Pros

Double cash back in the first year with no limits

Long 0% APR intro promotion

No annual fee

Cons

Low baseline cash back rate (1%)

Low spending caps for bonus cash in the 2% categories ($1,000/quarter)

Discover it® Chrome — officially known as the Discover it® Chrome Gas & Restaurant Credit Card — is a hybrid cash back and gas credit card with no annual fee. Discover it Chrome’s rewards program favors gas station and restaurant purchases, and moderately rewards other types of spending. It belongs to a broad family of Discover cash back and travel rewards credit cards, including the original Discover it, Discover it Miles, Discover it for Students, and its near-carbon copy, Discover it Chrome for Students.

Discover it Chrome also competes with a number of popular gas and cash back credit cards issued by other companies. Its closest competitors include Chase Freedom Flex and the Citi Double Cash Card.

If you dine out regularly and have a decently long commute, Discover it Chrome could be the right credit card for you. Find out how it compares to other popular rewards cards and decide if it deserves a place in your wallet.

What Sets the Discover it Chrome Card Apart

The Discover it Chrome Card is a straightforward no-annual-fee rewards card, but that doesn’t mean it has no features worth calling out. These three set it apart from (most of) the rest.

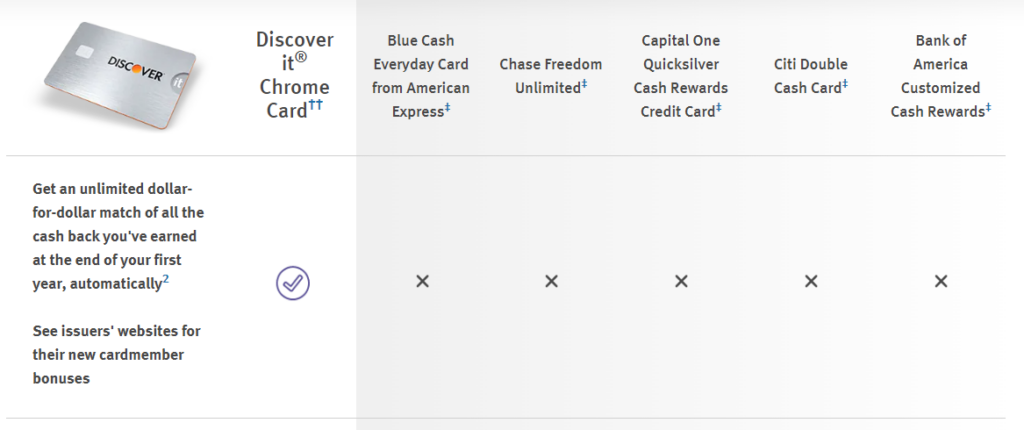

- Double Cash Back in the First Year. Discover automatically doubles all cash back earned during the first year, with no caps or limits on how much bonus cash you can snag. The more you spend, the more you earn. No other credit card issuer (that I’m aware of) offers this sort of bonus.

- Long 0% APR Promotion. Discover it Chrome isn’t the only cash back credit card with a 15-month 0% APR intro promotion on purchases and balance transfers. But that’s not stopping us from calling this benefit out — it’s just about the best you can do in the category.

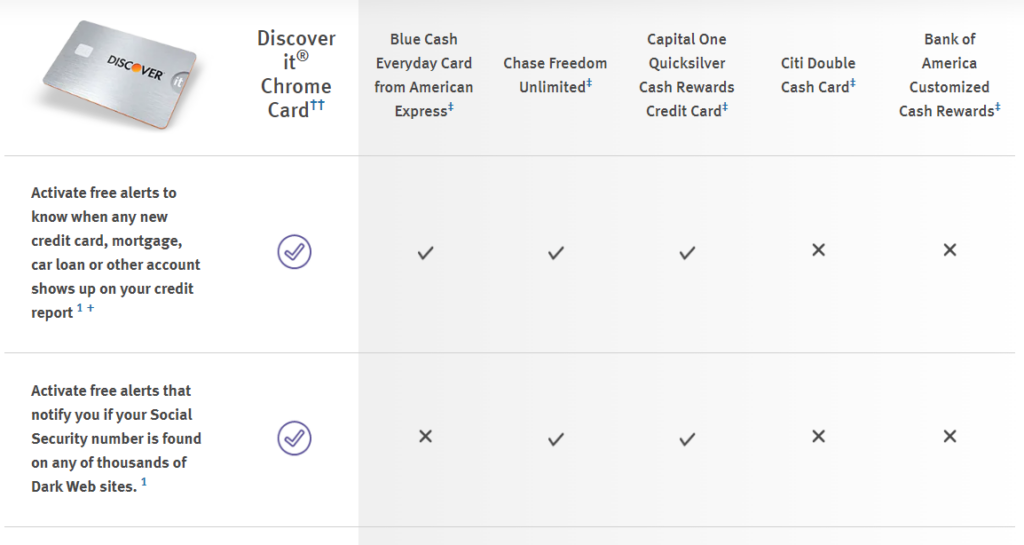

- Top-Notch Security Features. Discover it Chrome (like Discover credit cards in general) has better security features than most competing cards. Notable perks include periodic dark web scans for signs of identity theft and complimentary personal data removal from popular people-search sites, which are notorious for selling consumers’ data without their consent.

Key Features of Discover it Chrome

These are the most important features of the Discover it Chrome credit card. Keep reading for details on the cash back program, the first-year Cashback Match bonus, and the 0% APR intro promotion (one of the best in the cash back category).

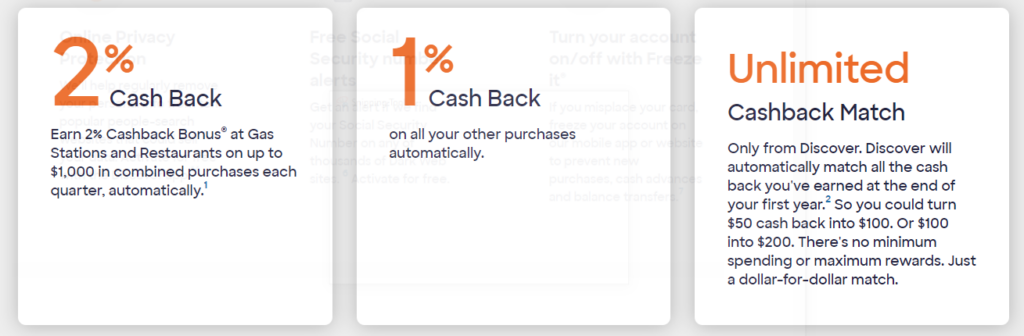

Earning Cash Back

Discover it Chrome earns 2% cash back on gas station and restaurant purchases, up to $1,000 in total spending per quarter. All spending above that limit earns an unlimited 1% cash back. All other purchases also earn an unlimited 1% cash back.

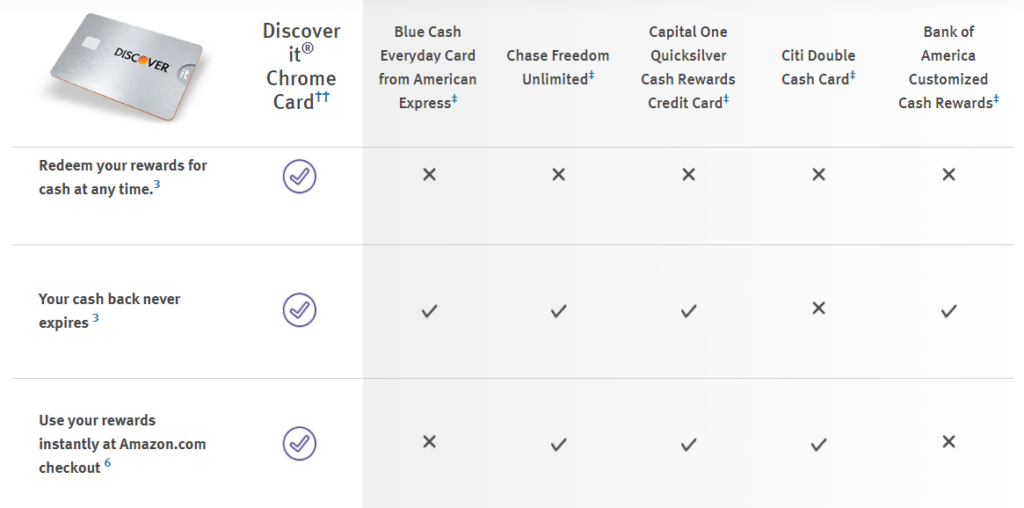

Redeeming Cash Back

Discover allows you to redeem your cash back rewards for statement credits, bank account deposits, and Amazon.com purchases in any amount, at any time. You can also redeem for both electronic and physical gift cards, subject to a $20 minimum.

First-Year Double Cash Back (Cashback Match)

On your first card membership anniversary, 12 months after your sign-up date, Discover automatically doubles all the cash back you accumulated during the previous year. There’s no limit to how much you can earn from this bonus, so it’s great for heavy spenders.

The more you spend, the greater your Cashback Match. If you earn $100 in first-year cash back, you receive a $100 bonus on your card membership anniversary, bumping your total first-year cash back earnings to $200. Likewise, $200 in first-year cash back becomes $400, and so on.

This benefit is basically unique to the Discover universe, as you can see below.

Freeze It

Discover it Chrome’s Freeze It feature lets you lock your account from any Internet-connected device. Freeze It prevents anyone (including you) from making new purchases or cash advances, and was created for situations in which you suspect that your card has been stolen or your account compromised in some other way.

You can unlock your account in the same manner once the danger has passed (or you locate a misplaced card). Remember that automatic or scheduled payments continue to execute as normal when Freeze It is turned on, and interest on unpaid balances continues to accumulate at the normal rate.

Introductory APR

Discover it Chrome has a 15-month 0% introductory APR on purchases and balance transfers. Qualifying balance transfers must be made by the 10th day of the third month account opening. For instance, if you open your account in June, you have until September 10th to take advantage of the promotion.

Free FICO Score

Discover it Chrome comes with a free FICO credit score on every monthly paper or electronic statement. Your FICO score is also available on-demand through your online account dashboard.

Additional Security Features

Discover it Chrome has some above-and-beyond security and identity protection features that many other cards don’t. These include:

- Regular scans of and removal requests to popular people-search websites known to sell consumers’ data

- Regular dark web scans for signs that your identity has been compromised

- Optional credit report alerts that notify you of new items on your report — another potential sign of identity theft

Here’s how Discover it Chrome stacks up to other on credit report alerts and dark web scans:

Important Fees

Discover it Chrome has no annual fee or foreign transaction fee. Balance transfers always cost a flat 3% of the transferred amount, and cash advances always cost the greater of $10 or 5%. Late and returned payments cost $35.

Credit Required

This card requires good to excellent credit. You don’t have to have a blemish-free credit report to qualify, but if your FICO credit score is much below 700, you might have trouble.

Advantages of Discover it Chrome

These are the biggest upsides of the Discover it Chrome credit card. Highlights include no annual fee, first-year double cash back (Cashback Match), and a long 0% APR introductory period.

- No Annual Fee. Discover it Chrome has no annual fee. That’s an important advantage over competing cash back cards, such as Capital One QuicksilverOne Cash Rewards Credit Card and Blue Cash Preferred from American Express.

- Consistent Gas and Restaurant Rewards. Discover it Chrome always earns 2% cash back on gas and restaurant purchases, up to $1,000 in spending per quarter. For cardholders who use this card as their everyday spending card, this is a predictable return on two fairly broad and common types of spending. Many cash back competitors either don’t offer special gas or restaurant rewards, such as Capital One Quicksilver Cash Rewards Credit Card or offer such incentives only intermittently (e.g., Chase Freedom Flex).

- First-Year Double Cash Back Can Be Huge. Discover it Chrome doubles your first-year cash back earnings, with no caps or restrictions. That’s potentially huge: The bonus raises the 2% gas-and-restaurant reward to 4% on up to $4,000 in annual spending (boosting maximum annual 2% cash back earnings from $80 to $160), and raises the baseline cash back rate from 1% to 2%.

- No Penalty APR and First Late Payment Fee Waiver. Discover it Chrome never charges penalty interest. It also waives the late fee on your first late payment. If you occasionally miss a payment, this is a great advantage that can actually save you money.

- Solid Intro APR Period. Discover it Chrome’s 15-month 0% intro APR on purchases and balance transfers is a great help for new cardholders who need to make big upfront purchases or transfer existing high-interest balances from other credit card accounts.

- Anytime, Any Amount Redemption for Statement Credits, Deposits, and Amazon.com Purchases. Discover it Chrome lets you redeem your cash back rewards for statement credits, bank account deposits, and Amazon.com in any amount and at any time. This is great news for light spenders, who can go months at a time without hitting some competing cards’ redemption thresholds. (See comparison below.)

- No Foreign Transaction Fee. Discover it Chrome never charges foreign transaction fees, which is great news if you regularly travel outside the country – perhaps on driving vacations to Canada or Mexico, where you can use this card to fill up your car and try new cuisines. Many competing cards do charge foreign transaction fees – sometimes as high as 3%. Just bear in mind that Discover isn’t accepted as widely abroad as Visa or Mastercard.

- No Need to Have Excellent Credit. Discover doesn’t explicitly market the Discover it Chrome card as a remedy for bad credit, nor as a tool for building credit. However, it’s no secret that this card’s qualification standards aren’t as onerous as those of some competing cash back credit cards. Even if this is your first non-secured credit card, there’s a real chance that you can pass muster, as long as you prove that you have good credit and can accept a lower starting credit limit.

Disadvantages of Discover it Chrome

These are the most notable downsides of the Discover it Chrome card. Decide for yourself if they’re enough to push you into another card’s arms.

- Low Maximum Cash Back Rate. Discover it Chrome’s maximum cash back rate is 2%. While that’s higher than some competing cards with flat-rate 1.5% cash back schemes, such as Capital One Quicksilver, it’s lower than many cards with special cash back rewards categories. For instance, Bank of America Cash Rewards Credit Card earns 3% cash back on gas purchases, while American Express Blue Cash Preferred earns up to 6% cash back on grocery purchases.

- Low 2% Category Spending Caps. Discover it Chrome caps spending in its 2% gas-and-restaurant category at $1,000 per quarter, which adds up to $4,000 per year. That’s lower than some other category-spending cards, such as Blue Cash Everyday and Preferred ($6,000 annual cap on grocery purchases, which respectively earn 3% and 6% cash back), not to mention Chase Freedom Flex ($1,500 quarterly, or a $6,000 annual cap on rotating 5% categories).

How Discover it Chrome Stacks Up

Discover it Chrome doesn’t have any direct analogues — I’m not aware of any other cash back credit card that pays 2% cash back on gas and restaurant purchases up to $1,000 in combined quarterly spending.

But there are plenty of similar credit cards with tiered cash back programs that can reward gas and restaurant purchases above others. One of my favorites is the Citi Custom Cash Card, which automatically pays 5% on up to $500 in eligible purchases in your top spending category each month.

| Discover it Chrome | Citi Custom Cash | |

| 5% Rewards | None | Yes, on the first $500/month spent in your top spending category (automatically changes monthly) |

| 2% Rewards | Yes, on the first $1,000 in combined quarterly spending on gas and restaurants | None |

| 1% Rewards | All other eligible spending | All other eligible spending |

| First-Year Double Cash Back | Yes, unlimited | No |

| Annual Fee | $0 | $0 |

Final Word

Discover it® Chrome has a nice 2% cash back bonus for frequent restaurant and gas station shoppers. However, its $1,000-per-quarter 2% category spending limit is a bit low. If spend heavily at restaurants and gas stations, you’re likely to blow through that limit pretty quickly.

But that doesn’t mean Discover it Chrome has no place in your wallet. If your credit is good enough to qualify for a more generous gas or dining-out card, use that as your default food and fuel spending card. Once you hit its quarterly or annual spending limit, pull out your Discover it Chrome card and stretch your remaining restaurant and gas dollars just a bit further.

Pros

Double cash back in the first year with no limits

Long 0% APR intro promotion

No annual fee

Cons

Low baseline cash back rate (1%)

Low spending caps for bonus cash in the 2% categories ($1,000/quarter)