Pros

Instant cash advances

No interest or late fees with Empower Cash Advance

No credit check to sign up

Cons

No credit card option (yet)

Unavoidable monthly fee after the first 14 days

No savings accounts

Empower is an appropriately named financial empowerment app built around a simple premise: that the credit system shouldn’t be stacked against ordinary consumers.

Empower’s core paycheck cash advance product turns the tables on the traditional credit system. It helps you build credit and boost your credit score over time as you repay your advances. For best results, open an Empower Card account and get paid via direct deposit up to two days faster.

Intrigued? Read on to learn more about Empower’s capabilities and potential benefits.

Key Features of Empower

Empower is more than a simple cash advance app. It offers two levels of cash advance power, plus a user-friendly debit card that can help you get paid up to two days early if you qualify.

Here’s what you should know about the most important Empower features.

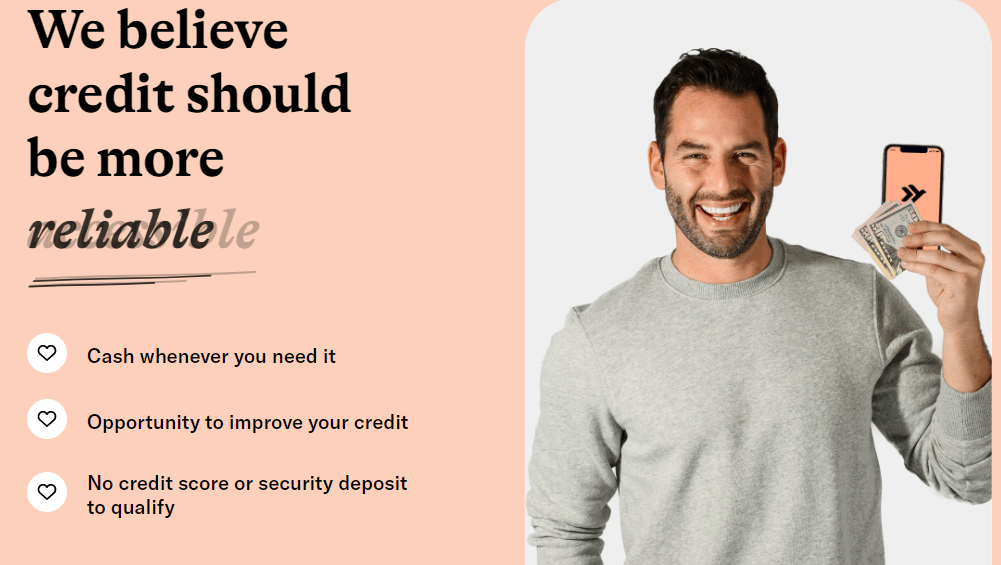

Empower Cash Advance

Empower’s core feature is Empower Cash Advance.

Use it to borrow up to $250 against your next paycheck, depending on how much you need.

Empower Cash Advance does not require a credit check as a condition of sign-up, nor for individual advances. You won’t pay interest on your cash advances and won’t pay a late fee even if you miss a repayment.

After a 14-day free trial, Empower Cash Advance costs $8 per month. But Empower reports your payment history to the major consumer credit bureaus, meaning each repayment is an opportunity to build credit. And a good credit score could save you a bundle on future loans and lines of credit.

Empower Card

The Empower Card is a Visa debit card backed by Empower.

You don’t have to have one, but Empower recommends it because it enables instant fund delivery. If you have an Empower Card, you receive funds on your card as soon as you request an advance.

You can spend the funds on your Empower Card wherever Visa is accepted, and you can keep it topped up by setting up direct deposit with your employer or benefits payer. If your payer qualifies, you may get your funds up to two days early — that’s a Wednesday payday instead of the usual Friday.

Other benefits of the Empower Card include:

- Free access to nearly 40,000 MoneyPass ATMs

- Up to 10% cash back on eligible purchases

- Automatic repayment of instant cash advances when you get paid

Empower Thrive

Empower Thrive is a new Empower service level that doesn’t cost any more than Empower Cash Advance — but does offer far more instant cash advance firepower.

Start with a $200 credit line against your next paycheck, then increase your limit all the way up to $1,000 with successive repayments. The more advances you receive and repay, the stronger your history of responsible credit use will become.

Like Empower Cash Advance, Empower Thrive doesn’t charge interest as long as you repay your advances in time. Otherwise, pay a variable interest rate that’s subject to change with prevailing interest rates.

External Bank Accounts

If you don’t want to open an Empower Card account, that’s fine. You can receive cash advances in an external savings or checking account securely linked to your Empower app, as long as it’s backed by a U.S. financial institution.

There’s no additional fee to do it this way, but you’ll need to wait for the funds to clear into your external account. That can take a few business days, so it’s not ideal if you need your money right away.

Empower AutoSave

The Empower AutoSave feature is an automatic savings and money management tool that analyzes your income and expenses and quietly sets aside small amounts into a savings bucket up to four times per week.

You can make changes to your savings plan at any time or let Empower continue to do the work for you. You can also set a personal spending limit each month to ensure you retain at least some of your paycheck at the end of the period.

Although your savings balances don’t earn interest, they’re separate from your safe-to-spend funds, which means they’ll remain untouched if you don’t withdraw them.

Empower Fees

Other than the $8 monthly fee, Empower is pretty light on levies. Empower charges none of the following:

- Minimum balance fees

- Overdraft fees, although Empower generally denies transactions if they’d result in a negative account balance

- Insufficient funds fees

- ACH transfer fees

- Card replacement fees

- In-network ATM fees

If you use your Empower Card abroad, expect to pay a 1% foreign exchange fee.

Advantages of Empower

Empower has a lot going for it. Its core benefits include instant cash advances with no interest or late fees, no credit check to sign up, and the real likelihood of building credit with responsible use.

- Instant Cash Advances. If you have an Empower Card, you’re eligible for instant cash advances. You’ll receive your funds as soon as you trigger the advance — perfect for paying your bills on time.

- No Interest or Late Fees With Empower Cash Advance. Empower Cash Advance doesn’t charge interest or late fees, even if you don’t pay right when you receive your next paycheck. Of course, paying back your advances on time is the best way to build credit with Empower.

- Up to $250 Advanced With Empower Cash Advance or $1,000 Advanced With Empower Thrive. You can get a cash advance worth up to $250 with Empower Cash Advance. As you demonstrate your ability to use Empower responsibly over time, you can qualify for advances as large as $1,000 with Empower Thrive.

- No Credit Check to Sign Up. Empower doesn’t require a credit check as a condition of account approval or cash advance approval. It’s therefore ideal for folks with limited credit or impaired credit.

- Potential to Build Credit With Responsible Use Over Time. Empower offers the possibility — but not the guarantee — that you’ll build credit and raise your credit score over time with responsible use. For best results, repay your cash advances promptly and use any other credit you apply for responsibly as well.

- 14-Day Free Trial. Empower comes with a 14-day free trial during which you won’t pay the monthly maintenance fee. This should be enough time to get through at least one cash advance cycle, after which you can cancel without obligation if you decide Empower isn’t right for you.

Disadvantages of Empower

Empower isn’t perfect. Key downsides include the unavoidable monthly fee after the first 14 days and the lack of a credit card for users looking to take the next step in their credit journeys.

- No Way to Avoid the Monthly Fee After Free Trial Ends. Empower’s $8 monthly fee isn’t excessive if you consistently use the platform, but the fact remains that there’s no way to avoid it.

- No Credit Card (Yet). Empower is a great way to build credit, but it’s a bit less flexible than a secured credit card because advances need to be repaid on your next payday. The Empower Card is a useful debit card, but Empower currently does not offer a credit card.

- No Interest on Savings. Empower is definitely not a high-yield savings account. If you’re looking for a competitive yield on savings balances, pick another low-cost financial account.

How Empower Stacks Up

Empower isn’t the only paycheck cash advance app on the market. It competes directly with Brigit, another user-friendly, relatively low-cost app compatible with Android and iOS.

Here’s how the two stack up.

| Empower | Brigit | |

| Monthly Subscription Fee for Instant Deposit | $8 | $10 |

| Maximum Advance | $250 with Empower Cash Advance; $1,000 with Empower Thrive | $250 |

| Late Fees? | No | No |

| Budgeting Tools? | Yes | No |

Final Word

Empower is a convenient way to get a piece of your next paycheck days in advance — and to get paid in full up to two days early if you have the Empower Card and your payer qualifies.

Empower is also a great tool for building and improving credit if you’ve struggled to do so through other means (or you’re just new to credit overall). But you must use it responsibly and avoid other behaviors that can hurt your credit score for it to work as advertised.

Empower is a great tool, but it can’t work miracles.

Pros

Instant cash advances

No interest or late fees with Empower Cash Advance

No credit check to sign up

Cons

No credit card option (yet)

Unavoidable monthly fee after the first 14 days

No savings accounts