Pros

No annual fee

1.5% back on all eligible purchases

10% back on Uber purchases + complimentary UberOne membership

Cons

No bonus cash back categories other than Uber

Requires a credit score and credit check

Not appropriate for credit-impaired students

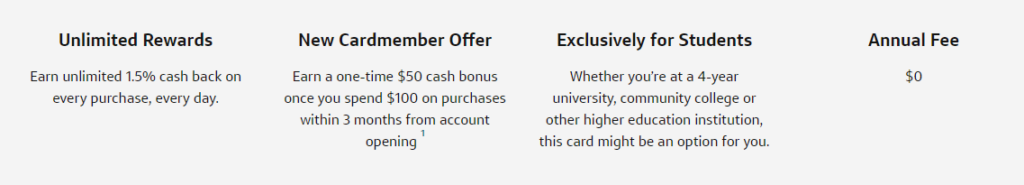

The Capital One Quicksilver Student Cash Rewards Credit Card (also known as Quicksilver Rewards for Students) is a cash-back credit card designed specially for college students. An ideal spending aid for younger folks (and lifelong learners) with fair credit, it’s appropriate for anyone attending or planning to attend a four-year institution, community college, or other qualifying higher education institution.

Quicksilver Rewards for Students boasts a flat cash-back rate — unlimited 1.5% back on every purchase, every day — and no annual or foreign transaction fees. Capital One reports card utilization and payment activity to the three major credit reporting bureaus, giving Quicksilver Rewards for Students cardholders a golden opportunity to build credit over time with responsible use and timely payments.

Quicksilver Rewards for Students has much in common with the flagship Capital One Quicksilver Cash Rewards Credit Card, which has stricter credit standards. It also shares a brand with the Capital One QuicksilverOne Rewards Credit Card, which is marketed to general audiences (not just students) with fair or average credit.

What Sets Quicksilver Rewards for Students Apart

The Capital One Quicksilver Student Cash Rewards Credit Card is not your typical student credit card. It stands out from its fellows in three key ways:

- 1.5% Cash Back on All Eligible Purchases. For a student credit card, this is a very solid return on spending. And it’s unlimited, so if you’re fortunate enough to have a steady income as a student, you can really rack up the points.

- 10% Cash Back on Uber Purchases & Complimentary UberOne Membership. Capital One credit cards have outstanding benefits for Uber and Uber Eats fans. It’s notable that Capital One extends these benefits to student cardholders, who typically get short shrift.

- Solid Early Spend Bonus. Many student credit cards don’t bother with early spend bonuses (sign-up bonuses). Quicksilver Student’s offer won’t break any records, but it’s notable for the category.

Key Features of the Capital One Quicksilver Student Cash Rewards Credit Card

The Capital One Quicksilver Rewards for Students card has a straightforward cash back rewards program, relaxed underwriting requirements, and some other benefits worth writing home about.

Early Spend Bonus

For a limited time, earn $50 when you spend $100 in the first 3 months.Earning Cash-Back Rewards

The Capital One Quicksilver Rewards for Students card earns 1.5% cash back on most eligible purchases, every day. Eligible hotel and car rental bookings earn unlimited 5% cash back when made through Capital One Travel. There’s no limit to how much you can earn over time.

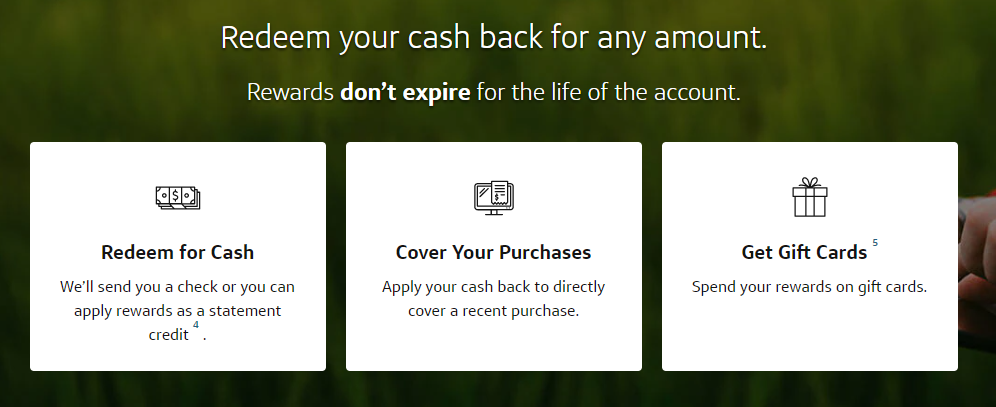

Redeeming Cash-Back Rewards

You can redeem your accumulated cash-back rewards for:

- A general statement credit to your account balance

- A targeted statement credit applied to specific past purchases

- A paper check mailed to your address on file

- Credit for eligible purchases made with PayPal

- Gift cards offered by participating partner merchants

You can redeem in any amount and at any time.

Bonus Uber Cash Back

For a limited time, eligible purchases with Uber and Uber Eats (including ride-hailing and delivery) earn 10% cash back, with no limits on how much you can earn. That’s a fantastic rate of return for a no-annual-fee credit card.

Complimentary UberOne Membership

For a limited time, Quicksilver Student also comes with a complimentary Uber Eats membership. Benefits include:

- Up to 10% off eligible Uber Eats delivery purchases (in addition to 10% bonus cash back)

- Up to 5% off eligible Uber purchases (in addition to bonus cash back)

- No delivery fee on eligible Uber Eats orders

- Members-only perks and promotions

You don’t need to do anything to earn these benefits, other than use your Quicksilver Student card.

Additional Card Benefits and Perks

The Capital One Quicksilver Rewards for Students card has some additional benefits worth noting:

- Extended warranties on eligible purchases with existing manufacturers’ warranties

- Complimentary travel accident insurance, subject to policy limits and exclusions

- A card lock feature that protects your account from fraud

- Randomly generated virtual card numbers that ensure you don’t have to give your real card number to random online merchants

- Complimentary access to Capital One Shopping, a browser plugin that can help you find a lower price when you shop online

- 24/7 complimentary concierge service when you shop, dine, or travel

- 24/7 travel assistance and emergency cash advance service if your card is lost or stolen

- Periodic free credit report alerts (for events such as an increase or decrease in your credit score) on your Experian or TransUnion credit report

These benefits may be subject to terms and limitations and are subject to change at Capital One’s discretion.

Important Fees

Quicksilver Rewards for Students does not charge an annual fee. There’s no fee for foreign transactions, including transactions made at overseas points of sale and online purchases made with merchants located outside the United States. See terms and conditions for information about balance transfer fees and cash advance fees.

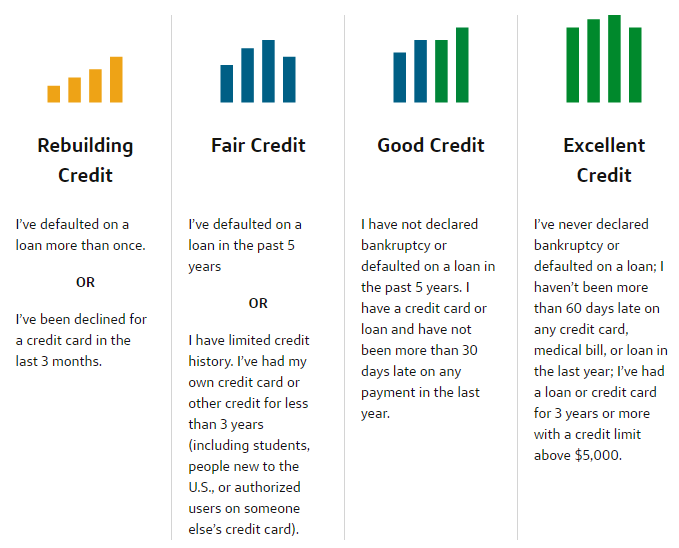

Credit Required

The Capital One Quicksilver Rewards for Students card is appropriate for students and soon-to-be students with fair credit or better. It’s not suitable for students with poor credit or limited credit, nor new-to-credit students who don’t have credit scores. The graphic below shows how Capital One defines “fair credit” and its other credit quality tiers.

This card offers modest credit lines for applicants. You may be able to apply for a credit line increase after demonstrating a record of timely payment and responsible card utilization.

Advantages of the Capital One Quicksilver Student Cash Rewards Credit Card

The Capital One Quicksilver Rewards for Students card has some key advantages over other student credit cards and entry-level cash-back cards. They include a straightforward and relatively generous rewards program, low card fees, and relaxed underwriting.

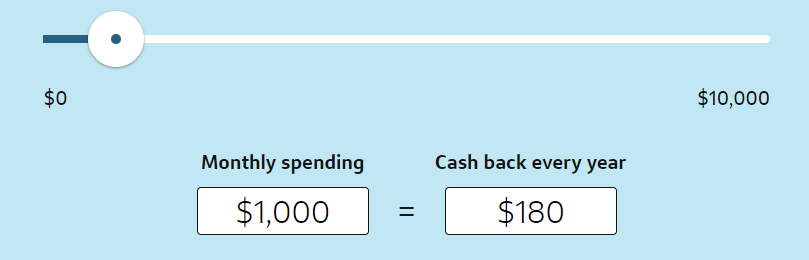

- Solid Rate of Return on All Eligible Purchases. The Capital One Quicksilver Rewards for Students card has a simple rewards scheme: a 1.5% cash-back rewards rate on most eligible purchases, every day, with no caps on earning potential or rotating bonus categories to worry about. This isn’t the most generous cash-back program around, but it’s above-average for a student credit card. The graphic below shows how much you could earn in a year at a $1,000/month spend rate.

- No Foreign Transaction Fees or Annual Fee. Quicksilver Rewards for Students doesn’t charge an annual fee or foreignt transaction fees. These are key benefits for budget-conscious students who don’t want to pay to keep the card around and who plan to study abroad or shop with international merchants while in college.

- Open to Applicants With Less-Than-Perfect Credit. Quicksilver Rewards for Students is appropriate for applicants with fair credit scores. You don’t have to have perfect (or even good) credit to apply for this card.

- Nice Lineup of Fringe Benefits. Quicksilver Rewards for Students has some choice fringe benefits, including extended warranties on eligible purchases, basic protections for travelers, and fraud protection measures like a handy card lock feature. These might not be the deciding factor in your decision to apply for this card, they certainly don’t hurt.

- Nice Early Spend Bonus (Sign-Up Bonus). Capital One Quicksilver Rewards for Students has a nice early spend bonus (also known as a sign-up bonus) for new cardholders.

Disadvantages of the Capital One Quicksilver Student Cash Rewards Credit Card

Although it’s one of the best credit cards for students, the Capital One Quicksilver Rewards for Students card is not perfect. Its disadvantages include a missing early spend bonus, no 0% APR introductory promotion on purchases or balance transfers, and no bonus cash-back categories.

- No Broad Way to Earn Cash Back Above the 1.5% Rate. You can’t earn rewards any faster than this card’s flat-rate 1.5% baseline rewards rate allows, with the exception of eligible Capital One Travel purchases. That’s not a bad baseline for an entry-level student credit card, to be sure, but it’s also not up to the standards of premium cash-back credit cards that offer 5% back or more on eligible purchases.

- Not Appropriate for New-to-Credit Applicants. Quicksilver Rewards for Students does not require excellent or even good credit, but it does require some credit history. This is a drawback for applicants who don’t have any credit history to point to, including those who haven’t been able to build credit without a credit card and international students seeking a U.S.-based payment solution for the first time.

How the Capital One Quicksilver Student Cash Rewards Credit Card Stacks Up

Believe it or not, Quicksilver Student is just one of several student credit cards backed by Capital One. See how it compares to another popular option for students: the Capital One SavorOne Rewards for Students Card.

| Quicksilver Student | SavorOne for Students | |

| 3% Cash Back | None | Unlimited on dining, entertainment, popular streaming services, grocery stores |

| 1.5% Cash Back | All eligible purchases | None |

| 1% Cash Back | None | All eligible purchases that don’t earn 3% back |

| UberOne Membership | Yes | Yes |

| Bonus Uber Cash Back | Yes, up to 10% | Yes, up to 10% |

| Annual Fee | $0 | $0 |

Final Word

The Capital One Quicksilver Rewards for Students card is one of the better student credit cards on the market right now. With a flat cash-back rate that’s right where an entry-level card’s should be, no annual fee, and a relaxed underwriting process, it has the potential to be a real asset for many college students.

Is Quicksilver Rewards for Students perfect? Far from it. It’s not suitable for applicants with bad credit scores or no credit scores at all, which excludes many young people who haven’t had a chance to build credit as minors and most international students as well.

And its fringe benefits aren’t specially designed with students in mind, as is the case for some more innovative cards in this niche. You won’t find a free or discounted subscription to Amazon Prime Student or rewards on purchases of streaming services here, for example.

Before deciding to apply for Quicksilver Rewards for Students, make sure it’s the best fit for your needs. After all, this is a card you hope will carry you through the next four years — or however long remains on your student journey.

Pros

No annual fee

1.5% back on all eligible purchases

10% back on Uber purchases + complimentary UberOne membership

Cons

No bonus cash back categories other than Uber

Requires a credit score and credit check

Not appropriate for credit-impaired students