Quick Look

- The Fed raised its benchmark interest rate by 25 basis points at its July 2023 meeting.

- Due to the rate hike, interest rates on credit cards and mortgages may climb into August.

- Savings account yields could increase as well.

- The Fed is expected to hike rates at least one more time in 2023, but the timing is not clear.

The Federal Open Market Committee of the Federal Reserve hiked the closely watched federal funds rate by 25 basis points, or one-quarter of a percent, at its meeting in July 2023. Federal Reserve Chair Jerome Powell announced the move at 2pm Eastern Time on Wednesday, July 26.

The FOMC’s July 2023 rate hike is the latest in a long series of hikes beginning in early 2022. It pushed the target federal funds rate to range between 5.25% to 5.50%, a 525-basis-point increase from March 2022.

The Fed meets again on September 19 and 20, 2023. It’s not clear whether rates will increase again after that meeting, but economists widely expect at least one more rate hike before the end of 2023.

Cooling inflation data and encouraging signs of economic resilience were enough to convince the Fed to raise rates in July. But Chair Powell made clear, as he has in the past, that future increases would depend on what happens with inflation in the coming months. If the inflation rate remains significantly above the Fed’s 2% long-term target, further hikes are definitely on the table.

Find out what happened at this Fed meeting, what it means for the broader economy, and how you can prepare your finances for what’s to come.

The FOMC’s July 2023 Meeting

The market’s expectation for a 25-point hike came amid commentary by key Federal Reserve governors that the FOMC wasn’t quite done with its fight against inflation. But per comments from Christopher Waller and Chair Powell himself, the Fed is closer to the end of that fight than the beginning.

First, some background: The Fed raised rates at an unprecedented pace in 2022 amid persistently high inflation, and recent economic data suggested their efforts were beginning to pay off. The labor market was moderating, the red-hot housing market was cooling, and most importantly, inflation appeared to be peaking.

Those trends haven’t entirely reversed since earlier this year, but there’s new uncertainty as to how effective the Fed’s rate hikes have actually been. Or, framed differently, around how “sticky” inflation and labor market momentum are proving to be.

Macroeconomic data releases in the second and early third quarter of 2023 showed that inflation has moderated considerably since last year, though the rate remains above the Fed’s official 2% target. The June 2023 figures for the closely watched Consumer Price Index (CPI) — released on July 12 — came in at +0.2% month-over-month and +3.0% year-over-year. Both figures were below expectations.

Meanwhile, June 2023 nonfarm payrolls data came in at a solid but not red-hot 209,000 jobs added, above the “status quo” baseline of about 100,000 jobs per month and not yet low enough to quell fears of a runaway jobs market.

Perversely, the Fed wants to see clear signs that the economy is cooling before stopping its rate-hike campaign for good. Payroll numbers above 200,000 per month suggest the economy remains in good shape — maybe too good. Notably, Chair Powell revealed in July that the Federal Reserve is no longer forecasting a recession in 2023, though that leaves the door open for a downturn in 2024.

As always, traders will closely watch Chair Powell’s comments at his customary post-announcement press conference, when he’ll answer questions from financial journalists desperate for insight into the FOMC’s thinking. As is sometimes the case, he could say something that totally defies expectation, sending the market shooting upward or crashing downward.

We don’t get invited to these meetings, unfortunately. Were we in attendance at the July press conference, we’d ask Chair Powell these four questions.

Why Did the FOMC Hike Interest Rates Hikes Again in July 2023?

It’s still mostly about inflation.

The inflation rate is definitely heading in the right direction (down) but not fast enough. We saw a 3% annualized increase in June, higher than the Federal Reserve’s 2% target but lower than in recent months and not too far off historical norms.

But the Fed appears unconvinced that they’ve beaten inflation once and for all. Since 2022, the FOMC has been rerunning the Fed’s playbook from the early 1980s, when then-Chair Paul Volcker pushed the fed funds rate to 19% in a bid to quash sky-high inflation. While inflation isn’t quite as high now as it was back then, they’re taking the same “better safe than sorry” approach today.

How Do Fed Funds Rate Hikes Affect the Economy?

The federal funds rate is a key benchmark interest rate for banks and other lenders. Raising it increases the cost of the short-term loans most financial institutions need to operate normally. They pass those costs to their borrowers via higher interest rates on credit cards, real estate loans, and business loans and credit lines.

The correlation isn’t always perfect, but economic activity tends to slow as borrowing costs increase. Consumers buy less on credit and put off major purchases. Businesses delay or cancel planned investments. They may lay off contractors and employees if they can’t control costs elsewhere.

With businesses making less money and fewer people drawing paychecks, a feedback loop develops. Demand for goods and services falls. The economy slows further, maybe tipping into recession. Declining demand helps cool inflation, but at the (hopefully temporary) cost of livelihoods and profits.

When Will the Fed Stop Raising Rates?

Economists expect the federal funds rate to top out sometime in late 2023 or early 2024. They expect a terminal rate — the highest the Fed will let the funds rate get before it pauses or reverses its hikes — of between 5.25% and 5.50% from Q3 2023 through Q1 2024, according to the FedWatch predictive tool.

But some banks expect a terminal rate at or above 6%, which would cause more economic pain. And expectations of a terminal rate between 5.25% and 5.50% are not consistent with broad expectations for at least one more rate hike in 2023.

Once it hits the terminal rate, the Fed will probably keep rates steady for a while, unless the economy is in really rough shape. Then it’ll pivot — market-speak for beginning a rate-reduction cycle. Markets love it when the Fed pivots because it means lower borrowing costs and, usually, higher business profits.

Will the Fed Cause a Recession?

Earlier in this hiking cycle, it seemed more likely than not. Reuters’ October 2022 economist survey saw 65% of respondents predicting a U.S. recession by the fourth quarter of 2023.

Chair Powell seemed unbothered by the possibility of a recession at the time. Though he never said outright that he’s rooting for a recession, he repeatedly went on the record saying that asset prices (especially real estate values) need to come down. And in August 2022, he told attendees at the closely watched Jackson Hole Economic Symposium that the Fed’s commitment to fighting inflation was “unconditional.”

The stock market tanked as he spoke.

But lately, Powell has seemed more optimistic that the Fed can engineer a so-called “soft landing,” effectively cooling inflation without spiking unemployment or causing a formal recession. Time will tell if he’s correct.

What Fed Rate Hikes Mean for Your Finances

What do the Federal Reserve’s interest rate hikes mean for your wallet? Four things:

- Your credit card interest rate will go up. Like clockwork, credit card companies raise interest rates in lockstep with the Fed. Credit card rates increased by 25 basis points within a week of the May 2023 rate hike and should increase by the same amount after the July hike.

- Your savings account yield could increase. The relationship between savings yields and the federal funds rate isn’t quite as strong, but it’s still there. Banks just tend to raise yields more slowly than the Federal Reserve because they make money off the spread between what they pay customers and what they themselves pay to borrow.

- Your fixed mortgage rate won’t increase. Your fixed mortgage rate is, well, fixed. At this point, refinancing probably isn’t in your best interest, so just sit back and enjoy the rate you locked in when money was cheaper. If you have an adjustable-rate mortgage, your rates will go up, and it might be time to consider refinancing before it gets worse.

- Your retirement portfolio will remain volatile. It has been a rough year for stocks and bonds. We’re not in the business of stock-picking, but it’s a fair bet that market volatility will persist due to ongoing economic uncertainty and uncertainty around just how far the Fed will go to fight inflation.

Your Personal Finance Playbook: What to Do As Interest Rates Rise

The negatives of higher interest rates outweigh the positives, but it’s not all bad. Do these things now to protect yourself and make your money work harder.

- Move to a high-yield savings account. After the July 2023 hike, the most generous savings accounts yielded 5% or higher. For the first time in many years, this is actually higher than the inflation rate, which means your savings can increase in value (in real, inflation-adjusted terms) in the right account. Notably, traditional big banks’ paltry savings yields haven’t budged during this hiking cycle. Move your money to a high-yield online bank if you haven’t already.

- Pay off your credit card balances. You should never carry a credit card balance if you can avoid it, but it’s especially painful when interest rates are high. Make a plan to pay off your existing balances as soon as you can. If you need help, work with a nonprofit credit counseling agency.

- Hold off on buying more Series I bonds. They were your best bet to fight inflation until now. Unfortunately, the rate on new I-bonds has tanked as inflation cools, and bonds issued between May 1 and Oct. 31 of 2023 yield just over 4%. Rates reset twice per year, on Nov. 1 and May 1, but they’re unlikely to climb significantly at the next reset, so savings accounts will likely offer higher yield moving forward.

- Buy a new car sooner than later. Auto loans are a weird bright spot for consumers so far this hiking cycle. Dealer financing rates haven’t increased much since 2021 as car dealers fight softening demand for new cars while undercutting banks and credit unions that also offer auto loans. Plus, both new and used car prices are coming down to earth as supply increases and demand cools. But this favorable dynamic probably won’t last much longer, especially if the U.S. avoids a formal recession.

How We Got Here: Fed Funds Rate Hikes in 2023

The FOMC has raised rates at a breakneck pace in 2022.

The current federal funds target rate is 525 basis points higher than it was at the beginning of 2022. The gap will continue to increase with each subsequent Fed rate hike.

Markets and economists are divided on what happens next, however. Expectations were reasonably well-set for a pause at the June 14 meeting and a 25-point rate hike at the July 26 meeting and for a pause at the June 14 meeting, but there’s not much consensus beyond that.

It all comes down to the macroeconomic picture. Hotter-than-expected inflation readings or job growth numbers in Q2 2023 could convince the Fed to hike longer and higher than expected, even if it results in a longer, deeper recession than forecast. If the economy looks to be cooling faster than anticipated, it’s not out of the question that the Fed does nothing for a while, or even begins cutting rates.

In that case, markets will inevitably look ahead to the next big question of the current Fed cycle: when and by how much it’ll start cutting the federal funds rate.

| Meeting Date | Fed Funds Rate Change (bps) |

| March 17, 2022 | +25 |

| May 5, 2022 | +50 |

| June 16, 2022 | +75 |

| July 27, 2022 | +75 |

| Sept. 21, 2022 | +75 |

| Nov. 2, 2022 | +75 |

| Dec. 14, 2022 | +50 |

| Feb. 1, 2023 | +25 |

| March 23, 2023 | +25 |

| May 3, 2023 | +25 |

| June 14, 2023 | No change |

| July 26, 2023 | +25 |

One More Fed Move to Watch: Quantitative Tightening

The FOMC’s interest rate decisions might grab headlines, but they’re not the only moves the Fed makes to steer the economy.

Since the Great Financial Crisis of the late 2000s, the Fed has been in the business of buying, holding, and (occasionally) selling U.S. government bonds and other government securities. When the Fed buys securities, it’s called quantitative easing (QE). When it sells them or allows them to mature without replacing them, it’s called quantitative tightening (QT).

Quantitative easing increases the U.S. dollar supply, which is why some say the Fed “prints money” in response to economic weakness. Quantitative tightening decreases the dollar supply, though you don’t hear much about the Fed “burning money” to fight inflation.

Quantitative Tightening in 2022

The Fed bought more than $4 trillion in government securities between early 2020 and early 2022, adding to a sizable stockpile left over from the Great Financial Crisis. It began QT in June 2022 and accelerated the pace in September.

Since then, the Fed has reduced its balance sheet by about $95 billion each month. But with nearly $9 trillion still on its books, it’ll take more than 7 years to fully unwind its purchases. That’s far longer than economists expect the current cycle of interest rate hikes to last — and assumes no economic crises that demand quantitative easing between now and then.

Why Quantitative Tightening Matters for You

QT isn’t some abstract high-finance maneuver. By increasing the supply of U.S. government bonds, it puts upward pressure on rates, compounding the effects of fed funds rate hikes. For example, the yield on the closely watched 10-year U.S. Treasury bill jumped from about 1% in January 2021 to about 4% in late October 2022.

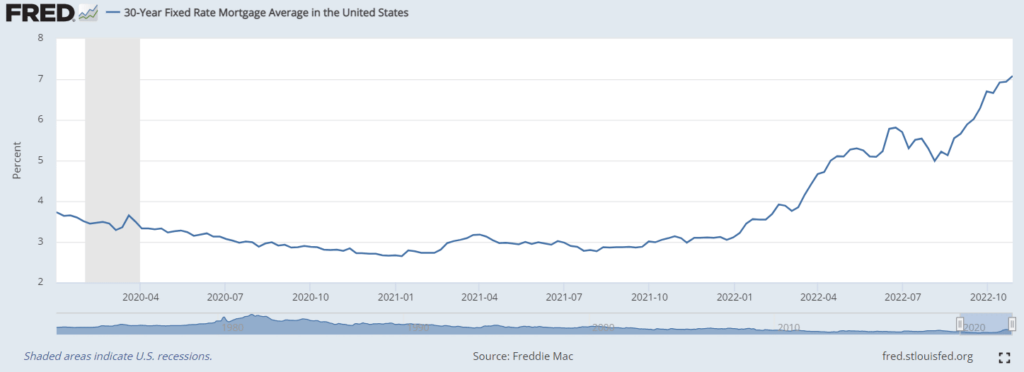

The combined effect of QT and fed funds rate hikes shows up in interest rates tied to both benchmarks, like mortgage rates. That’s why the average 30-year fixed rate mortgage rate increased by about 450 basis points between January 2021 and October 2022 — compared with just 300 basis points for the federal funds rate.

So if you’re in the market for a new house or want to open a home equity line of credit soon, the fed funds rate won’t tell the whole story. If the Fed accelerates QT, bond yields — and thus mortgage rates — could continue to rise even after rate hikes cease and inflation floats down to historical norms.