Pros

No need to try to time the market

No long-term obligation

Visibility into all active and closed stock recommendations

Cons

No prorated cancellation

Can't opt out of the email newsletter

Long-term subscribers must follow "sell" recommendations

Motley Fool Stock Advisor is Motley Fool’s flagship premium stock-picking service. The company has been providing investment insights and financial recommendations to customers for more than 25 years.

At its core are two monthly stock recommendations tracking high-growth stocks, one each from Motley Fool co-founders David and Tom Gardner, delivered in detailed email newsletters making a case for — and outlining the potential risks of — each security.

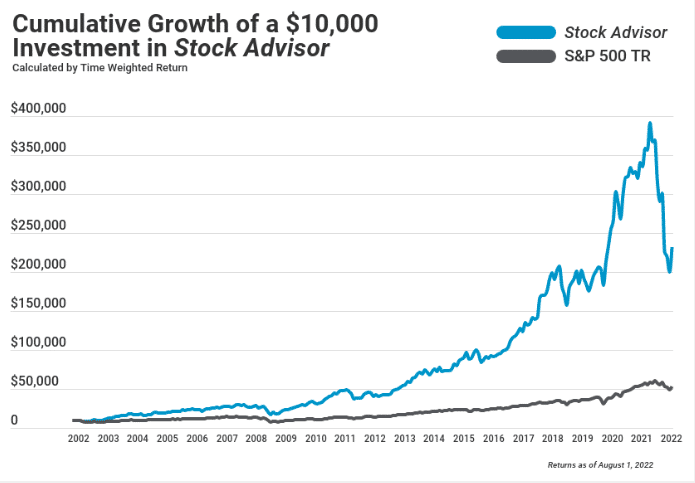

Since 2002, Motley Fool Stock Advisor picks have dramatically outperformed broader market indexes. Cumulatively, Stock Advisor picks returned 468% through July 2022, dwarfing the S&P 500 index during the same period (124%).

Put another way, a $10,000 investment in Stock Advisor picks at the investing service’s inception was worth north of $150,000 by July 2022, while $10,000 invested in the S&P 500 over the same period was worth under $50,000 by July 2022.

How Motley Fool Stock Advisor Stacks Up

Motley Fool Stock Advisor is one of the best-known premium resources for serious DIY investors. It’s not the only one though — not even close.

See how it stacks up against another popular recommendation engine at a similar price point: Seeking Alpha Premium.

| Motley Fool Stock Advisor | Seeking Alpha Premium |

| About $199/year or $99/year for new subscribers in the first year | About $20/month when paid annually |

| Recommendations from David and Tom Gardner and their term | Recommendations from top-rated Seeking Alpha authors |

| Detailed recommendations using proprietary metrics | Recommendation quality varies |

| Value-adds include stock screeners, watchlists, performance tables and charts, and more | Value-adds include earnings call audio, stock screeners, and more |

| Performance 3x the S&P500 (at least) | Performance depends on which recommendations you look at |

What Is Motley Fool Stock Advisor?

The Motley Fool Stock Advisor program, developed by the stock market gurus at Fool.com comes with a slew of additional features and recommendations, including:

- Best Buys Now (Best Stocks to Buy), a rotating selection of top monthly stock picks culled from more than 300 candidates

- Starter Stocks, a group of blue-chip and growth stocks for novice investors

- Premium Reports and Articles available only to paying members

- Premium Community Boards where members can exchange tips and strategies with other members of the investment community

See the “Key Features” section below for more details on these and other Stock Advisor features.

Stock Advisor’s Suitability

Motley Fool Stock Advisor is not for everyone. Motley Fool advises Stock Advisor members to build diversified portfolios consisting of at least a dozen recommended stocks, and to buy and hold all recommended stocks for at least three to five years.

Motley Fool makes no representations that their Stock Advisor is a key to quick riches, nor does it guarantee returns on any of its recommendations.

Motley Fool Stock Advisor also isn’t designed for long-term investors looking to match, not beat, the performance of broader stock market indexes.

None of this is to say that Stock Advisor isn’t worth its sticker price, just that prospective subscribers should determine whether picking individual stocks — and, specifically, Stock Advisor’s recommendations — is a good fit for their investing strategy, objectives, and risk tolerance.

Here’s what you need to know about Motley Fool Stock Advisor’s pricing, features, and overall suitability for individual investors.

Motley Fool Stock Advisor Pricing

Motley Fool Stock Advisor subscriptions are available monthly or annually. Pricing is as follows:

- Monthly Subscription: $39 per month. Each month, the subscription renews on the numerical date of initiation; for example, if you began your subscription on June 10, it will renew on or about the 10th of each month moving forward.

- Annual Subscription: $199 per month at full price. Each year, the subscription renews on the date of initiation; for example, subscriptions that begin on June 10 renew on June 10 each year.

- Discounted Annual Subscription: $89 per year for the first year. This is a limited-time introductory offer available to new members only.

All subscriptions renew at then-current rates. For instance, should the full-price annual membership increase from $199 to $219 while your subscription is active, you’ll be charged the new membership fee of $219 at your next renewal date.

Motley Fool doesn’t refund or prorate canceled subscriptions, except for a 30-day money-back guarantee on annual memberships. However, members may apply balances remaining on canceled subscriptions to other Motley Fool premium service subscriptions.

Key Features of Motley Fool Stock Advisor

Here is what you get with your Motley Fool Stock Advisor subscription:

1. New Recommendations

Each month, Motley Fool subscribers receive two “new recommendations,” one each from Motley Fool co-founders David and Tom Gardner.

Each recommendation comes in a dedicated email newsletter outlining:

- What the company does

- Key data about the company and its stock (e.g., market capitalization and price as of the recommendation date)

- Who its clients or customers are

- Who’s in charge (key executives and board members)

- Why Stock Advisor members should buy

- Notable risks to the recommendation, including potential “sell” triggers

Each recommendation is simultaneously visible — or nearly so — in Stock Advisor subscribers’ accounts.

2. Best Stocks to Buy

When you log into your Stock Advisor account, the Best Stocks to Buy dashboard is the first thing you’ll see on the home screen. This 12-stock dashboard updates every Thursday and completely refreshes every month.

It includes:

- Five “timely” picks from David Gardner

- Five “timely” picks from Tom Gardner

- David Gardner’s most recent new recommendation

- Tom Gardner’s most recent new recommendation

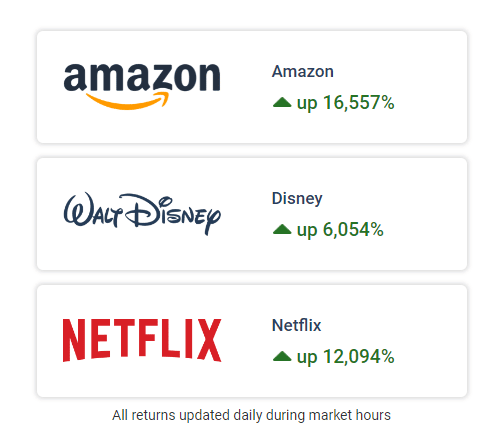

Individual picks frequently repeat on the Best Stocks to Buy list. For instance, Amazon has appeared more than 30 times since David Gardner first picked it back in September 2002.

Each pick includes an abbreviated version of the detailed dossier that accompanies newsletter recommendations, updated to account for recent industry or company changes, such as Amazon’s 2017 acquisition of Whole Foods, which further improved David Gardner’s opinion of the company.

3. Starter Stocks

This is another elite group of stocks culled from the Gardners’ past recommendations.

According to Motley Fool, Starter Stocks are ideal for novice investors looking to build strong stock portfolios from the ground up. The list’s components are updated at least once per year. Stock Advisor recommends adding them to portfolios consisting of at least 15 different stocks.

4. Stock Advisor Email Subscription

When you sign up for Stock Advisor, you’re automatically enrolled in its email newsletter. You can expect to receive four to eight emails per month, consisting of some or all of the following:

- New recommendations

- Trade alerts (e.g., when the team “closes” or cancels its recommendation on a stock and advises selling part or all of your stake)

- Expert analysis and commentary on individual stocks, industries, or economic conditions

- Updates to the Gardners’ Best Buys recommendations

- Multimedia content

Enrollment is mandatory; you can’t unsubscribe from the newsletter without canceling your subscription.

5. Stock Watchlist

Stock Advisor’s Watchlist feature isn’t revolutionary — it will look familiar to anyone who’s spent time on Yahoo! Finance or the back end of an online brokerage platform — but it’s useful nevertheless.

Simply search and add tickers to set up a real-time flow of news and analysis for your favorite stocks. It’s a great way to narrow down the universe of Stock Advisor recommendations to those that call your name.

6. Favorites

Stock Advisor’s Favorites feature is another place to collect and check up on the stocks you’re watching or have already taken positions in.

If you wish, you can securely link your brokerage account to your Motley Fool account to bulk-import your holdings and brokerage watchlist stocks. Once imported, you’ll automatically receive “buy” and “sell” recommendations on your holdings.

7. Scorecard

Scorecard is yet another visualization for stocks you’re holding. It’s a data-rich ticker collection that updates every minute during trading hours and features:

- Ticker symbol

- Current price

- Purchase price

- Purchase date

- Day change

- Return since purchase

- Return versus the S&P 500 index

You can link your brokerage account to trade Scorecard stocks with minimal friction.

8. Optional Email Subscriptions

Stock Advisor members can enroll in these optional email newsletters:

- Scorecard Updates: Daily or weekly premium content updates about the tickers you’ve added to your Watchlist or Scorecard.

- Special Offers: Money-saving, no-obligation offers from Motley Fool partners.

- Stock Up: A roundup of the best of Motley Fool’s recent free content, including articles, social media content, multimedia, news, and podcasts.

If you don’t mind inbox clutter, you might find some value here. If not, you’re under no obligation to enroll.

9. Performance Tables & Charts

The Performance section is the most data-rich portion of your Stock Advisor account. Recommendations appear in a long table that displays:

- The company name and ticker symbol

- The recommendation date

- The recommending team (David or Tom)

- Market capitalization and adjusted price as of the most recent market close

- Returns since recommendation (benchmarked against the S&P 500)

- Risk score (with risk increasing from 1 to 25)

You can drill down on some of these data points.

For instance, each linked ticker symbol leads to a stock information page with details about the stock’s fundamentals, price history, and recent news, plus an interactive performance chart and dividend calculator, when applicable.

10. Premium Research Reports

Stock Advisor members have access to premium research reports produced by Motley Fool staffers.

These reports usually cover industry and macro trends likely to affect Stock Advisor’s new and existing recommendations; typical titles include “Inside the Car of Tomorrow,” “The Ultimate Virtual Reality Investing Playbook,” and “AI Disruption Playbook.”

Some reports simply summarize recent Stock Advisor picks. One particular report highlights a legal cannabis investing opportunity that Motley Fool believes has incredible upside in one of the decade’s hottest market sectors.

11. Premium Articles

Stock Advisor members also have access to premium articles not visible to run-of-the-mill Motley Fool users. These articles tend to be shorter and newsier than premium reports, but length, format, and topics vary widely.

To peruse premium articles, click over to your Watchlist.

12. Stock Screener

This is another decidedly non-revolutionary tool that’s nevertheless convenient for market watchers. Use it to sort for:

- Market sector (e.g., energy or consumer)

- Stock price volatility

- Asset class

- Advisor recommendation conviction strength (e.g., “high” or “neutral”)

- Dividend yield

13. Premium Discussion Boards

Motley Fool Stock Advisor has more than two dozen members-only discussion boards covering topics like:

- Investing Basics

- Investing Strategies

- Personal Finance

- Best of Stock Advisor

Before you can post to any of these boards, you’ll need to create a user name. You’re under no obligation to participate; many Stock Advisor members silently hang out on their favorite boards, passively absorbing fellow members’ insights without contributing their own.

Advantages of Motley Fool Stock Advisor

These are Motley Fool Stock Advisor’s biggest selling points. Of note are the basic buy-and-hold approach, no obligation beyond the subscription term, and visibility into all active and closed recommendations since inception.

- No Need to Trade Aggressively or Time the Market. Although Stock Advisor isn’t designed for index investors looking to match broader equity markets’ performance, or those primarily or wholly seeking passive income, it’s not meant for overly aggressive investors, either — and certainly not for day traders whose strategies hinge on exploiting short-term market movements.

- No Obligation Beyond Your Subscription Term. Stock Advisor members aren’t obligated to continue their subscriptions beyond their scheduled end dates. Though subscriptions auto-renew by default, it’s easy to cancel at any time and pay nothing more.

- New Subscribers Can See Active Recommendations Since Inception. No matter when you subscribe to Stock Advisor, you’ll have full access to every active recommendation dating back to 2002 – more than 15 years of stock-picking history. That’s more than enough to build a diversified equity portfolio.

- Includes Access to Closed Recommendations. Your Stock Advisor subscription also includes access to closed recommendations — picks the Gardners have withdrawn for one reason or another since inception. This is invaluable; after all, stock picks are only as good as the fundamentals supporting them.

- Lots of Opportunities to Learn From Veteran Investors. Stock Advisor’s premium community boards offer ample opportunity for less-experienced members to learn from veteran investors. If you’re not ready to start buying stocks, or you’re looking to hone your personal investing strategy, this is a good place to start – and it’s far less noisy than public message boards or social media platforms.

- Tons of Premium Content. Depending on how you value it, Stock Advisor’s premium reports and articles alone – like its proprietary report on a top cannabis investment opportunity – justify the cost of a subscription. At a minimum, Stock Advisor is another resource for serious investors looking to cut through the noise and peer around the curve.

Disadvantages of Motley Fool Stock Advisor

Keep these disadvantages in mind as you weigh the benefits of Motley Fool Stock Advisor. Notable drawbacks include the fact that a subscription isn’t necessary for all premium Motley Fool content, you can’t opt out of the Stock Advisor email newsletter, and no prorating for canceled subscriptions.

- It’s Just One of Several Premium Services From Motley Fool. Motley Fool has a host of premium subscription services; Stock Advisor might be the flagship, but it’s not the whole package. If you’re looking for recommendations specifically about investing for (and in) retirement, you’ll need to sign up for Rule Your Retirement, a $149-per-year subscription tailored to folks prepping for their golden years.

- Subscription Isn’t Necessary for All Premium Content. Motley Fool undercuts its extensive lineup of subscription services by offering some premium content outside its pay walls. For instance, the Rule Breakers podcast – part of the $299-per-year Rule Breakers service – is available for free at multiple podcast providers.

- Can’t Opt Out of Stock Advisor Email Newsletter. Members can’t opt out of the Stock Advisor email newsletter; it’s one of the few non-negotiable things about a subscription. If you don’t want to receive four to eight new emails per month, think twice before subscribing.

- No Guarantee the Annual Subscription Discount Will Remain in Effect. The discounted annual membership rate – $89 per year – is a great deal for first-time Stock Advisor members, but there’s no guarantee it’ll remain in effect. If you do take advantage of it, be aware that your subscription may auto-renew at a higher rate, and plan accordingly.

- No Prorating for Canceled Subscriptions. Though Stock Advisor members are free to cancel at any time, Motley Fool doesn’t prorate subscriptions canceled well before their scheduled renewal dates. If you cancel an annual membership with six months left in the term, for instance, you’re still on the hook for half the fee. The one exception: You’re entitled to a full refund when you cancel an annual membership in the first 30 days.

- Long-Term Subscribers Must Heed “Sell” Recommendations as Well. Stock Advisor members aren’t obligated to act on any of the team’s recommendations, but their portfolios’ performance may deviate significantly from the Stock Advisor portfolio’s unless they faithfully act on “buy” and “sell” recommendations in a timely fashion. In effect, Stock Advisor members looking to mirror the recommended equity basket’s performance must outsource their investing strategies to David and Tom Gardner – even if they’d be better served doing otherwise.

Motley Fool Stock Advisor — Stock Pick Performance

Investing is all about making money in the market. When paying for a service designed to give you an upper hand as you invest, it’s important that the service has a history of generating significant returns.

Although the stock advisor service makes no promises that every alert will result in a winning investment, looking into the historic performance of its picks reveals an impressive record of profit with a few bumps along the road.

Some of the most notable recent investment alerts include:

- CrowdStrike Holdings (CRWD). On June 4, 2020, Tom suggested subscribers should invest in CrowdStrike Holdings at $95.98 per share. Those who did enjoyed 112% gains by early April 2021. The performance of the stock was so compelling that it popped up again in July 2020 as an alert at $107.27. An investment at this level would have yielded returns of nearly 90% by April 2021.

- ASML Holdings (ASML). On July 16, 2020, David pointed to ASML Holdings as the next big opportunity at a purchase price of $383.95. Investors who jumped on the opportunity earned more than 65% by early April 2020.

- Fiverr International (FVRR). On September 3, 2020, Tom suggested that Fiverr International was the next big opportunity, trading with a price of $116.59 per share at the time. By early April of 2021, the stock price had climbed by more than 95%.

- Bandwidth Inc (BAND). Given the fact that nobody can predict the future, there have been a few losing trades over the past year. One of the most notable was a recommendation to purchase Bandwidth Inc in September 2020 at $150.06. The stock was down around 14% by early April 2021.

If there’s a stock picking service that promotes its ability to be right 100% of the time, you should turn the other way and run. The fact is that when making an investment, you’re essentially making an attempt at predicting the future, and there’s no 100% proven science to doing that.

With that in mind, although the service has led to a few losing trades, it is also clearly a winner with the vast majority of alerts resulting in profitable investments, many of which far outpace the average returns of the stock market as a whole.

Is Motley Fool Stock Advisor Legit?

Yes, Motley Fool Stock Advisor is legit.

There’s no such thing as a 100% sure thing in investing. Nor is risk-free stock investing a thing.

Motley Fool Stock Advisor doesn’t promise either. What it does offer is a steady stream of high-conviction picks from David and Tom Gardner, the stock gurus behind the service. Many will beat the market; some won’t. But the Gardners stand behind them all.

Does that mean you should give them your hard-earned money? We think there’s compelling value in a Motley Fool Stock Advisor subscription for any risk-tolerant, high-volume DIY investor. The choice is yours, though.

Final Word

Picking stocks is an inherently risky business. To its credit, Motley Fool doesn’t suggest otherwise. Motley Fool Stock Advisor’s sales literature makes it clear that some Stock Advisor picks turn out to be duds, that subscribers must be prepared to buy and hold for several years, and that portfolios composed of a dozen or more picks do better than their less-diversified counterparts.

If you’re comfortable with all this, and willing to pay anywhere between $99 and $228 per year for hand-picked stock tips, you could do worse than Motley Fool Stock Advisor — a tip sheet that, unlike many imitators, has more than a decade of above-market returns under its belt.

Just don’t lose sight of the core principles of investing along the way. You’re not obligated to act on any Stock Advisor recommendations, nor should you ever invest more than you can afford to lose in securities that aren’t FDIC-insured, no matter how sound a tip appears.

Pros

No need to try to time the market

No long-term obligation

Visibility into all active and closed stock recommendations

Cons

No prorated cancellation

Can't opt out of the email newsletter

Long-term subscribers must follow "sell" recommendations