When I was a kid, my parents thought they didn’t need to worry about my financial education. They miscalculated. They mistook my penchant for collecting things — My Little Ponies, Troll dolls, and even cold, hard cash — for being responsible with money. Not so much.

By the time I graduated from college, I was in a ridiculous amount of debt. Most of it was from student loans, but a not-insignificant portion was from the irresponsible use of credit cards. Buy now, pay later. And pay, I did. My credit score was garbage, and I lived in terror of jobs that did credit checks.

Maybe you’ve been there. Or maybe it was unavoidable medical bills or a sudden job loss that ruined your credit. One way or another, you need to rebuild it.

How to Rebuild Your Credit

Your credit impacts every aspect of your financial life. That includes renting an apartment or being approved for a mortgage, all the way to insurance rates and business loans. Fortunately, there’s a lot you can do to rebuild it.

Start simple and take these steps as slowly and incrementally as you like. That includes starting one step before you’ve even finished the last and skipping any steps that don’t apply to you

Credit scores rarely leap up overnight. It takes time, patience, and ongoing effort to gradually rebuild credit.

1. Don’t Apply for New Credit

Before you do anything else, stop spending other people’s money. You can’t plant a healthy new tree if a declining one is still in its place.

Debt — particularly credit card debt — creates a vicious cycle. Focus on paying down your existing debts. It’s the first step to pulling up the roots of your old tree.

Beyond avoiding new debt, it also prevents damage to your credit score, as each new credit application causes a temporary ding.

But don’t stop here. If you do, after a decade or so, it could be like you never had any credit, which isn’t much better. If you’ve already done that, it’s OK. Just consider yourself an advanced rebuilder and keep going through this list, skipping the steps that don’t apply to you.

2. Check Your Credit Report

Before you can know what steps to take to rebuild your credit, you have to know what specifically is wrong with your credit. Read up on what it means to have a good credit score, and use that information to set your credit score goals.

The three primary credit bureaus — Equifax, Experian, and TransUnion — allow you one free credit report per year with no negative impact on your credit score. In fact, federal law mandates it. You can check all three at AnnualCreditReport.com.

Review every account, both open and closed, that appears on your credit report to ensure each appears accurate. If you see one that seems incorrect, follow whatever steps are necessary to fix credit report errors. It’s free and surprisingly simple. It’s also the fastest way to boost your credit score.

Unfortunately, you generally don’t get to see your actual credit score when you pull your free annual report. For that, you need a credit monitoring service. In fact, a credit monitoring service is the better option since you need to check the latest version of your credit report at least twice (if not regularly) during the rebuilding phase.

You have several options for free and paid credit monitoring services. I use Credit Karma’s free option. It provides you with weekly updates to your Transunion and Equifax scores and alerts you to major changes, such as new accounts reporting on your credit or data breaches.

I also have free accounts with each of the three major credit bureaus. TransUnion makes it kind of tough to find, though Experian and Equifax are easy enough to use. But they still don’t give you your scores unless you have a paid account.

Instead of signing up for all three of these accounts for $20 to $30 a pop, select a single, more robust option like ScoreSense. It’s about the same price as the most expensive credit bureau’s monthly monitoring and lets you view and monitor all three credit scores.

3. Pay Your Bills on Time

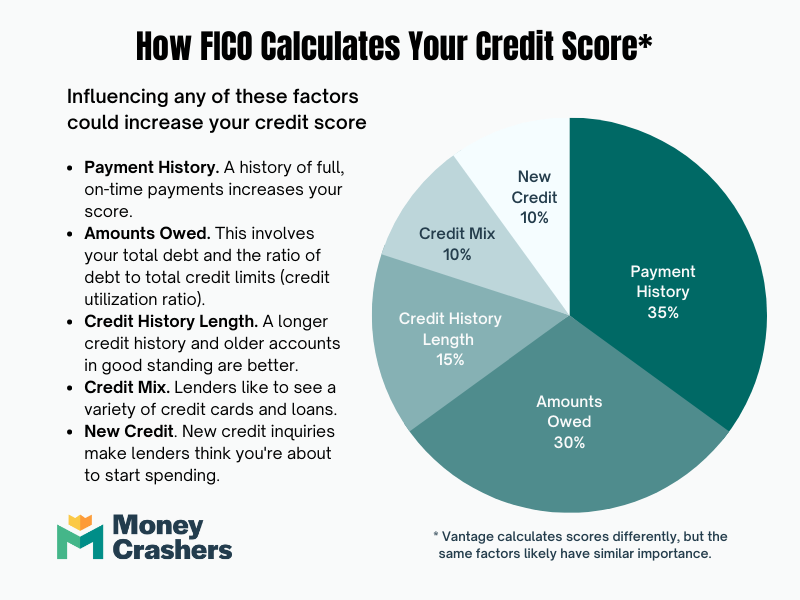

You will never improve your credit score if you keep making late payments. It’s that simple. Your payment history is a full 35% of your FICO credit score, which is the largest segment.

To ensure you don’t miss one, set up automated payments for everything. That includes your mortgage, car loans, credit cards, student loans, personal loans, and even utility bills.

Not all creditors report to the three major credit bureaus. For example, you don’t usually get credit for paying your electricity bill on time. But almost all report to at least one of the minor bureaus, such as the National Consumer Telecom & Utilities Exchange.

So while paying your utility bills on time doesn’t usually impact the credit score banks see, it could impact the one your utility companies see, which could impact your rates or qualification for service. The same is true of insurance and even employment.

Additionally, if you pay your utility bills and rent on time each month, you can increase at least one of your credit scores. Experian Boost is a free, voluntary program that ensures paying your bills on time increases your score. Just create a free Experian account and link the bank accounts you use to pay bills.

It only works with your Experian score, but it also only takes a few minutes and could make a difference if you’re [this] close to qualifying for a loan or lower interest rate.

4. Catch Up on Past-Due Accounts

If you’re behind on any of your loans or credit accounts, they need to become your highest priority, pronto. That means putting every spare dollar each month toward catching up on missed payments.

If you can do it without driving yourself crazy, freeze all discretionary spending until you catch up. No meals at restaurants, no paid sports or movies, no new clothes or accessories, no fancy self care products or services. If you treat it like the financial emergency it is, you’ll get to the other side faster.

One way or another, make a plan to pay off your delinquent accounts. If you have the cash to pay any of them off now, do so. If not, make at least a small payment toward each debt you plan to pay off. Consider it a down payment on your future.

Then, decide how much you plan to pay each month, and set it up on autopay. The more you pay each month, the faster you’re done with it, so make sure it hurts at least a little.

5. Calculate Your Optimum Credit Utilization & Amounts Owed

The second-most important factor bureaus use to calculate your score is your amounts owed. That includes your total debt and the percentage of debt to credit, known as your credit utilization.

Credit Cards

For revolving credit, like credit cards and home equity lines of credit, bureaus like to see all your balances under 30% of your available credit limit, both in the aggregate and per card. That means you should never charge more than 30% to any given card if you can help it. For example, if a card’s limit is $10,000, the highest balance you should ever have is $3,000.

Getting below a 30% credit utilization ratio is the second-fastest way to improve your FICO score after fixing errors on your report.

So never spend more than 30% of each card’s limit. To keep it straight, use garage sale stickers to label each card with the max amount you plan to spend, then keep your receipts with the card as you buy. Once a card gets to your self-imposed limit, remove it from your wallet until you’ve paid it off so you can’t accidentally use it.

Loans

When calculating your credit utilization, the bureaus don’t include installment loans like mortgages or auto loans because, as the name suggests, you pay them off in monthly installments. But loans and how much you owe on them still matter.

You obviously have to pay them in full and on time each month. But there’s no established percentage of outstanding loan debt to shoot for. In fact, to truly understand how much debt you can or should have in loans, you must calculate your optimum debt-to-income ratio. That doesn’t affect your credit score, but it does become important if you want to take out a loan, such as a mortgage.

In general, your debt-to-income ratio should be around 36%. So for every $1,000 in income, you should have no more than $360 (36%) in loan and credit card payments. That means your loans should be 36% minus the amount of your credit card debt.

For example, let’s say you make $5,000 per month. That means your optimum debt load is no more than $1,800 per month (5,000 x 36%). Now, let’s say you owe $650 per month in credit card debt. That means your cumulative monthly loan payments can be no more than $1,150 (1,800 – 650).

But don’t freak out if you go above that here and there. As long as you make on-time, in-full payments, the loan amounts mostly matter when you go to take out other loans. Just keep it close enough to the 36% max that you can get it down to that relatively easily if you need to borrow money.

6. Pay Down Your Credit Card Debt (& Loans), but Don’t Close Anything (Yet)

If you were over that 30% debt-to-income ratio on any of your credit cards, pay it down to that or less ASAP. Start with the highest-interest cards and work your way down. Pay it totally down, then don’t charge more than you can afford to spend in cash each month.

Next, pay your balance in full every month. That way, you incur no interest costs and only see the benefits of credit card perks like rewards and fraud protection.

And if you do the math on your debt-to-income ratio and need to get your loans lower too, get to work on that as well.

It sounds simple, and it is. But the goal here isn’t to pay off all your loans and credit cards and close your accounts. No credit is functionally almost the same as bad credit.

I will never forget my grandfather, a child of the Great Depression, deciding after he was well old enough to join AARP to buy a vehicle on credit for the first time in his life. He was purple-with-rage angry when his robust retirement fund and reliable pension, history of paying all his utility bills, and word weren’t enough to get a loan without a co-signer. (Did I say purple with rage?)

He’s probably one of the safest bets they could have made in terms of getting their money back. But that’s not what it looked like on paper.

And that can happen to you too. So don’t go closing all your accounts willy-nilly.

When it comes to loans, pay those as scheduled for the most part. If you need to lower your overall outstanding installment loan balance, work on one at a time, aiming for the highest-interest loan first. That way, the loans come off gradually and don’t cause too much of a credit score hit.

As for your credit cards, there’s no such thing as too much available credit when it comes to your credit score. So keep credit cards open unless they’re seriously tempting you to go rogue.

If you have a card you need to use to keep open but no longer want to keep in your daily rotation, set it up to autopay a bill each month. Then, set up your bank account to automatically pay the card balance.

Once you have your credit score where you want it, you can close credit cards you don’t need one at a time to limit the damage to your credit score.

7. Recheck Your Credit Report

If you set up paid or free credit monitoring, you’ve probably been checking in on it at least monthly to see where you are. If not, there’s no time like the present.

Everything you’ve done so far is just to prepare for rebuilding your credit. Going back to the tree analogy, you’ve chopped it down, removed the roots, and added nutrients to the soil in preparation for planting a healthy new tree.

Your credit report can show you what you need to do next to increase your credit score. Some of the remaining steps may be unnecessary for your situation. So ensure you understand the cause-and-effect of each and choose the options best-suited to your needs.

8. Open a Secured Credit Card

If you still have credit cards open, and they make up around 30% of your overall credit or less, you can skip this step and keep working on raising your score by using those correctly. Others may not be so lucky, but having at least some credit card debt is important.

Some people have no credit cards because they went hog-wild the first time, and no credit card company you should buy stock in would give them that kind of blank check, even if it has a limit. Or maybe you’re credit-averse or just never had credit cards in the first place. Heck, it could be a combination of any of those.

One way or another, to get your credit score above, say, 600, you’re going to need at least one credit card. And if no one will give you one, you can still get it by applying for a secured credit card.

Secured credit cards offer a cheap and easy way to demonstrate the pattern of on-time payments that can increase your score. And since there’s no risk to the credit card issuer, they’ll give a secured card to just about anyone who otherwise qualifies for a credit card.

It works like this: You send the credit card issuer money in the amount you want your limit to be. The issuer holds your cash as collateral. Then, the secured card works like a typical credit card, including reporting to the bureaus. You eventually get your deposit back, usually when you close the card but maybe when you graduate from a secured to unsecured card.

You don’t have to use these training wheels forever. Once you establish a better credit history, you can move on to a normal credit card.

In fact, some of the best secured credit cards gradually entrust you with more responsibility. For example, Capital One’s Platinum Secured Credit Card may allow some users more credit than their initial deposit. And even if they don’t, you may qualify for a deposit-free credit increase within as little as six months if you use it responsibly, which is the goal since you’re trying to build credit.

But don’t confuse secured credit cards with reloadable prepaid cards. Prepaid cards don’t report to the credit bureaus, so they can’t help you build credit.

Oh, and remember when I said they’d give a secured credit card to almost anyone? The operative word is “almost.” If you can’t get one, whether it’s because of a really long history of nonpayment or a bankruptcy, look into plastic-free options like CreditStrong. It’s essentially a savings account that reports to the credit bureaus like a credit card, and there’s no credit check or risk you could use it to spend money you don’t have.

9. Get a Co-Signer

Secured credit cards are fantastic when you have no other options. But secured cards lack the features you might find on traditional credit cards. While there are some notable exceptions, secured cards don’t usually provide you with any kind of rewards or extras like extended warranties or airport lounge access.

If a card like that would be useful for you, you might be able to get one if a loved one agrees to co-sign. A co-signer is someone who guarantees that if you don’t pay your bills, they will. That could be tough if your credit is in the toilet. But a spouse, partner, parent, or child may be willing to help you if they truly believe you’re going to turn it around this time.

As a co-signer, they don’t have the same legal rights with regard to the card. For example, they’re not legally entitled to use your credit and may have no way to access the full account information.

But I think we can all agree they have the moral right to know some details, such as whether you paid the bill that month or whether you’re going to have the money to pay the bill that month. They may even want to know how much money you make and more details about your regular bills, such as rent and utilities, before they agree to sign.

Unfortunately, that can lead to them taking other liberties, like critiquing your purchases and financial decisions. If that’s already your relationship with that person, you might as well get something out of it. But if not, look out for that dynamic.

The good news is that some credit card companies let you remove a co-signer after a certain amount of time passes with you making full, on-time payments. The bad news is the potential relationship issues it can cause if you don’t hold up your end of the deal. So you should only take this step if you’re sure you can handle it.

But some credit cards disallow co-signers, such as American Express and Capital One. So be sure to choose a credit card issuer that allows it.

10. Become an Authorized User

Did you know that if you become an authorized user on someone else’s credit card, their entire card payment history near-instantly appears on your credit report?

You get a card in your own name, but it’s linked to their account. When you make a purchase, it goes on their statement and runs up their balance.

If you don’t have much credit history, it can boost your credit score by dozens of points. It’s fast, simple, and gives you access to more credit without having to apply for it, which temporarily lowers your score.

Of course, it requires someone to trust you enough to give you access to their credit card. If you rack up debt, they’re on the hook for it. Only spouses and close family members even consider this in most cases. Even then, expect resistance given your less-than-stellar credit habits.

The credit bureaus aren’t the only ones you need to prove your reliability to as you rebuild your credit and personal finances. To sweeten the deal, you could offer to let the account holder keep the card and its details in their possession so you can’t run up the balance without them knowing about it.

11. Get a Credit-Builder Loan

A relatively recent addition to the world of personal finance, credit-builder loans report to the credit bureaus like normal installment loans, such as mortgages or car loans. But instead of borrowing from a lender, you effectively lend money to yourself. The “lender” just holds your money in an escrow account for you.

You choose a loan term (length) and amount. You then agree to make regular monthly payments to the lender over that term, which the lender sets aside for you in your escrow account.

To give yourself the best chance of finding a credit-builder loan that suits your needs and budget, look for a loan provider that offers multiple loan types, term lengths, and loan amounts. For example, CreditStrong, a leader in credit-builder loans, offers a revolving credit line and two different installment loan products, both of which come with multiple plans based on loan size and repayment term.

Regardless of term length or loan amount, the lender generally makes money by charging a small fee and interest for the trouble of creating your escrow account and reporting your on-time payments each month. At the end of the loan term, you get your money back, minus any outstanding fees.

Most credit-builder lenders allow you to set up automated monthly payments to make it even easier.

12. Consider Credit Counseling

They don’t teach budgeting, personal finance, and credit building in schools. They should. But they don’t. That’s why so many people are bad at it.

Take a bite of humble pie and acknowledge that you could stand to know more about budgeting and debt than you do. Reach out to a nonprofit that offers credit counseling to get some expert help. Your local Consumer Credit Counseling Service provides free or low-cost assistance to those in need.

Final Word

It’s rarely quick or easy to rebuild your credit. It requires you to make changes to your spending habits as well as your mindset around money.

Even after you start doing everything right, it typically takes at least a year to accrue a good payment history that will have any effect on your credit score. It can take up to 10 years to remove black marks like legal judgments and bankruptcies.

The effort will pay off. When it comes time to apply for your next apartment or take out a loan, you’ll qualify for a low interest rate, low or no fees, and a small down payment.