Pros

No annual fee

Reasonable minimum deposit

Relatively low APR

Cons

No rewards program

No interest on your deposit

Requires a credit check to apply

The Citi® Secured Mastercard® is a secured credit card with no annual fee and a required minimum security deposit of $200 when you open your account, prior to card activation.

If you have poor credit, or lack much of a credit history at all, this is a great card for building or rebuilding your credit. Although a recent bankruptcy filing is likely to disqualify your application, most other major credit blemishes are acceptable.

The Citi Secured Mastercard is comparable to other secured credit cards designed for people who wish to improve their credit scores, as well as certain unsecured cards for people with fair credit, such as Capital One QuicksilverOne and Capital One Platinum. However, those unsecured cards generally require stronger credit histories and a demonstrated ability to use credit responsibly.

What Sets the Citi Secured Mastercard Apart

What makes the Citi Secured Mastercard different from other secured credit cards? There’s nothing totally unique about it, but these three features do stand out:

- Doesn’t Require Long Credit History. The Citi Secured Mastercard doesn’t require much (or any) credit history to qualify. In fact, you’re better off applying with limited credit and no FICO score at all than with a truly abysmal credit score.

- No Annual Fee. Most secured credit cards (and unsecured credit-building cards too) charge an annual fee if they accept applicants without long credit histories. Citi Secured is different, in a good way.

- Reasonable Security Deposit. You can open your account with a deposit as low as $200. That’s not the lowest security deposit around — the Capital One Platinum Secured card’s minimum deposit is just $49 — but it’s doable if you have a bit of savings.

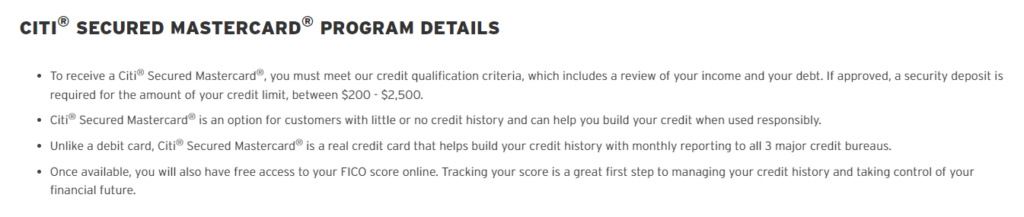

What else can you expect from the Citi Secured Mastercard? You’ll find more details on its features and capabilities in the section below, but here’s the high-level summary from Citi itself:

Key Features of the Citi Secured Mastercard

These are the most important features of the Citi Secured Mastercard. Read on to understand the initial deposit requirements, your potential credit limit requirements, possible fees, and other important things to know before you apply.

Initial Deposit Requirement and Refund

Once your card application is approved, you have 30 days to submit an initial deposit of at least $250, and as much as $2,500. This deposit is held for 18 months in a Collateral Holding Account that does not bear interest.

To receive a refund of your deposit, you need to pay off your card balance (if any) in full and close your card and wait until the 18-month period ends (at which point Citi may offer to upgrade you to an unsecured card), or apply and receive approval for an unsecured Citi credit card before the end of the 18-month period.

Credit Limits and Credit Increases

Your credit limit is determined when Citi processes your application, and is equal to the deposited amount held in your Collateral Holding Account – anything between $250 and $2,500. If you use your card responsibly and make timely payments, Citi may increase your credit limit automatically and invite you to deposit additional funds, though this isn’t guaranteed.

Credit Bureau Reporting

Citi reports your monthly payment activity, including on-time and late payments, to the major credit reporting bureaus. After a while, timely payments (within approximately one month of your statement closing date) can build your credit and raise your credit score.

Important Fees

There is no annual fee. The foreign transaction fee is 3%. Balance transfers cost the greater of $5 or 3% of the transferred amount, while cash advances cost the greater of $10 or 5%.

Credit Required

This card is for people with bad credit, so qualification standards are quite lenient. However, Citi does run a credit check during the application process and will not approve your application if you have had a bankruptcy in the recent past.

Advantages of the Citi Secured Mastercard

The Citi Secured Mastercard has a reasonable APR (by category standards) and no annual fee, among other benefits.

- Reasonable APR. By secured credit card standards, Citi Secured Mastercard has a reasonable regular APR. Some competitors’ APRs are significantly higher.

- No Annual Fee. Most secured credit cards charge annual fees, so Citi Secured Mastercard is a notable exception. Merrick Bank’s Secured Visa and BankAmericard Secured Credit Card both charge more than $35 per year, for instance.

- Decent Credit Limit Range. The maximum initial credit limit on this card is $2,500. That’s not stratospheric, but it’s better than many competing secured cards, which seem not to trust new cardholders at all. Some cap credit limits at just a few hundred dollars to start.

Disadvantages of the Citi Secured Mastercard

Consider these drawbacks before you apply for the Citi Secured Mastercard. Only you can decide whether they’re bad enough to break the deal.

- Credit Limit Can’t Be Higher Than Security Deposit. Your credit limit is always equal to your security deposit, no matter how much you deposit or how reliably you repay your balances. Some competing cards, including Capital One Secured Mastercard, offer credit limits greater than the cardholder’s initial security deposit.

- No Rewards. Citi Secured Mastercard doesn’t have a rewards program. That’s a big drawback relative to some lesser-known secured card competitors, including Navy Federal Credit Union nRewards Secured, which offers unlimited 1% cash back.

- Credit Check Required. Citi requires all Secured Mastercard applicants to submit to credit checks. If you’ve filed for bankruptcy within the past couple years, your credit report reflects that, and your application will almost certainly be denied. Some competing secured cards, including OpenSky Secured Visa, don’t make credit checks part of the application process.

- Has Penalty APR and Foreign Transaction Fee. This card comes with a hefty penalty APR and a 3% foreign transaction fee. These charges and fees hurt cardholders who occasionally make late payments or travel outside the United States. Not every secured card charges penalty interest and foreign transaction fees – for example, Capital One Secured Mastercard waives both.

- No Interest on Collateral Account. Your Citi Collateral Holding Account is interest-free, so your security deposit doesn’t grow with time. This is an unfortunate change from previous versions of the Citi Secured Mastercard, which held security deposits in interest-bearing CD accounts. It’s also a minor drawback relative to competing cards such as the U.S. Bank Secured Visa Card, which holds deposits in FDIC-insured accounts with annual interest rates of comparable to other big-bank savings accounts. That’s not much, but it’s still something.

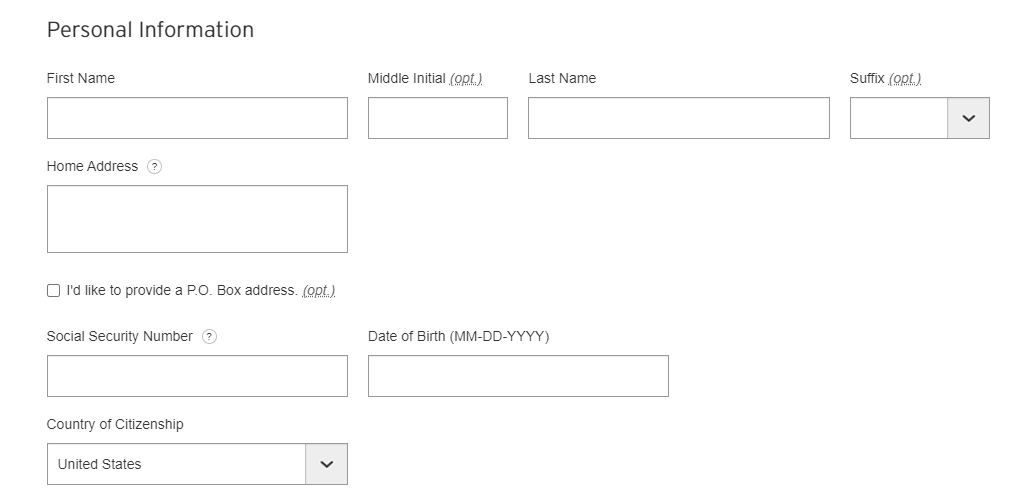

- Requires a Social Security Number to Apply. More and more secured credit cards accept applicants without Social Security numbers. Not so Citi Secured, which has maintained this requirement for years. If you’re new to the United States, this could be a major roadblock.

How the Citi Secured Mastercard Stacks Up

The Citi Secured Mastercard is an above-average secured credit card. It’s not so good that you shouldn’t consider other options before applying, though.

Here’s how it compares to the similar-but-different Capital One Platinum Secured Credit Card. Size them up, then decide which makes more sense for your needs.

| Citi Secured | Capital One Platinum | |

| Initial Deposit (Minimum) | $250 | $49 |

| Credit Limit (Maximum) | $2,500 (initial) | $1,000 (initial) |

| Credit Limit Increase | No set schedule, but you can get your security deposit back after 18 months | Possible after 6 months |

| Rewards | None | None |

| Annual Fee | $0 | $0 |

Final Word

Like other secured credit cards, Citi® Secured Mastercard® is a means to an end: better credit. It’s not a card to aspire to hold in your wallet for the long term. Rather, it’s a card that’s meant to be used as a stepping stone to a higher credit score.

Following many consecutive months of responsible use and timely payments, your Citi Secured Mastercard will hopefully have served its purpose. You then have a green light to apply (and receive approval) for better credit cards: cash back credit cards, low-APR credit cards, and cards with attractive sign-up bonus opportunities. As long as you use those cards responsibly, you’ll have no further use for your Citi Secured Mastercard.

Pros

No annual fee

Reasonable minimum deposit

Relatively low APR

Cons

No rewards program

No interest on your deposit

Requires a credit check to apply