Pros

Solid cash back program (up to 5% back)

No annual fee

Bonus cash back for on-time payment

Cons

No early spend bonus

No bonus for good grades

No 0% APR intro promotion

Journey Student Rewards from Capital One is a popular student credit card with no annual fee, a solid cash back program that rewards general spending, and relatively loose credit standards that make it a plausible first credit card choice.

It shares the limelight with several other popular student cards. It’s also comparable to certain secured credit cards that appeal to students who wish to build or improve their credit. Is it right for you?

What Sets the Journey Student Credit Card Apart

The Journey Student Credit Card isn’t revolutionary by any stretch. Still, a few features set it apart from most competitors.

- Bonus Cash for On-Time Payments. Pay your bill in full and on time, get a 0.25% cash bonus. Rinse and repeat each statement cycle.

- Up to 5% Back on Eligible Purchases. Most Journey purchases earn 1% cash back, or 1.25% with the on-time payment bonus, but Capital One Travel purchases earn 5% back. A nice boost for students heading home for the holidays or stepping out for spring break.

- Loose Underwriting With a Clear Path to a Higher Credit Limit. Journey accepts applications from students with limited credit, though it does have some underwriting standards. Wherever you start, after 6 months of responsible use, you may qualify for a higher credit limit.

Key Features of Journey Student Rewards from Capital One

These are the key features of the Journey Student Credit Card from Capital One. This is a straightforward card, but there’s still plenty to learn about it.

Earning Cash Back Rewards

The Capital One Journey Student Card earns unlimited 1% cash back on most purchases.

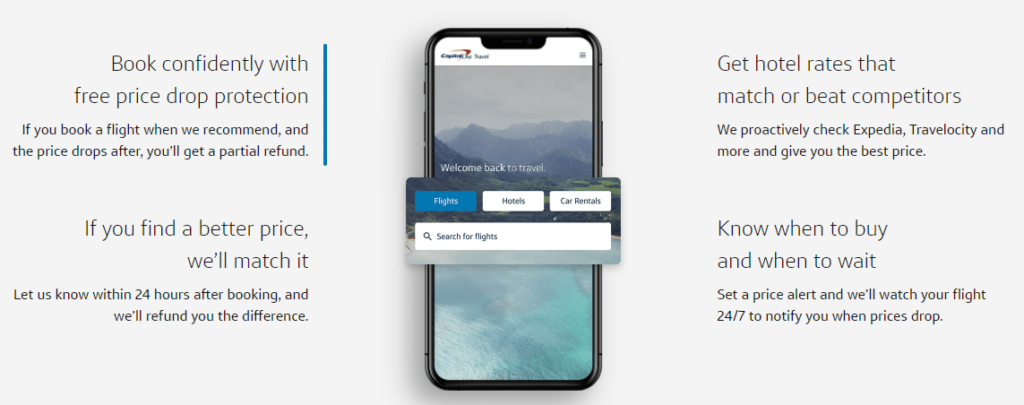

The big exception: You’ll earn unlimited 5% cash back on hotels and rental cars booked through Capital One Travel (terms apply). Capital One Travel is an in-house booking engine that’s exclusively for Capital One cardholders, so it’s useful in its own right.

There’s no limit to the amount of cash back you can earn, and rewards don’t expire as long as your account remains open and in good standing.

On-Time Payment Bonus

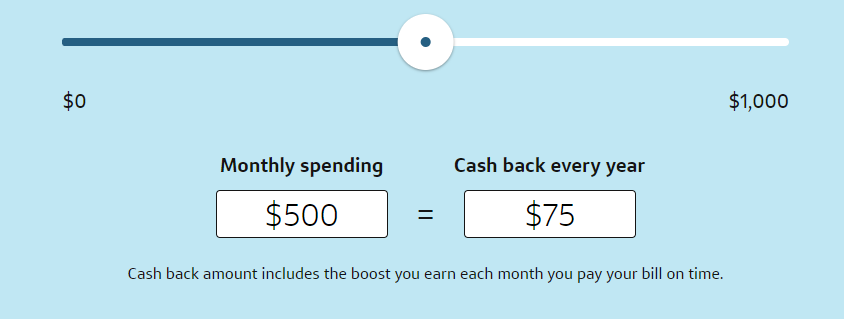

If your account is not past due on the last day of the billing cycle, you receive a bonus equal to 0.25% of the cash back you earned during the cycle, for a total cash back rate of 1.25% on most eligible purchases. In other words, you get a 0.25% cash-back bonus for paying your bill in full and on-time.

Redeeming Cash Back Rewards

You can redeem your accumulated cash back in any amount, at any time, for a statement credit or paper check.

You can also set up automatic redemptions, either at a set time each calendar year, or when you cross a specified threshold: $25, $50, $100, or $200.

Finally, you can redeem for merchandise indirectly by using your accumulated points to pay for Amazon.com purchases. Capital One doesn’t have its own shopping portal for Journey cardholders, however.

Credit Line Increase

Capital One automatically considers you for a credit line increase in as little as six months, provided you’ve used your card in a responsible manner up to that point. Your credit line may continue to increase with further responsible use, though Capital One makes no guarantees on this point.

Important Fees

This card does not have an annual fee, foreign transaction fee, or balance transfer fee.

Capital One CreditWise & Eno

Each month, you get a free credit score with your paper or online statement, thanks to the Capital One CreditWise suite. You’re also able to check your score on demand in your online account dashboard.

Additionally, Capital One CreditWise includes a host of credit-building tools and educational content for free. It also has an automated assistant, Eno, that you can text for basic information and updates about your account.

Other Benefits

This card comes with some practical fringe benefits, including 24/7 emergency card replacement for travelers and complimentary rental car insurance when you charge the full cost of the rental to your card.

You can also pick the due date that works for you, whenever it falls during the month. And you can get up to $500 in bonus cash by referring friends to Journey (terms apply).

Credit Required

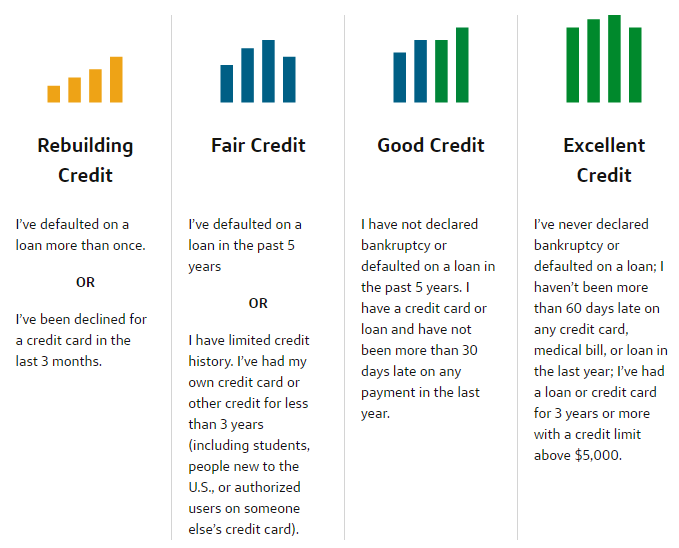

This card is for students with average, fair, or even limited credit. A few credit blemishes likely won’t disqualify your application, though serious issues (such as recent bankruptcy) probably will.

See Capital One’s credit quality tiers graphic below for more information about what exactly is meant by “fair” and “limited” credit.

Advantages of Journey Student Rewards from Capital One

Here’s what the Journey card has going for it. Note the lack of an annual fee, the solid but not spectacular rewards program, the on-time payment bonus, and the opportunity to increase your credit line in as little as 6 months.

- No Annual Fee. The Journey Student Credit Card doesn’t have an annual fee. That’s a nice benefit relative to the Citi Secured Mastercard, which carries a $25 annual fee. When you’re on a student budget, the last thing you need to worry about is an annual tax on your credit card.

- Good Cash Back Rewards Program. The Journey Student Credit Card earns a flat 1% cash back on most purchases and 5% cash back on eligible Capital One Travel purchases. That’s a good rate in the student credit card realm, which isn’t known for generous rewards programs.

- Opportunity to Increase Your Credit Line in As Little As 6 Months. If you make consistent, timely payments on your account, you’ll automatically be considered for a credit line increase in as little as six months. Many student credit cards make no guarantees about when cardholders are to be considered for credit line increases, and the fact that you’re automatically considered eliminates the hassle of calling up and formally requesting an increase.

- On-Time Payment Bonus. The Journey Student Credit Card further rewards timely payment patterns with an on-time payment bonus equivalent to 0.25% of all cash back earned during the payment period. This boosts the card’s effective cash back rate to 1.25%, which is higher than most student credit cards’ baseline cash back rates.

- No Foreign Transaction or Balance Transfer Fees. This card doesn’t have balance transfer or foreign transaction fees. If you plan to spend a semester abroad or transfer a high-interest balance from another student credit card, this dual perk definitely reduces the cost of doing so.

- No Penalty APR. The Journey Student Credit Card doesn’t have a penalty APR. That’s great news for students who occasionally miss payments during school breaks or at end-of-semester crunches.

- Flexible Rewards Redemption. You can redeem your cash back rewards at any time and in any amount. If you don’t use your card that often, it can take months to reach other cards’ minimum redemption thresholds.

- Capital One Travel Is an In-House Booking Engine. It’s not unique to Journey, but Capital One Travel is a nice benefit for Capital One cardholders in general. Use it to book travel at the best available price (subject to a limited guarantee).

Disadvantages of Journey Student Rewards from Capital One

Consider these drawbacks before applying for the Journey student card. There’s no early spend bonus, no intro APR offer, no GPA bonus, and relatively low rewards ceiling for most purchases.

- No Early Spend Bonus. The Journey Student Card lacks an early spend bonus. That’s bad news for students who want to juice their cash back rewards from the get-go.

- No Introductory APR Offers. Capital One doesn’t offer an introductory APR on this card.

- No Good Grades Discount or Bonus. Unlike some competitors, Capital One doesn’t reward you for good scholarship.

- Rewards Rate Capped at 1.25% for Most Purchases. This card’s rewards rate is capped at 1.25%, with the exception of Capital One Travel purchases. Yes, even with the on-time payment bonus. Although that’s a higher baseline than most other student cards, it’s lower than what’s achievable with some other popular student credit cards.

- Rewards Can’t Be Redeemed for Merchandise. Journey’s cash back rewards can’t be directly redeemed for merchandise purchases, though you can redeem them for purchases made on Amazon.com. This is a drawback relative to some other student credit cards with their own e-commerce portals.

How the Journey Student Rewards Card Stacks Up

Journey isn’t the only student credit card from Capital One. It shares the spotlight with the newer and frankly more generous Capital One SavorOne Rewards for Students Card. See how the two compare and decide which is right for you.

| Journey Student Rewards | SavorOne for Students | |

| 3% Cash Back | None | Unlimited on dining, entertainment, popular streaming services, grocery stores |

| 1% Cash Back | On all eligible purchases (1.25% with on-time payment) | All eligible purchases that don’t earn 3% back |

| On-Time Payment Bonus | 0.25% | None |

| UberOne Membership | No | Yes — up to 10% off, $0 delivery fee, and more |

| Bonus Uber Cash Back | No | Yes, up to 10% |

| Credit Required | Fair, limited | Fair or better |

| Annual Fee | $0 | $0 |

Final Word

Journey Student Rewards from Capital One doesn’t have the most generous cash back rewards program, lowest APR, or juiciest benefit lineup. But, for students just starting out on the path to financial fitness, it can be an incredibly powerful spending aid.

Every timely payment made with this card demonstrates to Capital One and future credit card issuers that you’re capable of managing credit responsibly. In just 5 months, your diligence and self-restraint could pay off with a higher credit line. Over a longer period of time, you’ll prove to risk-averse lenders that you’re a good candidate for higher-end cards with more generous rewards and favorable terms.

And, by then, you likely won’t be eking by on a student budget.

Pros

Solid cash back program (up to 5% back)

No annual fee

Bonus cash back for on-time payment

Cons

No early spend bonus

No bonus for good grades

No 0% APR intro promotion