Pros

Cashback Match doubles first-year cash-back rewards

No annual fee

No minimum to redeem cash back

Cons

5% bonus categories require manual activation

Cashback Match puts light spenders at a disadvantage

Low baseline cash-back rate (1%)

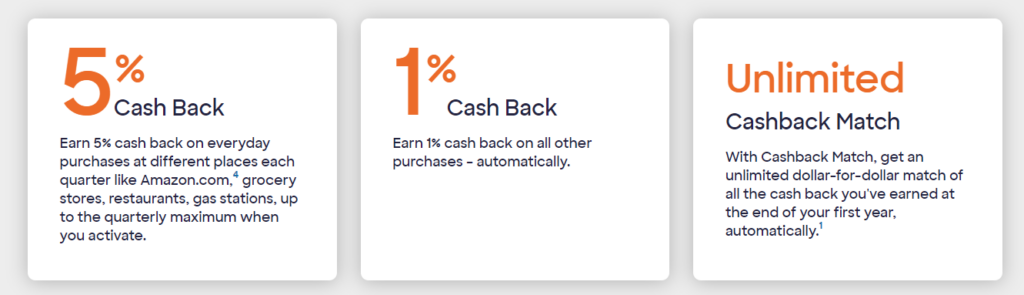

Discover it® Cash Back is a cash back credit card with no annual fee and a nice rewards scheme. The card earns a base rate of 1% cash back on all purchases, but select rotating categories — for example, gas stations, restaurants, and department stores — earn 5% cash back on up to $1,500 in purchases per quarter. Discover it Cash Back is part of a larger family of cash back and travel rewards credit cards, with stablemates such as Discover it Chrome, Discover it Miles, and Discover it for Students.

Discover it Cash Back competes with a number of popular cash back credit cards, not including its Discover-branded peers. The closest analogues is Chase Freedom Flex, which also has rotating 5% bonus cash-back categories. It’s often mentioned in the same breath as flat-rate cash-back cards like Capital One Quicksilver Cash Rewards Credit Card and Citi Double Cash Card too.

If you’re in the market for a new cash-back credit card with no annual fee and the potential to reliably earn 5% on eligible purchases, keep reading. Discover it Cash Back could what you’ve been waiting for.

What Sets the Discover it Cash Back Card Apart

The Discover it Cash Back Card is not your standard cash-back credit card. Three features set it apart from most competitors:

- Double Cash Back in the First Year. Discover’s Cashback Match feature boosts your first-year cash-back earnings by 100%, regardless of how much you earn. This is a powerful incentive to make Discover it Cash Back your primary credit card, at least for the first 12 months it’s in your wallet.

- Earn Up to $300 in Bonus Cash Each Year. Discover caps bonus cash-back earnings in its rotating 5% categories at $75 per quarter ($1,500 bonus category spend). But that’s still $300 per year when fully utilized, a nice haul for a credit card with no annual fee.

- Above-and-Beyond Security Features. Every credit card claims to be secure, and federal law and regulation require a slew of standard security features in any card available to U.S. consumers. But Discover goes above and beyond with features like Online Privacy Protection, which regularly scrubs cardholders’ data from popular people-search sites that may sell it (and are vulnerable to hacking besides).

Key Features of the Discover it Cash Back Card

These are the most important features of the Discover it Cash Back Card. Note the Cashback Match (double cash back during the first year your account is open) and signature 5% bonus categories that rotate quarterly.

First-Year Double Cash Back (Cashback Match)

On your first card membership anniversary, Discover it Cash Back automatically doubles all cash back earned in that year, with no caps or restrictions. This includes cash back you earn through the Discover Deals shopping portal, which can pay north of 5% on eligible purchases.

The more you spend, the more valuable this benefit is, and there’s no upper limit on your first-year Cashback Match. $200 in first-year cash back turns into $400, $400 into $800, $800 into $1,600, and so on.

Earning Cash Back

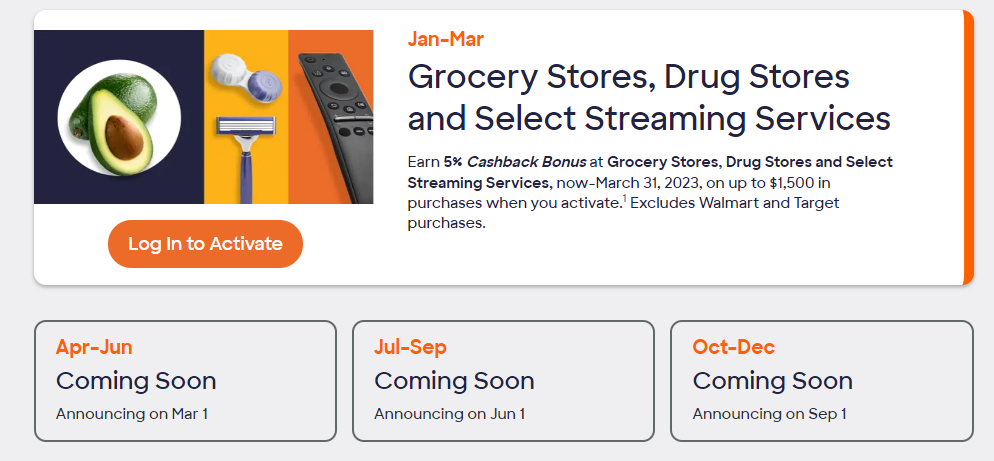

Discover it Cash Back earns 5% cash back on select quarterly rotating categories. Popular categories include gas station purchases, department store purchases, and restaurant purchases — check out our guide to recent and future 5% bonus categories for more examples and a peek at what’s ahead.

The 5% cash back benefit applies to the first $1,500 spent across all rotating categories in a given quarter. Once you hit $1,500, future purchases in the rotating categories earn an unlimited 1% cash back. Note that you need to manually activate your 5% cash back categories each quarter, and cash-back earnings are not retroactive to the beginning of the quarter, so it pays to activate before the first day.

All other purchases also earn an unlimited 1% cash back, with the exception of select purchases made through the Discover Deals online mall. Those purchases can earn 5% or more, subject to purchase and item restrictions.

Redeeming Cash Back

You can redeem your accumulated cash back rewards for statement credits, bank account deposits, pay-with-points at Amazon.com, and electronic and physical gift cards. Statement credit and bank account deposit redemptions can be made at any time, in any amount. Gift card redemptions come with a $20 minimum.

Freeze It

Discover’s Freeze It feature allows you to lock your account with a single click from any Internet-connected device, preventing new purchases, cash advances, and other activities. It comes in handy when you misplace your card or suspect that your account has been compromised.

If you later find your card, you can unfreeze your account using the same method. Keep in mind that balances continue to accrue interest and automatic payments for bills and other recurring expenses continue to execute as normal when your account is frozen.

Introductory APR

Discover it Cash Back comes with a 15-month 0% introductory APR on purchases and balance transfers. To qualify, balance transfers must be made by the 10th day of the third month after you open your account. For instance, accounts opened in January have until April 10th to take advantage of the promotion.

Free FICO Score

Discover it Cash Back includes a free FICO credit score on every monthly paper or electronic statement. You can also access your FICO score at any time through your online account dashboard.

Custom Card Design

Discover lets you customize your card face’s design — a valueless but fun perk that many credit card issuers don’t bother with. Choose from 25 designs depicting everything from clover plants to the New York City skyline.

Important Fees

There is no annual fee or foreign transaction fee. Balance transfers cost a flat 3% of the transferred amount. Cash advances always cost the greater of $10 or 5%, and late and returned payments cost $35.

Credit Required

This card requires very good to excellent credit. Any blemishes of note are likely to be disqualifying.

Additional Card Features

The Discover it Cash Back Card has two other notable features: a card security suite that includes free Social Security number alerts (great if you suspect you’re the victim of identity theft) and an online privacy protection feature that removes your personal information from popular people-search websites known for selling consumer data.

Advantages of the Discover it Cash Back Card

These are the most important advantages of the Discover it Cash Back Card. Are they impressive enough for you to add this card to your spending lineup?

- No Annual Fee. Discover it Cash Back doesn’t have an annual fee. That’s a nice advantage over competing cards such as Blue Cash Preferred Credit Card from American Express and Capital One QuicksilverOne Cash Rewards Credit Card.

- First-Year Cash Back Boost Dramatically Increases Earning Power. Discover it Cash Back’s unlimited first-year cash back bonus doubles the cash back you earn during your first year of card membership. That effectively raises the 1% baseline cash back to 2%, which is higher than competitors such as Capital One Quicksilver. Even better, the first-year bonus raises your 5% cash back rate to 10%, which is basically unheard of among fellow cash back cards.

- No Penalty APR. Discover it Cash Back doesn’t charge penalty interest and waives the late fee on your first late payment. That’s a nice break for cardholders who occasionally miss payments — and an advantage over competitors such as Chase Freedom Flex.

- No Foreign Transaction Fee. Discover it Cash Back doesn’t charge a foreign transaction fee. That’s great news for cardholders who travel abroad with any frequency. Some competing cards, including Amex EveryDay Card from American Express, come with foreign transaction fees ranging from 2% to 3%. However, Discover isn’t accepted by as many international merchants as Amex, Visa, or Mastercard.

- Nice Intro APR Period. Discover it Cash Back has a 15-month 0% introductory promotional period on purchases and balance transfers, which is great news if you need to make a big upfront purchase or transfer a high-interest balance from another credit card.

- No Minimum Redemption Threshold for Cash Redemptions. You can redeem your accumulated cash back rewards for statement credits, bank account deposits, and Amazon.com purchases at any time and in any amount. That’s a big advantage over competing cards with minimum redemption requirements.

- Don’t Need Excellent Credit. While Discover it Cash Back isn’t marketed as a tool for building credit, nor as a credit card option for people with bad credit, it does not have exacting qualification standards for new applicants. If you have good to very good credit, there’s a strong chance you’re going to be approved for this card, albeit at a lower credit limit than someone with excellent credit. Some other cash back credit cards, including Blue Cash Preferred Card from American Express and American Express EveryDay Preferred, require excellent applicant credit.

Disadvantages of the Discover it Cash Back Card

These are the biggest downsides of the Discover it Cash Back Card. Only you can decide if they’re enough to warn you off this card altogether.

- No Fixed Sign-up Bonus. Discover it Cash Back doesn’t offer a fixed-rate sign-up bonus, only the double first-year cash perk. For light spenders, that’s a drawback compared to competing cards such as Bank of America Cash Rewards Credit Card.

- 1% Baseline Cash Back Is Lower Than Some Competitors. Discover it Cash Back’s 1% baseline cash back is lower than that offered by many competing cards. If you don’t take full advantage of the 5% cash back categories, this puts you at a serious disadvantage to competing cards with higher baseline cash back rates. For instance, Citi Double Cash Card has an effective 2% unlimited cash back rate on all purchases, while Capital One Quicksilver has an unlimited 1.5% cash back rate.

- Manual Cash Back Activation Required. Discover it Cash Back requires you to manually activate your 5% cash back categories each quarter. You can do so online or by phone. While activation isn’t incredibly time-consuming, it’s certainly inconvenient, and raises busy cardholders’ risk of simply forgetting to take advantage of the 5% bonus. Many other cash back cards, including Blue Cash Everyday from American Express, don’t require you to activate quarterly categories.

- Bonus Cash Back Isn’t Retroactive to the Beginning of the Quarter. This is a drawback relative to Chase Freedom Flex, which does make cash back retroactive as long as you activate by the 14th day of the quarter’s last month. If you want to max out your potential cash-back earnings here, be sure to activate before the first day of the quarter.

How the Discover it Cash Back Card Stacks Up

The Discover it Cash Back Card’s closest competitor — or, at least, its most similar competitor — is the Chase Freedom Flex Credit Card.

The comparison table shows why. See how the two cards stack up and decide which is better for you.

| Discover it Cash Back | Chase Freedom Flex | |

| 5% Rewards | Up to $1,500 spent in quarterly rotating categories | Up to $1,500 spent in quarterly rotating categories, plus unlimited on Chase Travel℠ purchases |

| Manual Activation for 5% Rewards | Yes | Yes |

| Retroactive Cash Back in 5% Categories | No | Yes |

| 3% Rewards | None | Restaurants and drugstores, both unlimited |

| 1% Rewards | All other eligible purchases | All other eligible purchases |

| First-Year Cash Back Match | Yes | No |

| Online Privacy Protection | Yes, covering 10 popular people-search sites | No |

| 0% APR Offer | 0% APR on purchases and balance transfers for 15 months from account opening | 0% APR on purchases and balance transfers for 15 months from account opening |

| Annual Fee | $0 | $0 |

Final Word

Like Chase Freedom Flex and other cash back rewards cards with tiered, rotating spending categories, Discover it® Cash Back rewards you for making certain types of purchases at certain times. That’s great news for applicants who intend to use this as a primary credit card and make a wide variety of purchases with it.

However, Discover it Cash Back’s approach to cash back certainly isn’t the only way to do such things. If you prefer a card without quarterly rotating categories or spending caps, there are plenty of great alternatives on the market.

Pros

Cashback Match doubles first-year cash-back rewards

No annual fee

No minimum to redeem cash back

Cons

5% bonus categories require manual activation

Cashback Match puts light spenders at a disadvantage

Low baseline cash-back rate (1%)