Pros

Great for investors with modest budgets

No early withdrawal penalties

No fees to bondholders

Cons

Strict online purchase limits ($50,000 max)

No FDIC insurance

Low real returns in high-inflation environments

Americans are increasingly bullish about investing with purpose. Inflows to socially responsible investing (SRI, also known as ESG) funds and strategies spiked in 2021, capping nearly a decade of breakneck growth. Today, a significant share of all assets under professional management in the United States use SRI strategies.

And it’s not just those willing to pay professional money managers getting in on the action. Small-dollar, DIY investors enjoy a growing portfolio of SRI options to invest not only in stocks, exchange-traded funds (ETFs), and mutual funds, but in fixed-income instruments (bonds) as well.

Worthy Bonds is among the most interesting of these options. As the name suggests, it enables investing in socially responsible bonds. If you’re looking to diversify your SRI holdings, Worthy Bonds definitely deserves a closer look.

What Is Worthy Bonds?

Backed by Worthy Financial, its parent company, Worthy Bonds is a niche platform that offers only one instrument: a 36-month coupon bond sold in $10 increments. Bond proceeds benefit small businesses and nonprofits, not corporate issuers or government treasuries. It’s a variation on peer-to-peer lending, without the high-interest personal loans.

Rigid purchase limits and the lack of investment diversity all but ensure Worthy Bonds will remain a complement to, rather than the focal point of, your core investing strategy. But with no platform fees or penalties for early withdrawal and a flat 5% rate of return, Worthy Bonds is a compelling alternative to short- and medium-term savings instruments, including certificates of deposit (CDs) — despite Worthy accounts’ lack of FDIC insurance.

Intrigued by Worthy Bonds’ potential? Read on for more about its features, advantages, drawbacks, and overall suitability for retail investors looking to buy bonds.

Key Features of Worthy Bonds

The Worthy Bonds platform, and the fixed-income instruments available on it, have some important features worth noting before you begin investing.

Worthy Bonds

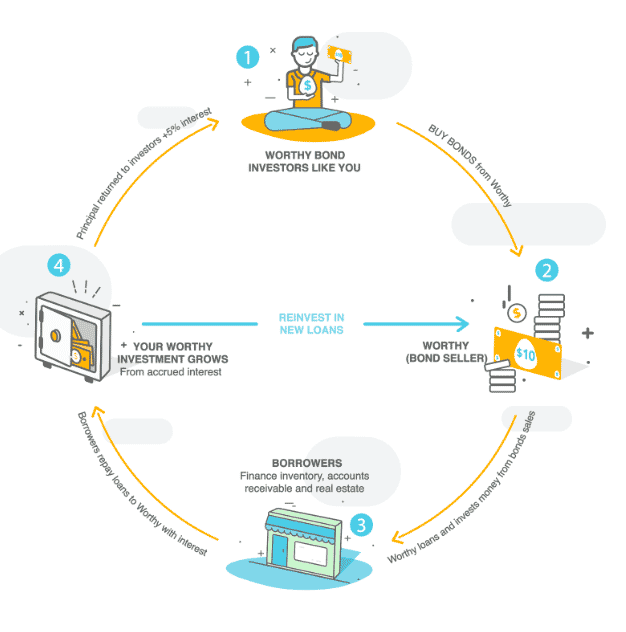

Worthy Bonds are bonds registered with the Securities and Exchange Commission (SEC) and available for purchase by individual investors in $10 increments, starting at a minimum investment of $10. Worthy invests all bond sale proceeds in asset-backed (secured) small-business loans.

Worthy’s business borrowers generally use these loans to fund short-term investments like inventory purchases, and they repay with interest on a 36-month term. Worthy doesn’t disclose rates charged to business borrowers, but all bonds produce a flat 5% annual return (coupon rate) for Worthy’s peer investors. Because all bonds are backed by tangible assets, investors’ risk of loss is relatively low on any given bond. However, Worthy advises that defaults do happen, and the lack of FDIC insurance limits investors’ recourse.

Worthy Bonds carry no fees or hidden expenses. Like all traditional lenders, Worthy makes money through its rate spread — the difference between the (higher) interest rate charged to business borrowers and the (lower) rate paid out to individual bondholders.

Worthy Bonds are issued by one of several subsidiaries, including Worthy Peer Capital, Worthy Peer Capital II, and Worthy Community Bonds. Bond-specific issuer information is available in the bond’s prospectus.

Purchase Restrictions

Worthy Bonds imposes strict numeric limits on online bond purchases: no more than $50,000 (5,000 bonds) for accredited investors and no more than 10% of the greater of annual income or net worth for nonaccredited investors.

The SEC defines accredited investors as:

- Individuals who earned at least $200,000 in annual income in the two tax years prior and reasonably expect similar or higher earnings in the coming year

- Couples who earned at least $300,000 in the two tax years prior and reasonably expect similar or higher future earnings

- Individuals or couples with a net worth greater than $1 million

Accredited investors can get around the purchase limit by buying bonds directly from Worthy Bonds, rather than through the online portal. It’s not clear what if any restrictions there are on purchase volume for investors who go this route.

Account Types

Worthy Bonds offers several different account types for individuals, families, and their representatives:

- Taxable accounts (interest is taxable as ordinary income)

- Tax-advantaged retirement accounts (traditional, Roth, and rollover IRAs)

- Trusts

Worthy bonds offers two special account types for corporate entities as well:

- Nonprofit accounts for investors who wish to invest through not-for-profit entities

- Business accounts for investors who wish to invest through for-profit entities

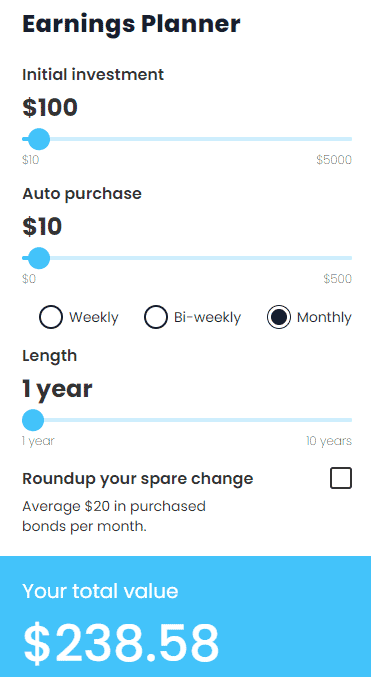

Manual and Scheduled Bond Purchases

Once you’ve set up your Worthy Bonds account and linked an external funding account (a bank account, debit card, or credit card), you can manually purchase bonds in any amount (subject to total purchase limits). You can also set recurring bond purchases in fixed amounts on a weekly, biweekly, or monthly schedule.

Automatic Investments

If you prefer, you can use the spare change from rounded-up transactions in your linked funding account to automatically purchase Worthy Bonds.

Round-ups always go to the nearest dollar, meaning a $3.50 purchase produces $0.50 in additional capital. Round-ups transfer to your Worthy Bonds account via Dwolla, a payment transfer app, and trigger a new bond purchase whenever your balance reaches $10.

Cash-Out and Interest Withdrawal

Worthy Bonds allows interest-only withdrawals and principal cash-outs at any time during the 36-month term, with no early withdrawal penalties. Larger withdrawals may take several weeks to process, but smaller interest-only withdrawals typically execute quickly.

Worthy Causes

Worthy Causes uses Worthy Bonds’ round-up feature to donate bonds to nonprofit organizations. When you sign up for Worthy Causes, proceeds from rounded-up purchases made in your linked external account fund bond purchases in $10 increments.

Those bonds are then transferred to your choice of participating nonprofit organizations, entitling them to a 5% annualized rate of return and full cash-out authority. If you’ve chosen a qualified tax-exempt nonprofit organization, your bond donations may be tax-deductible for state and federal income tax purposes if you itemize deductions.

Referral Program

For each successful referral, Worthy Bonds pays both parties — the referrer and referred — one bond at the standard $10 face value. When the gifted bond is held to maturity, the total referral value for each party is $10 plus 36 months’ interest at a 5% annualized rate.

Advantages of Worthy Bonds

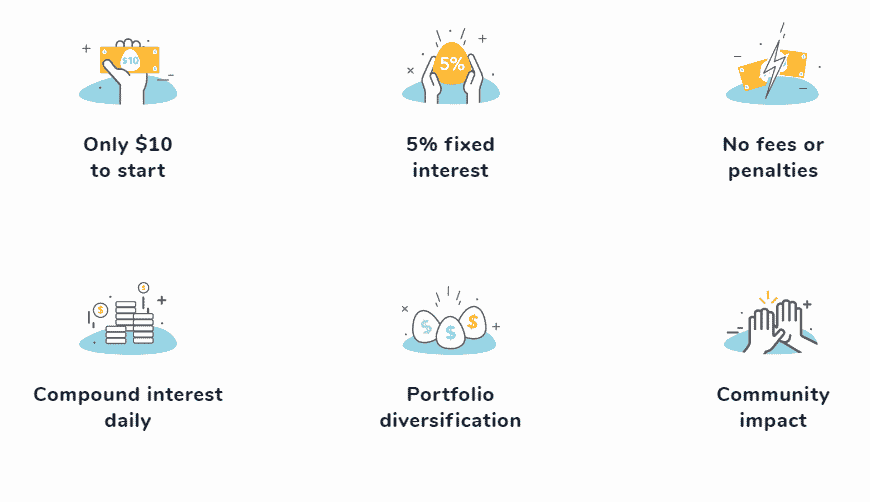

Worthy Bonds’ key advantages center on its accessibility for everyday investors, easy-to-understand terms, and community-first mission.

- Built for Low-Dollar Investors. Worthy Bonds is designed for everyday investors. With bonds priced at just $10 apiece, it’s easy for bondholders of limited means to dip their toes into the water here.

- No Fees to Bondholders. Worthy Bonds doesn’t impose any fees on bondholders. Instead, it earns money by charging borrowers more than it pays bondholders — a standard lending arrangement.

- Solid Rate of Return on All Bonds. Worthy Bonds always yield 5% annualized. That’s significantly higher than savings and CD yields, although Worthy Bonds are riskier than those FDIC-insured instruments. Perhaps more importantly, Worthy’s yields are less volatile than savings yields. Per Worthy, they’re not subject to change with benchmarks like the federal funds rate or 10-year U.S. Treasury rates — although they’re not guaranteed to remain fixed at 5% forever.

- No Penalties for Early Cash-Out. There’s no penalty for cashing out your bond’s principal before the 36-month term expires. That’s a big advantage over some corporate and government bonds, which may have call restrictions, and over CDs that charge early termination penalties.

- Easy to Withdraw Accrued Interest. It’s easy to create a reliable income stream by regularly withdrawing accrued interest from your Worthy account. As with early principal withdrawals, there’s no penalty for doing so.

- Supports Small-Business Owners. Every Worthy Bond supports a small-business owner who might otherwise struggle to find competitive financing — not a billion-dollar corporation or government treasury with bottomless borrowing power.

- Round-Up Feature Increases Bond-Buying Power. Worthy Bonds’ round-up feature is a great way to reduce the cash flow impact of your fixed-income investments while keeping your overall savings rate up. When you invest via Worthy Causes, your round-ups may also be tax-deductible — although you won’t earn any interest on the bonds.

- Not Correlated With the Stock Market. As community-oriented fixed-income instruments, Worthy Bonds’ value and returns aren’t correlated with the stock market. That’s good news for investors seeking to diversify away from the usual mix of individual stocks, ETFs, and mutual funds.

Disadvantages of Worthy Bonds

Worthy Bonds does have some significant disadvantages, including purchase limits for all investors and risks that aren’t shared by savings accounts and other FDIC-insured financial products.

- Accounts Aren’t FDIC-Insured. Worthy Bond accounts aren’t insured by the Federal Deposit Insurance Corporation. It’s the platform’s biggest drawback relative to traditional bank- or credit union-based savings vehicles, and it definitely justifies the higher coupon rate.

- Online Purchase Limits Apply to All Investors, Including Accredited Investors. Worthy Bonds limits online bond purchases by any individual investor to $50,000 in cumulative face value. Nonaccredited investors must abide by even lower investment limits: 10% of annual income or net worth, whichever is lower. However, accredited investors can get around limits by purchasing bonds directly from Worthy Bonds, rather than the online portal used by nonaccredited investors.

- No Way to Buy Corporate or Government Bonds. Unlike traditional brokerages and some newer fintech solutions, Worthy Bonds doesn’t sell corporate or government-issued bonds. Those instruments may carry lower risk, offer higher returns, or deliver certain tax advantages that boost net return.

- Returns May Be Less Competitive in a Higher-Rate Environment. Although inflation has been low for years, economic conditions are always subject to change. In general, fixed-income investments — and savings accounts, to be sure — suffer during prolonged periods of high inflation. Worthy Bonds’ seemingly rigid returns may do worse than other assets in such times.

How Worthy Bonds Stacks Up

There are no shortage of non-FDIC-insured investment platforms for nonaccredited investors these days. Worthy Bonds is just one of many — as is its particular niche, fixed-rate small business bonds.

Let’s see how Worthy Bonds stacks up against another popular investing platform for small-dollar investors seeking returns not closely correlated with public equities markets. Here’s a head-to-head comparison against Groundfloor, a real estate crowdfunding portal that helps everyday folks advance hard money loans to house flippers.

| Worthy Bonds | Groundfloor | |

| Minimum Investment | $10 | $10 |

| Maximum Investment | $50,000 per investor for online purchases; no limit overall for accredited investors | Not disclosed |

| Hold Period | 36 months | Variable, but generally under 15 months |

| Potential Returns | 5% on all bonds | 6% to about 15%, depending on borrower quality |

Worthy Partner Rewards

Worthy has big plans to roll out a loyalty program that rewards bondholders with perks and discounts from select partners. Some would-be Worthy partners are pretty big names, and though no deals have officially been inked, it’s likely we’ll see an official rollout in the near future.

Final Word

Worthy Bonds is a great way to invest in bonds that support local business owners who desperately need working capital, rather than massive corporations or governments that already have plenty.

Strategy-wise, Worthy Bonds is a nice place to park short- and medium-term savings at higher interest yields than you’re likely to earn at any traditional or online bank — although you must understand the risks inherent in bond investments and the implications of having no FDIC insurance.

All in all, Worthy Bonds is a fun little niche product with big passive income potential for investors seeking diversification. It’ll be interesting to see how it develops and whether it comes to serve as a model for other socially responsible fixed-income platforms.

Pros

Great for investors with modest budgets

No early withdrawal penalties

No fees to bondholders

Cons

Strict online purchase limits ($50,000 max)

No FDIC insurance

Low real returns in high-inflation environments