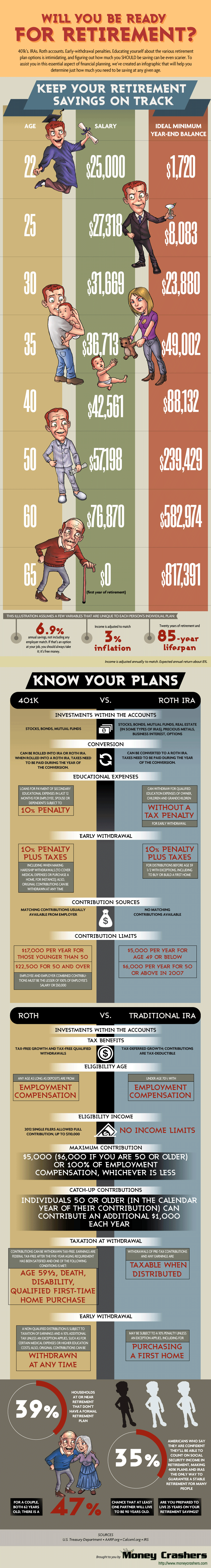

401k’s. IRAs. Roth accounts. Early-withdrawal penalties. Educating yourself about the various retirement plan options is intimidating, and figuring out how much you should be saving can be even scarier. To assist you in this essential aspect of financial planning, take a look at this infographic and determine just how much you need to be saving at any given age.

It’s also important to know the key difference between a 401k and IRA (Roth and traditional), including tax benefits, contribution limits, conversion, and eligibility age. Are you currently on track with your retirement planning? Here are some statistics that may surprise you:

- 39% of households nearing retirement do not have a formal retirement plan.

- Only 35% of Americans are confident they can rely on social security.

- For a couple both 62 years old, there is a 47% chance that one of them will live to be 90. Are you prepared to live 25 years on your retirement savings?

- Early withdrawal from retirement plans incur a 10% penalty plus taxes.

Spread the Word

Feel free to embed this infographic on your blog or website. Simply copy and paste the code below.

Embed Code – 800px wide

Embed Code – 600px wide

You can also share on social media sites by using the buttons below.