In 2016, “adulting” – behaving like a responsible adult – made the short list for Oxford Dictionaries‘ Word of the Year. This term shows up a lot on social media, mostly among millennials talking ironically about mundane tasks like making dinner. Typical tweets might read, “Cooking an actual dinner! Not just spaghetti! #adulting,” or, “This is why you can’t put off laundry for a whole month #adulting.”

But all irony aside, these everyday skills are important to know. It can be a rude awakening to start life on your own and realize you have no idea how to cook a meal or do your laundry. If you’re just about to move out of your parents’ house for the first time, you’ll need to learn these vital skills before you head out the door.

Life Skills Every Adult Should Have

Moving into adulthood means doing a lot of things you’ve probably never done before. You’ll have a full-time job, complete with a paycheck. That means you’ll need to manage your own money, including paying bills and taxes. You’ll also have a place of your own, bathrooms to clean, and meals to cook.

Fortunately, none of these things is all that hard to do – but you do have to know how. Here are the top skills you’ll need to pick up in order to count yourself as a full-fledged adult.

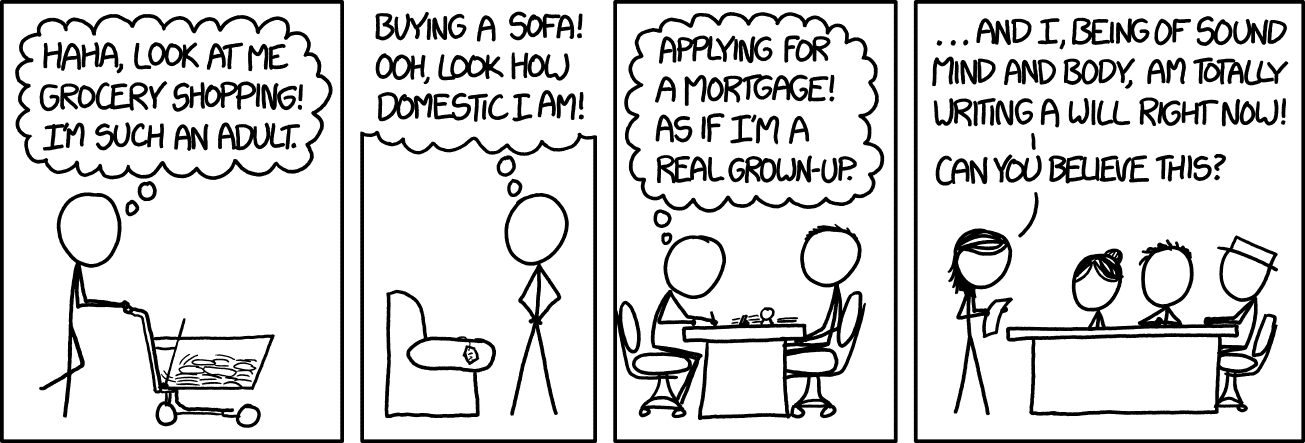

Pro Tip: If a stick figure can write a will, so can you. Use Trust & Will, the leading digital estate planning platform, to draw up a last will and testament that expresses your final wishes with the force of law. And if you have assets you’d like to keep out of the time-consuming probate process, turn to Trust & Will to create a revocable trust too.

1. Read a Pay Stub

If you’ve never had a full-time job before, you’re likely to be confused the first time you get your paycheck. Instead of a single number for the amount you’ve earned, you see over a dozen, with cryptic labels next to them. To help you cut through the confusion, here’s a quick guide to the parts of a pay stub and what they all mean:

- Identification. The top section of a pay stub contains identifying information. Typically, it includes your name and address, a Social Security Number (SSN) or some other employee ID number, and your employer’s name and address.

- Earnings. The section marked “Earnings” shows how much money you made. It shows how many hours you worked during a given pay period (typically one or two weeks), your hourly pay rate if you’re paid by the hour, overtime earnings (if any), and sometimes your year-to-date earnings.

- Taxes. This section shows how much you paid in taxes. First comes federal income tax, which can be marked as “FedTax” or “Fed Withhold.” There are also separate deductions for Social Security and Medicare. These can be listed together as FICA (Federal Insurance Contributions Act), or separately as OASDI/EE (employee share of Social Security) and MED/EE (employee share of Medicare). Finally, depending on where you live, you could see several deductions for state and local taxes. These can include state income tax (possibly marked as “withholding”), city income tax, state disability insurance (SDI), and family leave insurance (FLI).

- Tax Data. The section marked “tax data” or “tax filing status” shows your marital status and any allowances you get for yourself and your dependents. Make sure this information is right; if there’s a mistake, such as your employer listing you as married when you’re single, you could be paying way too much in taxes.

- Pre-Tax Deductions. This section shows all the money that comes out of your paycheck before your taxes. This lowers your taxable income, which in turn lowers the tax you pay. This section includes benefits like health, dental, and vision care. It also includes any contributions to a workplace retirement plan, such as a 401(k) or 403(b).

- After-Tax Deductions. In some cases, you could also have money taken out of your pay after taxes. For instance, if you pay union dues, these might be listed as an after-tax deduction. Another possible example is special benefits from your employer, such as reduced-rate life insurance.

2. Manage a Bank Account

Now that you’re earning money, you need a place to keep it. If you don’t already have a bank account, your first step is to choose a bank that’s right for you and open an account. Your choices include mega-banks with branches all over the country, smaller local banks, online-only banks, and credit unions. To decide which is right for you, consider factors such as the availability of local branches and ATMs, online and mobile banking services, the perks and limits of each bank’s accounts, types of bank fees the bank charges, the ease of reaching customer service, and other benefits, such as loans, credit cards, and investment products.

Once you have an account, you need to keep track of it. Back in the day, people used to “balance their checkbooks” every month to make sure the amount they thought they had in the account was the same as the amount the bank thought they had. They had to write down every transaction they made in a paper check register, then check all those entries against their monthly bank statement. If the totals didn’t match, they’d have to go through everything again trying to track down the error.

Nowadays, when paper checks are rare and most transactions post quickly, this all sounds very quaint and twentieth-century. However, even in the modern world, it’s still important to keep a close eye on your account. First of all, it’s the only way to make sure you always have enough money in your account to cover all the transactions you make – including ones that are scheduled in the future. If you don’t keep an eye on your balance, you could get hit with a $35 overdraft fee on account of a $9 monthly Netflix payment.

And second, if someone’s managed to steal your debit card or hack into your account, you’ll be able to spot the fraudulent charges right away. That way, you can report them to the bank immediately and avoid major losses. If you report bogus debit card charges within two business days, the most you can lose is $50. However, if you wait two days after getting your statement, your liability jumps to $500 – and after two months, you could be on the hook for everything.

To avoid problems, log in to your bank account at least once a week to check your balance so you’ll know how much you can safely spend. At the same time, check the list of recent transactions. If you see any payments you don’t recognize, contact the bank right away to clear up the problem.

3. Pay Bills

Paying bills, like banking, has changed a lot in the modern world. Twenty years ago, you used to get a bill in the mail, write out a check to cover it, stick it in an envelope, and mail it. You also had to enclose a payment stub with your check and line everything up in the envelope so the mailing address was displayed correctly. And you had to make sure to do all this at least a few days before the bill was due so your check would arrive in time.

Now, in most cases, you can receive and pay bills online. Instead of getting a paper bill, you get an email telling you to log on and download your bill from the service provider’s website. You can then pay it directly through the site, through your bank’s online bill payment portal, or through a third-party service. All these sites will walk you through the steps to pay your bill and have the payment transferred straight from your bank account.

Online bill payment is a lot faster than the old-fashioned method. The downside is that when you get all your bills online, it’s easier to forget about paying them. Unlike a paper bill that’s sitting right in front of you, an emailed reminder can easily get lost or forgotten in your overflowing inbox.

Here are a few ways to manage your bills so you’ll be sure to pay them on time:

- Flag the Message. Whenever you get a bill notice by email, flag it in your email program. For example, in Thunderbird, you can mark an email with the “Important” tag, and the subject line will turn bright red. That way, it catches your eye every time you look at your inbox, so you won’t forget about it.

- Have a Bill-Paying Night. Set aside a specific time each week for dealing with bills, such as every Monday evening. Ideally, you should do this at the same time you check your bank balance, so you’ll know you have enough money to cover all the payments. Then you can go through your messages, find all the bills, and deal with them all at once.

- Use Reminders. Budgeting and banking apps can send you reminders when a bill is due. Then you can log in and pay them immediately. The app can also warn you if you need to transfer more money to your account before paying.

- Do It Automatically. Many service providers let you set up automatic bill payment plans. The minute a bill comes in, the money comes straight out of your bank account to pay it. This saves you the trouble of logging on and paying them, but it also has drawbacks. For one, there’s a risk that you might overdraw your account if you haven’t left enough money in there to cover a payment when it comes due. Also, you don’t get a chance to check the bill for accuracy before paying it. This makes it harder to catch errors and fraudulent charges and dispute them.

4. Use Credit Sensibly

Millennials are a lot more cautious with credit cards than the generations before them. In fact, a 2016 Bankrate study found that two out of three millennials don’t use them at all. Instead, they tend to make purchases with debit cards or mobile payment systems, such as Apple Pay or Android Pay.

Avoiding credit cards is a smart choice in one way: It helps you avoid the dangers of credit card debt. According to CreditCards.com, the average American adult with credit cards owes more than $5,000 on them. When you look specifically at users who routinely carry a balance on their cards, that amount shoots up to over $7,500.

However, credit cards have advantages as well as disadvantages. For instance, they offer better protection against theft and fraud than debit cards. Also, many credit cards offer perks like purchase protection, extended warranties, and rewards programs. And there are some businesses, such as hotels and car rentals, that won’t let you make a reservation without one.

A longer-term problem is that going without credit cards makes it difficult to build a credit history. That makes it difficult to get any other kind of loan, such as a car loan or a mortgage – which, in turn, could keep you from buying a home down the road. Plus, even if you never borrow money, your credit rating still affects your life. A good credit score can help you get better rates on auto insurance and even make you more attractive to employers.

It makes most sense to go ahead and use a credit card – but carefully. See this list of the best cash back credit cards to find the right option for you. Then, be sure to follow the ways to get the benefits of credit cards while avoiding their pitfalls:

- Always Pay Your Balance in Full. If you carry a balance on your cards, you end up paying around 15% interest on every purchase. Over time, those interest payments pile up, and you can end up deep over your head in debt. Paying the whole balance every month is the best way to stay out of trouble.

- Think Carefully About Purchases. Some studies show that consumers are more likely to overspend when they pay with plastic. However, this doesn’t happen in situations where people are forced to think carefully about the value of what they’re buying. When you shop with a credit card, always keep an eye on costs. Thinking about the total price of what’s in your shopping cart will help you avoid careless spending.

- Watch Out for Sneaky Fees. Credit cards hit users with fees at every opportunity. To avoid them, read your card’s terms carefully. Always watch your balance to avoid over-limit fees, and make payments on time. And avoid cash advances and balance transfers, which almost always come with a hefty fee.

5. File a Tax Return

Filing a tax return is near the top of the list of things Americans hate to do. In a 2017 survey by Wallethub, 40% of Americans said they would rather change a baby’s diaper than do taxes, 24% would rather miss a connecting flight, and 12% would rather spend a night in jail.

However, the truth is, for most young people, taxes aren’t that hard. If you’re filing for the first time, there’s a good chance you’ll be able to use the simplest form, the 1040EZ. This form is only one page long and can be completed either online or the old-fashioned way – on paper – in under an hour. The only tricky part is figuring out whether you can take the Earned Income Credit (EIC).

You can use the 1040EZ if:

- You’re either single or a married couple filing jointly

- You have no dependents

- Your income is under $100,000

- You have no business or investment income, and your interest income is no more than $1,500

- You are claiming no tax credits other than the EIC

If you don’t meet these requirements, you’ll have to use the more complicated Form 1040A or 1040. However, there are still ways to make the process easier. There are several free online tax prep services that can guide you through the process. Just be aware that some of these “free” programs actually charge a fee to file the tax return for you, and most of them charge an additional fee to file a separate state tax return.

6. Make a Budget

When you ask people to name their best strategies for saving money, making a budget is at the top of the list. In a 2016 poll by Claris Finance, 42% of all respondents – and more than 95% of those who had tried it – said keeping a budget helped them save.

When you have a budget, you can see exactly where all your money is going each month. You can figure out how much you can afford to spend on your biggest expenses – housing, food, transportation – and how much you can put into savings. And, if you have debt, you can keep track of your progress toward paying it off.

The hardest part is getting started. Here’s a quick outline of how to make your first budget:

- Write Down Your Earnings. Figure out how much you earn in a month from wages, tips, and so on. You can make a budget to cover any time period, but one month works well because so many expenses are paid monthly.

- Write Down Your Expenses. Write down everything you spend money on in a month. For fixed expenses, such as rent, write down the amount you pay each month. For expenses that vary, such as groceries, figure out the average you pay in a month. And for expenses that only come due once in a while, such as auto repairs, figure out the yearly cost and divide it by 12. Include all major categories, such as transportation, healthcare, and debt payments.

- Plan for Savings. Make sure to include a line in your budget for savings. If you plan to save “whatever’s left” at the end of the month, there’s a good chance you’ll never have anything left. Instead, pay yourself first: Treat savings as an expense and take money out for it ahead of everything else.

- Balance the Budget. Add up your income and your expenses. If the amounts match, you’re in good shape. If income is higher than expenses, even better – you can take the extra and add it to your monthly savings. If expenses are higher than income, look for ways to cut back – or, if you can, earn some extra money.

- Adjust as You Go. Your first attempt at a budget is just that – a first attempt. Chances are, you’ll need to adjust it over time. Keep track of what you spend each month, and if you need to, move dollars from categories where you tend to come in under budget to those where you go over.

If you have trouble sticking to your budget, try a different method. Many people find envelope budgeting helpful because it physically sets aside the amount of money they can spend in each budget category, so there’s no way to go over. Or, if your income varies from month to month, try zero-based budgeting. It bases your spending on how much you made the previous month, so you don’t have to worry about falling short if you earn less the following month.

7. Carry Insurance

No matter how carefully you budget, there will always be some expenses you can’t handle. A house fire, a car accident, or a major health problem could wipe out all your assets in one stroke – and then some. That’s why you need insurance.

There are three main types of insurance that most people need. Home insurance – either homeowners insurance or renters insurance – protects you in case of fire, theft, or accidents in your home. Auto insurance protects you from loss caused by car accidents. Lastly, health insurance covers the cost of expensive medical care.

There’s no denying that insurance can be expensive. However, there are several tricks that can help keep the costs down:

- Shop Around. When you’re shopping for an insurance policy, get quotes from several different companies. You can usually get a quote on the insurer’s website by entering some basic information about yourself and your needs. To save time, you can use a comparison shopping site. You enter your information once, and the site forwards it to several insurers who contact you with quotes. You can also use the health-plan finder at HealthCare.gov to compare health insurance policies.

- Trim Your Coverage. Sometimes, the top-of-the-line policy is more than you realistically need. For instance, every car driver needs liability insurance, which covers you for damage you cause in an accident. However, if you drive an older car, you can probably do without collision coverage and comprehensive coverage, which cover damage to your car. Dropping this coverage can cut the cost of the policy by as much as 50%.

- Raise the Deductible. Most insurance policies have a deductible – a fixed amount that you have to pay out of pocket before your insurance coverage kicks in. Typically, the higher you make this deductible, the less you’ll pay in premiums (monthly payments). To keep your insurance costs down, set your deductible to the highest level you can handle. This can save you hundreds on your premiums each year.

- Be a Better Risk. Insurance companies charge less to people they think are less likely to make a claim. For example, young and healthy people pay less for health insurance. You can’t change your age, but you can lower your insurance costs by adopting healthy habits, such as quitting smoking. Likewise, you’ll pay less for auto insurance if you can show that you’re a safe driver.

8. Rent an Apartment

Nothing makes you feel more like an adult than moving into a place of your own. Often, the hardest part isn’t leaving home – it’s finding the right apartment. Finding a place you can live with, and can afford on a starting salary, can be a big challenge.

To make it a little easier, break the process down into steps:

- Set Your Budget. To get a quick estimate of how much rent you can afford, take your monthly income and multiply it by 30%. This is the amount the Department of Housing and Urban Development sets as the upper limit for affordable housing costs.

- Choose a Neighborhood. Next, figure out what areas you’d be willing to live in. The ideal neighborhood is reasonably safe and convenient to your workplace, but still in your price range. If you can’t find any areas that fit these requirements, see if you can bring the price down by finding a roommate. Sharing a two-bedroom apartment with a roommate usually costs less than having one bedroom all to yourself.

- Hunt for Apartments. Finding the right place can take a while, so give yourself plenty of time for this step. Search the “apartments for rent” section in newspaper want ads and Craigslist, and check out apartment-search sites like Rent.com. When you find a listing that seems to fit your needs and your budget, make an appointment to go look at it. Seeing the place for yourself is the only way to make sure it’s safe, clean, and in good condition. You can also talk to the other tenants about how they like the building and the landlord.

- Fill Out an Application. When you find a place you like, the next step is to fill out an application. Be prepared to provide information about your income, as well as references to your character.

- Read the Lease. If you get the apartment, read through the lease agreement carefully before you sign it. It should cover details like when the rent is due, what happens if it’s late, how much the security deposit is, and rules about guests, pets, smoking, and so forth. Make sure you know and understand all the rules before you put your name to it.

- Move In. Now comes the fun part: moving into your new place. If you’ve never had your own place before, you probably don’t have that much furniture, so you can likely pack and move your belongings with help from some friends instead of hiring movers. The place is likely to look a little bare at first; however, yard sales, Craigslist, and thrift stores are good places to find cheap furniture and accessories to fill the space.

9. Clean Your Apartment

Having an apartment of your own means you also have to clean it on your own. You could pay someone to do it for you, but that can get expensive – about $100 per session, according to Home Advisor.

If you’re used to having only one room of your own to keep clean, trying to take care of a whole apartment can feel overwhelming. However, the job becomes a lot more manageable if you do a little bit at a time. If you clean one small area every day, the mess never builds up to the point that you can’t face it.

There are some cleaning jobs it’s best to do every day, such as making your bed, washing dishes, and putting away clothes. Bigger jobs like vacuuming, dusting, or cleaning the bathroom only need to be done weekly or even monthly.

A cleaning schedule can help you stay on top of these once-in-a-while jobs. The idea is to assign one or two cleaning tasks to each day of the month so you never have to do too much at once. It’s also a good way to split up chores between you and a roommate so you’ll each do your fair share. You can make your own cleaning schedule or use a ready-made chart like this one from Apartment Therapy.

Of course, knowing when to clean isn’t the same thing as knowing how. Some jobs, such as wiping a counter, are kind of self-explanatory, but others are more complicated. If you’re not sure how to tackle a particular cleaning job, try searching sites like Apartment Therapy and The Spruce. They’re full of useful articles that can fill you in on the nitty-gritty of how to clean a bathroom, mop a floor, or change a vacuum-cleaner bag.

10. Do Your Laundry

The first time I ever used a coin laundry, I was away from home on a summer study program. A friend and I decided to combine all our white and colored clothes into one big load to save money. I recalled that white clothes were normally washed in hot water and colored clothes in cold, so we decided to compromise and wash everything on warm. The result: a red T-shirt bled in the wash, and we both wore pink socks for the rest of the time we were there.

If you want to avoid a problem like this, you need to check the tags on your clothes before you wash them. They’ll explain what kind of care each garment needs. Usually, the instructions are in plain English – for example, “machine wash warm, tumble dry low” – but sometimes they’re spelled out in cryptic symbols. This guide from the cleaning company Persil lists the most common washing symbols and what they mean.

Typically, the label lists the hottest wash and dry temperatures that the clothes can handle. Thus, if it says “machine wash hot,” that doesn’t mean you have to use hot water – just that you can. This means you can save money on laundry by washing all your clothes in cold unless they’re especially dirty. Similarly, clothes that say “tumble dry high” can safely be dried on low speed or air-dried.

However, if the tag says a garment needs special handling – for example, “gentle cycle” or “dry clean only” – take it seriously. It’s a lot cheaper to take that expensive jacket to the cleaner than to replace it because it shrank in the dryer. Similarly, pay attention to tags that say clothes should be washed “with like colors” – that’s a good sign the dye is likely to bleed.

11. Cook a Meal

If you’ve never cooked for yourself before, it’s tempting to decide you just won’t bother. You can always eat out for most of your meals, or rely on convenience foods like canned soup and frozen dinners. Unfortunately, doing this is a good way to blow your food budget. Convenience foods aren’t as costly as restaurant meals, but they’re a lot more expensive than cooking for yourself – and most of the time, they’re not that healthy or tasty, either.

The good news is that cooking your own meals doesn’t have to be a lot of work. The old saying “anyone who can read can cook” isn’t quite true, but anyone who can read can learn to cook with a little effort. Here’s how to get started:

- Find Some Recipes. The first thing you need to cook your own meals is some good recipes. One good cookbook for people on a budget is “Good and Cheap” by Leanne Brown, which is full of recipes you can make on just $4 a day. It’s available in both English and Spanish, as either a bound book or a free PDF. You can find other good cookbooks for newbie cooks by searching “cookbooks for beginners” online. Cookbooks with “college” in the title are also good bets. Finally, you can find lots of cheap and easy meal ideas on cooking sites like AllRecipes.

- Start Simple. Once you’ve found a cookbook you like, start out with some of the simpler recipes in the book to build up your skills. As you get more confident, you can work your way up to the more complex ones.

- Use Some Prepared Foods. Cooking for yourself doesn’t have to mean cooking everything from scratch. There’s nothing wrong with combining fresh ingredients with prepared ones, such as canned chicken broth or pasta sauce from a jar.

- Cook What You Like. There’s no point in cooking kale because it’s good for you if you know you won’t eat more than a few bites of it. Instead, choose some other veggie that you actually like.

- Invest in Useful Tools. There are a couple of useful kitchen gadgets that can make cooking for yourself a lot easier. For example, a microwave is handy for heating up leftovers, thawing meat, and cooking veggies quickly. A slow cooker is also a great tool for busy cooks. You can throw in some ingredients in the morning and have a hot meal waiting for you when you come home from work.

- Save Your Leftovers. One problem with cooking for yourself is that most recipes are designed to feed two to four people. However, you can turn this to your advantage by saving your leftovers. You can take a portion to work for lunch or warm it up for dinner on a day when you don’t have time to cook. And if you don’t feel like eating the same thing for several days, you can store the leftovers in the freezer to reheat whenever you need a quick meal.

12. Shop for Groceries

If you’re going to cook your own food, you also need to know how to shop for food. This isn’t a complicated job, but it takes a little planning. If you just walk into the store and grab whatever looks good, you could walk out with two avocados, a container of yogurt, a coffee cake, and no idea what to make for dinner.

The best way to avoid this problem is to make a list before you go to the store. By planning out your shopping trip, you’ll save time in the store and also save money on groceries. Here’s how:

- Check the Sale Fliers. If you get a grocery store flier in the mail, check it first to see if there are any especially good deals. If there are, plan out meals that will take advantage of them. For instance, if there’s a sale on chicken, you could plan to make roast chicken and chicken pot pie.

- Choose Your Recipes. Next, flip through your cookbook and decide which meals you’d like to make. Start your shopping list by writing down the ingredients you’ll need for those dishes. As you plan, think about how much of each ingredient you’ll need to buy and how long it will keep. For example, if you have to buy a whole bag of spinach to use half of it in a spinach salad, make sure you have a plan to use up the rest before it goes bad.

- Add Staples. Check your fridge to see if you’re running low on any staple foods – that is, things you use regularly, such as eggs, milk, or cereal. If you are, add these to the list as well.

- Shop With Purpose. When you get to the store, check the signs on each aisle to see which ones have the items on your list. Go into those aisles only instead of cruising up and down each aisle. This saves time and helps you avoid costly impulse buys.

- Compare Prices. When you find an item you need, check all the brands on the shelf to see which one has the best price. In many cases, you’ll find that store brands offer better deals than big-name brands.

- Use Your Loyalty Card. If your grocery store offers a free loyalty card, sign up for one, and be sure to have it with you every time you shop. Handing over this card at the checkout gives you access to special deals that are only for cardmembers.

- Develop Your Saving Skills. As you become a more skilled shopper, you can move on to advanced tricks and tips to save even more money. Extreme couponing is one good example. Also, if you have several grocery stores in your area, you can make a grocery price book to keep track of which stores have the best deals on different items.

Final Word

Mastering these skills doesn’t mean you know everything you’ll ever need to know as an adult. There are many more things adults need to learn – but they vary from person to person. For example, if you drive a car, then you’ll need to know how to maintain that car – and, someday, how to buy a car when you need to replace it. On the other hand, if you don’t drive, you’ll need to know how to travel by bus and train to get from place to place.

Also, as an adult, you’ll eventually need financial skills beyond basic budgeting and bill paying. Depending on your situation, you might need to know how to pay off debt quickly – or, by contrast, how to establish credit for the first time. You’ll need to know how to use your workplace retirement plan if you have one, and how to start your own traditional or Roth IRA if you don’t. And no matter what kind of fund you use, you’ll need to learn how to choose investments wisely.

In the end, a lot of what you need to know as an adult depends on the adult you want to be. As you wend your way toward middle age, you’ll figure out more about what you want to do in life – and that, in turn, will tell you what skills you need to do it.

What skills do you think are most important for an adult to have?