Pros

Great early spend bonus

High cash-back rate (2% on all eligible purchases)

Annual cash-back bonus for big spenders ($200k+ annual spend)

Cons

Has an annual fee

Minimal noncash redemption options

Limited business benefits and services

Capital One Spark Cash Plus is a business cash back charge card with a $150 annual fee and a straightforward rewards program that pays you an unlimited 2% cash back on every purchase you make. Like many fellow business cards, it offers business benefits such as free employee cards and spending reports, though it’s a bit less generous on this front than some competitors.

Spark Cash Plus is comparable to a number of other business rewards cards, some of which are annual-fee-free and some of which charge annual fees ranging as high as $550. They include: the Chase Ink Business Preferred® Credit Card ($95 annual fee) and the American Express Blue Business Cash Card (no annual fee), among others.

How the Capital One Spark Cash Plus Card Stacks Up

Intrigued by the Capital One Spark Cash Plus Card? Before you move forward with your application, be sure to check out similar small business credit cards too.

One card that should definitely be on your shortlist if you’re considering Spark Cash Plus is the Chase Ink Business Unlimited Card. Ink Business Unlimited is another flat-rate cash-back card that’s in the same universe as Spark Cash Plus — but different enough to warrant a closer look.

| Spark Cash Plus | Ink Business Unlimited |

| $150 annual fee | No annual fee |

| $200 annual cash-back bonus when you spend over $200k in a year | No annual spend bonus |

| Earn a one-time cash bonus of $1,200 once you spend $30,000 in the first 3 months. | Earn $750 bonus cash back after you spend $6,000 on purchases in the first 3 months from account opening. |

| Pay in full every month | Can carry a balance; 0% intro APR for 12 months on purchases, then variable regular APR applies (18.49% to 24.49%) |

Key Features of the Capital One Spark Cash Plus Card

These are the key features of the Spark Cash Plus card. Note the great early spend bonus, straightforward rewards program, and annual cash-back bonus, among much else.

Early Spend Bonus

Earn a one-time cash bonus of $1,200 once you spend $30,000 in the first 3 months.Earning and Redeeming Cash Back Rewards

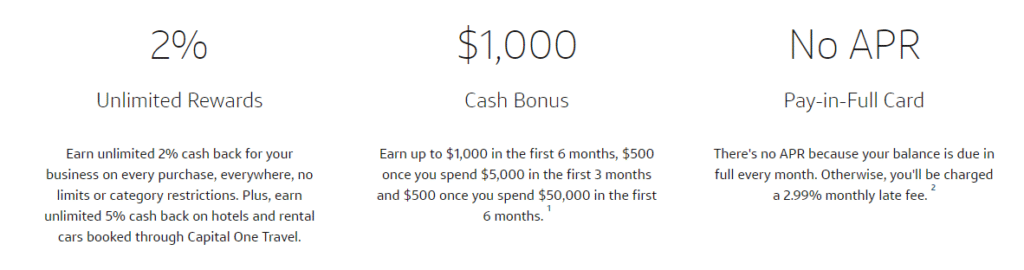

Capital One Spark Cash Plus earns a flat, unlimited 2% cash back on most purchases. Eligible hotel and rental bookings earn 5% cash back when made through Capital One Travel. Rewards don’t expire as long as your account remains open and in good standing.

You can redeem your accumulated cash back in any amount for paper checks or statement credits. Alternatively, you can elect to receive automatic redemptions (statement credits or checks) once you hit a preset threshold: $25, $50, $100, or $200.

Annual Cash Back Bonus

Earn an annual $200 cash bonus every year you spend $200,000 or more.

Important Fees

The annual fee is $150. There is no balance transfer fee, foreign transaction fee, or fee for extra employee cards (and those cards earn unlimited 2% cash back as well). There is no APR or preset spending limit.

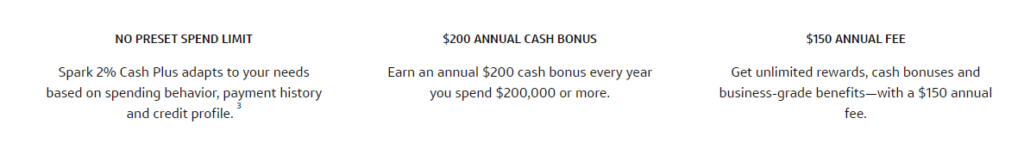

Quarterly and Year-End Summaries

With your account, you receive periodic spending summaries that feature detailed, categorized, and itemized looks at your spending, as well as that of your employees, if applicable.

Downloadable Purchase Records

Your account comes with downloadable purchase reports that are ready for export to accounting platforms such as Excel, QuickBooks, and Quicken, streamlining your business’s year-end accounting and tax preparation process.

Additional Benefits

This card comes with a nice lineup of additional benefits, including:

- 24/7 emergency card replacement

- Complimentary loss and damage coverage on rental cars charged in full

- Lost luggage protection up to $3,000 per trip when you charge the full value of the travel ticket (airfare, train fare, and so on) to your card.

Credit Required

This card requires excellent or good credit. A few minor dings probably won’t disqualify your application, but more serious issues aren’t acceptable.

Advantages of the Capital One Spark Cash Card

Here’s what Spark Cash Plus has going for it. Highlights include a category-leading early spend bonus, high baseline cash-back rate, and annual bonus for big spenders.

- Great Early Spend Bonus. This card’s early spend bonus is fantastic. Indeed, it’s one of the best new cardmember offers of any small business card.

- No Foreign Transaction or Balance Transfer Fees. Spark Cash Plus doesn’t have any foreign transaction or balance transfer fees. This dual benefit is great for two types of cardholders: those who do business outside the U.S., and those who wish to transfer high-interest balances from existing credit card accounts. Some popular alternatives carry foreign transaction fees ranging from 2% to 3%. Most carry balance transfer fees of at least 3% or $5 per transfer, whichever is greater.

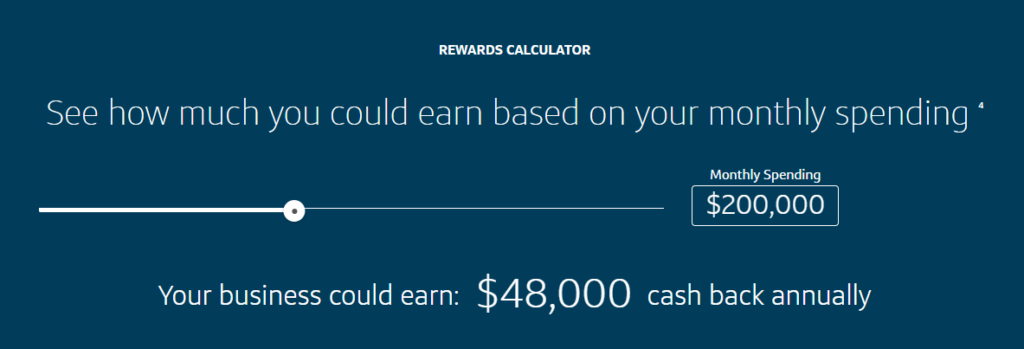

- High Baseline Cash Back Rate. This card earns 2% cash back with no limits or restrictions. A consistent 2% rate is fairly rare for any card, consumer or business, and is a great boost for business owners with heavy spending needs in a wide range of categories.

- Flat Cash Back Scheme Is Super Simple. Spark Cash Plus has a super simple cash back rewards program: unlimited 2% cash back on every purchase, every day, with the exception of hotel and rental car bookings through Capital One Travel. This is great news for people who can’t be bothered to deal with tiered and capped spending categories or, even worse, rotating categories. Many competing business rewards cards, including the Chase Ink and American Express business card families, have more complicated deals that include tiers and caps.

- Annual Cash Back Bonus for Big Spenders. Spend at least $200,000 per year with this card and you can look forward to a $200 annual cash bonus. That’s a nice bonus haul at the end of the year.

- Flexible, Any-Amount Rewards Redemption. You can redeem your accumulated cash back rewards in any amount, as long as you’re willing to take a paper check or statement credit.

Disadvantages of the Capital One Spark Cash Card

Consider these drawbacks before applying. In particular, note the annual fee (which has risen in recent years), limited noncash redemption options, and limited business benefits compared with other top small business credit cards.

- Has an Annual Fee. Although this card’s $150 annual fee is relatively modest compared with some competing business cards, it’s still a problem for business owners who don’t spend enough to cover it. For a fee-free card with similar benefits, consider Capital One Spark Cash Select.

- Minimal Noncash Redemption Options. If you don’t want to redeem your accumulated cash back rewards for actual cash, this isn’t the card for you. Your other redemption options are limited to gift cards, which may erode the value of your points. By contrast, the Chase Ink and American Express business card families both offer access to extensive merchandise portals – Ultimate Rewards and Membership Rewards, respectively. These portals allow you to redeem for a wide variety of merchandise items, often at a $0.01-per-point rate – and even higher, in some cases.

- Limited Business Benefits. This card doesn’t have a ton of benefits, especially for business owners, aside from the downloadable purchase records and quarterly spending reports. That’s a disadvantage relative to some other business cards.

Final Word

Spark Cash Select, the annual-fee-free junior cousin of Spark Cash Plus, earns an unlimited 1.5% cash back on all purchases. Aside from a few business benefits not available with Capital One’s consumer cards, it’s nearly identical to the Capital One Quicksilver Card, though the lack of balance transfer fees is an important Spark Cash Select benefit that’s not available to Quicksilver cardholders.

Meanwhile, with a flat, unlimited 2% cash back rate on all purchases, Capital One Spark Cash Plus is like a turbocharged Quicksilver – again, with the added benefit of nonexistent balance transfer fees. Although many other business cards have more generous benefit packages, it’s hard to do better than Spark Cash Plus’s baseline earning rate. If all you care about is the bottom line, this card needs to be high on your list.

Pros

Great early spend bonus

High cash-back rate (2% on all eligible purchases)

Annual cash-back bonus for big spenders ($200k+ annual spend)

Cons

Has an annual fee

Minimal noncash redemption options

Limited business benefits and services