Pros

Unsecured (no security deposit required)

No annual fee

Potential for credit line increase in 6 months

Cons

No rewards program

High regular APR

Requires a credit check for approval

The Capital One Platinum Credit Card is a no-frills, no-annual-fee credit card designed for consumers who wish to build their credit. Although it’s not a secured credit card and thus doesn’t require an upfront deposit, it has a fairly high regular APR and comes with a low initial credit limit. However, when used responsibly, Capital One Platinum is a useful bridge to higher spending limits and more generous rewards credit cards.

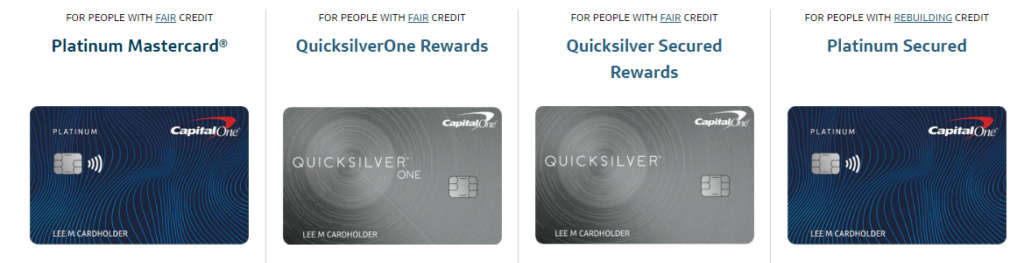

Capital One Platinum is comparable to other unsecured credit cards for consumers with average credit, including Capital One’s own QuicksilverOne Cash Rewards Credit Card. It also competes with a host of secured credit cards designed to build and improve credit, including the Capital One Platinum Secured Credit Card and the Bank of America Secured Credit Card.

It’s important to note that this card is stripped-down and devoid of many of the perks that more generous credit cards offer as a matter of course, such as cash back or travel rewards and early spend bonuses. However, that doesn’t mean it’s not a potentially game-changing card for people who need to improve their credit standing.

Is the Capital One Platinum Credit Card Legit?

It feels funny to ask whether a Capital One credit card is legitimate. Capital One is a major financial institution, so the answer is self-evidently yes, right?

It should be, but you can never be too careful. And Capital One Platinum’s pitch, that you can build credit without putting down a security deposit that you may or may not ever get back, seems too good to be true. So is the Platinum Mastercard from Capital One a scam?

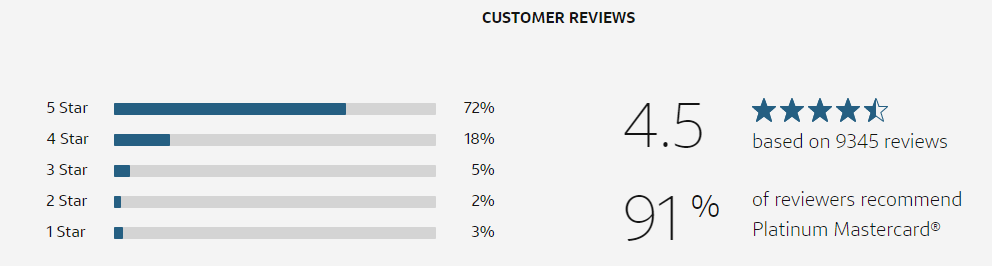

No, it’s not. This is a legitimate Capital One credit card, same as any other. It’s pretty well-liked too, if ratings and reviews managed by the independent BazaarVoice are any indication. At last check, more than 9,000 verified Platinum users weighed in, and 72% gave it a glowing five-star review. Another 18% gave it four stars, which still counts as a recommendation.

Your own experience might differ, and I did find some reviews complaining about the lack of credit line increases, perks, and other advertised benefits. But all in all, this is heartening feedback.

Key Features of the Capital One Platinum Credit Card

These are the key features of Capital One Platinum. It’s not a feature-rich card by any stretch, but there are definitely a few things you should know before applying.

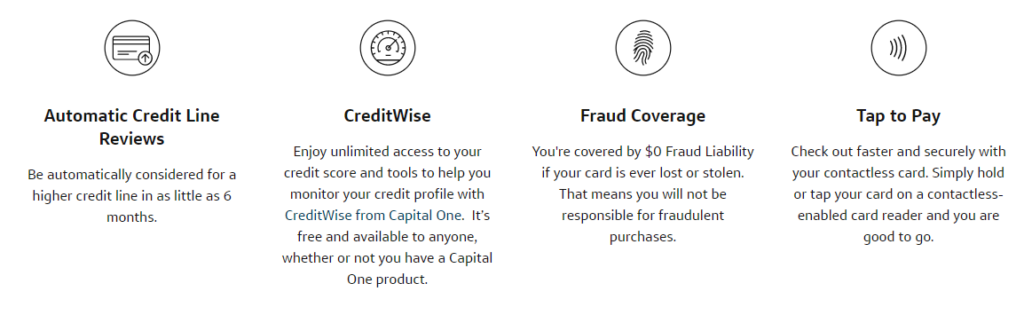

Credit Line Increase

If you use your card responsible, you’ll be automatically considered for a credit limit increase in as little as six months. Further credit line increases are possible with continued responsible use.

Important Fees of the Capital One Platinum Credit Card

This card has no annual fee, balance transfer fee, or foreign transaction fee.

Capital One CreditWise

Thanks to Capital One’s CreditWise suite, you’re entitled to a free credit score with your paper or online statement each month. You can also access your score at any time in your online account dashboard. Additionally, CreditWise includes a host of credit-building tools and educational content.

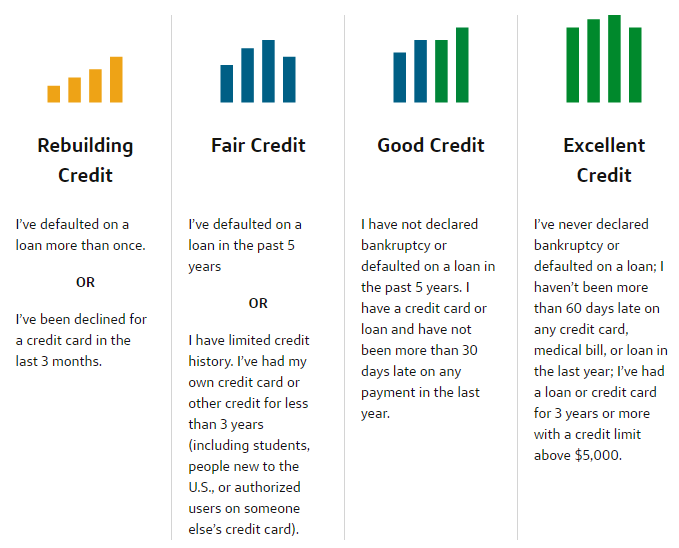

Credit Required

The Platinum card is for consumers with fair credit and is actively marketed as a tool for building credit. Even if your credit history is checkered or spotty, you’re welcome to apply.

The definition of “fair credit” varies by issuer. For Capital One, you have fair credit if you’ve defaulted on a loan in the past 5 years or you have a limited credit history.

Advantages of the Capital One Platinum Credit Card

Here’s what Capital One Platinum has going for it. Note the fact that it’s unsecured (no deposit required!) and has no annual fee or foreign transaction fee. The opportunity to increase your credit line in as little as 6 months is nice too.

- No Deposit Required. The Capital One Platinum Card doesn’t require an upfront deposit to secure your account. That’s a big advantage relative to secured competitors, some of which require $200 (or greater) minimum deposits before you can use your card. Most also cap your spending at the deposited amount, forestalling the possibility of a credit line increase until you scrounge up more funds.

- No Annual Fee. This card has no annual fee. Many of its closest competitors, including the BankAmericard Secured Card and the Citi Secured Mastercard, do carry annual fees.

- No Balance Transfer Fee or Foreign Transaction Fee. Capital One Platinum doesn’t charge balance transfer fees with this transfer APR (Purchase & Transfer APR: 30.74% variable APR) or foreign transaction fees – rare perks in the credit-building category. That’s great news for cardholders who wish to transfer balances from other cards or use their Platinum cards outside the U.S.

- No Penalty APR. This card doesn’t carry a penalty APR, which is an excellent benefit if you occasionally miss a payment. The OpenSky Secured Visa and Citi Secured Mastercard both carry penalty APRs.

- Opportunity for Credit Line Increase in As Little As 6 Months. If you use this card responsibly, you could be eligible for a credit line increase in as little as 6 months. Many competing cards make you wait as long as 12 months to request an increase. If you’re planning to make a large, time-sensitive purchase, or simply want more month-to-month spending flexibility, a year is a long time to wait.

- Useful Credit-Monitoring and Credit-Building Tools. The free credit score other Capital One CreditWise tools are super-useful for cardholders committed to building – and understanding – their credit. Some competing cards, including the BankAmericard Secured Card, don’t come with free credit scores.

Disadvantages of the Capital One Platinum Credit Card

Consider these drawbacks before applying for the Capital One Platinum card.

- No Rewards. Capital One Platinum doesn’t have a cash back or travel rewards program. If you want a card designed for building credit and earning rewards, consider Capital One’s QuicksilverOne Cash Rewards Card or the Navy Federal Credit Union nRewards Secured Card.

- High APR. Even by credit-building card standards, this card comes with a high regular APR. If you intend to carry a balance from month to month, consider lower-cost options such as Navy Federal Credit Union nRewards Secured or DCU Visa Platinum Secured, both of which have lower regular APRs.

- Pre-approval Credit Check Required. The Capital One Platinum application requires a credit check. While substantial credit blemishes aren’t likely to disqualify you, you probably won’t be approved for this card with a recent bankruptcy, foreclosure, or pattern of delinquency on your record. Some competing cards, such as Merrick Bank’s Secured Visa and OpenSky Secured Visa, don’t run your credit during the application process.

How the Capital One Platinum Credit Card Stacks Up

The Capital One Platinum card is one of several Capital One cards designed for people with fair or rebuilding credit (see below for more ideas). Let’s see how it compares to the similarly named Capital One Platinum Secured Credit Card.

| Platinum Mastercard | Platinum Secured | |

| Security Deposit | None | $49 and up |

| Credit Limit | Variable | $1,000 to start |

| Credit Limit Increase | After 6 months | After 6 months, may require another deposit |

| Annual Fee | $0 | $0 |

| Credit Required | Fair | Rebuilding |

| Credit Check | Yes | Yes |

Final Word

Let’s address the elephant in the room: This credit card has a highly misleading name. Platinum is a precious metal that’s worth hundreds of dollars per ounce. Travel loyalty programs’ platinum tiers are often at or near the top of their frequent traveler hierarchies, conferring luxurious benefits worthy of true VIPs. The best-known “platinum” credit card is the legendary American Express Platinum, one of the credit card world’s original status symbols.

Needless to say, the Capital One Platinum Credit Card is a not an exclusive card. However, when used responsibly, it’s absolutely worth its weight in gold (or platinum). If this Platinum card is what ultimately teaches you the value of making timely payments and spending within your means, you might just find a “real” Platinum Card in your wallet one day.

Pros

Unsecured (no security deposit required)

No annual fee

Potential for credit line increase in 6 months

Cons

No rewards program

High regular APR

Requires a credit check for approval