If you have multiple sources of debt, it can start to feel like no amount of monthly payments is enough to pull yourself up and out of it. There’s a reason people refer to debt as a slippery slope: Getting out of it, especially once you have multiple debts accruing interest all at once, is a complicated process.

The good news is, there are multiple ways to pay off debt. Here, we explore one in particular — the debt snowball method — and how to tell if it’s right for you.

What Is a Debt Snowball?

The debt snowball method is a payment strategy that prioritizes paying your smallest debts first. Many people are tempted to apply any “extra” funds they’ve saved in a month toward the debt with the highest interest rate or to divide it equally across different accounts, which can make the snowball method seem counterintuitive. However, this strategy is surprisingly effective for gaining momentum to pay off multiple accounts.

We’ve broken down the method step by step below. Once you’re ready, download our printable debt snowball worksheet and get started! If you want a version you can edit, download the debt snowball spreadsheet instead. It contains some example figures to give you an idea of what to include.

How to Snowball Your Debt

The debt snowball method is very simple:

- Excluding your mortgage (if you have one), list your debts from smallest balance to largest balance.

- Each month, make only your minimum monthly payments on each debt except the account with the smallest balance.

- Pay as much as you’re able toward your smallest debt.

- Repeat each month until your smallest debt is paid off.

- Once your smallest debt is paid off, repeat the process by continuing to pay the minimum payment on every account except the one with the smallest balance until all of your debt is paid off.

Why a Debt Snowball?

The debt snowball works so well because it methodically frees up the minimum monthly payments on each account that you pay off one at a time, allowing you to add that amount to the extra funds you apply to your next month’s payment.

For example, say you usually have about $200 left to put toward your debt at the end of the month after you’ve paid your rent, bills, and made all of your minimum monthly payments. If you pay the full $200 above the minimum payment on your smallest debt each month, once that debt is paid off, you’ll have $200 to put toward your next smallest balance — plus the amount of the minimum payment you used to make on your now-repaid account.

As you pay off each new account, you can add or “snowball” the paid-off debt’s minimum payment amount to your next smallest balance until you’re completely out of the red.

A Note About Interest

Many will point out that, by ignoring the interest rates of your debts and starting with the lowest balance regardless of APR, you’ll wind up paying more in the end because your larger-interest debts will be some of the last to be paid off.

The argument for the debt snowball is that it enables you to build momentum more quickly, increasing the likelihood of faster success by keeping your motivation high. Starting with a larger debt means you won’t get the experience of closing out a debt until much later. This can leave you feeling dejected and less motivated to scrimp, save, and apply every free cent to paying off your debt.

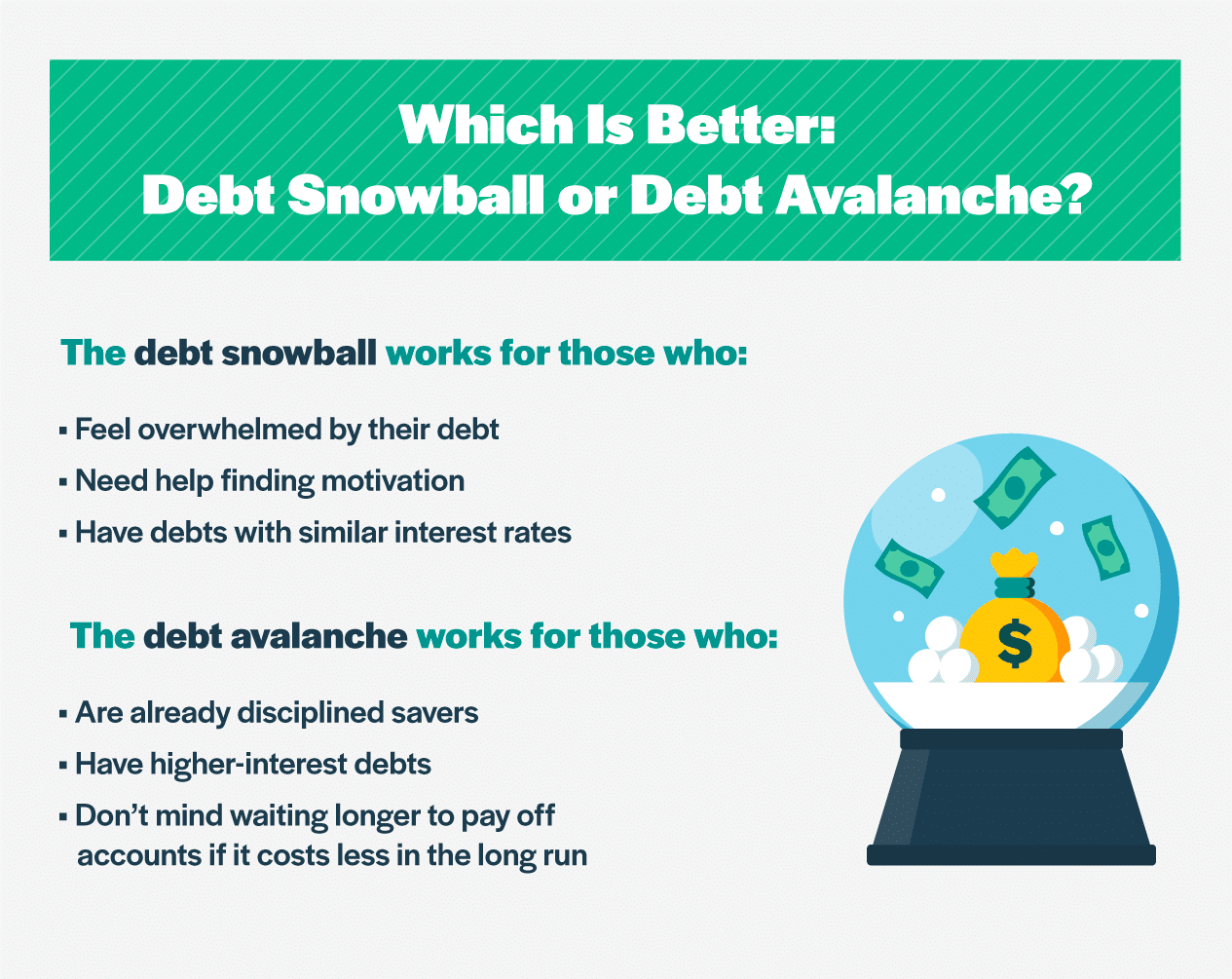

Debt Snowball vs. Debt Avalanche

If you feel confident in your ability to stay committed to the debt payoff process, you may be able to save more by flipping the debt snowball method on its head and aiming for a “debt avalanche” instead.

The debt avalanche method works the same way the debt snowball method does except when it comes to the order in which you pay off your debts. Whereas the debt snowball method has you order your debts from smallest to largest by balance, the debt avalanche has you order your debts from smallest to largest by interest rate.

By choosing the debt avalanche method, you may be able to shave off a few hundred dollars in interest from your overall payment amounts.

Final Word

No matter which debt payoff method you choose, the key is to have a plan and then stick to it, putting every extra dollar and cent you can find toward your debt payoff plan. Once you’ve decided which debt strategy is for you, you can take on a side hustle or find easy ways to save, adding every extra bit of income you find.

Your debt might feel unmanageable now, but you’ll be surprised at how quickly the debt snowball piles up!