Douugh

Douugh Pros

- No monthly maintenance fee

- Multiple savings subaccounts

- Unlimited investment subaccounts

- No managed investment fee

Douugh Cons

- No interest on savings subaccounts

- No credit score monitoring yet

- No credit card yet

These days, it’s like you can’t turn around without bumping into a free checking account. Dozens of reputable online banks offer free checking, as do hundreds if not thousands of brick-and-mortar traditional banks. Many throw in free high-yield savings accounts for good measure too.

That’s all well and good, but many consumers demand more. Only a select few financial companies bother to listen.

Douugh is one of those companies. Its personal finance app offers a one-stop solution for day-to-day spending, bill tracking and payments, building an emergency fund, and investing for the future. It’s all knitted together by powerful automation capabilities that reduce the amount of time required to manage and grow money.

Douugh wants its users to live financially healthier lives, and it delivers on that promise. Read on for a detailed look at the features, capabilities, and advantages of this groundbreaking personal finance app.

Key Features of Douugh

Douugh has features for everyday spending, recurring bill payments, short-term savings, and longer-term investing. It has some additional capabilities that make it more effective and user-friendly as well, like a financial dashboard that provides a holistic snapshot of your personal finances.

Autopilot

Autopilot is the automated engine that makes Douugh what it is. It’s a collection of proprietary algorithms that help the Douugh app divvy up deposits in the most efficient way possible. It’s designed to eliminate the need for spreadsheet budgeting or separate budget apps while empowering users to make smarter financial decisions.

Autopilot automates the once time-consuming process of splitting your paycheck into separate buckets for day-to-day spending, recurring bills, short-term savings, and investments. The feature uses information about your spending patterns and recurring expenses to calculate how much should go into your spending and bills buckets.

Then, it divides the rest between your short-term savings and investments in accordance with the goals you’ve set for yourself. This ensures that you’re financially protected from unforeseen expenses and that as much of your money as possible has the opportunity to grow.

Checking Account (Spending Jar) and Virtual Card

Douugh’s seamless spending and bill payment capabilities run on a free checking account tied to a super-secure virtual card. This is a Mastercard debit card that’s accepted anywhere Mastercard Debit is — that’s millions of merchants in the U.S. and beyond. And you can earn real rewards on digital purchases using Douugh’s browser extension.

Once Douugh divvies up your paycheck among the various buckets for bills, savings, and investments, the funds left in your checking account are safe to spend before next payday. This balance is essentially your maximum spending target for the pay period. Ideally, you’ll have money left over when your next paycheck hits.

Douugh bank account balances are FDIC-insured up to $250,000.

Bills Jar

Douugh’s Bills Jar is the hub for your recurring bill payments. That might include your electricity and water bills, your monthly auto loan payment, your rent check — any expense that comes up on a weekly, monthly, quarterly, or any other basis.

Once Douugh is aware of a bill and has the payee’s information, it makes bill payments on schedule with no action required on your part. You can use your virtual card number or actual account number to pay your bills through Douugh.

Stash Jars

Douugh has unlimited subaccounts for short-term savings. These are your Stash Jars, also known as Savings Jars.

You can open as many Stash Jars as you like and give each a specific purpose or short-term goal. Douugh starts out all new users with an Emergency Jar (rainy day fund) with a built-in goal of $1,000. You’re free to customize goal amounts for your Emergency Jar or any other Stash Jar you create.

Balances held in Stash Jars don’t earn interest. They are FDIC-insured up to $250,000, however.

Grow Jars (Portfolio Jars)

Douugh also has unlimited subaccounts for long-term investing. These are your Grow Jars, also known as Portfolio Jars.

Like Stash Jars, Portfolio Jars can be used for specific or general purposes and have fully customizable balance goals. You might designate one Portfolio Jar as a general taxable investment account that holds funds you don’t need anytime soon, another as a vacation fund, and a third as a wedding or new baby fund.

Portfolio Jars use low-cost exchange-traded funds (ETFs) to build diversified investment portfolios that automatically rebalance to keep pace with the market. Depending on your risk tolerance, you can choose from three portfolio types: Conservative, Moderate, and Aggressive. Conservative portfolios have the most bond exposure and least stock exposure; Aggressive portfolios have the most stock exposure and least bond exposure.

Douugh offers traditional (core) and ethical/sustainable portfolio options. Sustainable portfolios avoid sectors and industries like tobacco, weapons, and fossil fuels. Fund managers include Vanguard, State Street, Invesco, and Impact Shares.

Douugh does not charge trading commissions or management fees on balances held in Grow Jars. However, component funds generally charge fees and expenses that Douugh can’t control.

Pulse

Pulse is a comprehensive account dashboard that provides a clear and concise financial snapshot.

Douugh calls Pulse “a real-time read on your financial fitness.” At a glance, it shows the balances in all your accounts (Jars) and any external accounts connected to your Douugh account. Add all your active external accounts and Pulse provides a complete view of your net worth.

Potential Future Features of Douugh

Douugh is a relatively new financial app. It’s constantly testing and deploying new features and capabilities. While individual features may come and go, Douugh appears committed to providing a one-stop money management experience for its users.

Douugh’s website highlights several features that the company may roll out in the near future. These include:

- Additional automation capabilities that make Douugh even more hands-off for users

- Cryptocurrency investing

- Credit score monitoring

- A new Credit Jar for purchases made on credit

Check back here and on Douugh’s website for more details about these features as they get closer to launch. And keep an eye out for additional new Douugh features as they’re announced.

Advantages of Douugh

Douugh has a lot going for it. Overally, this is a very low-cost personal finance app with a wide range of capabilities and user-friendly benefits that some competitors lack.

- No Monthly Maintenance Fee. Unlike some competing banking and money management apps, Douugh doesn’t charge a monthly maintenance fee on any of its accounts. Nor does Douugh charge a subscription fee as a condition of use.

- Multiple Savings Subaccounts (Stash Jars). Douugh lets you create as many savings subaccounts (Stash Jars) as you’d like. Douugh encourages users to assign each Stash Jar a specific savings purpose, like “emergency fund” or “European vacation.” This approach makes it easy to visualize and track progress toward your financial goals over time.

- Commission-Free Managed Investments. Douugh doesn’t charge trading commissions or management fees on Portfolio Jars balances. While it’s far from the only commission-free investment platform around, Douugh’s management fee waiver is much rarer — and potentially much more profitable for investors in the long run.

- Unlimited Investment Subaccounts. Douugh allows unlimited Portfolio Jars. That helps users to segment specific medium- and longer-term financial goals into discrete accounts and makes it easier to keep track of those goals. Most traditional brokerages haven’t caught onto this concept yet — a big advantage for Douugh.

- Access to Nearly 40,000 Fee-Free ATMs. Douugh users have access to a healthy-sized ATM network — nearly 40,000 in all. You won’t pay a fee to Douugh to withdraw cash at machines in this network.

- Compatible With iOS and Android. Douugh is compatible with iOS (Apple iPhone) and Android devices. Whichever side of the smartphone wars you land on, you can be sure Douugh works on your device of choice.

- FDIC Insurance on Bank Deposits. Douugh provides FDIC insurance on checking and savings account balances up to the statutory maximum (currently $250,000). That’s a welcome source of reassurance for users who want to be sure their funds are protected for the long haul.

Disadvantages of Douugh

Douugh does have some downsides. For example, its short-term savings balances (Stash Jars) don’t earn interest, and it doesn’t yet offer credit score monitoring or credit products.

- Stash Jar Balances Don’t Earn Interest. Stash Jars are not interest-bearing savings accounts. If you want to take advantage of the miracle of compound interest, you’ll need to move funds to Grow Jars (Portfolio Jars), which aren’t FDIC-insured.

- Douugh Doesn’t Offer Credit Score Monitoring (Yet). Douugh doesn’t yet offer any direct way to check your credit or monitor your credit score from the app. That could be coming soon, though.

- Douugh Doesn’t Offer a Credit Card (Yet). Douugh also doesn’t offer any credit products — no credit card, portfolio line of credit, or personal loan. Douugh does tease a future “Credit Jar,” details of which may be forthcoming.

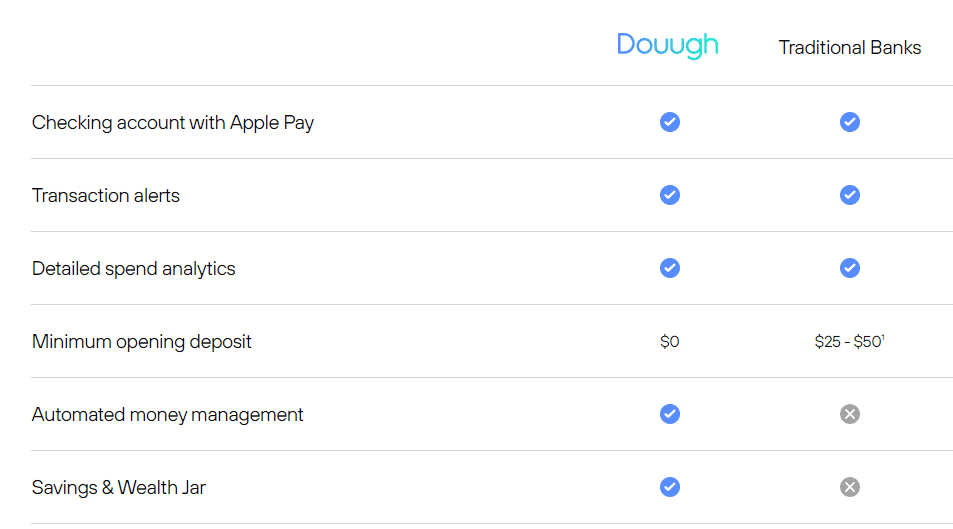

How Douugh Stacks Up

Douugh has plenty of competition. Though it has a lot going for it, it’s only one of many fintech apps that simplify day-to-day money management and investing.

Here’s how it stacks up against Chime, a top competitor.

| Douugh | Chime | |

| Debit Card? | Yes | Yes |

| Credit Card? | No | Yes, for building credit |

| Interest on Savings | None | Yes, competitive APYs |

| Investments Options | Yes, unlimited investment subaccounts | No investment options |

Final Word

Douugh is a mobile-friendly personal finance app that helps users automate their finances. It streamlines and brings order to a basic process of adult life — something we all have to do in one way or another, whether we like it or not.

For that alone, Douugh deserves praise. But the app goes far beyond mere budgeting automation.

With unlimited buckets (Jars) for short- and long-term savings goals, Douugh could be the only tool you need to create and execute a financial plan. With a seamless checking account and virtual card, Douugh could well replace your current bank. And with new products and services in development, Douugh only looks to get better.

Maybe it’s time for you to give Douugh a try.