Pros

Built-in envelope budgeting

Simple spend controls

Theft protection

Budgets for partners and families

Cons

Charges a monthly fee

No interest or rewards

Can't handle credit card purchases

No cash deposits

Budgeting is a pain for a lot of people. Setting limits on spending feels restrictive and difficult to adhere to.

The cash envelope budgeting system solved this problem for a lot of people. Popularized by Dave Ramsey decades ago, the system assigns a job to every dollar you bring in — where to spend it, save it, or use it to pay down debt — by literally putting cash into envelopes for designated expenses.

Few of us use actual cash for the bulk of our purchases anymore, however, so fintech has had to adapt to bring this useful budgeting system into the digital age. Utah-based entrepreneurs Ryan Clark and Shane Walker founded Qube Money — or, simply, Qube — to address this need.

The fledgling banking-and-budgeting app lets you visualize and manage your budget, control spending, and automate saving through its signature “qubes.” To determine whether this is the solution for your banking and budgeting needs, get to know its features.

Key Features of Qube Money

Qube’s premise is simple: It turns the envelope budgeting method digital and layers it on top of your bank account for seamless digital cash envelope budgeting.

“Qubes” for Budgeting, Saving, and Paying off Debt

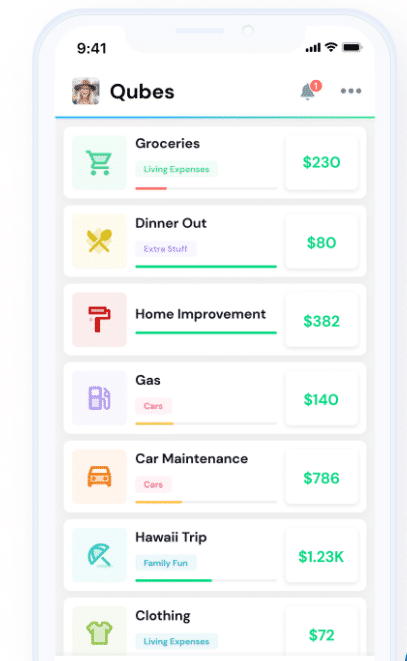

The key to this app is the “qube,” a virtual envelope that designates each of your dollars for a specific job. It aims to help you create a proactive budget that encourages you to set aside money for expenses, debt payoff, and savings before you spend.

Like an envelope-based budgeting system, you create a qube for anything you want to use your money for. For example, you can create qubes for typical budget categories like rent, electricity bills, cable bills, cellphone payments, and car loan payments.

You can create qubes for spending categories, such as groceries, clothing and fashion, transportation, drinks and dining out, and entertainment. You can also create qubes based on where you shop, like Amazon, Target, or Sephora.

Use goal-based qubes to help you save money for purchases like a vacation, wedding, or new car. You can even dedicate qubes to paying off debt to make sure you set aside enough every month before you spend it elsewhere.

Once you set dollar amounts for each qube, the app funds each category as you add money to your account through money transfers or paychecks. Before you spend, you must unlock a qube to let the app know which bucket of money to draw from for your purchase. For online bill pay, the app draws from an assigned qube automatically based on customized rules that you set in the app.

$0 Balance Debit Card

The secret to changing your spending habits with Qube is that you have to make real-time spending choices. Your debit card doesn’t carry a balance until you choose a qube to unlock from the app. When you want to make a purchase — either by typing your card info in for online checkout or by swiping your debit card — you have to unlock a qube in the app to instantly fund your card.

That comes with a serious security benefit — your bank account balance is protected in case your card is stolen. But its real benefit is its ability to curb overspending and balance your budget.

Unlocking a qube before you spend forces you to reckon with your budget in real time the way taking cash out of envelopes does. Don’t have enough in your “dining out” qube? You could pull from your “wedding savings” qube, or you could pass on dinner plans and stay in for the night.

You have complete control over how you use the money in your account. Qube simply creates a system that lets you see the ramifications of spending choices before you make them.

Qube also helps you keep track of the purchases you do follow through on. When you swipe, tap, dip, or enter your card, the app records the transaction in your account and updates the balance in the corresponding qube. It then returns your card to the default $0 balance.

Quick Sign-Up With No Minimum Opening Deposit

To sign up for Qube Money, add your details into its online registration form on the website or in the app.

There’s no minimum opening deposit requirement, so you can set up your account anytime and transfer money into it whenever you’re ready.

You can fund your Qube account in several ways:

- Link to an external bank account. If your bank is in Plaid’s network (most banks are), you can connect it directly to your Qube account to instantly transfer up to $250 at a time. Your first instant transfer is free, and you’ll pay a 4% fee each time after that.

- Direct deposit payments. Set up direct deposit with your employer, and have your paycheck deposited into your Qube account.

- ACH and person-to-person transfers. Use your Qube account and routing number to receive a transfer from any external account.

Reimbursed ATM Fees

You can use any ATM to withdraw cash from your Qube account, and it’ll reimburse ATM fees up to $10 per month. You’re limited to three ATM withdrawals per day and a total of $250.

Partner Budgeting

You can add a partner to any Premium or Family account for shared money management.

You and your partner share a single bank account, but you designate which qubes are shared and which are individual. Both users can see shared qubes, but you can only see individual qubes assigned to you.

For shared qubes, you can opt in for notifications when your partner opens a new qube and when they spend money, so you can both stay on top of shared budgets and goals.

Accelerated Direct Deposit

Get access to your funds up to two days ahead of your typical payday when you set up direct deposit for your Qube account. How soon you get paid depends on when your employer initiates the deposit and which financial institution the company uses.

FDIC-Insured Checking Accounts

Qube Money accounts are backed by its partner bank, Choice Fin, a subsidiary of Choice Financial Group.

When you open and manage an account through Qube, your money is held in a Choice Fin account. Your money in the account is FDIC-insured up to $250,000, just like any other checking account. Qube Money, as a fintech company rather than a bank, provides the technology that lets you budget within your online bank account.

Qube Plans and Pricing

Budgeting needs vary depending on your lifestyle, so Qube is designed with features for a variety of budgets and financial situations.

Qube offers three plans for individuals, couples, and families, each with its own set of features and capabilities.

- Basic: A free individual account with up to 10 qubes.

- Premium: A joint account with unlimited qubes and automated budgeting, saving, and bill pay. The cost is $6.50 per month when paid annually or $8 per month when billed monthly.

- Family: Coming soon, the Qube Family Plan is a joint account with unlimited qubes, up to 10 extra debit cards for kids and teens, parental controls, in-app money requests, and chore tracking for allowance payments. This plan costs $11.50 per month when paid annually.

Advantages of Qube Money

Qube addresses several key consumer financial needs through its budgeting-focused banking app, including:

- Built-In Envelope Budgeting. The cash envelope system is a smart way to control how much money you spend and where you spend it. Until recently, most options for applying this budgeting method to digital payments were clunky and cumbersome. Qube builds the system right into your bank account, so you don’t have to do any extra work to manage your money.

- $0 Balance Debit Card to Control Spending. Qubes and the $0-balance debit card create a hurdle you (or your kids) have to overcome before making a purchase. That builds in a moment to stop an impulse purchase or avoid spending money you need for other necessities, and adds intention to your money choices.

- Automatic Theft Protection. As long as you keep all qubes locked, the balance on your debit card remains at $0, so thieves don’t have access to your funds even if they steal your card number or swipe your debit card.

- Partner and Family Budgeting. Joint accounts, shared qubes, and cards for kids and teens let you divvy up budgets for everyone in your household without coordinating separate bank accounts — whether you share finances with one other partner or several older kids.

Disadvantages of Qube Money

As a young app, Qube has plenty of room to grow. Some characteristics it could improve as it develops include:

- No Functional Distinction Among Expenses, Debt, and Savings. Each qube you create is the same, whether you intend it for discretionary spending, bills, debt repayment, or savings goals. Viewing these disparate priorities in one long list in the app can be overwhelming and counterproductive, because your needs and interaction with each area of your financial life are different.

- Premium Plan Has a Monthly Fee. Qube is an outlier in digital banking apps for charging monthly fees when you upgrade to the Premium plan. It offers a free account with basic budgeting features, but most users will want the additional features that come with its $6.50-per-month option. Even that’s higher than many monthly maintenance fees for traditional bank accounts.

- No Interest or Rewards. Qube accounts don’t earn interest or accrue debit card rewards, which is unusual for bank accounts that charge a monthly fee.

- No Accounting for Credit Card Purchases. External spend-tracking apps or software can account for all your spending — from all bank accounts and credit cards. To effectively keep your budget through Qube, you have to do all your spending through your debit account, which could mean you miss out on cash back or other credit card rewards.

- No Cash Deposits. Qube doesn’t offer a way to deposit cash into your account through an ATM or retail location. Of course, you can deposit cash into an external bank account and then transfer the funds into your Qube account, but that adds time and an extra step to the process.

How Qube Stacks Up

Qube isn’t the only digital budgeting app for individuals, partners, and families. It competes against a slew of others, some of which have close ties with banks or other financial institutions and others of which are built first and foremost for budgeting.

One of the best-known Qube competitors is Chime, a financial app that also has budgeting, saving, and spending features.

| Qube Money | Chime | |

| Interest-Bearing Account | None | Yes, a linked savings account that earns a competitive APY |

| Early Payday | Yes, up to 2 days early | Yes, up to 2 days early |

| Envelope Budgeting | Yes, with a $0 balance debit card for ease of use | No |

| Automated Savings | Yes, using savings qubes | Yes, through paycheck transfers or sale round-ups |

Final Word

For many, envelope budgeting is a wise way to save money, stay on top of expenses, and prioritize financial goals without feeling restricted or overwhelmed. Giving every dollar a job ensures you have the money you need for essentials while knowing exactly how much you can use for fun without worry or guilt.

Qube Money is a smart design for an online bank account that addresses the pressing consumer need for a seamless way to keep a budget and spend mindfully. Unlike many digital accounts, it integrates couple and family budgeting needs to give parents and partners visibility into family finances within a single app.

Without the ability to earn interest on your savings or distinguish financial goals from spending buckets, this app may not appeal to savvy savers. However, it’s a young app with a lot of potential, and it’s a good fit for those it’s meant to serve: anyone who needs a hand sticking to their budget.

Pros

Built-in envelope budgeting

Simple spend controls

Theft protection

Budgets for partners and families

Cons

Charges a monthly fee

No interest or rewards

Can't handle credit card purchases

No cash deposits