The average American has more than $6,000 in credit card debt. That figure is climbing quickly as total U.S. credit card debt surpasses $930 billion, closing in on the all-time high set in 2019.

The vast majority of people who carry credit card balances are current on their bills. Sure, they’re paying too much to carry those balances — we always advise paying off your credit card bills in full each month absent a true emergency — but their credit scores aren’t suffering for it.

That could change in 2023. The U.S. credit card delinquency rate, which measures the proportion of credit card users who’ve fallen well behind on their bills, remains low by historical standards. But it’s rising quickly, and the one-two punch of a softening economy and rapidly rising credit card debt could spell trouble for more borrowers.

Credit Card Delinquency Rates Are Near a 10-Year Low

First, the good news: Credit card delinquency rates are lower than they’ve been in many years.

The delinquency rate for U.S. credit card users was 2.08% in Q3 2022, the latest period the Federal Reserve has data for. That’s up from the all-time low of 1.55% in Q3 2021, but still lower than at any time since the Fed began tracking delinquency rates in 1991.

Each credit card issuer has its own definition of “delinquency,” but an account generally must be at least 30 days past due to qualify.

Why Is the Credit Card Delinquency Rate So Low Right Now?

The credit card delinquency rate has been low by historical standards for some time. It dropped below 3% in Q2 2012 and hasn’t regained that level since. It fell to new lows in 2020 and 2021 as consumers dramatically reduced spending during the COVID-19 pandemic.

Several factors figure into the persistently low delinquency rate:

- Consumer Deleveraging After the Great Financial Crisis. The Fed graph shows a smooth decline in delinquencies from late 2009 into 2015. This is the result of literally millions of consumers working to get out of debt after racking up big credit card bills in the Great Recession.

- More Cautious Underwriting by Credit Card Companies. Credit card delinquencies spiked to 6.77% in Q2 2009, an all-time high, and took years to normalize. This taught credit card companies a painful lesson about the dangers of loose underwriting. They tightened their standards for years afterward, though there are signs they’re making similar mistakes again today.

- Relatively Strong Labor Markets and Income Growth. Not counting the early days of the pandemic, the U.S. has seen many years of basically uninterrupted job and income growth. While these gains haven’t been evenly distributed, they’ve helped keep overall delinquency rates low.

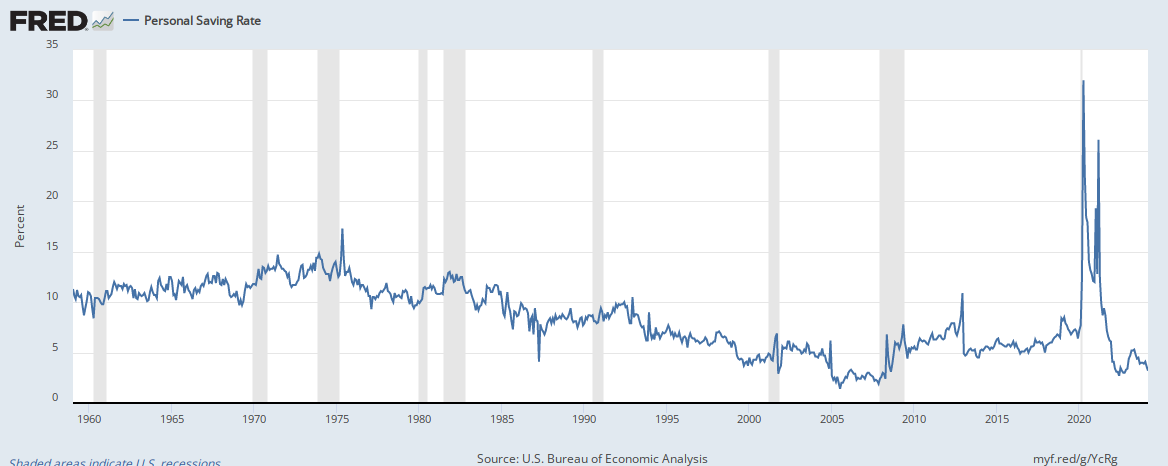

- Changing Spending Patterns in the Pandemic. The pandemic upended normal consumption patterns and temporarily reduced overall consumer spending. This allowed middle- and upper-income households to save much more of what they earned and to lean less on credit cards.

- Pandemic Stimulus. Multiple rounds of federal and state stimulus pumped trillions of dollars into the economy. Much of that landed in consumers’ bank accounts, further padding their savings and reducing their need for credit cards.

Transunion Expects Delinquency Rates to Rise to Levels Not Seen Since 2010

Now for the not so good news: The credit card delinquency rate is rising quickly. Many observers expect this trend to continue in 2023. Some believe the delinquency rate will hit levels not seen in 10 years.

TransUnion, one of the three major U.S. consumer credit reporting agencies, is among them. Its 2023 Consumer Credit Forecast sees delinquency rates for both credit cards and personal loans rising to their highest levels since 2010. It’s forecasting a 2.60% credit card delinquency rate at the end of 2023.

Why Are Credit Card Delinquency Rates Rising?

Hanging over TransUnion’s prediction is a sharp rise in credit card originations, or new credit card accounts. Credit card companies approved 87.5 million new credit card accounts in 2022, the highest figure in years.

| 2019 | 2020 | 2021 | 2022 | 2023 (forecast) |

| 66.8 million | 50.5 million | 76.8 million | 87.5 million | 80.9 million |

Although TransUnion forecasts fewer credit card originations in 2023 than 2022, 80.9 million new accounts still would be well above the prepandemic baseline.

Several factors contribute to this trend:

- Consumer Finances Are in Relatively Good Shape. Consumer balance sheets are strong thanks to rising incomes and savings. Credit card issuers have a broader pool of qualified applicants to choose from.

- Consumer Credit Scores Are Historically High. Consumer credit scores have been on an uptrend for years. This is another factor expanding the qualified applicant pool.

- The Credit Card Market Is Expanding. We’ve seen a wave of new credit card products recently, including some specifically designed for consumers with bad or limited credit. Along with long-overdue changes to make underwriting fairer, this is another building block of a broader applicant pool.

- Credit Card Issuers Aren’t Pulling Back (Yet). Notwithstanding a brief lull in 2020, credit card issuers haven’t tightened up their lending standards yet. That’s likely to change in 2023, but for now, the party continues.

First-time and lower-income credit card users account for part of the surge in credit card originations. Statistically, these cohorts are more likely to lapse into delinquency.

But they’re not the only reason credit card delinquencies are already rising. Several additional factors are at work as well:

- Falling Real Incomes. Rising incomes aren’t keeping pace with inflation. Consumers have less disposable income — and less money to spend in general — than they did last year or the year before. And inflation isn’t expected to return to the Federal Reserve’s 2% target rate anytime soon.

- No More Pandemic Stimulus. The federal government is done pumping money into the economy. That’ll help control inflation in the longer term, but for now, it removes a key support for struggling consumers.

- A Softening Labor Market. The red-hot labor market is cooling, and the Federal Reserve is doing everything in its power to cool it further. More people out of work or underemployed means more people struggling to stay current on bills.

- Declining Home Equity. Rising interest rates are pressuring the U.S. residential real estate market. Prices began declining in 2022 in many markets, and 2023 should bring broader price declines. As homeowners’ equity dries up, so will home equity credit lines, forcing them to lean on credit cards more than they should.

- Dwindling Savings. Federal Reserve data shows that the personal savings rate skyrocketed in 2020 and early 2021, then fell nearly as quickly. It’s now at historic lows as consumers rapidly burn through stockpiles accumulated during the pandemic. To compensate, consumers are relying more on credit cards — some unsustainably so.

Is This a Warning Sign of Bigger Issues to Come?

TransUnion’s 2023 credit card delinquency forecast is concerning, but the bureau isn’t predicting the sort of consumer credit catastrophe that occurred during and after the Great Financial Crisis.

Some observers do believe the economy is headed for a deep recession, which would likely push credit card delinquency rates far above TransUnion’s prediction of 2.60% at the end of 2023.

They point to some of the same factors that we already know are pushing delinquency rates up, like falling real incomes, dwindling savings, and a weakening labor market. They’re also concerned about geopolitical risks affecting commodity prices and supply chains, such as the war in Ukraine. And they see a much weaker U.S. housing market that could threaten global credit markets, as occurred in the runup to the Great Financial Crisis.

I’m not in the sky-is-falling camp, but it’s clear that the outlook for the next year has a far broader range of uncertainty than usual. Looking at recent data on credit card delinquencies, personal incomes and savings, layoffs, and housing prices, I wouldn’t be surprised by a deeper-than-expected recession that stretches into 2024.

I also wouldn’t be surprised by a “soft landing” scenario, where U.S. growth slows without tipping the economy into recession. Despite rapid interest rate increases, the labor market has proven unexpectedly resilient. Inflation appears to have peaked, reducing the need for further Fed rate hikes. Global supply chains have largely normalized and commodity prices have stabilized, even if risks remain.

With Interest Rates High, Now Is the Time to Pay Down Debt & Save

The most important things you can do for your future self when interest rates are high are pay down existing high-interest debt and put your money in a high-yield savings account or CD. In that order.

Pay Off Credit Card Debt First

Credit card interest rates usually rise in lockstep with the federal funds rate, which has increased by more than 4% since early 2022. If you’re carrying a balance on existing credit cards, make a plan to pay it off now.

Use the debt snowball or debt avalanche method. You’ll pay less interest overall with the debt avalanche method, but many find the snowball method easier to stick with, so do what feels right for you. If and when you can afford it, sprinkle in little debt payoff “snowflakes” to zero out your balances faster.

Then Save What You Can, When You Can

Traditional brick-and-mortar banks have lots of advantages, but high savings yields isn’t one of them. Shop around at top online banks and compare their savings rates; the best yield 4% or better. If you must choose, we’re partial to the Wealthfront Cash Account, which consistently yields at or near the top of the heap.

Put funds you don’t need right away in a certificate of deposit. Medium- and longer-term CDs usually yield more than savings accounts, the catch being that they tie up your money for the entire term. (You can get around this limitation with no-penalty CDs, but they often have lower yields and not all banks have them.)

If you have a brokerage account or don’t mind opening one, consider brokered CDs, which may have higher rates than you can find on your own. And if you have ample funds to spare, build a multi-CD ladder to maximize your potential returns.

Final Word

Predicting the future is difficult, but based on current trends, it seems clear that credit card delinquency rates will continue to rise in 2023. Whether they reach the historic highs of the Great Financial Crisis or level off at pre-pandemic levels remains to be seen.

My money is on the latter, but I’ve been wrong before. The good news is that if you’re concerned that rising delinquencies spell trouble for the broader economy, you can make two simple moves to shore up your finances: make an aggressive plan to pay down existing credit card debt and save what you can, when you can.