Pros

No annual fee

Solid sign-up bonus

Earn up to 5% cash back

Cons

Can't redeem points for hard cash

No intro APR promotion

Other important redemption restrictions

The Shop Your Way® Mastercard® is hands down the best and most lucrative way to take full advantage of the Shop Your Way rewards program, which rivals some of the best credit card and retail customer loyalty arrangements around. But it’s also really restrictive and frankly not the best choice for most consumers.

That’s partly because this card bears the scars of its past. The Shop Your Way Mastercard was once a retail credit card in the mold of warehouse club and superstore credit cards such as Target Redcard and the Citi Costco Anywhere Visa Card by Citi. Though it could be used anywhere Mastercard was accepted, it was really intended for use at Sears and Kmart stores, and its loyalty program was designed for Sears-universe loyalists.

Well, Sears is a shadow of its former self, and it can no longer lay exclusive claim to the Shop Your Way program. That seems like great news for would-be cardholders who don’t shop at Sears or Kmart, but the devil (as they say) is in the details.

What Is the Shop Your Way Mastercard?

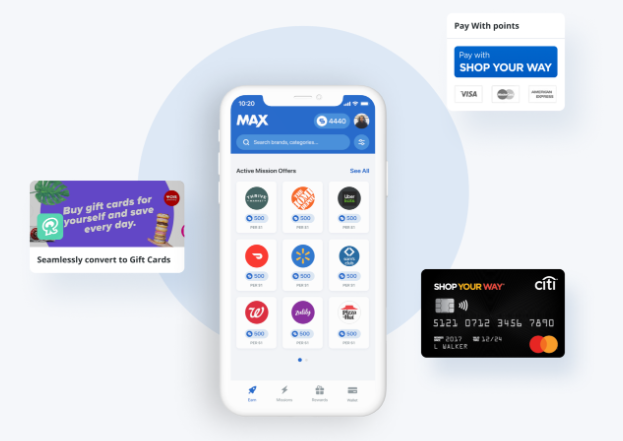

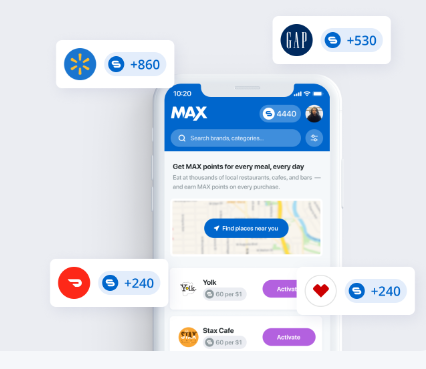

The Shop Your Way Mastercard is a rewards credit card with no annual fee. It boasts a lucrative cash back program that rewards cardholders with up to 5% back on select purchases in popular spending categories such as gas stations, grocery stores, restaurants, and select Shop Your Way partners. To take advantage, you simply need to apply for this credit card, join the free Shop Your Way program, and download the MAX app (where you’ll redeem your points).

Despite a lucrative rewards program, Shop Your Way doesn’t have many of the trappings of a traditional credit card. For instance, there’s no introductory APR promotion, nor are there many value-added benefits not directly related to shopping. The redemption process is a bit wonky too, though worth it if you’re willing to figure it out.

On the bright side, this card has no annual fee, so there’s no downside to keeping it in your wallet and using it only when shopping in favorite merchant categories. Plus, it’s available to applicants with less-than-perfect credit, so it’s a solid choice for those looking to build or rebuild their credit.

Interested in the Shop Your Way Mastercard? Here’s what you need to know about its features, advantages, disadvantages, and overall suitability.

What Sets the Shop Your Way Mastercard Apart

The Shop Your Way Mastercard is a bit of an odd duck as credit cards go. (No, not a compliment.) Here’s what sets it apart, for better or worse:

- Self-Contained Rewards Program. The Shop Your Way Mastercard earns Shop Your Way points, which must be redeemed using the separately-downloaded MAX app. These points have predictable value, so we use cash-back-equivalent percentages when discussing this card’s earn rate, but the currency itself isn’t transferable and can only be redeemed with a select group of Shop Your Way partners.

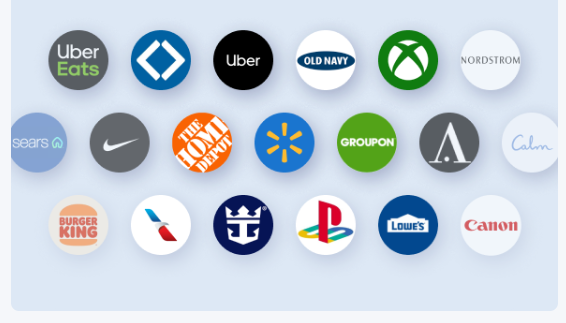

- No Cash Redemptions After the Sign-up Bonus. You can’t redeem Shop Your Way points for hard cash, and only certain points are eligible for gift card redemptions. The most reliable — and potentially restrictive — way to redeem is for purchases with Shop Your Way partners like Uber, Walmart, and Lowe’s.

- Earn Up to 5% Cash Back on Select Purchases. OK, this is a legit good thing. Setting aside the rewards program’s restrictiveness, the potential rate of return is better here than on most other no-annual-fee rewards credit cards.

Key Features of the Shop Your Way Mastercard

These are the most important features of the Shop Your Way Mastercard. See if it makes sense for your day-to-day spending (and earning) needs.

Sign-up Bonus

Through Jan. 28, 2023, earn a $75 statement credit for every $500 spent (up to $225) on eligible purchases in the first 90 days after your account approval date. Ineligible purchases include deferred interest and major purchase plan purchases.

Earning Shop Your Way Rewards Points

This card earns Shop your Way points according to the so-called 5-3-2-1 schedule:

- 5% cash back at gas stations

- 3% cash back at grocery stores and restaurants

- Unlimited 2% cash back with select Shop Your Way partners

- Unlimited 1% cash back on all other eligible purchases

The 5% and 3% categories are capped at $10,000 per calendar year. Once you cross that threshold, purchases in all favored categories (gas stations, grocery stores, and restaurants) earn unlimited 10 points per $1 spent until the calendar year rolls over.

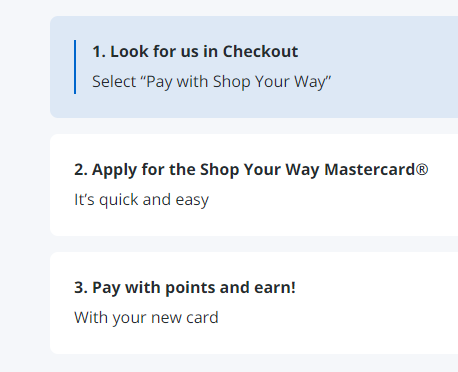

Redeeming Shop Your Way Rewards Points

You can redeem your accumulated points for discounts on merchandise at participating Shop Your Way merchants. You can also redeem some points for gift cards and other items, but restrictions may apply.

To redeem, you’ll need to download the MAX app and join the Shop Your Way program if you haven’t already. Participating merchants include Uber and Uber Eats, Zulily, The Home Depot, Lowe’s, Burger King, Walmart, and American Airlines.

Important Fees

There is no annual fee. Foreign transaction fees cost 3% of the transaction amount. Cash advances cost the greater of 5% or $5, while balance transfers cost the greater of 5% or $10. Late and returned payments cost up to $37.

Credit Required

This card requires average to good credit. Past credit issues won’t necessarily disqualify your application, though severe blemishes are likely to cause problems.

Advantages of the Shop Your Way Mastercard

These are the most important advantages of the Shop Your Way Mastercard. See if they’re worth your while.

- No Annual Fee. This card has no annual fee, meaning you don’t have to worry about the cost of keeping it in your wallet for occasional use.

- Solid Sign-up Bonus. This card’s sign-up bonus is pretty attractive: up to a $225 statement credit with eligible spend ($1,500 total) during the first 3 months. That’s in line with some of the country’s leading cash back credit cards.

- No Penalty APR. The Shop Your Way Mastercard does not charge penalty interest, even if you miss your payment due date due to an unexpected cash crunch or larger-than-anticipated emergency expense. Though the gap between this card’s regular interest rate and the penalty interest rates typically charged by other rewards cards isn’t huge, this omission can still save tardy cardholders substantial amounts of money in the long run.

- Opportunity to Earn 5% Back. You can earn unlimited 5% back on gas station purchases with this card, up to $10,000 per year in combined gas station, grocery store, and restaurant purchases. That’s an excellent earning rate that’s higher than many comparable cards’ highest cash back tiers.

- Loose Underwriting Standards. This card has relatively loose underwriting standards, at least compared to industry-leading cash back credit cards such as Blue Cash Preferred from American Express and the Capital One Quicksilver Cash Rewards Credit Card.

Disadvantages of the Shop Your Way Mastercard

Consider these downsides before applying for the Shop Your Way Mastercard. For many would-be cardholders, they’re dealbreakers in the aggregate.

- Can’t Redeem Points for Cash. One of the biggest drawbacks of this card is the fact that you can’t redeem Shop Your Way points for hard cash. Since cash is obviously the most versatile type of credit card reward, any card that doesn’t allow cash redemptions does its cardholders a disservice.

- No Intro APR Promotion. This card doesn’t have a 0% APR introductory promotion for purchases or balance transfers. That’s a big drawback for new cardholders who need to finance big-ticket purchases (such as home improvement projects) or get a handle on higher-interest credit card debts with a welcome balance transfer.

- Can Only Redeem Points With Select Shop Your Way Partners and Gift Card Merchants. Forget about cash. You also can’t redeem your accumulated Shop Your Way points for nonpartner travel, or non-Shop Your Way merchandise either. Gift card redemptions are limited as well. Sure, Shop Your Way works with some of the biggest brands around (Walmart, The Home Depot, Uber), but many if not most of your purchases probably occur outside its ecosystem. In any case, chances are you’d prefer a more versatile lineup of redemption options.

- Cash Advances and Balance Transfers Are Expensive. The Shop Your Way Mastercard isn’t the ideal balance transfer or cash advance vehicle. Both types of transactions are unusually expensive with this card: $10 or 5% for the former, and $5 or 5% for the latter. If you’re looking for a card that cuts you a break on balance transfers and cash advances, look to low-APR credit card options instead.

- Need to Download a Separate App to Redeem. To redeem Shop Your Way points, you need to download the MAX app. This isn’t a huge deal, but it’s certainly an extra step that most other rewards credit cards don’t require.

How the Shop Your Way Mastercard Stacks Up

The Shop Your Way Mastercard has attributes of traditional travel and cash-back credit cards (albeit with the Shop Your Way rewards program acting as an intermediary) and branded retail credit cards.

This makes true apples-to-apples comparisons different, but let’s see what we can do. Here’s how the Shop Your Way Mastercard compares against a popular retail card (Target Redcard) and a popular cash-back card (Citi Custom Cash).

| Shop Your Way | Target Redcard | Citi Custom Cash | |

| Max Rewards | 5% back on select purchases | 5% off all Target purchases | 5% back on select purchases |

| Base Rewards | 1% back | 5% off | 1% back |

| How to Redeem | Through the MAX app | At Target or Target.com | In the Citi ThankYou portal |

| Membership Required? | Yes | No | No |

| Redeem for Cash? | No | Yes (discounts only) | Yes |

Final Word

The Shop Your Way Mastercard® is meant for frequent shoppers who appreciate Shop Your Way Rewards’ discounting power and spend heavily in the favored (5%, 3%, and 2%) categories. The redemption scheme is its Achilles’ heel, with an expansive but incomplete roster of redemption partners and no option to redeem for hard cash or nonpartner travel. This certainly isn’t the card for me, and if you feel the same way, don’t feel ashamed to keep looking.

Pros

No annual fee

Solid sign-up bonus

Earn up to 5% cash back

Cons

Can't redeem points for hard cash

No intro APR promotion

Other important redemption restrictions