Pros

Low, flexible initial security deposit

No annual fee

Apply for a credit line increase in as little as 6 months

Cons

Relatively high regular APR

No rewards program

Requires a credit check for approval

The Capital One Platinum Secured Credit Card is a no-frills, no-annual-fee credit card designed for consumers who wish to build their credit. It’s a secured credit card that requires a modest upfront deposit (at least $49), carries a fairly high regular APR, and comes with a low initial credit limit. However, when used responsibly, the Platinum Secured card is a useful bridge to higher spending limits and more generous rewards credit cards.

This card is comparable to other secured credit cards for consumers with bad or limited credit.

It’s important to note that this card is stripped-down and devoid of many of the perks that more generous credit cards offer as a matter of course, such as cash back or travel rewards and early spend bonuses. However, that doesn’t mean it’s not a potentially game-changing card for people who need to improve their credit standing.

What Sets the Platinum Secured Credit Card Apart

This secured credit card has three features that really set it apart from the competition. They are:

- Low, Flexible Security Deposit. You can get started with as little as $49 here and earn a $200 initial credit limit in the bargain. Deposit more, get a higher limit: simple enough. And this is one of the few cards where your starting limit can be higher than your deposit.

- Quick Consideration for a Credit Line Increase. Not happy with your initial credit limit? Wait 6 months and apply for a credit line increase. If you’ve used your card responsibly in the meantime, there’s a good chance you’ll qualify.

- Credit-Building Support. You get the feeling that Capital One actually wants your credit to improve with this card. They don’t want to keep you in a holding pattern. Even if that’s because you’re liable to spend more (and potentially pay more in interest) with a more generous card, it’s nice that they’re serious about moving you up and out.

Key Features of the Capital One Platinum Secured Credit Card

These are the key features of the Platinum Secured Credit Card from Capital One. Note the flexible security deposit, potential for a credit line increase soon after account opening, and access to the Capital One CreditWise suite.

Security Deposit and Initial Credit Limit

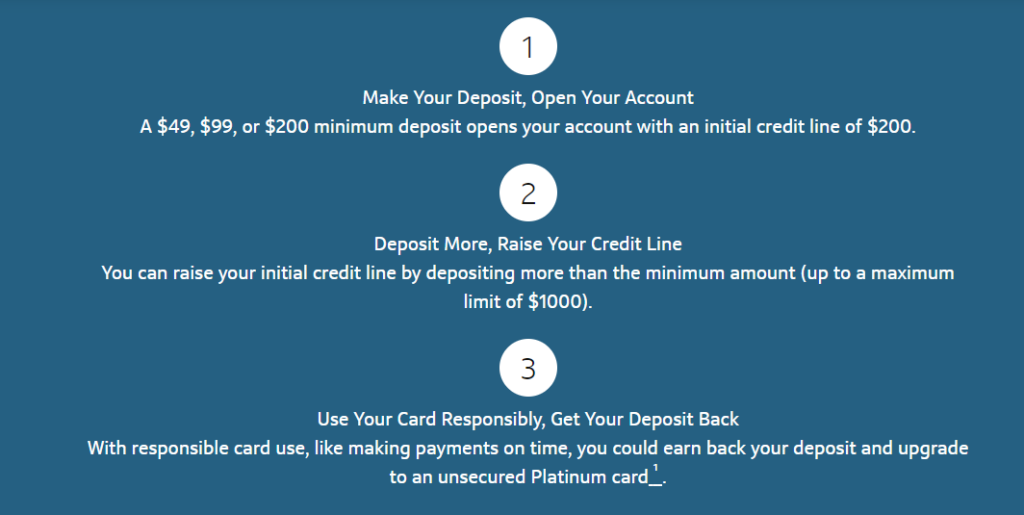

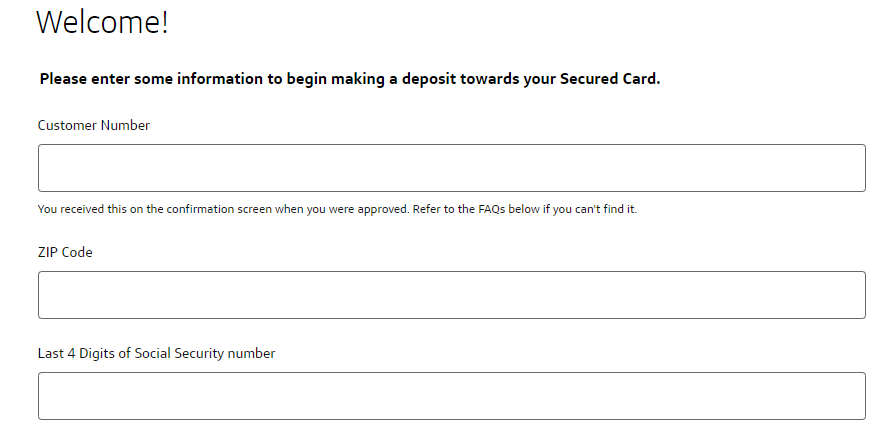

Before you can use this card, you must make a security deposit of at least $49 for a minimum initial credit limit of $200. The exact amount, and your corresponding credit limit, depend on your personal creditworthiness as assessed by Capital One.

Capital One caps your initial credit limit at $1,000, which is on the lower end of the range of competing secured cards. You can deposit more cash to bump up your limit as long as you don’t exceed $1,000.

Credit Line Increase

Your credit limit won’t stay under $1,000 forever. At least, it doesn’t have to.

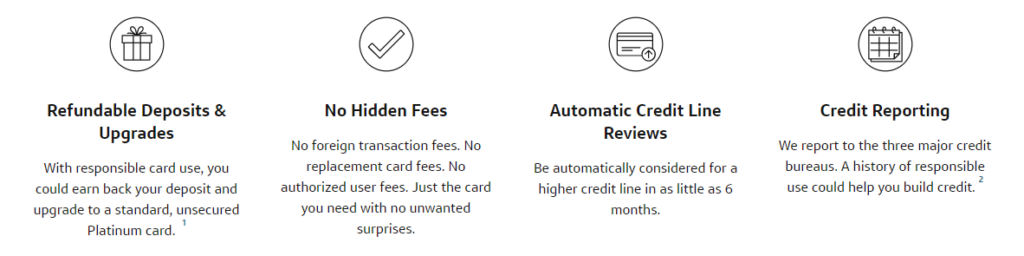

If you use your card responsibly, you could be considered for a credit line increase above the $1,000 initial cap in as little as six months. Further credit line increases are possible with continued responsible use.

The process for increasing your credit limit (and deposit) is super easy. You don’t even have to log in: Just follow a few basic prompts (shown below) to transfer your funds and boost your spending power.

Important Fees

This card has no annual fee, balance transfer fee, or foreign transaction fee.

Capital One CreditWise

Thanks to Capital One’s CreditWise suite, you’re entitled to a free credit score with your paper or online statement each month. You can also access your score at any time in your online account dashboard. Additionally, CreditWise includes a host of credit-building tools and educational content.

Credit Required

This card is for consumers with bad or limited credit and is actively marketed as a tool for building credit. Even if your credit history is checkered or spotty, you’re welcome to apply.

Advantages of the Capital One Platinum Secured Credit Card

Here’s what the Platinum Secured card has going for it.

- Low Upfront Deposit Requirement. You can open your account with a security deposit of as little as $49, depending on your creditworthiness, and qualify for a credit limit of $200 or more. That’s a big advantage relative to secured competitors, some of which require $200 (or greater) minimum deposits before you can use your card.

- No Annual Fee. This card has no annual fee. Many of its closest competitors, including BankAmericard Secured Credit Card ($39) and Citi Secured Mastercard ($25), do carry annual fees.

- No Balance Transfer Fee or Foreign Transaction Fee. This car doesn’t charge balance transfer fees or foreign transaction fees – rare perks in the credit-building category. That’s great news for cardholders who wish to transfer balances from other cards or use their Platinum Secured Credit Card from Capital One outside the U.S.

- No Penalty APR. This card doesn’t carry a penalty APR, which is an excellent benefit if you occasionally miss a payment. The OpenSky Secured Visa and Citi Secured Mastercard both carry penalty APRs (the latter ranging up to 29.99%).

- Opportunity for Credit Line Increase in As Little As Six Months. If use your card responsibly, you could be considered for a eligible for a credit line increase in as little as 6 months. Many competing cards make you wait as long as 12 months to request an increase. If you’re planning to make a large, time-sensitive purchase, or simply want more month-to-month spending flexibility, a year is a long time to wait.

- Useful Credit-Monitoring and Credit-Building Tools. The free credit score other Capital One CreditWise tools are super-useful for cardholders committed to building – and understanding – their credit. Some competing cards, including the BankAmericard Secured Credit Card, don’t come with free credit scores.

Disadvantages of the Capital One Platinum Secured Credit Card

Consider these drawbacks before applying for the Platinum Secured Credit Card from Capital One.

- No Rewards. The Platinum Secured Credit Card doesn’t have a cash back or travel rewards program. If you want a card designed for building credit and earning rewards, consider the QuicksilverOne Cash Rewards Card ($39 annual fee) or Navy Federal Credit Union nRewards Secured Credit Card (no annual fee).

- High APR. Even by credit-building card standards, this card comes with a high regular APR. If you intend to carry a balance from month to month, consider lower-cost options such as Navy Federal Credit Union nRewards or DCU Visa Platinum Secured, both of which have lower regular APRs.

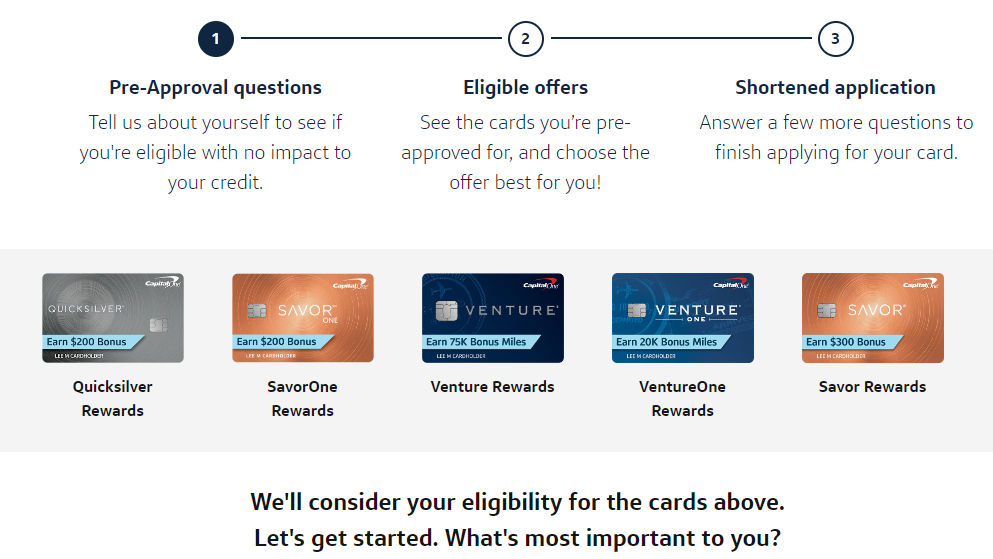

- Pre-approval Credit Check Required. This card’s application requires a credit check. While substantial credit blemishes aren’t likely to disqualify you, you probably won’t be approved for this card with a recent bankruptcy, foreclosure, or pattern of delinquency on your record. Some competing cards, such as Merrick Bank’s Secured Visa ($36 annual fee) and OpenSky Secured Visa ($35 annual fee), don’t run your credit during the application process. On the bright side, Capital One’s pre-approval process automatically considers you for more generous cards, so there’s a chance you can bypass Platinum Secured altogether (see below).

How the Capital One Platinum Secured Credit Card Stacks Up

The Capital One Platinum Secured card is one of the better secured credit cards on the market, but it’s not the only one worth considering. Here’s how it stacks up against another option: the Citi Secured Mastercard.

| Capital One Platinum | Citi Secured | |

| Initial Deposit (Minimum) | $49 | $250 |

| Credit Limit (Maximum) | $1,000 (initial) | $2,500 (initial) |

| Credit Limit Increase | Possible after 6 months | Not clear, but you can get your security deposit back after 18 months |

| Rewards | None | None |

| Annual Fee | $0 | $0 |

Final Word

Needless to say, the Capital One Platinum Secured Credit Card is a not a high-end credit card. It’s not even the most generous secured credit card from Capital One. That honor goes to the secured version of the Quicksilver Cash Rewards Credit Card.

However, when used responsibly, the Platinum Secured card is absolutely worth its weight in gold (or platinum, as the case may be). If this card is what ultimately teaches you the value of making timely payments and spending within your means, you might just find a real Platinum Card in your wallet one day.

Pros

Low, flexible initial security deposit

No annual fee

Apply for a credit line increase in as little as 6 months

Cons

Relatively high regular APR

No rewards program

Requires a credit check for approval