Pros

Expansive free version

Super mobile-friendly

Automatic account syncing

Cons

No automated savings

No investment advice or assistance

Iffy customer support

How do you manage your personal budget? Perhaps you’re a fan of old-fashioned envelope budgeting. Maybe you use computer spreadsheets to track your income and obligations in one place. You might even use prepaid debit cards to control your spending.

Mint is a powerful, interactive budgeting option that costs nothing to set up and use. Backed by Intuit, the same company that supports TurboTax, the Mint system is designed to create a complete picture of your household finances, whether you manage them individually or hold joint accounts with your spouse.

Most of Mint’s features are available in the app’s free version. Mint recently rolled out a premium version — aptly named Mint Premium — that costs about $5 per month and includes more sophisticated financial insights, spending projections, and automatic subscription cancellation.

What Is Mint? Capabilities & Benefits

Mint syncs with deposit accounts, investment accounts, valuable assets such as a vehicle or home, and credit accounts such as loans and credit cards. With this data, the service provides a snapshot of your net worth, as well as up-to-date transaction and payment information across your entire financial ecosystem. Mint also categorizes transactions and payments into general silos: restaurants, cars & taxis, home improvement, credit card payments, and so on.

To focus and control your spending, saving, and long-term planning, Mint lets you create spending budgets and savings goals, and track your progress within each. Plus, Mint has interactive analytic tools that highlight spending and saving trends over time, making it easier to tie particular habits and behaviors to specific financial outcomes. Mint can even help you take steps to improve your personal credit, increasing your attractiveness to lenders and making it easier to qualify for personal loans with favorable rates and terms.

There are tons of budgeting and personal finance apps out there, but Mint’s closest competitors include:

- PearBudget

- You Need a Budget (YNAB)

- NeoBudget (see our NeoBudget review for more details)

Mint also shares some features with personal finance apps like Personal Capital, Acorns, and Digit. These apps are geared more toward savings and investments, but they do have useful budgeting features that complement their main offerings.

And Mint makes it easy to manage your upcoming expenses with Mint Bills. Once a separate one-stop bill-pay system, Mint Bills is now fully integrated with the Mint app. It seamlessly aggregates your bank accounts and facilitates one-time or recurring payments to creditors, service providers, landlords, and virtually anyone else in the United States.

You don’t have to put all your eggs in Mint’s basket. You can employ other personal budgeting methods in parallel with your Mint account, or simply use Mint to track certain aspects of your financial life.

Key Features of Mint (Free Version)

Mint’s primary features track and organize users’ financial lives. They include an accounts tracker, an investments tracker, a transaction tracker, and a bills tracker. Mint also boasts some useful financial tools to set goals, create budgets, and gain insights into your money management behaviors.

Accounts Tracker

This feature “accounts” for:

- Bank Accounts: To set up a bank account, you enter the account and routing number complete the verification process.

- Credit Accounts: This category includes loans (such as mortgages), credit cards, and non-card revolving lines of credit. The setup procedure is broadly similar to that for bank accounts, though you’ll need to enter loan numbers and possibly other pertinent information, including account logins.

- Major Assets: These include physical assets such as cars and homes. To set up each asset, you’ll need to answer some basic questions (vehicle make, model, year, and mileage, or address of home) to find its approximate value. You can adjust an asset’s value manually as well.

The “Accounts” tab doesn’t include investment accounts.

Once each account or asset is entered, its value is reflected in your net worth. Mint communicates with your banks and creditors to update your deposit and credit balances daily. Mint also periodically updates real estate values through a partnership with Zillow. However, the platform doesn’t account for vehicle depreciation, so you need to adjust car, boat, and RV values manually from time to time.

Investment Tracker

This feature tracks your investment accounts:

Mint syncs with each account and updates its value every day at market close. Although you can’t research securities or do other brokerage-type functions, you can peek into each account and look at the value and performance of individual holdings here. If you’re looking to open a new brokerage account or switch advisors, Mint runs promotions from partner companies in this feature as well.

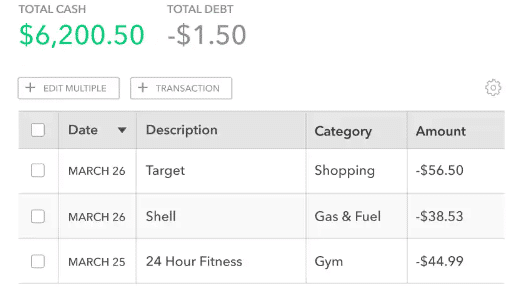

Transaction Tracker

Mint keeps track of every credit (paychecks, external transfers) and debit (purchases) to your synced accounts. The transaction roll looks similar to an online bank statement, with the payee or payer and dollar amount clearly indicated in line-item format.

Mint assigns most transactions to specific spending categories, leaving the Uncategorized label for paper check payments and all other transactions that can’t be categorized for whatever reason. However, paper check payments to Mint-synced credit accounts – for instance, an auto loan or credit card – should show up in relevant categories. You can manually categorize Uncategorized transactions at any time.

Bill Tracker (Mint Bills)

Known as Mint Bills, Mint’s bill tracker is a free bill organization system that exists within the regular Mint app. It looks like a typical bank bill-pay system – you can add payees and keep track of recurring obligations in a single dashboard. There’s also a customizable, opt-in email alert system that advises you of pending and past-due bills, low cash balances, late fees, and other valuable information.

Unlike a single-bank bill-pay system, Mint’s bill tracker is a one-stop deal – it has access to as many bank accounts as you allow, enabling you to see all of your obligations and accounts without logging into them individually. Unfortunately, you can’t actually pay your bills using Mint’s bill tracker.

Financial Goals

Mint helps you define and set financial goals that give purpose to your spending and saving. The platform has several predefined goal templates, such as “pay off your loans” and “take a trip,” and one custom goal template. Each template comes with some pre-populated information, such as outstanding credit balances and APRs, and requires you to enter additional information such as desired monthly payment or savings amount to determine the goal’s total time-frame and cost.

Mint encourages users to tie specific goals to specific savings accounts or create a new account for each goal so that Mint can see how much you’ve saved in that account. It can then tell you how much more you need to save to reach that goal. However, neither approach is required. If you prefer, you can just manually update each goal’s balance as you save.

Budgets

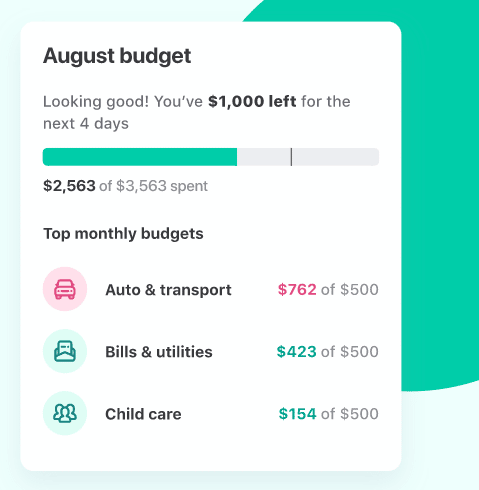

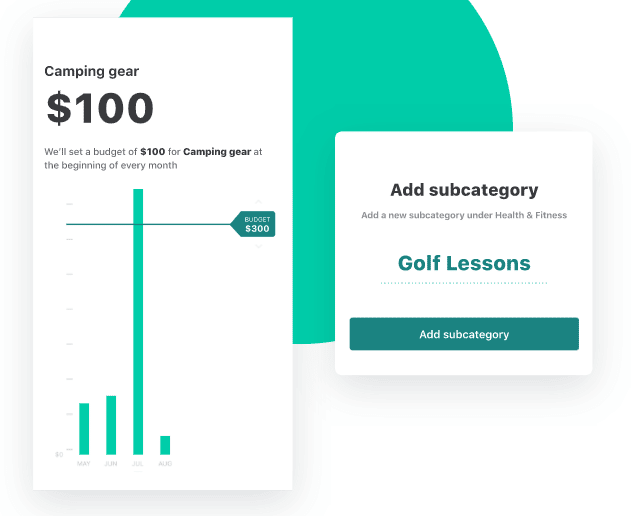

Mint’s budgeting tool helps you set budgets on a monthly, custom-period (two months to one year), or one-time (for special projects, trips, or other one-off spending events that involve multiple purchases) basis. The most common way to use the budgeting tool is simply to set monthly budgets for each spending category, including Uncategorized.

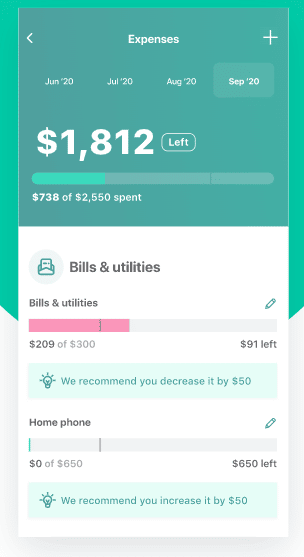

Using information from your synced accounts, Mint tracks your daily spending, provides running totals of what you’ve spent relative to your total period allotment for each category, and tells you how much you have left to spend across all categories. If you’re consistently over or under in a particular category, you can adjust your budgeted amounts accordingly.

Trends

Mint’s Trends feature is your headquarters for financial analysis. Trends employs bar graphs or pie charts (your choice) to track your spending, income, net income, assets, debts, and net worth over customizable periods. You can break these categories into subcategories – for instance, spending at specific merchants or in particular categories, such as home improvement.

The real value of Trends is its ability to show how your spending, income, and assets change over time, and thus to highlight habits or shortcomings that might negatively impact your financial health. It’s a great way to catch worrying financial issues before they seriously impact your bottom line.

Find Savings

Mint is free for users, but it has to make money somehow. That’s what the Find Savings tab is for.

Basically, Find Savings is Mint’s partner portal. It features a slew of recommendations dressed up as savings tips – for instance, Mint might recommend a Chase Sapphire Preferred Credit Card, and then calculate your “savings” from cash back points (relative to your current debit card or non-rewards credit card) based on your total monthly spending.

Ways to Save covers such products as:

- Cash back credit cards and travel rewards credit cards

- Bank accounts

- Brokerage accounts

- Insurance policies

- 401(k) rollovers

- Loans

Account Dashboard

Your account dashboard offers a high-level look at all the accounts and assets you’ve shared with Mint. It also includes a snapshot of your spending and saving trends, monthly budget status, ongoing goals, and upcoming payment due dates. And there’s a handy, scroll-able list of financial alerts: recent account deposits, excessive spending in particular budget categories, late fees or interest charges on credit cards, and other notifications. The alert list does include some sales pitches dressed up as notifications – such as “Have you stopped contributing to your 401k lately?” followed by an entreaty to roll over your 401k with a partner company.

Mint Premium — Features & Capabilities

After years of being totally free, Mint rolled out a premium version with no ads and some additional capabilities not available with the free version.

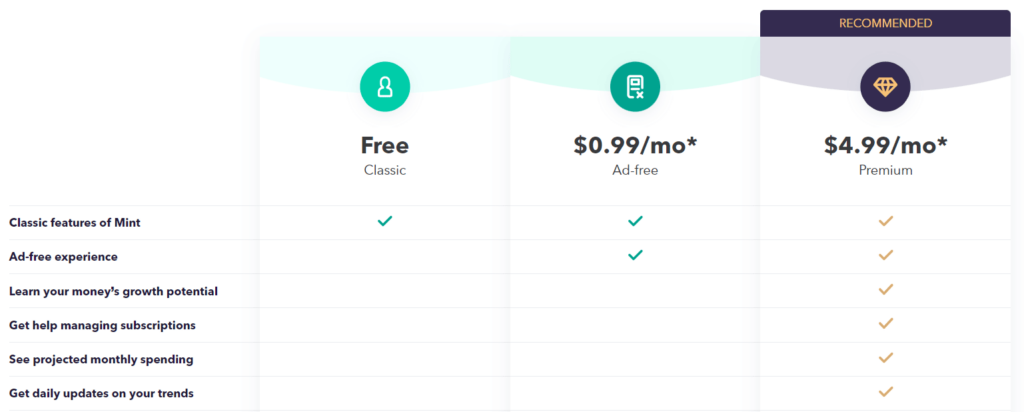

To be clear, most of Mint is still totally free. But for $4.99 per month, Mint Premium gives you an ad-free experience and three nice value-adds.

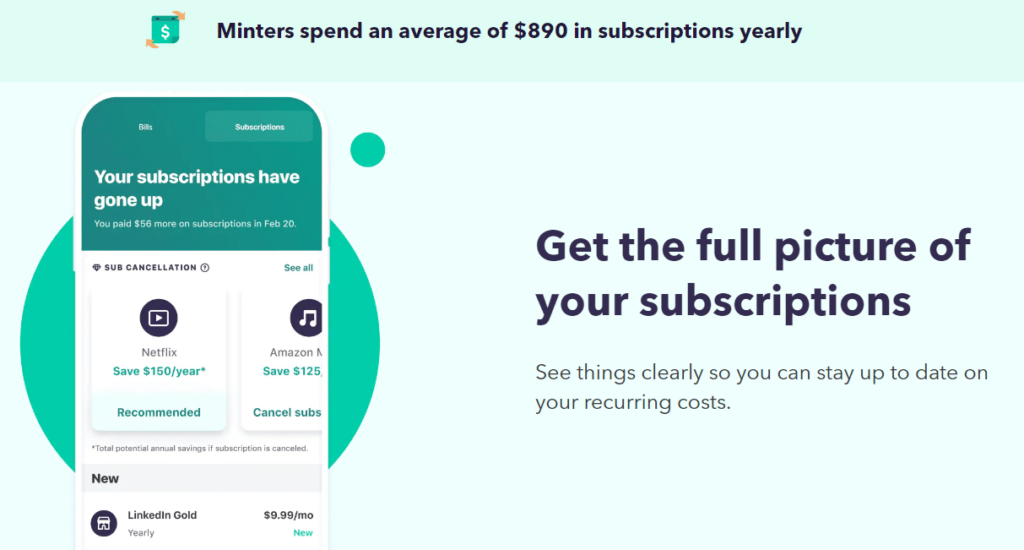

Subscription Cancellation

Mint can automatically cancel unwanted subscriptions on your behalf — or at least try to. Just share your account details with Mint and the app engages with the provider to cancel or reduce the cost of your subscription.

Spending Projections

Mint Premium helps you anticipate future spending in specific budget categories and offers daily suggestions to ensure you don’t go over your allotted spend.

Money Spotlight

Money Spotlight is Mint Premium’s crowdsourced financial insights module. It uses information gleaned from the entire Mint community to show how your financial behaviors stack up.

Mint Premium also increases the frequency of Trends updates. This makes for a more responsive, insightful spend-tracking experience and can more quickly alert you to anomalies in your financial behaviors.

Don’t care about these features, but not a fan of ads? Mint offers an ad-free version of the free plan for $0.99 per month.

Other Mint Features & Functions

Some other key includee:

- Email Alerts: You can instruct Mint to send you email alerts corresponding to any Overview alert – low account balances, pending payments, spending category overruns, and more. This is useful if you’re not in the habit of logging into your Mint account regularly. If these alerts ever get annoying or overwhelming, you can opt out of certain alerts or shut them off completely.

- Free Credit Score: You can obtain a free FICO credit score periodically through your account dashboard. You need to enter some personal information, including your address and Social Security number. The inquiry doesn’t require a hard credit pull, so your credit score isn’t affected. All Mint-sourced credit scores come with detailed, semi-personalized information about improving your score, correcting errors, and assessing implications.

- Mobile Apps: Mint has free, downloadable mobile apps for Android and iOS. They include all the regular platform’s features and functions, so you never have to worry about finding a place to pull out your laptop if you need to check your Mint account.

- Optional Financial Coaching: Every Mint user is entitled to one 15-minute session with an in-house financial coach at no out-of-pocket cost. This is an opportunity to ask burning questions about your finances or get an expert’s opinion on planning for the next phase of life. If you want to continue after your first session, pay a one-time fee of $125 for two more sessions and a personalized financial action plan.

Advantages of Mint

Mint has some impressive advantages, include an expansive free version and a great mobile app.

- Free to Sign Up and Use. Mint is totally free to sign up for and use, and there’s no obligation to upgrade to Mint Premium. Many competing platforms, such as PearBudget and YNAB require payment. The only way you’ll spend money with Mint’s free version is if you take advantage of its Find Savings opportunities – and those revenues only indirectly kick back to Mint, without any direct out of pocket payments required on your end.

- Mobile Functionality Is User-Friendly and Convenient. Mint is one of the most mobile-friendly money management and budgeting apps out there, and Mint Bills is designed to be mobile-first. It arguably works better on a small screen, in fact.

- Overview and Email Alerts Reduce Account Logins. Mint’s detailed account dashboard and alerts help you keep track of what’s happening with your finances without logging into individual accounts regularly or digging through paper statements. In fact, if you turn your email alerts all the way on, you won’t even have to log into Mint regularly. Thanks to Mint’s email alerts, I rarely log into my Mint account more than once a week.

- Free, On-Demand Credit Score Is Convenient. As a Mint user, you’re entitled to a free credit score periodically. This is a highly convenient perk that’s not very common in free or paid money management apps. Surprisingly, you can’t get your credit score with competitors such as PearBudget and NeoBudget.

- Automatic Account Syncing. Mint automatically syncs with your deposit and credit accounts, so your balances update after transactions and deposits. This keeps you spending within your means and ensures you don’t miss upcoming payments – a convenient perk that’s far from universal in the budgeting app world. NeoBudget and PearBudget both require manual transaction entry, a time-consuming and error-prone endeavor.

Disadvantages of Mint

Mint does have some important downsides. Notably, it lacks an automated savings module and doesn’t offer any investment assistance or advice.

- No Automated Savings. While Mint allows you to set savings goals and determine how much you can save in a given budget period, it doesn’t do the work of saving for you. You’re responsible for actually moving money into your savings or investment accounts. Some competing platforms, such as Acorns and Digit, have automated savings systems that move set amounts of money into savings accounts on a regular basis or round-up purchases to the next dollar and deposit the overage into a particular account.

- No Investment Advice or Assistance. Aside from brokerage recommendations and comparisons in the Ways to Save tab, Mint doesn’t offer much in the way of direct investment advice or assistance. Personal Capital and Acorns both have human and automated advisors to help you plan your long-term investment strategy and manage your invested funds.

- Partner Recommendations Are Pushy. Mint’s free version has an annoying downside: more partner pitches than you can count. The entire Ways to Save tab is a classifieds page for financial service providers. Mint receives compensation from every provider on that page, though there appear to be different levels of sponsorship that affect the order and placement of card offers.

- Iffy Customer Support. Mint has rather limited customer support. The primary help asset is a user-driven community forum that, while usually helpful, is a bit disorganized. Mint used to have a live chat feature and a support ticketing system that let you put your queries in front of real live humans, but both appear to have been discontinued.

- Dashboard Data Relies on Feedback from Tied Accounts. To maintain an up-to-date dashboard, Mint relies on regular input from your banks, loan servicers, credit card issuers, and other relevant parties. Communication problems between Mint and a bank or creditor can delay dashboard updates, resulting in an inaccurate or out-of-date financial snapshot that could lead to missed payments or ill-advised spending decisions.

How Mint Stacks Up

Mint isn’t the only free (or cheap) budgeting app for consumers looking to improve their financial health. Though it was one of the first digital money management platforms, it has drawn a ton of imitators, including some with even more features and capabilities.

One of its most formidable competitors is Personal Capital, which blends budgeting and spend tracking with multiple levels of wealth management.

| Mint | Personal Capital | |

| Connects to External Accounts | Yes | Yes |

| Automatic Spend Tracking | Yes | Yes |

| Personalized Spend Recommendations | Yes | Limited |

| Financial Advice | Financial coaching only | Wealth management and financial planning |

| Pricing | Most features are free; Premium costs $4.99/mo | Budgeting and spend tracking is free; wealth management starts at 0.89% AUM |

Final Word

Mint is a useful personal finance tool, but it’s not a panacea. No matter how comprehensive or easy they are to use, digital money management apps can’t eliminate the human element from budgeting, planning, and spending. To get the most out of an app like YNAB (You Need A Budget), you need to maintain discipline and diligence in the face of life’s challenges and distractions.

And if you’re using Mint with a spouse or partner, remember that it’s not a replacement for open, honest communication about your household’s budget and finances. Instead, look at it as a helpful starting point for productive financial conversations.

Pros

Expansive free version

Super mobile-friendly

Automatic account syncing

Cons

No automated savings

No investment advice or assistance

Iffy customer support