Have you ever wondered what the history and the parts of a credit card are? How did they get started, and what constitutes a credit card?

This article will discuss the history and anatomy of a credit card: what are all the numbers and magnetic bits, and why are they there?

We’ll also discuss how credit card issuers maintain security features, offer benefits and perks to their members, the future of credit cards, and more.

Keep reading to learn everything you need about credit card parts and how they work.

Parts of A Credit Card

First, let’s look at the anatomy of the credit card:

Front of the Credit Card

The front of the credit card will typically have the following.

- Credit card number: The numbers on the front of your credit card make up the credit card number, or your account number. This identifies your credit line when you try to use the card. It’s important to keep this number private because with your credit card number, expiration date, and 3-digit number on the back, anyone could use your card.

- Bank Identification Number: The BIN is similar to your bank’s routing number for your personal bank account. The first six to eight numbers route the payment instructions to the proper payment network and issuing bank.

- Major Industry Identifier (MII): The first digit of your card is the MII and indicates the type of institution that issued your card. Among the most common MIIs, Amex cards start with a 3, Visa cards start with a 4, Mastercards start with a 5, and Discover cards start with a 6.

- Check digit: The last digit of your credit card number is a check digit. This is used to verify the authenticity of your card number and is based on an algorithm that considers the other digits in your card. If the check digit doesn’t match a certain value, the credit card is invalid, and the bank will decline the transaction. The check digit is one feature of many used to prevent fraud.

- Cardholder name: The name on the card identifies the person eligible to use it. This may or may not be the person who applied for and opened the card. Card owners can get cards for authorized users, such as a spouse or child.

- Expiration date: All credit cards expire if for nothing else than safety. Getting a new card with a new expiration date and security code reduces the risk of someone knowing your information and using your card. Cards also expire to allow all cardholders to have cards with the latest technology.

- EMV Chip: Metal chips in credit cards make them more secure than traditional magnetic strips. The chip encrypts your credit card information as it’s processed, reducing the risk of fraud.

- Name of the credit card issuer: The credit card issuer is a bank. You’ll see the bank’s name on the credit card. This is who you make payments to and contact if you have an issue with your card.

- Payment network logo: Each credit card is from a credit card company, such as Visa, Mastercard, Discover, or American Express. When you pay online or over the phone, you typically have to identify your card type.

Please Note: Not all credit cards have this information on the front, and it depends on the type of card. Some cards are moving a lot of this information to the back of the card.

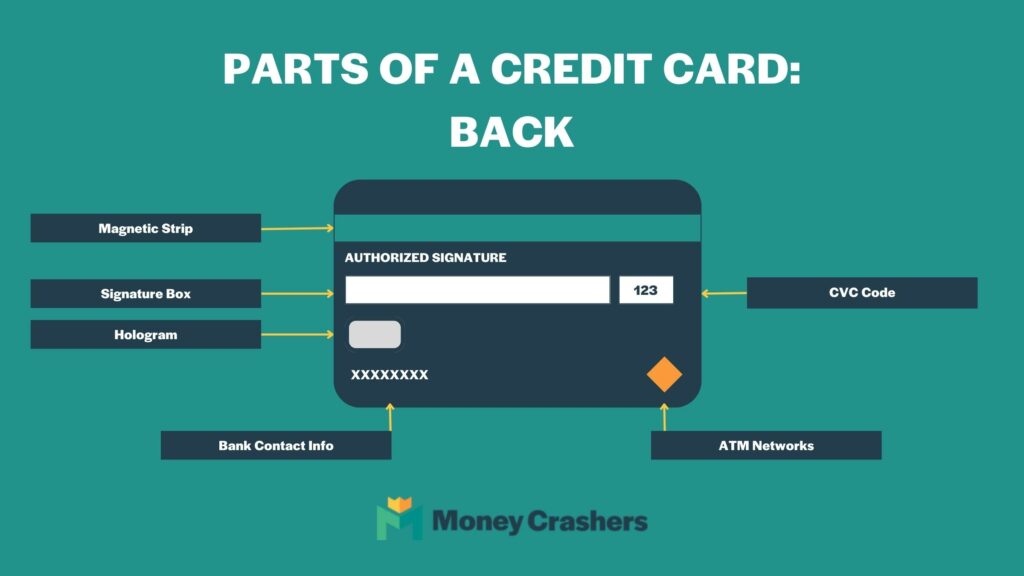

Back of the Credit Card

The back of a credit card typically has several identifying markers.

- Magnetic stripe or magstripe: The black strip on the back of the card is magnetic and, when swiped, provides all the necessary information to process a payment, including your name, the account number, and card expiration. It’s important to keep it safe because thieves can steal this information and create a fake strip to use as your credit card.

- Card Verification Code (CVC): The Card Verification Value (CVV) is the 3-digit security code for extra security measures. It may be after a longer code, but they ask for the three-digit code when making a payment. It helps limit fraudulent activity, especially with online or phone purchases. Vendors will ask for the code to verify you have the card. While it doesn’t guarantee the cardholder is using the card, it decreases the likelihood of fraud.

- Signature box: The white box on the back of the card is a signature box that retailers use to verify your signature when you sign for transactions. This can help prevent fraudulent activity; however, it’s not as helpful since most transactions are electronic or no-contact today.

- Hologram: Most cards have a hologram logo on the back. Because holograms aren’t easily replicated, spotting a fake credit card is easier with holograms.

- ATM networks: You may notice other logos of ATM networks on the back of your card. This indicates where you can use your credit card to make cash withdrawals.

- Issuing bank’s contact information: The information to contact the issuing bank is on the back of the card, including the phone number, physical mailing address, and/or website.

How Do Credit Cards Work?

A bank or financial institution issues credit cards and enables cardholders to pay for goods or services at retailers that accept payment by credit card.

In the United States, Visa, Mastercard, Discover, and American Express dominate the credit card network. Capital One, Chase Bank, and Wells Fargo are three common issuing banks.

The bank or financial institution pays the retailer for your purchase — based on an agreement you have with the creditor to pay those charges, which is your accrued debt. Through your credit card, your bank offers you a line of revolving, unsecured credit.

The amount of unsecured credit they extend to you is based on various factors, including creditworthiness (credit score), payment history, income, total debt load, and length of your relationship with the bank. Credit limits can be lowered, increased, or even canceled based on the terms outlined in your agreement.

Many credit cards offer rewards, like cash back, airline miles, or points you can redeem for perks.

Expert Tip: If your chip isn’t working, some retailers will not take your card, even if it does have a magnetic strip. But don’t worry! If your chip isn’t working, it could just be from a build-up of grime, and a good wiping could mend your chip as good as new.

What Can You Do With A Credit Card?

Credit cards are a convenient way to make purchases, but there are other ways to use them too.

- In-person purchases: Making a purchase in a store with a credit card is its most common use. You swipe, insert, or tap the card on the credit card reader and if approved, you use a portion of your credit line to pay for the purchase.

- Online purchases: Making a purchase online is only possible with a credit (or debit ) card. When buying online, you must manually enter your credit card information including the credit card number, expiration date, and security code. The same is true for purchases made over the phone.

- Set up autopay: To avoid late payments, you can set up many bill payments, such as utilities, cell phones, and internet bills, on autopay. The bill amount comes from your credit line on the specified date, and then you have a credit card bill to pay.

- Cash advances: If you need cash fast, you may be able to get a cash advance at a partner ATM, as noted on the back of your card. Beware, though, cash advances usually have a much higher APR than purchases and do not have a grace period. Read your credit card agreement closely to determine what to expect.

- Earn rewards: If you qualify for a rewards credit card, you can earn points or miles that you can convert to statement credits, or redeem for other rewards, such as airline tickets, hotel reservations, or gift cards.

History of Credit Cards

Forms of credit cards have existed for at least 5,000 years in ancient Mesopotamia. They used clay tablets to show a record of transactions among neighboring merchants.

Credit cards became more well-known and originally started as “Diners Club” cards in the 1950s. Founder of the Diner Club, Frank McNamara, accidentally left his wallet while dining in New York City. This incident prompted the idea of a way to pay for items without having your wallet.

The restaurant would send the bill to the Diners Club, where payment would be remitted directly to the restaurant’s bank. Then, the cardholders would be required to pay their bill in full each month to the Diner’s Club, and they would receive a small commission.

American Express developed its first charge card in 1958. Since then, credit cards have revolutionized the banking, merchant, and consumer purchasing experience. There is no longer any need to carry cash when making a purchase in most cases.

Credit Cards vs. Debit Cards vs. Prepaid Cards

While some may think credit cards, prepaid cards, and debit cards can be used interchangeably, they differ.

Prepaid Credit Card

Generally speaking, a prepaid credit card is a card you load money onto and use until it is gone. Some prepaid credit cards allow reloading, and others do not. A prepaid card is not linked to a bank checking account. If you lose the prepaid credit card, there may be little protection to recover your money.

Credit Card

A credit card generally means you are using money that isn’t yours. You make payments and pay an interest rate to your credit card issuer for the funds that you borrowed when you made purchases.

Debit Card

A debit card is linked to your bank account and is as close to cash as cards get. A debit card is directly tied to your checking account, so whatever money you have is pulled straight out of your account when you use your debit card.

This usually happens instantaneously, whereas credit cards have a grace period of a few days before the money clears. There are fewer protections with debit card use versus credit cards.

Frequently Asked Questions

What is the anatomy of a credit card number?

A credit card number is usually 16 digits. The first six are the card issuer’s number (Visa, Mastercard, etc.), the subsequent five numbers indicate the issuing bank, and the last numbers are your individual account number.

How do credit card statements work?

You receive credit card statements monthly. Each month, it shows your transactions from the last billing date to the current one. It also shows any accrued interest charges from unpaid balances and any other charges. The statement shows the minimum required payment that you must pay, but you are free to pay the entire balance to avoid interest charges or any increment you can afford.

Why do I have to sign the back of my credit card?

Before the most recent technology, a signed credit card was the easiest way to prevent fraud. Retailers would compare the signature on the card to the signature you complete in front of them. With today’s technology, though, most people use cards without contact or showing them to the cashier, so the signature panel isn’t as helpful.

Are credit card signature boxes a thing of the past?

It is possible that we may see signature lines go away altogether as microchips and other technology become more advanced. Mastercard announced in 2018 that cardholder signatures would be optional on cards and receipts.

Why is the magnetic stripe necessary if we use the chip?

Magstripe may be unnecessary — or becoming unnecessary. Since many debit and credit card issuers are moving to EMV (Europay, Mastercard, and Visa) chip cards, magnetic stripes are becoming obsolete.

According to Mastercard, they will phase out magnetic stripes in 2024, depending on the region. Banks in the United States will no longer be required to issue chip cards with magnetic stripes starting in 2027.

How do I change the expiration date of my credit card?

You can’t change the expiration date of your credit card; you will need to get a new one.Once your credit card expires, it doesn’t mean your credit card issuer will close or cancel your account; it just means you need a new physical card.

Credit card companies do this for several reasons, including physical card use, security, and encouraging consumers to reevaluate and update their credit card plans if necessary.

Most card issuers will mail you a new card before expiration, but other companies require you to call. If your card is nearing its expiration, it may be a good idea to contact your issuer and make sure a replacement is coming.

What’s the difference between a CVC and a CVV?

The CVC and CVV are the same despite having different names. CVC stands for Card Verification Code, and CVV stands for Card Verification Value. They both reference the three digit security code on the back of your credit card to prevent fraud.

Bottom Line

Knowing the parts of a credit card is important as they are an essential part of making purchases in the world. Knowing the anatomy of a credit card can help you understand your card’s security features and network reach and choose the right credit card.

Since many of these features are being phased out over the next few years, you may want to start changing now how you access and use your credit card for both in-store and online purchases.