Pros

No annual fee

Solid offer

Up to 2% cash back on eligible purchases

Cons

Has as foreign transaction fee

Spending cap on 2% cash-back earnings

The American Express Blue Business Cash™ Card is a popular business credit card with no annual fee and a solid cash back rewards program that rewards business owners for everyday purchases they’d make anyway. With no annual fee, it works well as a general-purpose business credit card, and its 12-month, 0% on-going APR promotion is great for business owners looking to finance big purchases.

The Blue Business Cash Card competes with a number of business-oriented rewards cards, including American Express Blue Business Plus and Chase Ink Cash Business.

How the American Express Blue Business Cash™ Card Stacks Up

Not sure whether the Blue Business Cash Card is right for you? Before we get too deep into the review, let’s take a look at how it compares with another popular cash-back card for small business owners: the Capital One Spark Cash Plus credit card.

| American Express Blue Business Cash™ Card | Capital One Spark Cash Plus Card | |

| Annual Fee | $0 | $150 |

| Cash-Back Rate | 2% cash-back on the first $50,000 spent on eligible purchases each year, then 1% cash-back on eligible purchases | 2% cash back on most purchases; 5% cash-back on eligible Capital One Travel purchases |

| Intro APR | 0% APR on purchases for 12 months from account opening, then variable regular APR applies: 18.49% to 26.49% APRs will not exceed 29.99% (see rates and fees) | No introductory APR offer at this time |

| New Card-Member Offer | Earn a $250 statement credit after you make $3,000 in purchases on your Card in your first 3 months. | $500 once you spend at least $5,000 in eligible purchases in the first 3 months and another $500 once you spend at least $50,000 in eligible purchases in the first 6 months |

Key Features of the American Express Blue Business Cash™ Card

These are the key features of the Blue Business Cash Card.

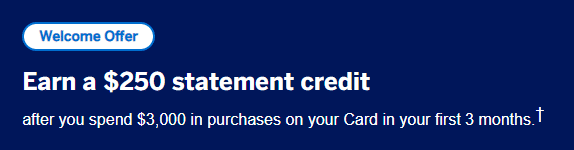

New Card-Member Offer

Earn a $250 statement credit after you make $3,000 in purchases on your Card in your first 3 months.

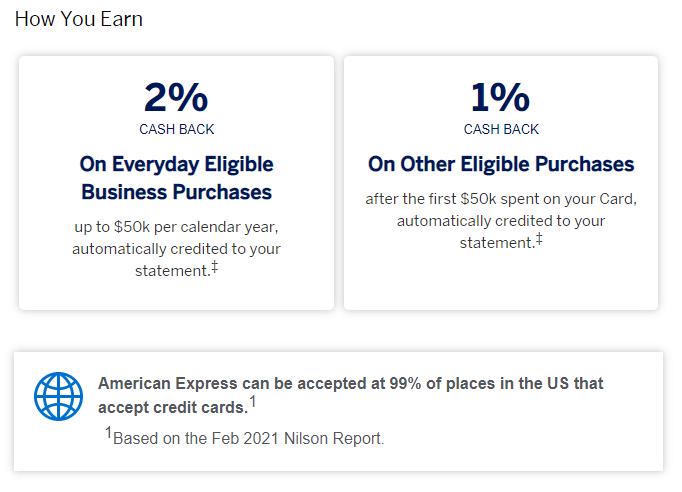

Earning Cash Back Rewards

The American Express Blue Business Cash Card earns 2% cash back on the first $50,000 spent on eligible purchases each year. Above the limit, purchases in these categories earn an unlimited 1% cash back.

Redeeming Cash Back Rewards

Accrued cash back is automatically applied to your account as a statement credit at the end of each billing period.

Introductory APR

Enjoy 0% APR on purchases for 12 months from account opening. For rates and fees of the American Express Blue Business Cash Card, please visit this rates and fees page.

Regular APR

Following the conclusion of the introductory APR period, variable regular APR applies: 18.49% to 26.49% APRs will not exceed 29.99%, depending on your creditworthiness and other factors – see rates and fees for important information.

Important Fees

There is no annual membership fee. Foreign transactions cost 2.7% of the total transaction amount, regardless of denomination. Late and returned payments cost up to $39. See rates and fees.

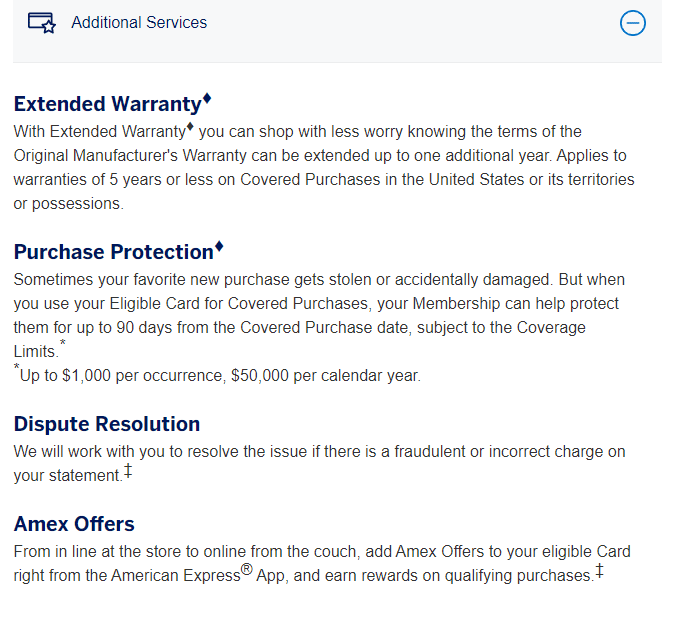

Additional Business Benefits

Blue Business Cash comes with a slew of value-added benefits that aren’t available to non-business cardholders. These include:

- The American Express® Business App, which allows you to add receipt images and text tags to specific transactions in your American Express online account and phone app

- The ability to assign an authorized Account Manager (such as a trusted employee) to handle things like dispute resolution, additional card ordering, and payments

- Customizable account alerts

- Integrations with third-party apps and sites like QuickBooks and Bill.com

Expanded Buying Power

With this card’s Expanded Buying Power feature, you can spend beyond your credit limit to make bigger purchases for your business while earning cash back on those purchases. However, your additional spending power isn’t unlimited – it adjusts with your card use patterns, payment history, credit record, financial resources known to Amex, and other factors.

Credit Required

This card requires good to excellent credit. Any notable credit blemishes are likely to be disqualifying.

Advantages of the American Express Blue Business Cash™ Card

The American Express Blue Business Cash Card has some significant benefits for regular users. It has no annual fee, a solid offer, a good cash-back program, and simplified cash-back accrual and redemption, among other high points.

- No Annual Fee. This card doesn’t come with an annual fee, a noteworthy benefit for budget-conscious business owners. Rival cards such as Chase Ink Business Preferred® ($95) and the Business Gold Card from American Express ($375) do have annual fees.

- Earn 2% Cash Back on the First $50,000 in Eligible Purchases Each Year. Blue Business Cash earns 2% cash back on the first $50,000 in eligible purchases each year. That works out to potential 2% cash back earnings of $1,000 annually, which can make a huge difference for business owners who watch every dollar. By contrast, Capital One Spark Classic for Business offers a flat 1% cash back on all purchases.

- Strong Introductory Interest Promotion on Purchases. This card has a 12-month 0% APR introductory promotion on purchases. If you’re planning a substantial business investment too large to pay off in a single month, this is your opportunity to save hundreds on interest charges.

- Cash Back Automatically Accrues to Your Account. With Blue Business Cash, you never have to worry about redeeming your cash back. That’s automatically done for you at the end of each billing period. Most other cash back business cards require you to manually redeem your rewards, a potentially inconvenient extra step that’s easy to get lost in the shuffle of everyday business obligations.

Disadvantages of the American Express Blue Business Cash™ Card

The American Express Blue Business Cash Card isn’t exactly perfect. It has a foreign transaction fee and a pesky spending cap for the 2% cash-back category — a cap that’s low enough to trouble heavier spenders.

- Has a Foreign Transaction Fee. This card’s 2.7% foreign transaction fee is a big bummer for business owners who routinely travel beyond the United States’ borders. The Capital One business credit card family (Spark) doesn’t charge foreign transaction fees.

- Spending Cap for the 2% Category. The 2% cash back category maxes out at $50,000 in eligible purchases per year, which may be a limitation for larger businesses with higher spending requirements. If you expect to exceed this limit in the normal course of events, consider alternatives such as the Business Green Rewards Card from American Express, the Business Gold Card from American Express, and the Business Platinum Card from American Express.

Final Word

If you haven’t considered applying for the American Express Blue Business Cash™ Card or another business credit card because you don’t think you qualify as a business owner, it’s time to take another look. Even if you’re a sole proprietor without formal incorporation, you may still be eligible for this credit card if you certify that you intend to use it only for business expenditures. In many cases, filing a Schedule C with your income taxes, signifying that you’re self-employed, is enough to demonstrate that you’re a business owner – whether you oversee a one-person operation or a multi-employee company.

It’s important to remember that while the American Express Blue Business Cash Card’s terms resemble those of many consumer credit cards, business cards are exempt from some of the key provisions of the CARD Act, such as the requirement that cardholders regularly be notified of changes in terms and conditions.

For rates and fees of the American Express Blue Business Cash Card, please visit this rates and fees page.

Pros

No annual fee

Solid offer

Up to 2% cash back on eligible purchases

Cons

Has as foreign transaction fee

Spending cap on 2% cash-back earnings

How to Start a Side Business or Hustle While Working a Full-Time Job

About one-third of American workers have at least one side gig. Balancing the demands of a side gig, freelancing operation, or startup business alongside your day job takes planning but can radically boost your income. Learn how to start a side business or side hustle while working a full-time job.

Read Now