Only 28% of Americans have a written financial plan, according to Charles Schwab’s 2019 Modern Wealth Index study. Those who have a written plan are in vastly better financial shape than their planless peers. Of the “planners,” 78% say they pay their bills on time and save money each month. A worrying 38% of “nonplanners” can say the same.

The stats continue in that vein. Among planners, 68% keep an emergency fund, compared to 26% of nonplanners. Fully 74% of planners automate a portion of their income to go to savings each month, compared with 25% of nonplanners. And 56% of planners feel “very confident” about reaching their financial goals, versus 17% of nonplanners.

Schwab goes on to list many more financial disparities between those who plan their budget and financial future and those who don’t. But you get the idea: If you want to build wealth, you need a written budget and financial plan.

Creating a Budget in Google Sheets

Budgeting doesn’t have to take much time, either upfront or on a monthly basis. It’s not rocket science, and the only math required is at a second-grade level.

In other words, don’t stress about writing your own budget.

No one says you have to create a traditional budget with a spreadsheet. If you give it a committed try and just don’t like the results, you can always try alternative budgeting tactics. But in my experience, this method creates simple clarity by letting you an view all of your monthly expenses and income on one page.

You can create a budget in Google Sheets from scratch, or you can use the template we provide below. Before you do, though, it’s important you understand why I organized my template the way I did because I take a different approach than many personal finance experts. So don’t just skip to the end to download the template.

Most importantly, budgets should start simple and only add complexity as needed. It’s one of the reasons why Dave Ramsey’s Baby Steps are so effective for the average person — they’re simple and easy to understand.

Formatting Your Budget

Start out with four umbrella sections in your budget: income, savings, expenses, and long-term goal progress.

For the income, savings, and expenses sections, include three columns beside each line item. Start with the planned amount, then list the actual amount you spend, and finally the difference between the two.

You only have to enter the planned amount into the template once, and you can set the template to automatically calculate the difference. Thus, you only have to enter the “actual” column numbers each month to see how you performed.

To automatically calculate the difference between the two numbers, subtract the planned number from the actual number. You’ll see this listed out in my template, as an example.

At the bottom of each of these sections, add the totals. You can use the Sum function to automatically add up each column for you. Just enter “=Sum(” and then highlight the cells you want totaled.

Simultaneously, the simplest and the most complex section involves your long-term progress. I personally have three numbers I track — and I recommend you track — although you may have additional goals as well. Every month, I measure my savings rate, my investable net worth, and my FI ratio (also called FIRE ratio). FI ratio stands for “financial independence” ratio, and it sounds more complex than it is. It simply refers to the percentage of your living expenses you can cover with your income from investments. At an FI ratio of 100%, you reach financial independence, working becomes optional, and you can retire if you like.

Budgeting Income

Documenting your income tends to be easy because you probably only have a few sources of it.

You likely have a primary job or gig as the main source of your income. List that first, and if you’re married and your spouse works, add a second line for their income. Only include your after-tax income to keep the numbers practical and realistic.

If you work a side gig, include that on the next line or lines if you work more than one side job.

Finally comes investment income. This includes passive income sources like dividends from stocks, bond payments, net cash flow from rental properties, and income from indirect real estate investments.

The ultimate financial goal is to build enough passive income that you can retire. Once you reach financial independence, regardless of your age, you can choose to keep working or you can storm out in a blaze of glory and go do something else with your life.

Total up your income at the bottom of the column using the Sum function.

As a final thought, I recommend only including four weeks’ after-tax income from your primary job. Most people get paid weekly or biweekly, not monthly, so in any given month you can only count on four weeks’ income. Occasionally, you get a “bonus” paycheck, but you can’t count on that in your monthly budgeting.

Budgeting Savings

The next section covers your savings. “Savings” in this context includes cash savings for your emergency fund, investments, and extra money funneled toward paying off high-interest debts.

Start by setting a target savings rate — the percentage of your after-tax income designated for long-term financial goals, rather than for spending. If you earn $4,000 per month after taxes, and you want to set aside $1,000 for reaching your goals, then you have a target savings rate of 25%.

Write down your target savings rate, and then convert that rate into a dollar amount you plan to save each month and include that in your budget too.

Next, list out the destinations for that saved money. If you don’t have anything set aside for an emergency fund, consider prioritizing that first and building at least $1,000 in cash savings. Or, if you have credit card debt you’ve carried over from previous months, paying that off may be your highest priority.

Beyond paying off unsecured debts, other potential destinations could include your brokerage account, IRA, Roth IRA, 401(k), 529 plan or ESA, or any number of other investment accounts.

How you prioritize your goals depends on your personal finances and long-term financial goals. For budgeting purposes, however, start by simply ensuring you don’t overspend each month, then work your way toward widening your savings rate.

Budgeting Expenses

Expenses get more complex because there are so many more of them to list.

I take a slightly different approach from most in how I categorize expenses. In my budget, I list all expenses not strictly mandatory every single month under the Discretionary category. That includes expenses like clothing, personal grooming products like moisturizers, and electronics.

That immediately raises many people’s hackles. They indignantly respond that they need clothing to survive. And who can live in today’s world without a smartphone?

I recommend budgeting this way for one simple reason: The risk isn’t that you’ll freeze to death or go without a smartphone. The risk is that you’ll overspend on these expenses.

By listing them as discretionary, it reminds you that you don’t need the latest iPhone model the day it hits the market or a brand-new Prada jacket. You can choose to spend your money on these things if you like, and you have every right to do so. But don’t fool yourself into classifying these optional expenses as mandatory.

Housing

You know your rent or monthly mortgage payment, so list it first. If you’re a renter, you can stop there.

If you own your home, your housing expenses don’t end at your mortgage payment. If your mortgage lender does not escrow for homeowners’ insurance and property taxes, make sure you list these on separate lines. These fall under the category of Irregular Expenses if they’re not included in your monthly mortgage payment, so funnel this money into your Irregular Expenses account (more on that later). Also consider contacting your mortgage lender to start escrowing for these expenses to automate them.

Homeowners must also budget for maintenance and repairs. I recommend budgeting between 5% and 10% of your monthly mortgage payment to set aside for these irregular-but-inevitable expenses.

To regularize your budget, consider switching to a biweekly mortgage payment. For most of us, that better mirrors how we get paid, and it makes budgeting easier. If you want to pay off your mortgage faster without noticing much difference, set your biweekly payment as half your monthly mortgage payment. You end up paying the equivalent of one extra month’s payment each year.

Transportation

The second-largest expense for most Americans is transportation.

If you own a car and have a loan, list your monthly loan payment first. Then list your car insurance, and if you pay it annually or semiannually, earmark it as a non-monthly expense. Transfer the monthly budget amount directly into your Irregular Expenses account.

The same goes for car maintenance: It falls under the category of irregular-but-inevitable expenses for car owners.

Finally, list fuel and parking expenses.

If you really want to save money, look into getting rid of a car. With all expenses included, the average costs to own, maintain, and drive a car total nearly $9,300 per year, according to AAA. Explore options ranging from walking and biking, public transportation, ridesharing services like Uber and Lyft, car-sharing services like Zipcar, and carpooling with coworkers. My wife and I intentionally moved into a home where we can walk, bike, and Uber everywhere we need to go, and we save a massive amount of money each year because of it.

Groceries

Too many people bend their budgets by setting a “Food” category rather than a “Groceries” category. They slip commercially prepared meals under the “Food” umbrella, justifying it as a mandatory expense.

Yes, you need food to live. No, you don’t need restaurant meals. Groceries are a mandatory expense, while commercially prepared meals are a discretionary expense.

Under the Groceries label, you can include necessary personal products like toilet paper and tampons. You can’t include discretionary personal products like cosmetics and expensive facial creams (more on them shortly).

Look for ways to save money on groceries each week as well. Just because groceries represent a mandatory expense doesn’t mean you have to spend an arm and a leg. One of the easiest ways is to use apps like Ibotta or Fetch Rewards.

Mandatory Utilities

You need a few utilities to survive. But again, many people use this category to justify spending on optional utilities.

You need electricity, and gas if your appliances run on it. You also need water.

In today’s world, everyone needs home Internet as well. Along similar lines, every adult needs a smartphone plan — although you can save plenty of money by switching to alternative carriers like Mint Mobile.

What you don’t need are cable TV subscriptions, landlines, video streaming services, music streaming services, and so on. These fall under discretionary expenses, not utilities.

Health Care

Everyone needs health insurance. Although some people get excellent health insurance through their employer, not everyone is so lucky.

Fortunately, you have plenty of options in today’s world for health insurance without employer coverage.

Budget for your health insurance premium, if applicable. And if you pay your own premium annually or semiannually, this too should go straight into your Irregular Expenses fund.

For workers who get a high-deductible savings plan through their employer, you should also budget monthly contributions to a health savings account (HSA). You need enough set aside to cover that high deductible.

Child Care

Parents of young children often need to budget for child care as a mandatory expense.

Not everyone needs to budget for this, but when you do, it gets expensive fast.

Life Insurance

Not everyone needs life insurance. But some people do.

If you’re married or have children and your surviving family members would be financially strapped if something happened to you, then you should have life insurance. How much and what type of life insurance you need vary based on your income and living expenses.

It represents an expense, so it belongs in your budget if you have it or need to buy it.

Discretionary

Everything else falls under discretionary spending.

There’s no right or wrong amount to spend on any of these items. Spend as much or as little as you like. The important thing is that you’re intentional about these expenses — that you set a budget based on your own priorities and stick to it each month.

- Commercially Prepared Meals. These include meals out at restaurants, work lunches you don’t pack and bring with you, takeout, delivery, and any other meal you pay someone else to prepare for you.

- Clothing and Accessories. I once went a year without buying a single piece of clothing — admittedly more to prove a point to my wife than anything else, but never mind that. Spend as much or as little as you want on clothing and accessories, but don’t delude yourself that you need that $100 sweater. What you need to survive, you probably already have in your closet. Include jewelry and watches in this category as well.

- Cosmetics and Personal Products. From makeup to face moisturizers, these also fall under discretionary expenses. Don’t try to sneak these under the mandatory Groceries category. Budget for them here where they belong.

- Electronics. Just because you need a smartphone doesn’t mean you need a brand-new, top-of-the-line model. You could just as easily spend $50 on a used phone and get several years of use out of it. Budget whatever you like here, but again, don’t kid yourself about needs versus wants.

- Alcohol and Tobacco. Cigarettes typically range in price between $6 to $8 per pack, depending on your state’s excise taxes. A one-pack-a-day smoker buying cigarettes at $7 per pack spends $2,555 per year on cigarettes, highlighting just one of the many financial benefits of quitting smoking. The same logic applies to alcohol. Don’t get me wrong, I enjoy a glass of wine with dinner. So I budget for it.

- Gifts. As outlined above, you need to set a monthly budget for gifts and then transfer that money into your Irregular Expenses fund each month. Otherwise, you can expect the holidays to leave you financially strapped and in debt every single year.

- Entertainment. This covers everything from concert and movie tickets to video streaming services like Netflix and Hulu and many, many others.

- Travel. As an avid traveler, I believe travel enriches you as a human being and everyone should do more international travel on a budget. What it doesn’t enrich is your bank account, so make sure you budget for it and put it either in a separate travel fund or in your Irregular Expenses fund.

Tracking Progress

In the final section of your budget spreadsheet, add a Progress & Goals section. Here you can track long-term financial growth to make your progress more tangible each month.

After all, “building wealth” sounds awfully vague. Watching your net worth tick upward each month makes it far more real, and it gives you the motivation you need to keep funneling money into savings and investments rather than faster cars and trendier clothes.

I track my monthly savings rate to make sure I hit my target. Savings rate is one of the most critical numbers for building wealth, so you want to keep an eye on it every month.

I also include investable net worth here. While many people simply track their total net worth, I exclude equity in my home and any cars. That equity remains inaccessible without either debt or selling the asset, at which time it ceases being equity and becomes cash. I believe investment assets paint a more accurate portrait of wealth for most people, and certainly for myself. You can use automated tools like Mint or Personal Capital to help track your net worth for you so you don’t have to run any numbers yourself each month.

Lastly, I track my FI ratio. As described above, that simply refers to the percent of my living expenses I can cover with passive income from investments. If you ever dreamed of retiring early — or retiring ever, for that matter — track your FI ratio.

You may also want to include progress toward specific goals here. For example, say you’re trying to save $15,000 for a down payment on your first home. Use this section of your budget to track your progress toward that goal each month.

Budget Templates

As promised, you can access my basic budget template here. It’s not pretty or polished; it’s simple and functional. Personalize it to meet your own needs. For example, you could delete “child care” and swap in another expense unique to you.

I marked calculated fields with light gray shading, so you know they already feature an automated formula.

This budget template is far from the only one available online. You can find thousands of budget templates online with a simple search if my template doesn’t work for you.

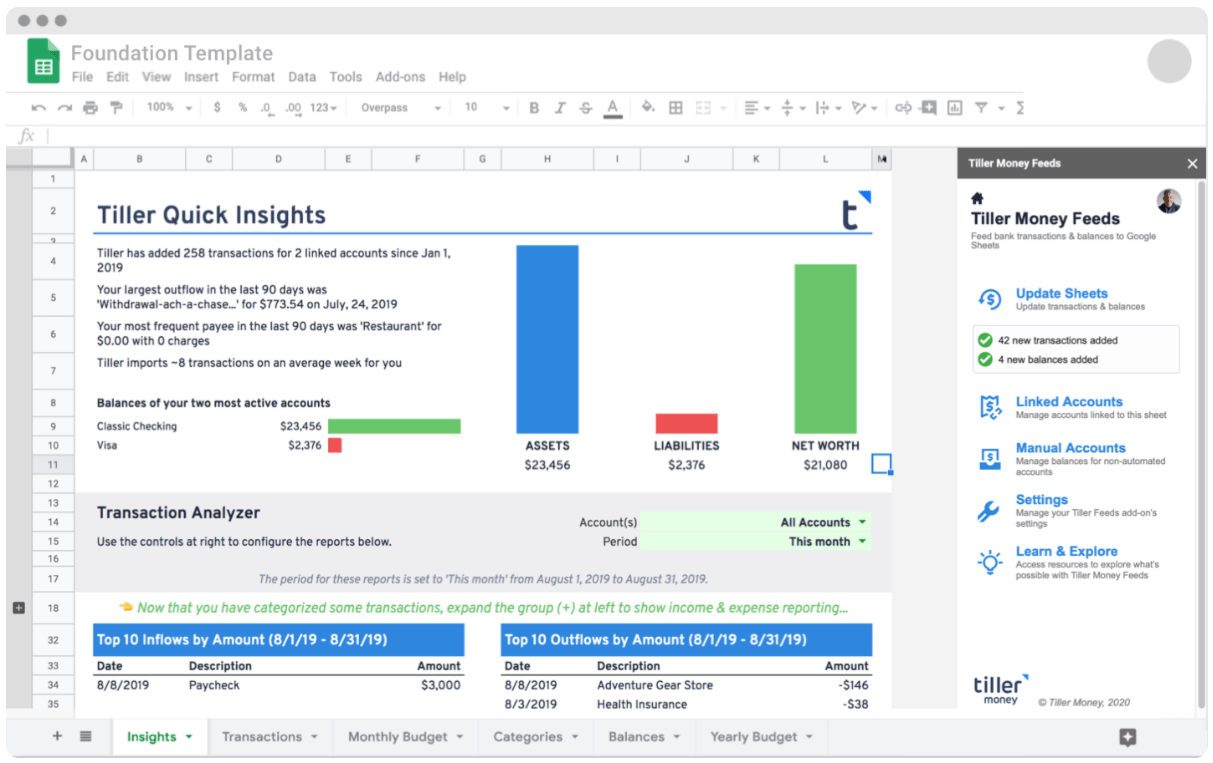

You can also try premium budgeting tools like Tiller. In a neat trick of data synthesis, Tiller connects to your various banking and financial accounts to automatically add your transaction history to your Google Sheets budget.

Crucial Accounts for Budgeting

The average person should keep three basic banking accounts: a free checking account for day-to-day expenses, a high-interest savings account for their emergency fund, and a second high-interest savings account for irregular-but-inevitable expenses.

- Checking Account. You use this account to pay bills like your rent or mortgage payment and to pay for day-to-day costs like groceries. Funds flow in each payday and flow out over the course of the month as you cover your living expenses. Money does not accumulate here — every penny that comes in is slated to also go out.

- Emergency Fund. Unexpected emergency expenses pop up far more often than anyone wants to acknowledge. This month, it’s a roof repair bill. Next month, it’s an unexpected dental bill when you need a cavity filled. In another six months, your car breaks down and needs $1,000 in repairs. No one likes to pay these bills, but you still need to budget for them. If you don’t have an emergency fund established, set on up today through an online bank like Varo.

- Irregular Expenses Fund. Unlike your emergency fund, irregular expenses occur frequently enough to budget for specifically, but they don’t go out every single month. Gifts, for example, represent irregular expenses. Over the course of a given year, you probably spend hundreds, perhaps thousands on holiday gifts, birthday gifts, wedding gifts, and shower gifts. These can ruin your budget if you fail to list them as a line item and budget for them. When you need to buy a gift or pay a semiannual insurance bill or some other nonmonthly expense, you can tap into your irregular expenses account.

Keep in mind these three accounts only represent the regular banking accounts you need. Investment accounts — such as a brokerage account, IRA, Roth IRA, 401(k), 529 plan or ESA, and HSA — all serve an entirely different set of needs.

Final Word

On the surface, budgeting may seem like a math problem. In reality, it’s a mindset problem and a discipline problem.

Don’t approach your budget by trying to squeeze a few pennies here and there. Instead, look at your expenses and ask yourself how you can change your lifestyle to live without certain costs.

Some of those changes often prove easy, such as replacing a $100 cable TV subscription with a $10 video streaming subscription. But the changes with the greatest impact on your budget are the ones that require the greatest lifestyle shift.

Put every single expense in your budget under the microscope. Yes, most people focus on reducing discretionary expenses, and those make a great starting point. But the three largest expenses — housing, transportation, and food — typically make up two-thirds to three-quarters of Americans’ budgets, so they offer the greatest potential for savings. Look into slashing your housing payment by house hacking, getting rid of one of your family’s cars, or limiting yourself to one commercially prepared meal each month.

No expense should be sacred. Pick and choose your expenses carefully. The more money you can put toward savings, the easier it is to build wealth and design your own perfect life.

How have you structured your budget? Where do you find the easiest, and the most effective, places to save money?