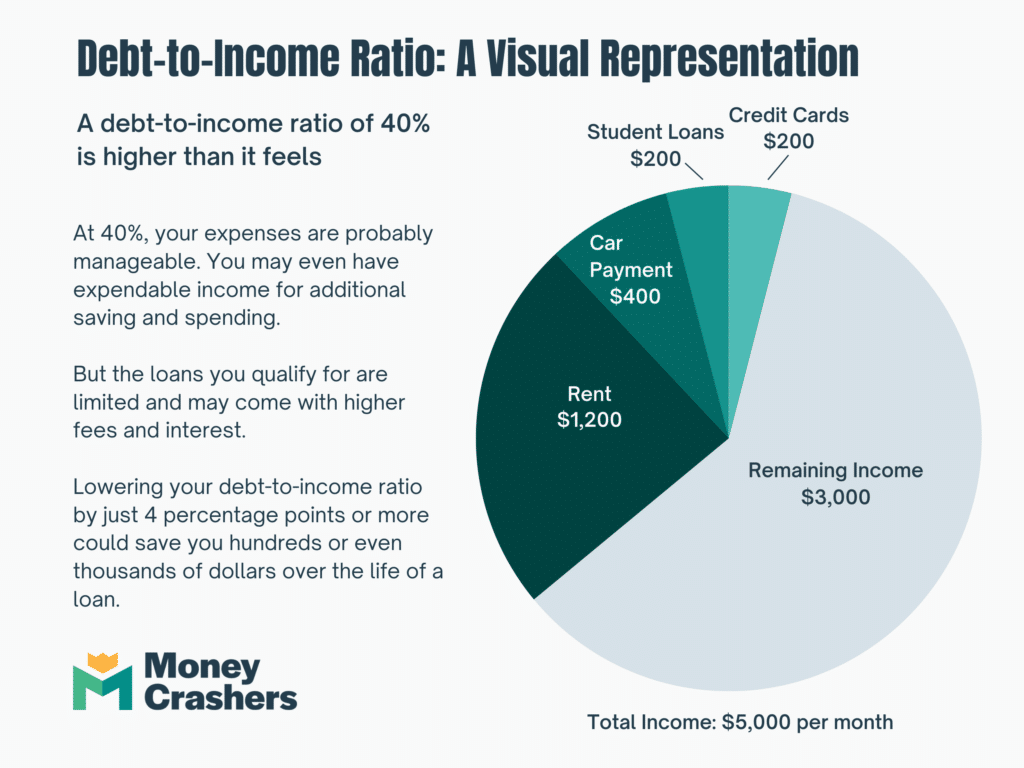

You have $2,000 in total monthly debt payments, broken down as follows:

- $1,200 for rent

- $400 for your car payment

- $200 in student loan payments

- $200 in credit card minimum payments spread across several cards

The income side is simpler. You’re a full-time salaried employee who earns exactly $60,000 per year, or $5,000 per month.

After plugging the numbers into the formula, you get:

R = (D ÷ I) x 100

R = (2,000 ÷ $5,000) x 100

R = 0.40 x 100

R = 40

With $2,000 in total monthly debt payments and $5,000 in total monthly income, your debt-to-income ratio is 40%. Less than half your income goes toward your debts, which might not sound so bad, but that’s actually more than lenders like to see. To get the lowest rates and fees on a loan, and especially a mortgage loan, your debt-to-income ratio should be under 36%.

Types of Debt-to-Income Ratio

There are two types of debt-to-income ratio: front-end and back-end. With few exceptions, the front-end ratio only comes into play when you’re applying for a mortgage loan. The back-end ratio is more comprehensive and used more often in lending decisions.

- Front-end. Your front-end debt-to-income ratio includes only your total monthly housing costs, not any other debts. If you rent, it’s your total rent payment divided by your income. If you’re a homeowner, it’s your total mortgage payment (including taxes and insurance if applicable) divided by your income.

- Back-end. This is a more thorough measure that includes your housing costs and all other applicable debts, such as credit card minimum payments, car loan payments, and student loan payments.

When Debt-to-Income Ratio Is Important

High debt-to-income ratios make lenders nervous. The higher it is, the less wiggle room you have to make good on your promise to repay debt.

You might be making ends meet on paper, but you’re not secure. Even a modest decline or interruption in your income or an unexpected increase in your expenses could force a choice between putting food on the table and continuing to make your loan payments.

The risk of default increases along with debt-to-income. So most lenders decline loan applications from people whose debt-to-income ratios they consider unacceptably high. They may approve applications from people with lower but still-high debt-to-income ratios, but they typically charge higher interest rates and fees to offset the increased risk.

What’s a Good Debt-to-Income Ratio?

A good debt-to-income ratio is below 36%. At least that’s the simple, one-sentence answer to this question.

Real life is a bit more complicated. What counts as a good debt-to-income ratio depends on the type of debt-to-income ratio you’re talking about, the type of loan in question, and the lender involved in the transaction.

Mortgages

Mortgage lenders approach debt-to-income differently than others. They’re the only type of lender that cares about the front-end debt-to-income ratio, and they’re also governed by different federal lending regulations that affect debt-to-income standards.

Mortgage lenders generally want to see a front-end debt-to-income ratio below 28%. In fact, few mortgage lenders approve conventional mortgage loans with front-end ratios above 28%. For FHA loans, which are backed by the U.S. Federal Housing Administration and designed for first-time homebuyers with lower credit scores, the maximum front-end ratio is 31%.

When it comes to back-end ratios, two numbers really matter for mortgage lenders: 36% and 43%.

Anything under 36% is a capital-G Good debt-to-income ratio. Borrowers with sub-36% back-end ratios have the best shot at qualifying for the lowest available interest rates and loan fees, assuming they also have excellent credit and stable employment and meet other criteria lenders like to see.

A debt-to-income ratio between 36% and 45% isn’t Good, but it’s often good enough for a lender’s approval if the applicant has stable income and good credit.

Above 45%, things get trickier. With some exceptions, Fannie Mae and Freddie Mac — the big government-backed corporations that buy and sell mortgage loans — won’t touch conventional loans with back-end ratios above that threshold. Because their options for selling these loans are limited, most lenders won’t approve them in the first place.

That said, Fannie and Freddie buy certain loans with back-end ratios between 45% and 50%. These loans require stricter lender scrutiny, which most feel isn’t worth it. And 50% is the absolute maximum Fannie and Freddie accept.

Other Types of Loans

Non-mortgage lenders don’t have to worry about Fannie’s and Freddie’s debt-to-income standards, but they still want to get paid.

While there’s some variation between lenders and loan types, 36% remains the key threshold for auto lenders and personal loan providers. Most non-predatory lenders decline loans with back-end ratios above 49% or 50% — or at least scrutinize those applications more closely.

If you’re buying a new car or trying to qualify for a personal loan, get your debt-to-income ratio well under 50% and ideally as close to 36% as possible.

How Your Debt-to-Income Ratio Impacts Your Financial Health

Your debt-to-income ratio affects a lot besides your ability to qualify for credit (at least non-predatory credit). You feel it in your credit score, your longer-term financial plans, and maybe even your mental health.

- Difficulty obtaining credit. The higher your debt-to-income ratio, the less likely you are to be approved for new credit. That affects your life in relatively small ways (say, being declined for a retail credit card from your favorite department store) and bigger ones too (like not being able to buy a house).

- Limited borrowing capacity. Even if you qualify for new credit, a higher debt-to-income ratio reduces the total amount you can borrow. You might need to settle for a lower credit limit on your credit card or a smaller mortgage loan that puts your ideal home out of reach.

- Financial stress. A high debt-to-income ratio doesn’t necessarily mean you’re living beyond your means, but it certainly increases your risk of financial — and mental and physical — stress.

- Risk of default. Even if things don’t feel out of control right now, a high debt-to-income ratio puts you at higher risk of default. You have less capacity to absorb financial shocks, like a period of unemployment or a big unexpected expense.

- Credit score impact. If you have a high debt-to-income ratio, you probably have a high credit utilization ratio as well. Debt-to-income doesn’t affect your credit score directly, but credit utilization does. It’s one of the most important credit-scoring factors.

- Limited financial flexibility. With more of your income earmarked to pay off your debts, you have less flexibility to buy the things you want or need, not to mention invest in your future.

- Delayed financial goals. Relatively few homebuyers — and even fewer first-timers — buy houses in cash. Many car buyers finance their rides too, especially new ones. A high debt-to-income ratio could mean renting when you’d rather buy or sinking more and more cash into an old, failing car.

Managing Your Debt-to-Income Ratio

Your debt-to-income ratio isn’t set in stone. It varies over time as you take on new debts and pay off old ones. And you can take any number of incremental steps — and more drastic ones too — to trim your debt-to-income ratio over time.

DIY: Strategies for Improvement

Reducing your debt-to-income ratio means changing one or both of the variables involved: your debt or your income. Ideally, it also means making and sticking to a financial plan that helps you live within your means.

- Pay off your credit cards in full each month. Unless you’re taking advantage of a limited-time 0% APR promotion to finance a large purchase or pay down a transferred balance, don’t carry month-to-month credit card balances. That raises your minimum monthly payment — and with it your debt-to-income ratio.

- Pay more than required on loans. Set aside a reasonable amount each month to make extra payments on loans like your mortgage and car loan. Even $100 per month can make a difference over time. Pull from nonessential purchases like takeout.

- Postpone big purchases. Put off any big purchase you need to finance — home improvements, a new car, even a new TV if you can’t pay for it out of pocket — until your existing debts are under control.

- Avoid applying for new credit. “Preapproved” credit card and personal loan offers are tempting, but they’re bad for your debt-to-income ratio. Don’t act on them or any other offers of new credit until your debt-to-income ratio is lower.

- Take steps to increase your income. That’s easier said than done if you already work full time and have nonwork obligations in your spare time. But a part-time job or occasional consulting work can significantly improve your debt-to-income ratio. And it could have a bigger impact than paying off existing debt on your current income.

- Make a monthly budget. If you don’t already have a household budget, make one that prioritizes paying down your debts. That might involve some sacrifice, but it’s worth it in the long run. If you already have a budget, revisit it and tighten up wherever you can.

Financial Planners: Seeking Professional Advice

If you feel overwhelmed or like you’re not making progress quickly enough, you can also seek professional help from legitimate credit counselors or financial advisors.

The best place to find help to manage and reduce your debt is a nonprofit credit counseling service. The U.S. Department of Justice keeps a list of federally approved credit counseling agencies, as do most state attorneys general and consumer protection agencies. You can also look for certified financial planners.

Credit counseling services vary by organization and clients’ financial situations. They can range from free or very low-cost counseling and education sessions to formal debt management plans, which bundle some or all of your debts in a way that makes them easier to manage and pay off.

Debt management plans carry some fees, but they’re not as expensive or as bad for your credit as for-profit debt settlement services.

If you already work with a financial planner or advisor, ask them for guidance. Even if you don’t, many financial planners offer flat-fee financial plans that don’t require an ongoing relationship. Expect to pay anywhere from a few hundred to a few thousand dollars for your personalized plan, but that’s money well spent if you have relatively high income (and a debt load to match).

Debt-to-Income Ratio FAQs

Calculating your debt-to-income is a simple math problem, and the concept itself is pretty easy to grasp. But given how important your debt-to-income ratio is to your financial life, it’s a good idea to understand what it means for you — and what it doesn’t.

How Does Your Debt-to-Income Ratio Affect Your Credit Score?

Your debt-to-income ratio doesn’t directly affect your credit score. FICO and VantageScore, the two most common consumer credit-scoring models, ignore debt-to-income as a credit-scoring factor.

However, your debt-to-income ratio can indirectly affect your credit score. For starters, if you have a high debt-to-income ratio, you probably have lots of debt in your name, relatively low income, or both. Your risk of missing loan payments or defaulting on your loans — the most important credit scoring factor — is higher.

Also, if your debt-to-income ratio is high, there’s a good chance your credit utilization ratio is high as well. Credit utilization is the second-most important credit-scoring factor after payment history, so a high credit utilization ratio is often bad news for your credit score.

How Does Debt-to-Income Ratio Affect Mortgages?

Your debt-to-income ratio directly affects your chances of qualifying for a mortgage. If it’s really high, you’ll have a hard time qualifying for a mortgage loan. If it’s a little lower but still high, expect to pay a higher interest rate and higher fees than your less-indebted fellow borrowers.

Which Expenses Don’t Count Toward Your Debt-to-Income Ratio?

Lenders’ debt-to-income calculations leave out some expenses you might think of as debts. The biggest ones are:

- Income tax payments

- Most other tax payments, except property taxes bundled into a mortgage payment

- Most insurance premiums, except homeowners insurance bundled into a mortgage payment

- Utility bill payments

- Payments on informal loans (like loans between family members) that aren’t reported to credit bureaus

- Groceries and other household essentials

- Transportation expenses, except car loan payments

Final Word

Like your credit score, your debt-to-income ratio is a super-important number for your financial life. It has a big say in whether you qualify for new credit and how much said credit costs you. It could help usher you into the home of your dreams or keep you tied to a rental property you hate for longer than you’d like.

But your debt-to-income ratio doesn’t stop there. On top of its direct impact on your ability to qualify for new credit, a high debt-to-income ratio reduces your financial flexibility, forces you to make tough choices about what to buy and when, and raises your financial stress baseline. Reducing it may require tough choices that go beyond skipping takeout one night a week or canceling a streaming subscription or two.

It takes time too. But it’s a worthwhile investment in your financial future — and in your personal well-being.