Pros

Detailed, proven budgeting methodology

34-day free trial

Big savings when you pay annually

Cons

Unavoidable cost after the free trial ends

Not fully automated

If you’re in the market for a new budgeting tool, you have no shortage of choices. More than a dozen legitimate alternatives to Mint offer a variety of takes on the budgeting process. All represent an upgrade from old-school spreadsheets, which are time-consuming and tedious to maintain.

Of these popular budgeting software programs, You Need a Budget (YNAB) is one of the very best.

Using the popular and reliable zero-based budgeting method and four simple rules for effective budgeting, YNAB empowers users to take control of their finances and keep more of their money where it belongs: in their pockets.

YNAB: The Basics

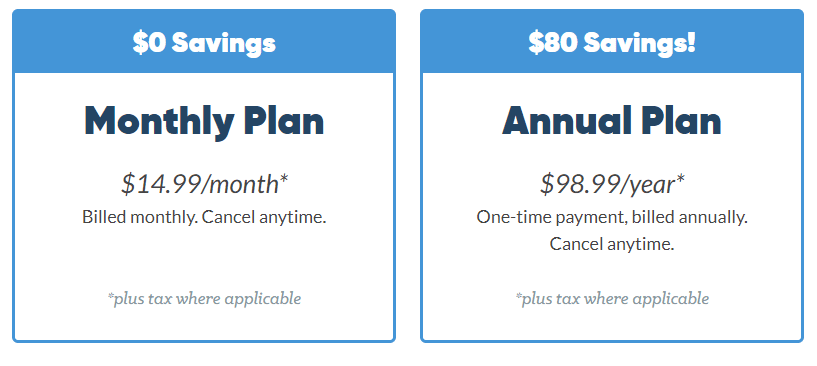

After a generous risk-free trial period, YNAB does require a paid subscription.

Monthly plan users pay $14.99 per month after a 34-day free trial period and can cancel at any time. Annual plan users pay $98 per year — saving $82 each year — and can also cancel at any time. In addition to the free trial period, student users enjoy this budgeting app free for 12 months.

All things considered, this is a small price to pay for a steady hand on the financial till.

Unlike competing “set it and forget it” products that rely on extensive automation and don’t do much to teach their users about building sustainable budgets, YNAB is as much an educational resource as a practical one. More than 100 educational workshops, plus a full-length book, complement robust desktop and mobile money management apps for individual and joint budgets.

Getting started with the YNAB budgeting app is pretty easy too. Per YNAB’s Getting Started Guide, preparing to set up your account takes about 20 uninterrupted minutes and includes three steps:

- Detailing Your Monthly Expenses. Make a detailed list of all your monthly expenses, big and small, across all budget categories. Exact figures or averages are ideal, but estimates are better than nothing. Try to include due dates for individual bills.

- Providing Your Financial Accounts’ Login Credentials to Securely Link Them With Your YNAB Account. This is optional but quite helpful if you’d like to avoid manually entering transactions into the YNAB interface. The more accounts you link up for YNAB’s syncing tool to incorporate, the more account balances YNAB will see, and the fuller the autopopulated picture of your total net worth and cash flow will be (minus any manually entered transactions). Be sure to include credit card accounts, bank accounts — including savings and checking accounts — and investment accounts.

- Shedding Preconceived Notions About Budgeting. YNAB advises new users to embrace a clean slate: to let go of any preconceived notions and past experiences with budgets — including failures — that might color their perceptions of the budgeting process. This makes the YNAB learning curve more manageable.

Why go through the trouble? To answer that question, let’s review the key features and capabilities that set YNAB apart from its competitors.

Key Features of You Need a Budget

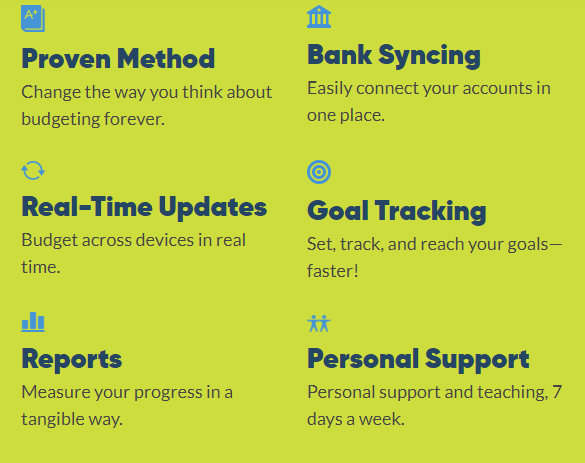

You Need a Budget doesn’t have a tiered or plan-based subscription model. All users can take advantage of the same features, functions, and capabilities.

The Four Rules of You Need a Budget

YNAB’s secret sauce is its Four Rules, common-sense principles that collectively comprise its take on the zero-based budgeting method. Here’s the short version of each rule:

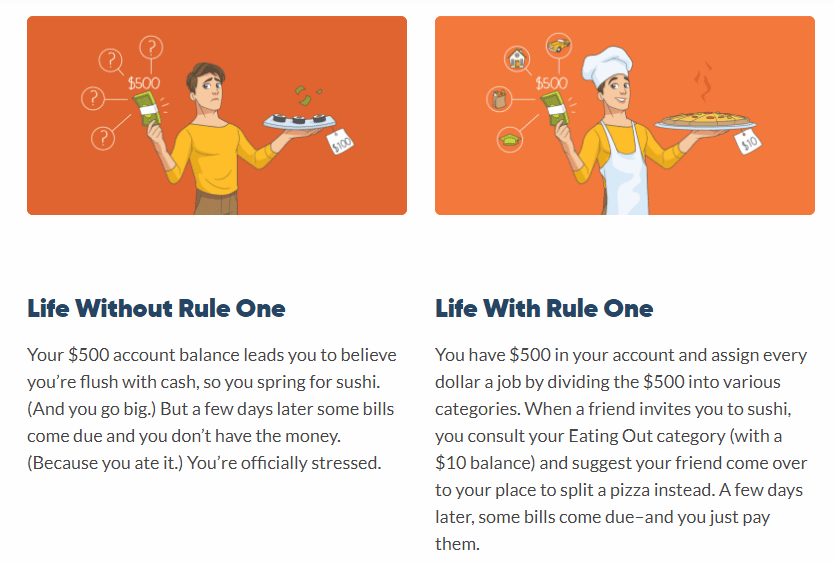

1. Give Every Dollar a Job

This is the basis for YNAB’s budgeting model. In essence, “giving every dollar a job” means allocating every dollar you earn to a specific expense category, be it groceries, housing, transportation, entertainment, or whatever else.

The idea is to create a solid, sustainable plan for how you’ll cover your expenses, essential and discretionary — not simply to spend money as you earn it.

2. Embrace Your True Expenses

This rule asks you to turn less frequent expenses, such as car or home repairs, into “bills.” This means allocating a fixed monthly “contribution” — really, a set-aside that you don’t spend — to each infrequent expense even if you expect not to incur that expense for months at a time.

These “contributions” sit in your bank account until the associated expense comes around, at which point you pay them with set-aside funds and move on without racking up credit card debt or turning to personal loans.

3. Roll With the Punches

We’ve all been guilty of overspending at times. When it happens to you, this rule asks you to adjust your budget on the fly.

If you overspend in one category for any reason, just move unused funds from another category to make up the shortfall and end the month in the same place.

4. Age Your Money

This rule is more aspirational than the other three — YNAB warns new users currently living paycheck to paycheck that they won’t get there overnight.

Eventually, however, this rule finds you covering this month’s bills with money earned last month — technically, 30 days ago or longer. Over time, as you age your finances further, you’ll facilitate the creation of a nice, multimonth emergency fund.

Joint Budgets for Couples and Cohabitants

YNAB’s shared budgeting feature makes it easy for users with shared finances to manage their budgets together.

This feature’s value is self-evident for anyone who has merged finances with a spouse or partner, but it’s also useful in less common or nontraditional situations, such as roommates pooling funds for shared household expenses.

YNAB works for joint users with shared accounts, fully separate finances, and hybrid situations (some shared and some separate accounts).

Goal Tracking Capabilities

The YNAB platform lets users set and track multiple financial goals simultaneously.

These can be near-term goals, like saving up for a security deposit on a new place, or longer-term goals, like an international vacation or a down payment on a house.

Reporting Capabilities

YNAB has a robust array of data tools that can help you make sense of your personal or shared finances.

More importantly, these financial reporting capabilities provide an accurate picture of how that picture changes over time, providing insights that might help you shore up your finances — or simply double down on strategies that already work well.

Customer Support and DIY Help Resources

YNAB offers dozens of live workshops and video courses for users eager to learn more about specific money management concepts and YNAB features.

The workshops are free for paid subscribers and scheduled at convenient times throughout the week. You can watch video courses at your leisure.

You Need a Budget: The Book

If you’re intrigued by the Four Rules of YNAB, “You Need a Budget: The Book” might be for you. This feature-length deep dive on the concept of zero-based budgeting as applied by YNAB is available for about $20 new on Amazon.

You don’t need to read the book to use the YNAB platform or appreciate the Four Rules, of course. But it’s a nice reference that doesn’t add to your cumulative screen time.

YNAB Apps for a Wide Range of Devices

In addition to a standard desktop version, YNAB offers tailored apps for an impressive range of devices. Each app has the same basic features and functions, just tailored to fit the specific device’s format:

- iOS smartphones

- Android smartphones

- iPad

- Apple Watch

- Amazon Alexa (compatible with Amazon Echo, Amazon Dot, and Fire TV Stick with Voice Control)

YNAB’s device page has more details and links to download each app type.

You Need a Budget Referral Program

You Need a Budget has a generous referral program that promises one free month of full use for each successful referral — with no limit to the number of free months you can earn.

A successful referral means a new YNAB customer who signs up for a subscription using a unique referral code you’ve shared. You can track active and completed referrals from your account dashboard.

You Need a Budget Gifting Program

YNAB also has a gifting program that lets users purchase nonrenewable 12-month subscriptions, billed at the annual rate ($84).

You’re responsible for paying the full subscription fee upfront, so this isn’t a win-win opportunity in the same sense as the referral program. But YNAB gift subscriptions certainly make practical holiday and birthday gifts for the frugal folks in your life.

Advantages of You Need a Budget

You Need a Budget is anchored by a proven budgeting methodology and offers an impressive range of mobile-friendly apps for true on-the-go budgeting. Its long free trial period, joint budgeting capabilities, and referral program all add value as well. Here’s why it’s among the best budgeting apps on the market.

- Supported by a Detailed, Proven Methodology. You Need a Budget is built atop a sturdy foundation: the detailed, proven methodology known as zero-based budgeting. YNAB’s Four Rules add a proprietary — although common-sense — layer to this structure. In other words, while YNAB is different, it’s not totally out of left field, which should be reassuring for first-time budgeters and skeptical returnees alike.

- Joint Budgeting Capabilities. YNAB offers joint budgeting for couples, families, and cohabitants, including roommates who pool some funds to cover shared expenses like rent and utilities. This is welcome news to millions of prospective users whose financial lives aren’t entirely unattached, and sometimes absent from bare-bones free budgeting apps.

- New Student Users Get 12 Months Free. Students get an entire year of YNAB free: 12 months from the sign-up date. That’s plenty of time to take the platform’s features for a spin, not to mention welcome news for penny-pinching students.

- All New Users Get 34 Days Free. All new users get 34 days (a 34-day trial) to try out YNAB with no risk or upfront payment. If you don’t like what you see during the trial period, simply cancel your subscription and pay nothing.

- Tailored Apps Enable YNAB on a Wide Range of Mobile Devices. YNAB has an impressive array of mobile-friendly and hands-free apps tailored to specific device types: iOS and Android smartphones, tablets, Apple Watch, and certain Alexa-compatible smart speakers. It’s a truly omnichannel budgeting solution.

- Nice Referral Bonus Opportunity. YNAB’s referral program incentivizes users to give the gift of zero-based budgeting. Each successful referral earns you a free month’s subscription — a $15 value for monthly plan members or a $8 value for annual plan members. The more folks you refer, the more room you’ll have to spare in your own budget.

Disadvantages of You Need a Budget

It’s difficult to find serious fault with You Need a Budget. However, the unavoidable subscription fee after the free trial period and limited automation will turn off some users.

- Costs About $100 Per Year (More When Paid Monthly) After the Free Trial Period. After the free trial period concludes, You Need a Budget reverts to a paid subscription model. Other than the referral program, whose benefits are limited by the supply of eligible referrals in your network, there’s no way to avoid paying for YNAB.

- Not Fully Automated. You Need a Budget does have some nifty automation features, including secure account links that factor real-world transactions into your budget on a rolling basis. But it’s not automated to the same extent as some competing solutions. That said, because they don’t provide a comprehensive picture of external accounts, account-integrated features like Simple’s Safe-to-Spend aren’t as useful for users with complex personal finances as YNAB’s budgeting solution is.

How You Need a Budget Stacks Up

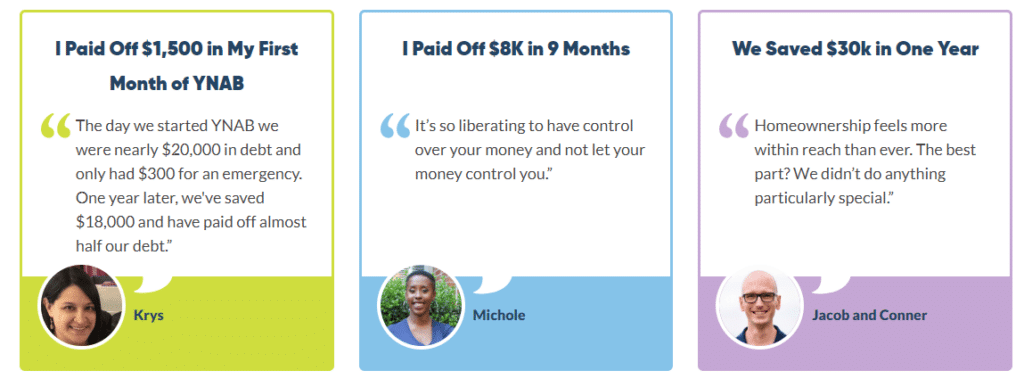

Few premium budgeting tools tick as many fiscal boxes as You Need a Budget. Countless users happily pay for YNAB year after year, reasoning (correctly) that it saves them far more than it costs.

Still, given the cost, it’s a good idea to consider other options before pulling the trigger on YNAB.

One competitor that immediately comes to mind is Mint. Here’s how the two compare.

| You Need a Budget | Mint | |

| Pricing | $14.99/month when paid monthly; $98.99 when paid annually | Most features are free; Mint Premium costs $4.99/month |

| Free Trial | Yes, 34 days | None |

| Automatic Savings | No | No |

| User Support | Extensive | Moderate |

Final Word

Zero-based budgeting isn’t for everyone. Nor are budgets themselves. Many consumers get by just fine with common budgeting alternatives that don’t require paid subscriptions or DIY spreadsheets.

That said, those of us who do prefer to rely on formal budgets to organize and plan our personal finances certainly don’t lack choices. As noted in the introduction, alternatives to Mint — the “default” budgeting tool for many years — are everywhere. Their quality varies greatly.

You Need a Budget holds a special place among them. In my opinion, and in the opinions of thousands of satisfied users, You Need a Budget is among the very best budgeting tools available to U.S. consumers. It’s certainly the best zero-based budgeting product around.

Whether this endorsement is sufficient to sell you on YNAB is another story. But you’d be remiss not to include it on your shortlist of budgeting tools.

Pros

Detailed, proven budgeting methodology

34-day free trial

Big savings when you pay annually

Cons

Unavoidable cost after the free trial ends

Not fully automated