Whenever I travel abroad, I carry at least one credit card that doesn’t charge foreign transaction fees (FTFs) — the surcharges issuers often impose to cover the additional cost of processing international purchases.

I haven’t kept a precise tally of how much I’ve saved by using credit cards that waive foreign transaction fees, but it’s definitely a three-digit number.

Using credit cards without foreign transaction fees helped me save money on international travel for many years. But traveling abroad isn’t the only situation where FTF-free cards prove useful. Find out where else you can expect to encounter foreign transaction fees and how to reduce or eliminate them entirely.

What Is a Foreign Transaction Fee?

A foreign transaction fee (or international transaction fee) is a fee tacked onto a credit or debit card transaction processed outside the United States.

On credit cards, the typical foreign transaction fee is up to 2% or 3% of the total transaction amount, depending on the issuer and the currency in which the transaction is denominated.

On debit card transactions, the standard fee is 1%. That doesn’t include potentially hefty withdrawal fees charged by foreign ATMs, though.

If you choose to denominate a foreign credit or debit card transaction in U.S. dollars, rather than local currency, it results in dynamic currency conversion fees. Those can be even higher than regular foreign transaction fees — north of 5% of the transaction value in some cases.

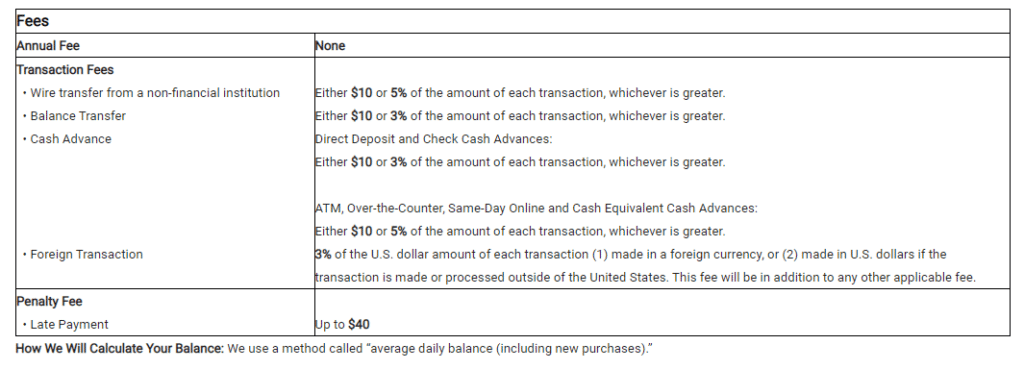

Your credit or debit card’s rates and fees disclosure should clearly spell out the foreign transaction surcharge, if any. It might not break down the currency conversion fee, however. Ask your bank if you’re not sure whether it charges that type of fee. Here’s an example disclosure:

Tips to Reduce, Avoid, or Waive Foreign Transaction Fees

Follow these tips to find credit and debit cards without foreign transaction fees and to reduce, avoid, or waive FTFs and currency exchange fees when you do have to use a card that charges them.

1. Look for Cards Marketed to Frequent Travelers — Even If You’re Not One

The best way to avoid foreign transaction fees entirely is to use credit cards that don’t charge them.

Many credit cards fitting this description are travel rewards cards. These are cards marketed to frequent travelers, like the Chase Sapphire Preferred® Card and the Capital One Venture® Rewards card.

But you don’t have to be a frequent traveler to qualify for a travel rewards credit card. Many reward spending on other types of purchases, like Sapphire Reserve’s 3x dining rewards. Others earn good returns on general spending. For example, the Venture card earns 2x miles on most purchases.

Plus, travel rewards cards tend to be more generous than general cash-back credit cards. They promise free or discounted airport lounge access, statement credits against travel and other purchases, opportunities to earn bonus rewards on partner purchases, and more. If you can earn rewards or use benefits worth more than the annual fee, a travel rewards card could be a good addition to your wallet.

2. Always Denominate Transactions in Local Currency

This should be the default option wherever you go. Often, you won’t even have the option to denominate overseas transactions in anything but the local currency.

If you’re given the choice to denominate a transaction in U.S. dollars, don’t take it. Doing so will expose you to dynamic currency conversion fees, which can top 5%.

That’s significantly more than the typical foreign transaction fee, which you’ll also pay if your card charges one. The temptation to see upfront what you’re paying in a familiar currency simply isn’t worth the extra cost.

Instead, wait a few business days, then check your online credit card statement (if you can do so securely while abroad). Your statement should show the transaction value in U.S. dollars.

3. Switch Banks or Open a Secondary Account That Doesn’t Charge Foreign Transaction Fees

If you’re otherwise happy with your bank but don’t want to be on the hook for foreign transaction fees, is switching institutions really called for?

Maybe not a wholesale switch where you withdraw every last penny and close your accounts. But opening a secondary account with a financial institution that doesn’t charge foreign transaction fees might be worth the effort.

Among bigger banks, Capital One and Charles Schwab stand out for waiving foreign transaction fees on debit card transactions.

Credit unions tend to charge lower fees in general, although many have membership requirements that shut out many would-be applicants.

For example, Pentagon Federal Credit Union (PenFed) waives foreign transaction fees entirely, but you need to have some connection to the military or military-adjacent civilian service to join.

4. Withdraw Cash at an International ATM in Your Bank’s Network

Cash remains king in many parts of the world. And not just low- and middle-income countries either. Japan has been surprisingly slow to adapt electronic payment methods, for example. Cash is still quite popular there.

Accustomed to card-happy places like the European Union, my wife and I were a little alarmed by what we found on our first journey to Thailand: few independent merchants seemed to accept plastic. Fortunately, our hotel accepted Visa and Mastercard.

Finding an ATM wasn’t difficult, as you would expect in a cash-rich country. But getting that cash proved costly. Because we hadn’t notified our primary bank we’d be traveling, our ATM card didn’t work. That forced us to use one of our credit cards’ cash advance lines. With cash advance and currency exchange fees, the cost came to well over 5% of the withdrawal.

Had we planned ahead, we probably could have avoided that expense. Most banks and credit unions belong to international ATM networks. If not entirely fee-free, ATMs in these networks are still much cheaper for U.S.-based travelers to use.

For example, Bank of America belongs to the Global ATM Alliance, a vast network of low-fee ATMs in Europe, Oceania, and parts of Asia. Currency conversion fees may still apply at Global ATM Alliance machines, but hefty international out-of-network transaction fees ($5 for Bank of America customers) don’t.

5. Withdraw Cash in Person at a Partner Bank

If you’re not concerned about a possible language barrier, skip the ATM and withdraw funds directly from a branch teller.

This eliminates any unavoidable ATM fees from the equation. It has the added advantage of a face-to-face transaction where you can ask questions about any fees and surcharges, assuming you and the teller speak the same language. (Even in countries where English isn’t the first language, tellers at major banks in big cities often have working English knowledge.)

Before leaving home, check your bank’s website for a list of partner institutions in your destination country and visit one promptly when you arrive. Some partner institutions might have branches in your arrival airport — a welcome convenience after a long journey.

6. Avoid Airport Currency Exchange Kiosks & Independent Currency Exchange Shops

Avoid airport currency exchange kiosks like the plague, unless you want to pay 5% to 8% of your transaction in currency exchange fees. Use in-network ATMs or partner bank branches, if available.

Likewise, after leaving the airport, avoid independent shops that exchange currency. Their markups are also super high, and as long as you’re in a decent-sized city, you’ll probably find a lower-cost ATM or bank branch nearby.

Finally, if you plan to venture to more remote parts of your destination country and don’t expect to be able to use plastic, load up on cash before leaving the city.

7. Use Your Travel Card When Shopping With International Merchants

Closer to home, use your travel credit card or other FTF-free card whenever you shop with merchants that process transactions outside the United States.

That’s any merchant based outside the U.S., including sellers on U.S.-based retail websites like Amazon or Etsy, and any merchant that ships its products from a non-U.S. fulfillment location.

Do this even if your credit card rewards program doesn’t favor online purchases. The only exception is when you’ll forfeit rewards worth more than the foreign transaction fee. For example, if you stand to earn rewards worth 4% of the transaction value, you’ll still net 1% after a 3% foreign transaction fee.

8. Ask for a Foreign Transaction Fee Waiver for Purchases Processed Overseas

As a last resort, ask your card issuer to refund foreign transaction fees charged on purchases processed overseas.

Issuers assess FTFs on purchases made in the U.S. but processed abroad. It’s not common knowledge, so most issuers are willing to cut cardholders some slack, at least the first time around. Especially with the potential for a negative review hanging in the air.

This tactic is less likely to work for in-person transactions conducted overseas. There, ignorance isn’t a defense because merchants know travelers expect FTFs.

Foreign Transaction Fee FAQs

The concept of a foreign transaction fee is simple, but the details can get messy. Learn more about how they work and how to beat them.

How Can You Find Credit Cards Without Foreign Transaction Fees?

Finding credit cards without foreign transaction fees is easier than it used to be due to growing consumer awareness of the issue and fierce competition between travel rewards credit card issuers.

Credit card issuers know foreign transaction fees are unpopular, so they tend to advertise cards without them. Some, like Capital One, don’t charge foreign transaction fees on any of their cards, eliminating any surprises from the equation.

Not sure where to start? Check our list of the best credit cards without foreign transaction fees.

When Are Foreign Transaction Fees Charged?

If you’ve ever made a purchase with an international vendor that processed the transaction outside the U.S., there’s a good chance you paid a foreign transaction fee.

Such transactions include obvious ones like buying something in person in another country. But there are plenty of less obvious examples, like booking a room on a hotel website hosted in Mexico or buying a hard-to-find book from an Amazon retailer based in the United Kingdom.

Some additional examples of when foreign transaction fees are (and aren’t) charged:

| Action | Will You Pay an FTF? |

| Booking an international flight on a U.S.-based booking site (like Priceline) | No |

| Booking an international hotel on a U.S.-based booking site | No |

| Booking an international flight directly with a non-U.S. airline | Probably |

| Booking an international hotel directly with the property | Probably |

| Buying a handmade item from a non-U.S. Etsy vendor | Yes, if the transaction is processed outside the U.S. |

| Buying something in a store outside the U.S. | Yes |

| Buying something from a non-U.S. seller on Amazon | No, unless you buy through a foreign Amazon subsidiary |

| Withdrawing cash from an ATM abroad | Yes |

How Are Foreign Transaction Fees Calculated?

Banks calculate foreign transaction fees based on the total amount of the purchase. This amount includes sales tax or value-added tax (VAT), if applicable.

To calculate the foreign transaction fee for a particular transaction, convert the FTF percentage into a decimal. Then, multiply that decimal by the full transaction amount. If you want to find out the grand total, including the FTF, add the result to the transaction amount.

This is simpler when the transaction is denominated in U.S. dollars, assuming a foreign currency transaction fee doesn’t apply.

Let’s say you’re using a card with a 3% FTF to buy a $100 piece of wall art from an Etsy seller based in Portugal. The transaction is processed in Europe, so the FTF applies. This is your calculation:

- Step 1: 100 x 0.03 = 3

- Step 2: 3 + 100 = 103

Your total transaction cost with the FTF is $103.

For transactions denominated in foreign currency, the transaction’s dollar value fluctuates based on the exchange rate. You can use the same calculation to calculate the FTF in foreign currency, but you won’t know the actual amount debited from your bank account or added to your credit card balance right away.

Can You Get a Foreign Transaction Fee Waived?

The best way to avoid foreign transaction fees is to use a card that doesn’t charge them in the first place.

If that ship has sailed and you want to get an FTF waived after a transaction goes through, contact your bank or card issuer’s customer service department and ask. Your request might be denied the first (or third) time you ask, but be persistent and escalate to a manager until you get to “yes.”

Ultimately, your bank wants to keep you as a customer. They’d rather eat the occasional foreign transaction fee than have you close your account and take your business elsewhere.

Do Bank of America Credit Cards Have Foreign Transaction Fees?

Some do and some don’t.

The popular Bank of America Customized Cash Rewards Card does charge a foreign transaction fee. But BofA’s premium rewards cards and travel cards don’t.

Bank of America credit cards without foreign transaction fees include:

- Bank of America Travel Rewards

- Bank of America Travel Rewards for Students

- Bank of America Premium Rewards

- Bank of America Premium Rewards Elite

- Co-branded Bank of America travel cards, such as the Alaska Airlines Visa Signature Card

Do Discover Credit Cards Have Foreign Transaction Fees?

No, Discover credit cards don’t charge foreign transaction fees.

The catch is that Discover credit cards aren’t as widely accepted by merchants in the U.S. or abroad. Yes, merchants in dozens of countries do take Discover, but Visa or Mastercard are accepted more often. If you plan to use your Discover card when traveling internationally, make sure you have a non-Discover backup.

What Other Banks Don’t Charge Foreign Transaction Fees?

Most big banks offer credit cards without foreign transaction fees. It’s increasingly common to see debit cards without foreign transaction fees too. But always read the fine print — the card’s rates and fees disclosure — and don’t hesitate to ask your bank or credit card issuer’s customer service if you’re not sure.

Top Cards With No Foreign Transaction Fees

We’ve roundup up the best cards without foreign transaction fees. Use this list to kick off your search for your next FTF-free spending card.

Any Capital One Credit Card

Capital One credit cards don’t charge foreign transaction fees, period.

Capital One cardholders, like all credit card users, may be obligated to pay for dynamic currency conversion when they choose to denote foreign transactions in their home currency.

For frequent travelers, the Capital One universe’s clear winner is the Capital One® Venture® Rewards Credit Card, which earns an unlimited 2 miles per $1 spent on all eligible purchases — an effective 2% rate of return when redeemed for travel. Learn more about the Venture Rewards card here.

The other Capital One standout is the Capital One Quicksilver Cash Rewards Credit Card, a popular cash-back credit card that earns an unlimited 1.5% back on all eligible purchases and does not charge an annual fee. Learn more about the Quicksilver card here.

See our reviews of the Capital One Venture Rewards Credit Card and the Capital One Quicksilver Cash Rewards Credit Card for more details.

Chase Sapphire Cards

Chase’s two Sapphire-branded credit cards are among the best travel rewards credit cards on the market today.

Chase Sapphire Reserve®

The Chase Sapphire Reserve® boasts a $300 annual travel credit, complimentary access to more than 1,000 airport lounges worldwide, potentially valuable perks and benefits at hundreds of hotels worldwide, and a generous rewards program that earns 3 points per $1 spent on eligible dining purchases.

Most travel purchases earn 3 points per $1 spent as well. Air travel and hotel and car rental purchased through Chase Travel℠ earn 5 total points and 10 total points per $1 spent, respectively. Sapphire Reserve has other benefits worth mentioning, both temporary and permanent.

Chase Sapphire Preferred® Card

The Chase Sapphire Preferred® Card is quite generous in its own right. It offers a $50 annual Chase Travel℠ hotel credit, plus:

- An impressive sign-up bonus

- 5 points per $1 spent on eligible travel purchases made through the Chase Travel℠ portal (after the hotel credit)

- 3 points per $1 spent on eligible dining purchases (including dine-in and takeout), select streaming purchases, and online grocery purchases

- 2 points per $1 spent on other eligible travel purchases (after the hotel credit)

- A 10% annual bonus points boost on eligible base point earnings

See our reviews of the Chase Sapphire Reserve Card and Chase Sapphire Preferred Card for more information.

The Platinum Card® From American Express

The Platinum Card® From American Express boasts a $200 annual airline fee credit, up to $200 in annual credits with Uber, complimentary access to more than 1,000 airport lounges worldwide, complimentary elite status with the Hilton Honors and Marriott Bonvoy loyalty programs (Gold and Gold Elite, respectively), and potentially valuable perks and benefits at hundreds of hotels worldwide.

For more information, see our Platinum Card® From American Express review.

Deserve® EDU Student Credit Card

The surprisingly generous Deserve® EDU Mastercard for Students boasts an impressive lineup of perks and benefits:

- A free year of Amazon Prime Student with a qualifying spend of at least $500 in the first three billing cycles

- A $100 credit during the first month of your new Feather furniture subscription

- A $10 statement credit when you pay for three consecutive months of Lemonade insurance coverage

- Cellphone protection up to $600 per claim

- 1% cash back on all eligible purchases

With no foreign transaction fees, this popular student credit card is ideal for students studying abroad for a semester — or longer.

See our Deserve® EDU Student Credit Card review for more information.

Any Discover Credit Card

Like Capital One, Discover never charges foreign transaction fees. That makes it useful for making purchases with international merchants that process transactions outside the United States.

Discover is not the best card to take on a trip abroad, though. Although it’s now accepted in more than 180 countries worldwide, its merchant acceptance rate still trails Visa’s and Mastercard’s. A random merchant in Paris or Tokyo is more likely to accept Visa than Discover.

Plus, Discover’s fraud detection system is more sensitive to international purchases, which is why Discover advises cardholders to notify the issuer of their travel plans before leaving.

Final Word

Exclusively using travel credit cards that don’t charge foreign transaction fees is just one of many ways to save money while traveling abroad.

One frugal travel tip that has served me well is basing my travel plans around foreign exchange rates.

If I’m not able to time my international travel to align with when the U.S. dollar is strong compared to most other currencies, then I consider altering my itinerary to incorporate places where the dollar is comparatively strong. Countries experiencing bouts of economic weakness or (nonviolent) political instability typically have weaker currencies than their more prosperous, stable neighbors.

Of course, the best strategy to maximize overseas travel savings is “all of the above.” For the financially adventurous among us, finding smart ways to reduce the total cost of travel without sacrificing comfort or safety is a big perk of the journey, and a profitable one at that.