Pros

Can reduce enrolled debt balances by up to 50%

No upfront fees or commissions

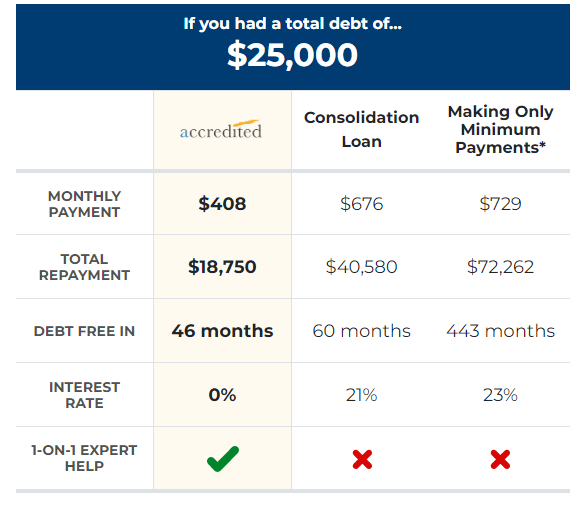

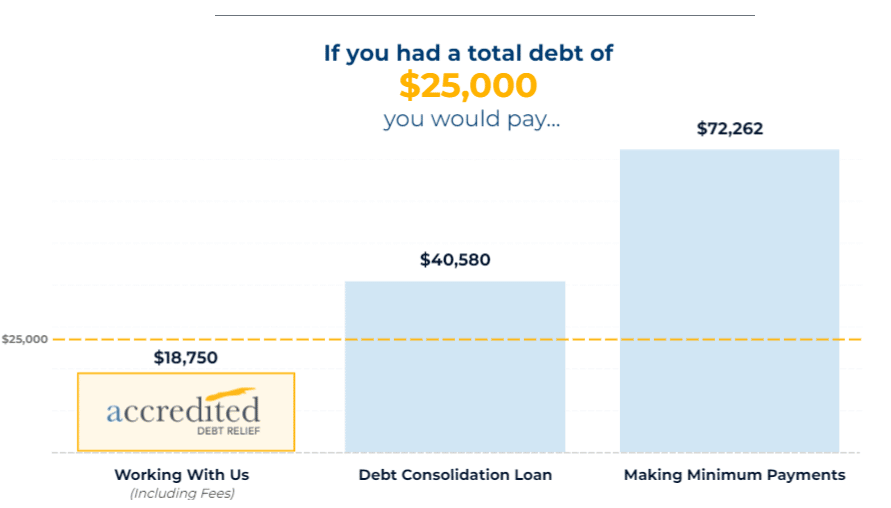

Payoff typically takes 1 to 4 years vs. 3 to 5 years with a debt consolidation loan

Cons

Program fees can range from 15% to 25% of the enrolled balance

Participation is likely to damage your credit temporarily

ADR requires a minimum enrolled debt balance of $10,000

Total U.S. consumer debt approached $15 trillion in 2020, according to Experian. That’s an increase of 31% from a decade earlier.

Credit card balances account for approximately $756 billion of that consumer debt load. Personal loan balances grab another $323 billion. Together, that’s more than $1 trillion in high-interest, unsecured consumer debt.

Professional debt settlement companies like Accredited Debt Relief (ADR) exist to help consumers pare down this type of obligation, which can wreak havoc on household budgets.

Although ADR makes no guarantee of results, it advertises its ability to reduce enrolled debt balances by up to 50% and help clients zero them out within approximately two to four years. For the trouble, ADR takes a healthy cut of the amount of debt enrolled in the program, although many still come out well ahead.

If you’re straining under the weight of your unsecured debt balances, Accredited Debt Relief deserves your consideration. Read on to learn more about its process, upsides, and downsides.

How Accredited Debt Relief Stacks Up

Accredited Debt Relief is a top provider of debt relief and a nationally recognized leader in debt settlement specifically.

It’s not the only debt relief company in the United States though. Let’s see how it compares to Freedom Debt Relief, which also offers debt settlement for people with significant unsecured debts.

| Accredited Debt Relief | Freedom Debt Relief |

| Minimum Enrolled Debt: $10,000 for debt settlement | $7,500 for debt settlement |

| Debt Settlement Fees: 15% to 25% of enrolled debt | 15% to 25% of enrolled debt |

| Total Timeframe to Full Settlement: Varies, but typically 1 to 4 years | Up to 4 years |

| Cancel Without Penalty: Yes, anytime | Depends |

Key Features — Accredited Debt Relief Process

Accredited Debt Relief helps people consolidate their debt without a loan and negotiates unsecured debt settlements on their behalf. Before signing up, understand:

- The eligibility requirements for its debt relief program

- How the onboarding process unfolds

- What to expect from its negotiation and debt settlement process

- What happens if you decide to withdraw from the program

Eligibility Requirements for Accredited Debt Relief’s Debt Settlement Program

Accredited Debt Relief’s debt settlement program has three key eligibility requirements:

- Enrolled Debt Balance. You must enroll at least $10,000 in eligible debt to participate in the program. You don’t have to enroll all your eligible debt but do have to meet this minimum balance.

- Enrolled Debt Types. ADR only works with unsecured debts, such as credit cards, unsecured personal loans, payday loans, and medical bills. Debts secured by collateral, like home loans and auto loans, aren’t eligible. Nor are federal student loans. Note that not all unsecured creditors negotiate with debt relief companies like ADR.

- Monthly Payments. You must have the financial capacity to make consistent monthly payments. You won’t be kicked out of the program if you miss a single payment, but ADR insists on consistent payment for best results.

ADR Onboarding Process

Accredited Debt Relief has a simple, three-step onboarding process:

- No-Obligation Consultation. Discuss your financial situation and debts with an ADR representative to determine whether you’re a good fit for the company’s debt relief services.

- Decide Which Debts to Enroll. In consultation with your ADR rep, determine which debts you want to enroll in the program.

- Set Up Your Dedicated Account and Customize Your Deposit. Work with ADR to set up a special savings account that you control. This is your Dedicated Account, and it’s where you’ll make your monthly program payments. Based on your enrolled debt size, financial goals, and monthly budget, set a monthly payment amount that you can afford.

Negotiation and Debt Settlement Process (How Accredited Debt Relief Works)

Once your Dedicated Account is set up, the Accredited Debt Relief team gets to work consolidating and reducing your debt. This stage of the relationship involves:

- No Further Communication Between You and Enrolled Creditors. ADR takes over responsibility for communication with your creditors, including any negotiations already in progress.

- No More Payments on Enrolled Debts. For best results, you need to stop making payments on any enrolled accounts. Expect your credit score to drop as a result. If your creditors or debt collection agencies contact you, you’re under no obligation to respond. ADR deals directly with creditors so that you don’t have to.

- Make Deposits Into Your Dedicated Account. Make your agreed-upon monthly payment into your dedicated account as the ADR team works to negotiate your enrolled debts lower.

- Approve Proposed Settlements. If you’ve enrolled more than one debt, ADR decides which to negotiate first. When it reaches a settlement with a creditor, ADR sends it to you for approval. According to ADR, 90% of clients see their first settlement within nine months of enrollment.

- Pay Off and Resolve Debts. After approving a settlement, pay off the creditor in full using the balance in your Dedicated Account. Once paid, the debt is marked “resolved” and should appear closed on your credit report. ADR takes a variable cut of your enrolled debt, typically in the 15% to 25% range. ADR’s fee is factored into your monthly deposit. Other fees and expenses may apply, including banking fees.

- Exit the Program. Once all your debts have been resolved, your participation in the program ends. Any balance remaining in the Dedicated Account returns to you, less fees and expenses charged by the bank, ADR, or other third parties.

Cancel Anytime With No Penalty

You can end your participation in ADR’s debt consolidation services at any time without further obligation to ADR. However, if you cancel with ADR and want to pursue settlement of any previously enrolled debts, you need to contact your creditors and begin negotiating with them directly.

ADR calls this a “money-back guarantee” because you’re entitled to a return of the funds held in your Dedicated Account when you cancel. However, depending on when you leave the program, you may be liable for account or program fees and expenses. You may also be liable for late fees and interest charges levied by your creditors if you’re not able to settle your debts on your own.

Advantages of Accredited Debt Relief

While Accredited Debt Relief’s debt consolidation program can’t work miracles, it absolutely can offer meaningful debt relief for certain clients. Its top selling points include the potential to slash enrolled debts by up to half, no upfront fees or commissions, and relatively fast payoff.

- Accredited Debt Relief Can Significantly Reduce Enrolled Debt Balances. Accredited Debt Relief emphasizes that individual results may vary and does not make specific guarantees. However, it points to an impressive track record of real-life savings. According to its homepage, ADR clients can reduce their enrolled debt balances by up to 50%. Its FAQ page notes potential savings up to 45% before fees.*

- Accredited Debt Relief Doesn’t Take Fees Until a Resolution Is in Process. ADR doesn’t charge any upfront fees or commissions and doesn’t make money unless it successfully negotiates a reduction in enrolled debt. You don’t pay a dime to ADR until you’ve approved a debt resolution on a particular account and made at least one payment toward that resolution.

- Missing a Single Payment Won’t Get You Booted From the Program. ADR doesn’t have a zero-tolerance rule for missed payments. Missing a monthly payment into your Dedicated Account won’t get you kicked out of the program. However, it could increase your total cost of participation by drawing out the process.

- Payoff Typically Takes Less Than 4 Years. ADR programs last from 12 to 48 months, depending on your budget, enrolled debt balance, and other factors. Most programs last 24 to 48 months. Still, that’s shorter than a traditional debt consolidation loan is likely to take to pay off and far shorter than simply making the minimum payments on your enrolled debts.

- You Make Just One Monthly Payment on Your Enrolled Debt Balance. ADR can position itself as a loan-free debt consolidation option because that’s what it is. It’s a way to consolidate multiple enrolled debts into a single monthly payment without applying for more credit. For the duration of the program, you make just one monthly payment into your Dedicated Account. That payment covers all enrolled debts.

Disadvantages of Accredited Debt Relief

Accredited Debt Relief has some notable drawbacks. These include its program fees, relatively high minimum enrolled debt balance, and the fact that program participation is likely to harm your credit.

- Accredited Debt Relief Takes a Significant Percentage of Participants’ Savings. Accredited Debt Relief isn’t a charity. If and when its negotiators reduce an enrolled debt balance, ADR takes a cut of the enrolled debt amount. Usually, this cut falls between 15% and 25% of the total enrolled debt, or $1,500 to $2,500 of a hypothetical $10,000 original balance.+

- Minimum Enrolled Debt Balance Is $10,000. ADR requires you to enroll at least $10,000 in eligible debt. That’s higher than the median credit card balance ($5,221 in 2020, according to Experian). If you’re struggling to pay down a smaller batch of high-interest debt, approach a nonprofit credit counseling service to set up a debt management plan instead.

- Program Participation Is Likely to Hurt Your Credit Score. To maximize its negotiators’ leverage, ADR advises program participants to stop making payments on enrolled debts. Unfortunately, this is likely to hurt your credit temporarily. You must decide whether the temporary but painful consequences of a lower credit score are worth the potential for long-term debt relief.

- Gentler Alternative to Bankruptcy, But Still a Setback for Your Credit. If you’re seriously contemplating bankruptcy, ADR’s program could be a gentler alternative. But if you think you can reduce your debt load without stopping payment on individual accounts, consider holding off.

- Accredited Debt Relief Only Accepts Unsecured Debts. Accredited Debt Relief only works with unsecured debts like credit cards, personal loans, medical bills, and payday loans. If your financial woes trace back to burdensome secured debts, like a mortgage you’re underwater on, ADR can’t help.

- Accredited Debt Relief Can’t Help With Federal Student Loan Debt. Federal student loan debt is technically unsecured. However, due to legal restrictions specific to federal student loans, ADR can’t help you consolidate or settle this type of debt. Look to other student loan consolidation options instead.

Final Word

Accredited Debt Relief offers a debt settlement service that can significantly reduce enrolled debt balances. ADR can also consolidate enrolled debt balances into a single monthly payment, simplifying your financial life.

While ADR doesn’t make any specific guarantees about its approach to debt relief, its track record speaks to itself. Many ADR program participants pay far less to settle their debts than they originally owed.

If you’re intrigued by that prospect, do your due diligence on other debt relief options. Then schedule a free consultation with one of ADR’s certified debt specialists and get ready to take the next step.

*The obligatory fine print: These savings figures don’t include ADR’s cut, which typically ranges from 15% to 25% of the enrolled debt amount.

+You can avoid this fee by negotiating settlements directly with your creditors. Doing so costs you nothing but your time and effort. You just need to determine whether the potential savings is worth the headache.

Pros

Can reduce enrolled debt balances by up to 50%

No upfront fees or commissions

Payoff typically takes 1 to 4 years vs. 3 to 5 years with a debt consolidation loan

Cons

Program fees can range from 15% to 25% of the enrolled balance

Participation is likely to damage your credit temporarily

ADR requires a minimum enrolled debt balance of $10,000