Pros

Great customer service

Strong savings and CD yields

Competitive auto and mortgage loan products

Cons

Few services for small businesses

No physical branches

No cash deposits

Online banks are powerful personal finance tools that offer convenient access to funds – but, not all are created equal. As one of the first online-only institutions, Ally Bank has developed a reputation for responsive customer service, high interest rates on checking and savings accounts, and reasonable fees.

Like many online banks, Ally has no physical branches, but it is an FDIC member, which means its customers’ deposits are insured up to $250,000. Despite the lack of a physical footprint, it has one of the most generous ATM fee reimbursement schemes around. Ally customers enjoy fee-free access to tens of thousands of ATMs across the United States.

Since its spinoff from GMAC in 2009, Salt Lake City-based Ally has accumulated more than a million customers and boasts billions in consumer deposits. It’s one of the biggest banks in the United States.

Read on to find out why.

Key Features of Ally Bank

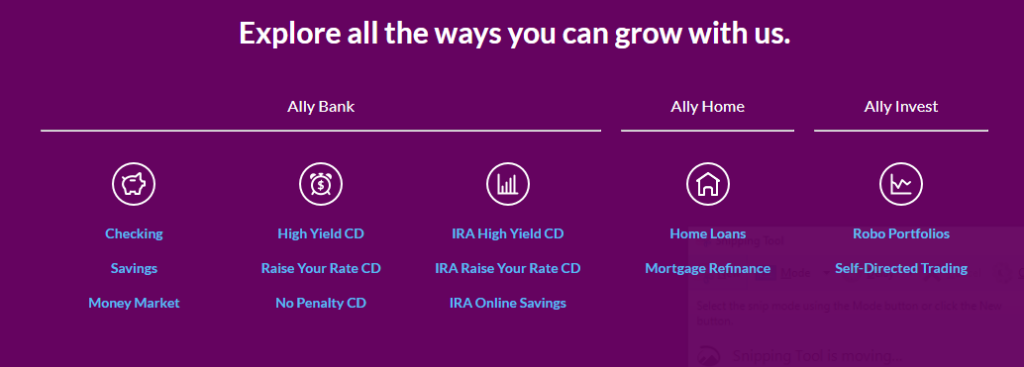

Ally Bank has a comprehensive lineup of consumer deposit accounts, consumer loans, and business products. It also boasts some useful value-added features that put it head and shoulders above the competition.

Interest Checking Account

Ally customers can open an interest-bearing checking account that comes with free checks and a MasterCard debit card. It doesn’t require a minimum balance to open, nor does it charge a monthly or annual maintenance fee. However, like all other Ally accounts, you can’t make deposits in physical cash.

At the moment, Ally’s interest checking accounts pay a competitive interest rate: 0.10% for balances of less than $15,000 and 0.25% for balances above $15,000.

High Yield Savings Account

Like its interest checking account, Ally’s savings account lacks opening deposit and minimum balance requirements, as well as monthly maintenance fees. Currently, this account yields 4.25%, although this figure may fluctuate on a daily, weekly, or monthly basis.

Ally Bank recently did away with the excess transaction fee for this account, so you can exceed the withdrawal limit of six per month without incurring a surcharge.

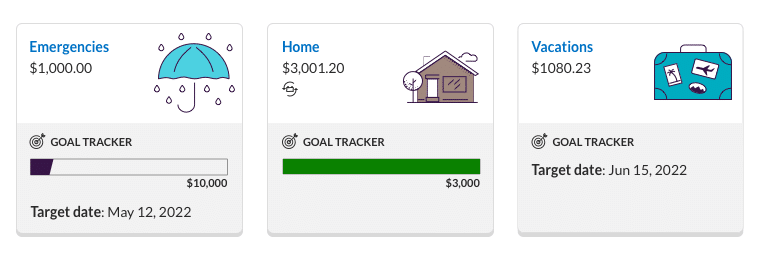

Savings Buckets

Use Ally’s Savings Bucket feature to create distinct savings subaccounts for specific savings goals, like building an emergency fund or saving up for the down payment on a new car. You don’t have to open a new savings account to create a bucket — you can segment your savings with just a few taps.

Savings Boosters

Ally makes it easier to boost your savings rate with three features collectively known as “boosters”:

- Recurring savings transfers that divert a portion of each paycheck to your savings account

- Round Ups, which round each transaction up to the nearest dollar — Ally then transfers the balance to your savings when you reach $5 in extra cash

- Surprise Savings — Ally looks for extra cash in your checking and ports it over to your savings account automatically

Multiple CD Options

Ally offers three core CD products. All come with 10-day best rate guarantees, meaning new accounts are automatically bumped up to higher yields if rates rise within 10 days of opening.

- High Yield CD: Available in terms of 3, 6, 9, 12, 18, 36, or 60 months. Rates currently vary from 3.00% for the 3-month vehicle (under $5,000 opening deposit, with slightly higher rates for larger deposits) to 4.10% for the 60-month vehicle (all balances).

- Raise Your Rate CD: If interest rates increase during your CD’s term, you can bump up your starting yield to Ally’s highest available yield at least once per term. On the two-year Raise Your Rate CD, you get one raise per term. On the four-year version, you get two.

- No Penalty CD: This one has a fixed 11-month term. Its yields are a bit lower across the board, but it comes with more flexibility. You can cash it out at any time without incurring interest penalties, which apply to all other CD types.

Ally also offers special “Select CD” products from time to time. These generally have moderate terms, in the neighborhood of 10 to 14 months, and competitive interest rates.

CD Laddering Tools

Ally’s CD Ladders are designed to mitigate one of the major drawbacks of long-term CDs: their tendency to tie up holders’ funds for years.

CD ladders consist of identically sized CDs whose terms range in length from one to five years. Upon maturity, each CD is automatically renewed at your maximum specified term, ensuring you have access to it on the same date every year. If you withdraw funds from a maturing CD, the other CDs in the ladder won’t be affected.

Money Market Accounts

This product lacks monthly balance requirements, fees, and minimum deposits, and comes with a Visa debit card. Outbound transfers, including point-of-sale purchases with the debit card, are limited to six per statement period. However, there’s no limit on ATM withdrawals.

It currently yields 4.40%, far more than brick-and-mortar competitors such as Wells Fargo and U.S. Bank.

Retirement Accounts (IRAs)

Ally’s IRA accounts allow you to invest in standard CDs, savings accounts, or Raise Your Rate CDs. These all follow the same rules and are available in the same term lengths as their non-IRA counterparts. You can open a Roth, traditional, or a SEP IRA if you’re a small business owner.

Auto Financing Products

With a separate log-in area for auto loan customers, Ally has a whole suite of auto financing products for individuals and fleets that buy or lease. It also offers a Buyer’s Choice option that allows you to sell your vehicle to Ally after making 48 monthly payments. For specific information about rates and terms, visit a dealership and begin the pre-qualification process.

Mortgage Loans

Ally Bank offers competitively priced mortgage loans in partnership with Better, a digital lender specializing in purchase and refinance loans.

Whether you’re in the market for a new house or looking to refinance your current mortgage, you’ll find what you need here. Choose from conventional, VA, FHA, and jumbo loans with fixed or adjustable rates, depending on the product type.

Not sure where to start? Use Ally’s mortgage tools — including a handy refinance calculator and a custom home affordability calculator — to get a handle on your situation

Ally Invest

Ally Invest is a low-cost brokerage platform that offers commission-free stock and ETF trading in a self-directed account.

If you prefer, opt for the robo-advisor option instead and pay no management fee for Ally to manage your investments on your behalf. The catch: You have to keep 30% of your portfolio’s value in cash as a buffer against market volatility.

Ally Invest has a ton of useful features. For more, check out our Ally Invest review.

Commercial Financing Options

Through Ally Financial, its parent company, Ally Bank offers commercial financing solutions for businesses with revenues of at least $50 million. These include term loans with fixed principal amounts which must be repaid within a specified timeframe.

Ally also offers revolving credit lines, which can be tapped or repaid within pre-set limits at your discretion. These products are designed to finance activities such as leveraged buyouts, mergers, and operational restructuring.

Check directly with Ally for more information about its commercial financing products.

Mobile Banking

Ally’s banking services are mobile-friendly. You can access all parts of your account, including balances, transfers, automatic bill-pay, and Ally’s ATM-finding tool, from your smartphone or tablet. You can also use the e-Check Deposit tool by taking a photo of the front and back of your endorsed check.

Person-to-Person Transfers

Ally’s P2P transfer feature lets you transfer funds between your checking or savings accounts and the U.S.-based bank accounts of your friends, family members, third-party vendors, and business associates. This mobile-friendly platform doesn’t require you to exchange bank account information, just email addresses or phone numbers

Trust Accounts

Ally Bank offers revocable and irrevocable living trusts, which can be efficient ways to preserve wealth or set aside gifts for others.

Revocable trusts can be altered or canceled by the grantors who set them up, with earnings and assets remaining under their control until death. They’re sometimes known as trust funds for this reason. Irrevocable trusts can only be changed by their beneficiaries.

Any Ally account can be opened as a trust, and the company’s employees can walk you through the process online or over the phone.

Overdraft Transfer Service

You can tie your checking account to an Ally savings or money market account and opt into the bank’s free Overdraft Checking Service. Ally doesn’t charge for overdrafts, a key advantage over many competing traditional and online-only banks.

In the event of an overdraft, Ally automatically transfers funds to your checking account in increments of $100. Each increment counts as one of six withdrawals that can be made from savings and money market accounts per statement period — though this limit is a formality these days thanks to Ally’s fee waiver.

Customer Service

Ally’s banking customer service team is available by phone 24/7. Wait times are posted on the website in real time. They’re usually minimal – the longest I’ve seen is eight minutes.

Ally’s auto service team is available during extended business hours on weekdays and regular business hours on the weekend. Hours for other verticals, such as commercial financing, may vary.

Advantages of Ally Bank

Ally Bank has a lot going for it. For starters, its customer service department is second to none, and it offers some of the best deposit account yields in the business. Innovative products and solutions, such as Raise Your Rate CDs and technology-enabled mortgage lending, round out the value.

- 24-Hour Customer Service With Short Wait Times. There’s a good reason why Ally touts its 24/7 customer service assets. Its call center is open around the clock, including on holidays, and actual employees answer online chats at all hours as well. The bank’s home page prominently displays call-in wait times. Some online banks, such as Capital One 360, only offer phone support during extended business hours. And, while TIAA Bank also has 24-hour live phone support, it doesn’t make its wait times available online.

- No Overdraft Fees. Ally doesn’t charge a fee for account overdrafts. This is a great benefit if you live paycheck to paycheck.

- Fee Reimbursement at Any ATM With No Restrictions. Ally reimburses customers who use their debit cards to make checking or money market account withdrawals from any U.S. ATM. This covers fees charged by third-party machines, such as those found at restaurants or bars, as well as fees charged by bank-owned machines. The company claims that this service applies to more than 400,000 ATMs across the country. Few other banks offer such a generous reimbursement scheme.

- Attractive CD, Savings Account, and Money Market Yields. Ally Bank’s CD, savings account, and money market yields compare favorably to those of other online banks. For instance, yields on its savings account and 12-month CD exceed those on comparable Capital One 360 vehicles. And unlike competitors like Capital One 360 and TIAA Bank, Ally also offers a No Penalty CD, which doesn’t penalize you when you terminate your CD early.

- Raise Your Rate CDs. If Ally’s CD rates rise, you can request a rate increase on your Raise Your Rate CD. You’re allowed one bump on a two-year RYR CD and two bumps on the four-year version. Once honored, the new rate is effective for the remainder of the CD’s term or until you request (for the four-year version) another hike. Unlike some rising-rate CDs, Ally’s version can’t be bought back, or “called,” by the bank before maturity. Many online banks, including Capital One 360 and TIAA Bank, still don’t offer rate-flexible CDs.

- Comprehensive Auto Financing and Mortgage Services. The scope of Ally’s auto financing and mortgage offerings is impressive. On the auto side, the bank easily accommodates large fleet customers and offers a flexible Buyer’s Choice option for individuals who aren’t sure how long they want to keep their cars. On the mortgage side, Ally works with Better — a tech-forward digital lender — to deliver some of the most competitive rates around.

- Convenient P2P Transfers and Billpay. Ally’s free P2P transfer tool facilitates easy, low-cost peer-to-peer and point-of-sale transactions between its customers and third parties. Among banks, this isn’t unique: Bank of America, Wells Fargo, and Chase all offer mobile-friendly peer-to-peer payments. What is unique is the pricing structure: Most other banks, and fintech peers like PayPal, charge fees for repeated transfers.

- 10-Day Best Rate Guarantee on CDs. Every newly opened Ally CD comes with a 10-day grace period. The CD continues to accrue interest during this time, but its long-term rate isn’t set until the period’s end. At that point, you receive the best rate Ally offered during the period on that type of CD, even if it’s not currently in effect. A hypothetical example: If the rate on a 36-month CD began at 1.49% on day 1 of 10, rose to 1.55% on day 4, and fell to 1.52% on day 10, you’d get the 1.55% rate for the CD’s entire term, including the 10-day grace period. Capital One 360’s CDs don’t come with such flexibility.

Disadvantages of Ally Bank

Ally Bank does have some downsides, including a bias toward larger businesses on the commercial side and a lack of flexibility for consumers — notably, no physical branches or cash deposits.

- Few Services Targeted to Small Businesses. With high minimum loan limits, Ally’s commercial financing services definitely cater to medium-sized businesses with substantial capital needs. And unlike Capital One 360, which offers business-only savings accounts and 401k services, Ally has virtually nothing for small business owners. The only exception is its SEP IRA, which is a traditional IRA that can be structured as a retirement plan for companies with multiple employees, as well as self-employed individuals.

- No Physical Branches. Whether this is really a problem for you depends on how much you value in-person banking. If you do — or at least like having the option to pop into your local bank branch — then Ally’s lack of physical branches might irk you.

- No Cash Deposits. Ally explicitly forbids customers from making cash deposits into their accounts. If this is your first bank account and you’ve previously dealt mostly in cash, this might be a problem. Some online banks, including Capital One 360, do accept cash deposits.

How Ally Bank Stacks Up

Ally Bank is one of the biggest, best-known online banks on the market. Is it also one of the best?

Let’s see how it stacks up against another popular digital bank: Discover Bank.

| Ally Bank | Discover Bank | |

| Savings Yield | 4.25% | 4.25% |

| Top CD Yield | 4.10% on the 5-year CD | on the 5-year, 7-year, and 10-year CDs |

| Checking Yield | Up to 0.25% | None, but 1% cash back on up to $3,000 in debit card transactions per month |

| Brokerage Account | Yes | No |

Final Word

Ally Bank has nearly a million individual customers and is among the 30 largest banks in the U.S. by deposit size.

It has several advantages over its peers, including generous yields on its savings vehicles, a lax fee and balance structure that favors smaller depositors, a robust auto lending department, and a responsive customer service team that’s always available.

Its drawbacks may prevent it from being a one-stop shop for all your saving needs, but if you’re willing to have your mortgage and brokerage accounts elsewhere, Ally is a good option.

Pros

Great customer service

Strong savings and CD yields

Competitive auto and mortgage loan products

Cons

Few services for small businesses

No physical branches

No cash deposits