Pros

No annual fee

Great cash-back program (up to 5% back on eligible purchases)

Long introductory APR promotion

Cons

Has a foreign transaction fee

No redemption bonus

Modest baseline cash-back rate

Chase Freedom Unlimited® is a cash back credit card with no annual fee, a very good sign-up bonus, a long intro 0% APR promotion, and a flat, unlimited 1.5% cash back earning rate on most purchases.

It shares many similarities with the original Chase Freedom card and its successor, the Chase Freedom Flex card, which also lacks an annual fee and comes with generous sign-up and intro APR promotion.

The biggest distinction between Freedom Unlimited and Freedom Flex is that Freedom Unlimited does away with Freedom Flex’s rotating cash back categories. Those categories allow cardholders to earn up to 5% cash back on select purchases, up to a quarterly spending cap, in addition to a 1% baseline earning rate on all other purchases. However, they are frequently criticized as being annoying to activate and track.

Chase Freedom Unlimited is comparable to a number of other cash back cards with flat, unlimited earning rates on most purchases: Capital One Quicksilver Cash Rewards Credit Card (1.5%) and Citi Double Cash Card (1% on purchases and 1% on bill payments above the minimum) are 2 noteworthy examples. It’s also comparable to cash back cards with tiered or rotating cash back categories, such as the American Express Blue Cash Everyday.

How the Chase Freedom Unlimited Credit Card Stacks Up

Chase Freedom Unlimited is one of the best cash-back credit cards on the market, but it’s not the only one. It has good company in the Citi Double Cash Card, whose flat-rate cash-back program is even easier to understand than Freedom Unlimited’s.

See how they compare and decide which makes more sense for you.

| Chase Freedom Unlimited | Citi Double Cash Card | |

| Top Reward Rate | 5% back on eligible Chase Travel℠ purchases | 2% cash back — 1% when you buy and 1% when you pay your bill |

| Other Reward Tiers | 3% back on eligible restaurant and drugstore purchases + 1.5% back on all other eligible purchases | None — all spending earns 2% cash back when you pay your statement on time |

| Annual Fee | $0 | $0 |

| Intro APR Promo | 0% APR for 15 months on purchases and balance transfers, then variable regular APR applies (currently 20.49% - 29.24%) | 0% APR for 18 months on balance transfers made within the first 120 days, then variable regular APR applies (currently 18.99% to 28.99%) |

Key Features of the Chase Freedom Unlimited Credit Card

These are the most important features of the Chase Freedom Unlimited Credit Card. Note the excellent sign-up bonus, solid cash-back rewards program (which earns up to 5% back on eligible purchases), and the long 0% APR introductory promotion.

Sign-up Bonus

Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!Earning Cash Back Rewards

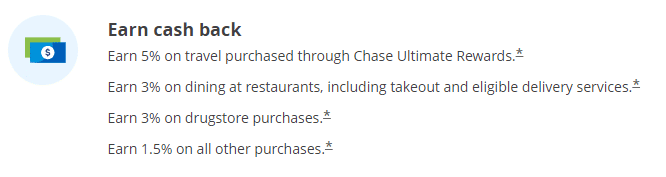

After the first year, Chase Freedom Unlimited earns an unlimited 1.5% cash back on most purchases, with no caps, restrictions, or spending categories. Certain other purchases earn cash back at higher rates:

- 5% cash back on eligible travel purchases made through the Chase Travel

- 3% cash back on eligible drugstore and dining purchases (including takeout and delivery)

Cash back is tracked via Ultimate Rewards points, which are worth $0.01 apiece – therefore, 10,000 Ultimate Rewards points equals $100 in cash. As long as your account remains open and in good standing, your points do not expire.

Redeeming Cash Back Rewards

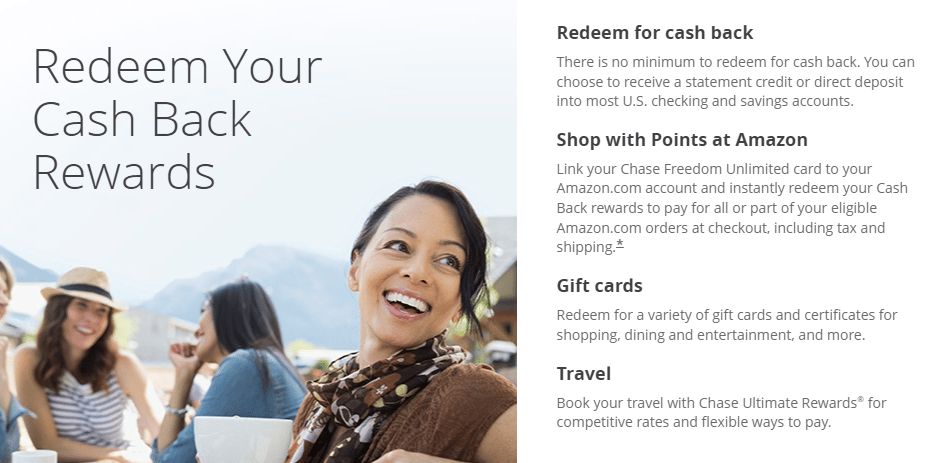

You can redeem your accumulated cash back for cash equivalents (such as statement credits and bank account deposits), gift cards, travel and general merchandise purchases made through Chase’s Ultimate Rewards portal, and merchandise purchases made direct with online retailers (such as Amazon).

Chase Freedom Unlimited allows cash redemptions in any amount, but merchandise redemption minimums vary based on item cost. See below for more details.

Points Transfer to Other Chase Credit Cards

If you also have the Chase Sapphire Preferred Card ($95 annual fee) travel rewards card or the Chase Ink Business Preferred® Credit Card ($95 annual fee) business card, you can transfer points earned through Chase Freedom Unlimited to those accounts.

Once transferred, you can redeem your points for travel purchases through the Chase Travel℠ and receive a 25% bonus (for instance, boosting the value of a 50,000-point redemption to $625), or transfer your points at a 1-to-1 ratio to approximately 10 frequent traveler programs.

However, having a Chase Freedom Unlimited card doesn’t automatically qualify you for Sapphire Preferred or Ink Business Preferred, and you’re not eligible for the redemption bonus or 1-to-1 point transfer if you only have Freedom Unlimited.

Important Fees

There is no annual fee. Foreign transactions cost 3%. Cash advances cost the greater of $10 or 5%.

Introductory APR

This card has a 15-month 0% APR purchase and balance transfer promotion.

Once the introductory period ends, Chase Freedom Unlimited’s regular purchase and balance transfer APR ranges between 20.49% - 29.24% variable, depending on your personal creditworthiness and prevailing interest rates.

Additional Benefits

This card comes with a number of additional cardholder benefits, including:

- Purchase protection against loss or damage for 120 days from purchase, up to $500 per item

- Complimentary collision and damage insurance for rental cars paid for in full with the card

- A free credit score, updated weekly, with Chase Credit Journey

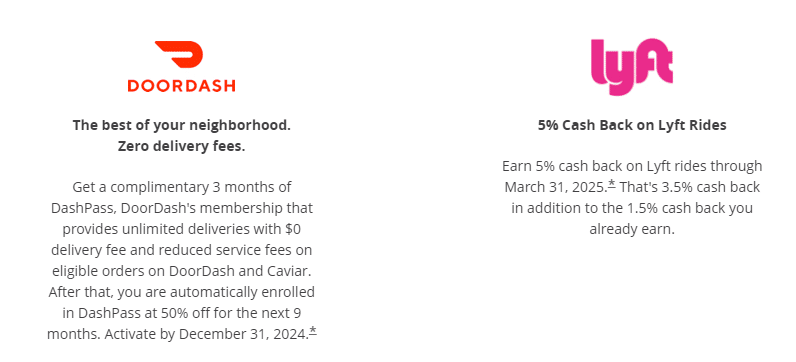

Plus, you’ll get some clutch partner benefits with Lyft and DoorDash as a Chase Freedom Unlimited cardholder. Details below.

Credit Required

This card requires good to excellent credit. Any notable blemishes on your credit record are likely to disqualify your application.

Advantages of the Chase Freedom Unlimited Credit Card

The Chase Freedom Unlimited Credit Card is the real deal. Key advantages include no annual fee, a great 0% APR introductory promotion, an above-average sign-up bonus, and a straightforward rewards program that’s also ahead of the pack.

- No Annual Fee. Chase Freedom Unlimited doesn’t have an annual fee, which is great news for cardholders who don’t earn points fast enough to offset the potential cost of a recurring charge.

- Great Intro APR Promotion. This card’s 15-month 0% APR purchase and balance transfer promotion is among the best in the no-annual-fee cash back category. Competitors such as the Capital One Quicksilver Cash Rewards Credit Card offer 0% APRs for 12 months or less.

- Very Good Sign-up Bonus. Freedom Unlimited’s sign-up bonus is significantly better than most competing no-annual-fee cash back cards.

- Cash Redemptions in Any Amount. You can redeem cash back earned with Freedom Unlimited at any time and in any amount.

- Wide Range of Redemption Options. Thanks to Chase’s Ultimate Rewards portal, you can redeem your accumulated rewards for virtually anything (including travel, merchandise, and purchases made directly with third-party retailers), and usually at a flat $0.01-per-point rate. This is a big perk relative to competitors such as Barclaycard CashForward, which limits redemption methods to cash equivalents.

- No Rotating Categories. Chase Freedom Unlimited doesn’t have tiered or rotating spending categories. This removes one of the biggest knocks against the Chase Freedom Flex card, which requires users to manually activate 5% bonus cash back categories each quarter. With Freedom Unlimited, you don’t even have to think about earning cash back – the card automatically maximizes your earnings for you.

- Doesn’t Require Perfect Credit. Chase Freedom Unlimited doesn’t require perfect credit. Still, this card isn’t designed for people with poor or fair credit, but a good to very good score isn’t sure to disqualify your application. Some cash back cards require legitimately excellent credit.

Disadvantages of the Chase Freedom Unlimited Credit Card

No credit card is perfect, and Chase Freedom Unlimited is no exception, even if it’s better than most. Watch out for the foreign transaction fee and the lack of a redemption bonus, for starters.

- Has a Foreign Transaction Fee. This card charges a 3% foreign transaction fee, which is a major bummer for people who frequently travel outside the United States.

- No Redemption Bonus. Chase Freedom Unlimited doesn’t offer a redemption bonus under any circumstances. This is a notable disadvantage relative to some competing cash back cards, which offer across-the-board 5% or 10% bonuses at redemption.

- Mediocre Baseline Cash Back. Freedom Unlimited has made some improvements to its cash-back program since it first launched back in the day, but its baseline cash-back rate remains at 1.5%. That’s no longer the gold standard for cash-back cards like it was in 2016 or 2017; now competitors like Citi Double Cash have higher baselines, at 2% or more.

Final Word

Chase Freedom Unlimited® offers some faint hope that credit card issuers actually listen to their cardholders’ concerns. Why? Because this card, first issued years after original Freedom’s debut, addresses the cardholding public’s biggest complaint about its predecessor: those pesky rotating 5% categories, which require manual activation each quarter – and mental effort to remember.

Freedom Unlimited’s flat, unlimited 1.5% earning rate on most purchases is much easier to manage. And that’s welcome news for busy cardholders who don’t want to think twice about which card to use in any given circumstance.

Pros

No annual fee

Great cash-back program (up to 5% back on eligible purchases)

Long introductory APR promotion

Cons

Has a foreign transaction fee

No redemption bonus

Modest baseline cash-back rate