Stock picking services are valuable tools for investors seeking appropriate investments and timing their market entry and exit.

These services are particularly attractive to beginners in stock trading and investors with limited time.

This guide outlines the ten best stock picking services for 2024. Our evaluation criteria include past performance, reputation, pricing, and target markets.

9 Best Stock Picking Services

Here are the best stock picking services to help you beat the market today:

- The Motley Fool Stock Advisor

- The Motley Fool Rule Breakers

- Seeking Alpha Premium

- Trade Ideas

- Moby

- Stock Market Guides

- Mindful Trader

- Wallstreet Zen

- Zacks

1. The Motley Fool Stock Advisor

Limited Time Promotion: Use coupon code SALE60 to receive a one-year subscription for $79.

- Designed For: Buy-and-hold investors

- Cost: $79/year

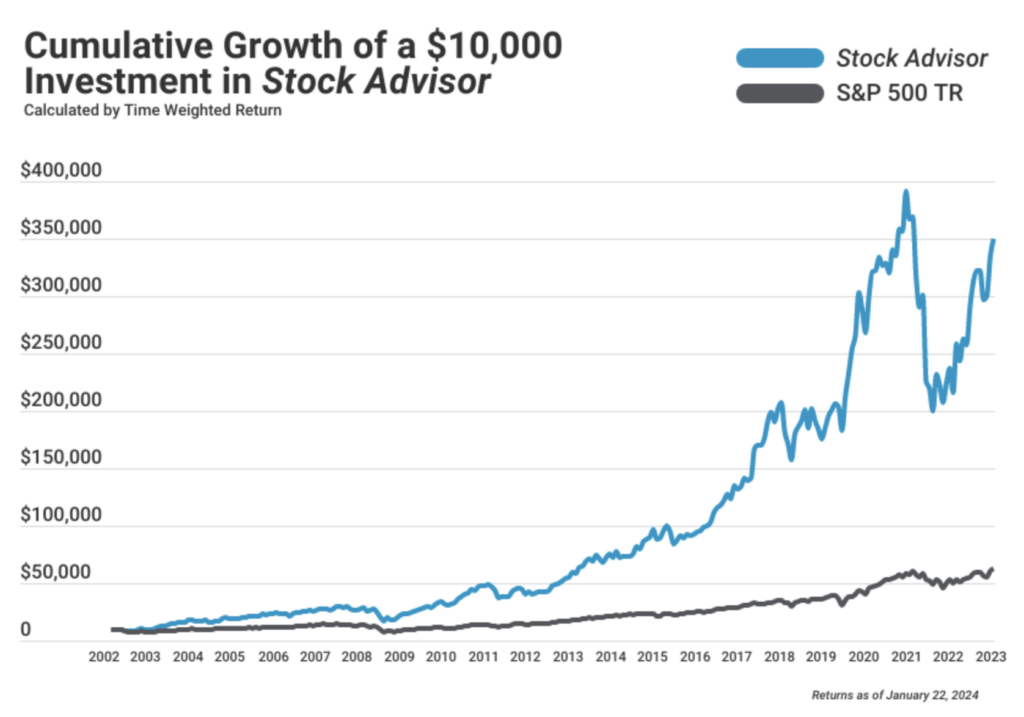

- Past performance: Returns 468% versus S&P 124%

The Motley Fool has been around for roughly three decades and has earned its place at the head of the table among long-term stock pickers.

The Motley Fool showcases that their Stock Advisor picks have delivered nearly four times the returns of the S&P 500 since their inception. That’s a cumulative return of 468%, far higher than the S&P (124%). That makes for a pretty impressive visual:

Further reinforcing the integrity of their approach, they urge you to commit to three investing principles when you enroll:

- Own at least 25 stocks.

- Hold your stocks for at least five years.

- Expect market downturns every five years.

The Motley Fool was founded in 1993 by two brothers, David and Tom Gardner. In the decades since, the two brothers have written four bestselling books, partnered with NPR for investing radio segments, and launched a series of wildly popular podcasts.

With over 1,000,000 subscribers, their Stock Advisor service has performed spectacularly by any standard.

The service includes four monthly newsletters, starting on the first Thursday of the month and then arriving weekly.

The first and third newsletters contain a new stock recommendation, and the second and fourth Thursday newsletters contain five New Best Buy Now stock picks. The latter comprise previous picks that they still recommend as strong buys.

When market conditions change, subscribers receive “sell” recommendation emails in real-time. Subscribers also get access to Fool’s “Top 10 Best Stock to Buy RIGHT Now” report and their “Top 5 Starter Stocks” that they recommend for all new investors.

The Stock Advisor subscription costs $199 per year. But for a limited time you can use coupon code SALE60 to receive a one-year subscription for $79. With its 30-day money-back guarantee, you can try an entire monthly cycle before deciding whether to continue.

For more information, see our full review of The Motley Fool Stock Advisor and its services.

2. The Motley Fool Rule Breakers

- Designed For: Buy-and-hold investors

- Cost: $299/year

- Past Performance: Returns 224% versus S&P 500 105%

The Motley Fool offers more than its flagship Stock Advisor subscription. The Rule Breakers newsletter features “hidden gem” growth stock picks, particularly companies poised to disrupt their industries.

Since its inception in 2004, the Rule Breakers stock picks have returned 224%, according to The Motley Fool. That’s in contrast to the S&P 500’s 105% over the same period.

If that sounds weaker than the Stock Advisor’s pick returns, remember that the Stock Advisor launched several years earlier.

The Rule Breakers stock picks tend to be up-and-comers rather than established mega-corporations. This adds an element of risk, so consider Rule Breakers only if you’re looking for scrappy growth stocks that the wider market hasn’t discovered yet.

Like Stock Advisor, subscribers receive stock recommendations on the first and third Thursdays of the month and five New Best Buy Now stocks on the second and fourth Thursdays. You also get sell notifications in real-time and access to The Motley Fool’s Starter Stocks.

At $299 per year, Rule Breakers costs a bit more than Stock Advisor, but you get the same 30-day guarantee.

3. Seeking Alpha Premium

- Designed For: Buy-and-hold investors, day traders

- Cost: $239 per year

- Past Performance: Beats the S&P 500 annually

Limited Time Offer: From March 27th-April 3rd, Seeking Alpha Premium will be priced at $179 (25% off!)

Seeking Alpha Premium is a powerful package of market intelligence tools designed to help you become the best investor or trader — or both — you can possibly be.

Seeking Alpha Premium delivers:

- Unlimited access to premium content created and curated by Seeking Alpha’s deep stable of expert contributors

- Seeking Alpha Author Ratings and Author Performance Metrics

- Proprietary quant ratings are available nowhere else

- Unlimited earnings call audio and transcripts

- Powerful stock screeners

- Article sidebars with key data, charts, and ratings

- Tracking for each investment idea’s performance

- And much more

4. Trade Ideas

- Designed For: Day traders

- Cost: $84/month – $167/month

- Past performance: Average returns of 20% annually

The software platform Trade Ideas uses an artificial intelligence named “Holly” to generate real-time trade recommendations for subscribers. Made up of more than 75 proprietary algorithms, Holly runs more than 1 million simulated trades each night before the trading day starts.

She then proposes stock trade picks in real-time, along with recommended entry and exit points. That delivers a complete day trading plan for each pick.

Trade Ideas also features its own internal broker, so you can authorize Holly to execute trades on your behalf rather than buying or selling manually through your own separate brokerage account. You can also link external accounts with Interactive Brokers and E*Trade to have all your trades in one place.

One particularly nice feature that Trade Ideas includes is their simulated trading option. It lets you trade with fake money and build your comfort level before you start slinging your hard-earned cash around the market.

5. Moby

- Designed For: Stock and Crypto Traders

- Cost: $8.33 per month to $29.95 per month

- Past Performance: Over 250%

Moby Finance was founded in 2020 to make complex investing information accessible and straightforward.

Content on Moby is informed by the expertise of former hedge fund analysts, who offer insights that are suited to beginning stock investors and more seasoned traders.

A Moby subscription comes with a comprehensive lineup of services, including weekly stock picks, market alerts, courses and lessons, newsletters, and rankings. Moby notes that its average Premium picks have returned over 250%.

It also has an excellent Trustpilot rating and a host of positive reviews highlighting its easy user experience, engaging reports, and solid stock picks. New users can currently save money by purchasing an annual subscription for $179.

6. Stock Market Guides

- Designed For: Swing traders, long-term investors

- Cost: $49/month

- Past performance: Beats the S&P 500 annually

Stock Market Guides is built on a proprietary backtesting software that has been used to analyze over 10 million stocks and options using Finhub and EODHD data.

All of the platform’s picks have historically beaten the average return of the S&P 500. The average backtested return for the Pre-Market Stock Picks and Market Hours Stock Picks is 72% and 89%, respectively.

Once you subscribe to the service and select your trade length preferences, Stock Market Guides will start emailing you daily alerts. There’s also a newsletter featuring trading analysis, and you can access trade alerts from your dashboard.

Each alert features the historical performance of the stock or option being recommended. The platform also offers tutorials on different trading strategies, such as its specialty, swing trading.

You can subscribe to four types of alerts, including pre-market stock picks and option picks, and market hours stock picks and option picks. Each one costs $49/month, and you can cancel at any time.

7. Mindful Trader

- Designed For: Swing traders

- Cost: $47 per month

- Past performance: Average returns 141%

The beauty of Mindful Trader is that you don’t need to stay on standby waiting for trade alerts constantly, making it one of the best stock picking services.

The recommended swing trades take up to 10 days between buying and selling, so you can buy anytime during the trading day. That’s a crucial perk given that most of us can’t glue our eyeballs to the screen all day waiting for alerts to pop up.

Eric Ferguson, the founder of Mindful Trader, put decades of stock market data through statistical analysis to create an algorithm that alerts him — and you — to high-probability market movements. He includes stock trades, futures trades, and options trades. More recently, he also added a stock equivalent to his futures trades, so you can mimic them even if you don’t want to hassle with trading futures.

Eric updates his website for logged-in subscribers when he executes a trade, so you can do the same in your own brokerage account. He makes the majority of his trades within the first half hour of the markets opening every day, so you can simply check the site once daily. These swing trades aren’t nearly as time-sensitive as faster day trades.

I also like the backtest review of Mindful Trader’s hypothetical returns. Over the last 20 years, Eric’s trading system would have yielded an average annual return of 141%. You can view the year-by-year return breakdown here.

I’ve personally been following Eric’s trades for around nine months now. During that time, I’ve earned an annualized return of 31.2%.

That doesn’t mean you won’t have losses some months. All traders know the stomach-dropping feeling of a string of losing trades. In Eric’s backtests, the median account drawdown was 24%.

That’s nothing to take lightly. I can personally attest to how jarring it is to go from thousands of dollars up for the month to thousands of dollars down, all within a window of just a few days.

Mindful Trader charges a monthly subscription fee of $47. Although not cheap per se, it’s less expensive than many competitors. The monthly billing interval means you can try it for a month or two and then cancel without losing a fortune if you don’t like the trading style.

8. WallstreetZen

- Designed For: Part-time investors

- Cost: $19.50 per month billed annually

- Past Performance: not disclosed

WallstreetZen is for the serious investor who isn’t quite a financial expert. Beyond simply shoving data in your face, WallstreetZen breaks it down, making it useful for everyday investors.

Investors have access to Zen scores, which are company scoring models made easy. Based on 38-data points, WallstreetZen helps investors find companies with great balance sheets, bright futures, and high yields.

Investors get access to one-line explanations of a stock’s performance, allowing you to make intuitive and fast investing decisions. You can also filter analysts, only seeing reports from analysts you trust and with a proven history. Get as detailed as seeing an analyst’s past performance history to determine the validity of what they suggest.

Other benefits include:

- Intuitive stock screener

- One-sentence explanations about stock moves

- Access to analysts with proven track records

9. Zacks

- Designed For: Technical traders

- Cost: $249/year to $2995/year

- Past Performance: 24.32% per year

Zacks Investment Research is one of the most well-known stock picking services. They provide technical and fundamental analyses and access to stock research reports, earnings estimates, and portfolio management tools.

The founder, Len Zack, created a scoring system that ranks stocks on a scale of 1 to 5 based on four factors:

- Agreement

- Magnitude

- Upside

- Surprise

Zacks covers stocks, mutual funds, and ETFs, covering over 10,000 stocks. Zacks has a free plan that provides access to limited articles, email alerts, and Zank Ranks and Styles Scores.

The paid versions provide access to stock screeners, recommendations, and Zack’s ranking list. However, Zack’s doesn’t provide personalized recommendations, and the platform is only for research; it doesn’t work with any platforms, so you must execute the trades yourself on your chosen platform.

What are Stock Picking Services?

Stock-picking services do exactly what they sound like — they pick specific stocks they believe will outperform the broader stock market. They recommend that you act on or ignore those stocks as you see fit.

They sound straightforward, and they are, but many new investors confuse them with similar-sounding services.

For example, stock screeners are tools that help you filter down the thousands of available stocks to a manageable few based on your precise criteria.

Stock scanners, while related, are another type of online investing tool that streams stock-related data and alerts in real-time.

And, of course, online stockbrokers offer the actual mechanism for buying and selling stocks online.

Keep in mind these services often overlap. Most stockbrokers offer stock screener tools. Some stock screeners offer real-time stock scanning.

What to Look for in Stock Picking Services

As with everything else, some stock-picking services are better than others, and everyone has different reasons for their choice of the best stock-picking service.

But stock pickers don’t simply vary based on quality. They also vary in focus.

Many specialize in serving day traders or swing traders, helping them identify stocks poised to jump or drop sharply that day or during the following week. Others serve long-term buy-and-hold investors, recommending stocks they believe will grow quickly in the years to come.

First and foremost, look for stock pickers with a strong track record of beating the market. No stock picker will get every call right, but the astute ones prove to be right far more often than wrong.

Before taking investment advice from any stock picker, verify their bona fides in the form of a track record. Compare their picks’ returns to the market at large whenever possible. It doesn’t matter if their picks saw 30% growth last year if the market grew by 35%.

The longer that track record, the better. Look for experience in your stock pickers, as a year or two of good picks could come down to luck. Twenty years of strong picks indicate skill.

Take a close look at stock pickers’ integrity as well. Ethical and transparent stock pickers never mislead their audience by recording trade wins but by leaving losing trades open, for example, and only reporting the closed wins.

Likewise, they never record profits before having them executed and in hand. They don’t claim wins for hypothetical historical profits they didn’t actually earn, saying, “Our system would have earned a 1,000% profit over the last ten years!”

Look for credibility and transparency indicators like free trial periods and money-back guarantees. It always helps to try a service before committing your money permanently.

Finally, make sure you understand their stock-picking strategy. Reputable stock pickers explain their approach and the data analysis they use, so do your homework to understand the stock picker’s methodology and ensure it aligns with your personal investing goals.

Advantages of Stock Picking Services

If you aren’t sure if stock-picking services are right for you, consider these advantages.

- Great for beginners: Investors not sure where to start or what data to use can benefit from stock pickers. You follow what the service tells you to invest in and get a hands-on lesson on investing.

- Passive investing: If you want to invest in stocks but don’t have the time to be a day trader, stock-picking services can help you choose your stocks fast, letting your portfolio grow without too much effort.

- Advice from experts: It’s not often you can get expert advice at a fraction of the cost of what it would cost to work with them in person. With stock picks sent directly to you, it’s much easier to pick your stocks confidently, knowing you have the backing of the experts.

Stock Picking Strategies

The best stock-picking services each have their own stock-picking strategies, but here are some of the most common.

Fundamental Data

Fundamental data is easy for even the beginning investor to understand and focuses on sales, earnings forecasts, gross margins, competitor analysis, and income growth. This focuses on a stock’s true value. When a stock’s price falls below its value, stock-picking services will generally suggest buying it.

Sentiment Data

Sometimes stock prices are driven by how society thinks, and that’s why some services use sentiment data. While this isn’t anything technical or fundamental and shouldn’t be the only method used for stock-picking, it can play a role, especially when the sentiment is high, and the stock has the potential to outperform its predictions.

Technical Data

Technical data is for the experienced investor who wants to get into the nitty-gritty of the stock’s historical performance. It doesn’t focus on a stock’s true value but instead on its historical patterns and predictions.

Final Word

Your likelihood of success as a day or swing trader depends on the quality of your information. Timely, accurate information makes profit possible for traders; without it, beating the market is next to impossible.

But beyond up-to-the-second financial alerts, traders and long-term investors alike also need help narrowing the field from thousands of stocks to a handful. That’s where stock picking services come in handy.

And, of course, they help in providing education. Trading or investing in individual stocks isn’t passive and easy like index fund investing. It requires deep knowledge and skill, and good stock picking services provide not just alerts and watchlists but a replicable system that any trader or investor can follow.

The promise is that if you follow the system, you can beat the market.