Pros

Earn up to 4% cash back (dining, entertainment & streaming)

Get 3% cash back at grocery stories (excluding Target® and Walmart®)

Excellent early spend bonus

Cons

Has an annual fee ($95)

Baseline cash back is mediocre (1%)

No bonus rewards on travel purchases

This offer is no longer available.

Savor Rewards From Capital One is a cash back credit card designed for people who like to eat. That’s pretty much everyone, right?

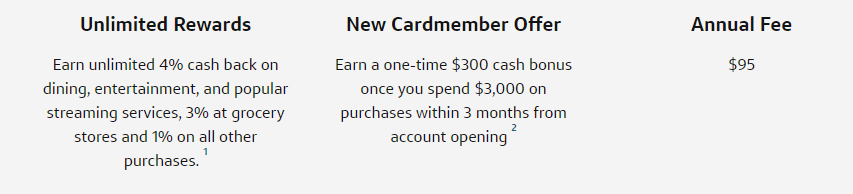

The headline here is unlimited 4% cash back on dining, entertainment purchases, and popular streaming services. That makes this one of the best credit cards for those seeking to save money eating out at restaurants. Grocery store purchases (excluding Target® and Walmart®) also earn cash back at an elevated rate: 3% unlimited. A juicy early spend bonus further sweetens the pot. The biggest drawback is undoubtedly the $95 annual fee.

If you’re looking for a no-frills, no-hassle cash back credit card that helps you save on everyday purchases, this product needs to be on your shortlist. If, on the other hand, you only occasionally eat at restaurants and/or splurge on entertainment experiences, bypass it in favor of the no-annual-fee SavorOne Rewards From Capital One credit card or forgo a dining credit card altogether.

What Sets the Capital One Savor Credit Card Apart

The Capital One Savor card has three benefits that really set it apart from the competition:

- 4% Cash Back on Dining and Entertainment Purchases. Savor is the best credit card for people who spend heavily on restaurant meals (including takeout) and entertainment. You won’t do better than 4%, not consistently anyway.

- Unlimited 3% Back on Grocery Purchases. Savor is an excellent credit card for people who spend a lot at supermarkets too. The 3% headline cash back rate isn’t the best you can do with a grocery store credit card, given the prevalence of supermarket bonus cash back offers, but the unlimited earning potential puts Savor in a class by itself.

- Generous Uber Benefits. Savor comes with complimentary UberOne membership, which can save you a boatload on Uber orders: up to 10% off Uber Eats deliveries plus no delivery fee on qualifying purchases. Plus, eligible Uber purchases get 10% cash back.

Key Features of the Capital One Savor Credit Card

These are the key features of the Savor card. Note the generous early spend bonus and solid cash back program, among other benefits.

Early Spend Bonus

When you spend at least $3,000 in eligible purchases within the first 3 months your account is open, you get a one-time cash bonus of $300.

Earning Cash Back

Capital One Savor has three main cash back rewards tiers:

- Eligible dining and entertainment purchases made at restaurants earn unlimited 4% cash back.

- Eligible grocery purchases made at supermarkets and other types of stores with the proper merchant classification (“grocery store” and variations) earn unlimited 3% cash back.

- All other purchases earn unlimited 1% cash back.

Select purchases earn higher rates of return, including Vivid Seats entertainment purchases (8%) and eligible Uber-universe purchases (10%). Capital One Savor has some additional Uber benefits, spelled out in more detail below.

Redeeming Cash Back

You can redeem your accumulated cash back rewards in any amount as a statement credit or check – your choice. You can also set up recurring redemptions at a set time of year or when you reach a certain dollar threshold: $25, $50, $100, or $200.

Other redemption options include credits against specific previous purchases and gift cards, but redemption values are subject to change at any time.

Complimentary UberOne Membership & Bonus Uber Cash Back

Savor has lots of “minor” perks, like access to the Capital One Travel booking engine and special dining perks through Capital One Dining.

One more-than-minor perk worth mentioning in detail is the complimentary UberOne membership and 10% bonus cash back on eligible Uber and Uber Eats purchases.

Check Capital One’s detailed description for the full story on UberOne, but here are the highlights:

- Unlimited $0 delivery fee on eligible food, groceries, and more on Uber Eats

- Up to 10% off eligible Uber Eats orders (in addition to 10% cash back)

- Up to 5% off eligible Uber rides (in addition to 10% cash back)

- Member-only perks and promotions

Bottom line: If you regularly order takeout from Uber Eats, get where you’re going in Uber ride-hailing vehicles, or otherwise utilize Uber’s services, Savor has you covered.

World Elite Mastercard Benefits

As a World Elite Mastercard product, this card comes with a slew of Mastercard-backed benefits, including:

- Extended Warranties: Mastercard doubles existing manufacturers’ warranties, up to 24 months extra, when you purchase the covered item in full with your card

- Complimentary Rental Car Insurance: You’re automatically entitled to complimentary loss and damage coverage for car rentals paid in full with your card when you waive the rental company’s offer of coverage.

- Concierge Service: This perk helps you get hard-to-get reservations, find entertainment and dining opportunities in unfamiliar places, and arrange complex travel or transportation transfers in the U.S. and abroad.

- Travel Accident and Baggage Delay Insurance: This modified form of travel insurance provides coverage in the event that you’re seriously injured or killed during common carrier travel, and when your bags are delayed to your destination for certain covered reasons.

- Price Protection: This benefit provides reimbursement when you find a lower marked price on a covered item paid for in full with your card within 120 days of the original purchase date. The per-claim limit is $250 and you’re limited to four claims in any twelve-month period.

- Trip Cancellation and Interruption Insurance: This is another travel insurance perk that reimburses you in the event that your trip needs to be canceled or cut short for certain covered reasons. See your explanation of benefits for exclusions and limitations.

Additional Benefits

Additional benefits backed by Capital One include:

- Premier Culinary Experiences: Get exclusive access to curated culinary experiences headlined by celebrity chefs.

- Exclusive Music Event Access: Score exclusive or VIP tickets to big-name musical events, including music festivals and shows headlined by A-listers.

- Sporting Event Access: Earn VIP or exclusive access and on-site perks at some of the year’s biggest sporting events.

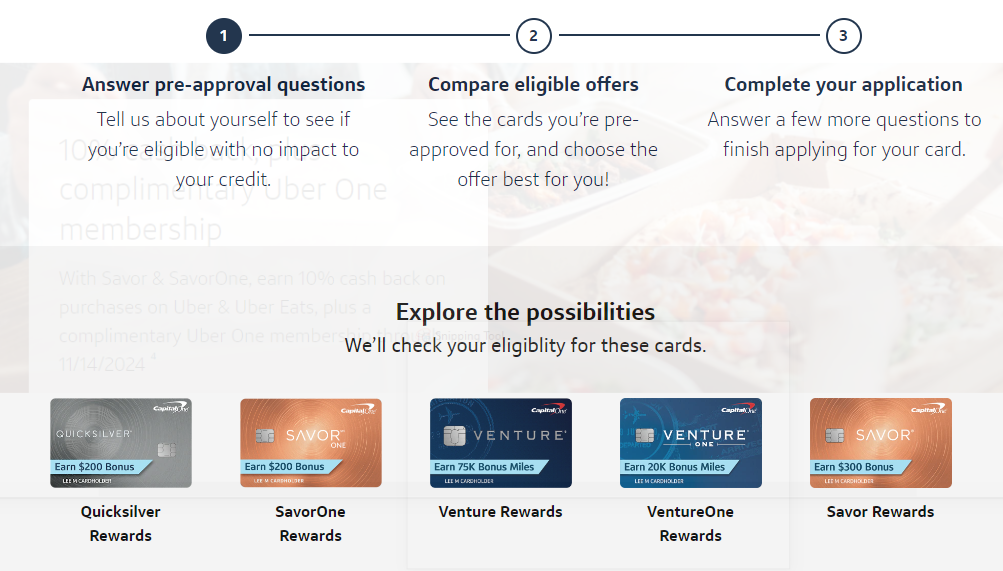

Preapproval Process for Capital One Cards (Including Savor)

One sort of overlooked benefit of Capital One (in general) is its slick preapproval process, which makes it super easy to find the right credit card without actually applying (and hurting your credit in the process).

The preapproval flow is a simple Q&A that susses out your preferences, gathers basic information about your credit and income, and then spits out credit card offers (potentially) for any (or all) of five popular Capital One names:

- Savor Rewards

- Quicksilver Rewards From Capital One

- SavorOne Rewards From Capital One

- Venture Rewards From Capital One

- VntureOne Rewards From Capital One

Important Fees

The annual fee is $95. There is no foreign transaction fee.

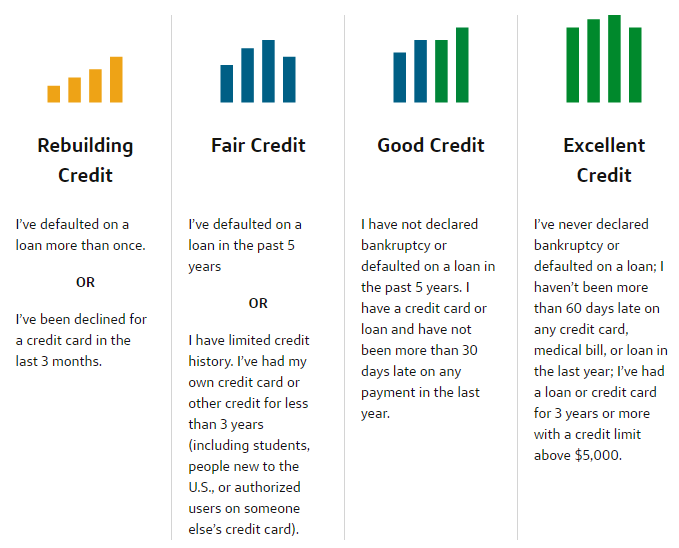

Credit Required

This card requires excellent credit. Capital One doesn’t specify a minimum credit score to qualify, but safe to say you’ll have trouble getting approved if your FICO score is below 700 (and probably more like 740).

Capital One is helpful enough to provide some details on what it means by “Excellent Credit,” the definition of which varies from issuer to issuer. Highlights:

- No bankruptcies on your credit report

- No loan defaults on your credit report

- No more than 60 days late on any relevant credit account in the past year

- At least 3 years of credit history

See how that compares to other credit quality tiers: rebuilding, fair, and good.

Advantages of the Capital One Savor Credit Card

Here’s why you should consider applying for the Savor card.

- Excellent Early Spend Bonus. This card’s early spend bonus is one of the best in the cash back category. You’ll qualify if you can spend at least $3,000 in eligible purchases within 3 months, which should be doable if you use this as your primary spending aid during that period.

- Up to 4% Cash Back. This card earns unlimited 4% cash back on dining purchases made at restaurants and most entertainment purchases. If you like to hit the town every once in a while, this is a fantastic tier.

- 3% Cash Back at Grocery Stores. Don’t overlook this card’s 3% category. Every dollar you spend at the grocery store earns 3% cash back, with no limits or restrictions. If you prefer cooking at home to dining out, Savor has you covered.

- No Foreign Transaction Fee. Savor doesn’t charge a foreign transaction fee. For cardholders who regularly venture outside the United States, this is a great way to save on international travel.

- Redeem Cash Back in Any Amount. You don’t have to wait to clear a cash back threshold to redeem your hard-won rewards. No matter how much or how little you have in your rewards account, you can pull the trigger and claim your cash whenever it suits you.

- Solid Mastercard- and Capital One-Backed Benefits. This card’s World Elite Mastercard benefits are great for frequent travelers and shoppers – basically, anyone who occasionally makes large purchases at home or on the road. The Capital One benefits, such as VIP or exclusive musical event access, are quite generous as well.

- No Penalty APR. This card has no penalty APR. That’s good news for cardholders who sometimes miss payment due dates through no fault of their own.

Disadvantages of the Capital One Savor Credit Card

Consider these drawbacks before applying for this card.

- Has a $95 Annual Fee. This card’s $95 annual fee is problematic for frugal consumers and those unable to spend heavily enough to offset the recurring charge.

- Mediocre Baseline Cash Back Rate. Savor’s baseline cash back rate is 1%. That’s a mediocre return on spending by any measure. If you’re looking for a higher rate on a wider range of spending types, check out Savor’s stablemate, Capital One Quicksilver Cash Rewards Credit Card. It earns an unlimited 1.5% on all spending, with no limits on how much you can earn.

- Cash Back Tiers Mostly Limited to Food-Related Purchases. Everyone needs to eat, but can you really build a credit card rewards scheme around the practice? If you’re looking for a broader-based rewards program, especially one that rewards you for travel, look to a more direct cash back competitor like Chase Freedom Unlimited or a travel rewards credit card like Chase Sapphire Preferred.

- No Introductory APR Promotion for Purchases. This card does not have a 0% APR introductory promotion for purchases. Contrast that omission with the long 0% APR promotion offered by Capital One Quicksilver.

- Requires Excellent Credit. This card requires excellent credit. If you have any noteworthy blemishes on your credit report, your application might be denied. Check your credit score for a better sense of what to expect.

- Can’t Redeem for Merchandise or Travel. You can’t redeem your accumulated cash back rewards for general merchandise or travel purchases (other than statement credits against specific travel purchases).

How the Capital One Savor Rewards Credit Card Stacks Up

The Capital One Savor Rewards Credit Card is arguably the best credit card on the market for frequent diners, and one of the best for people with big grocery budgets.

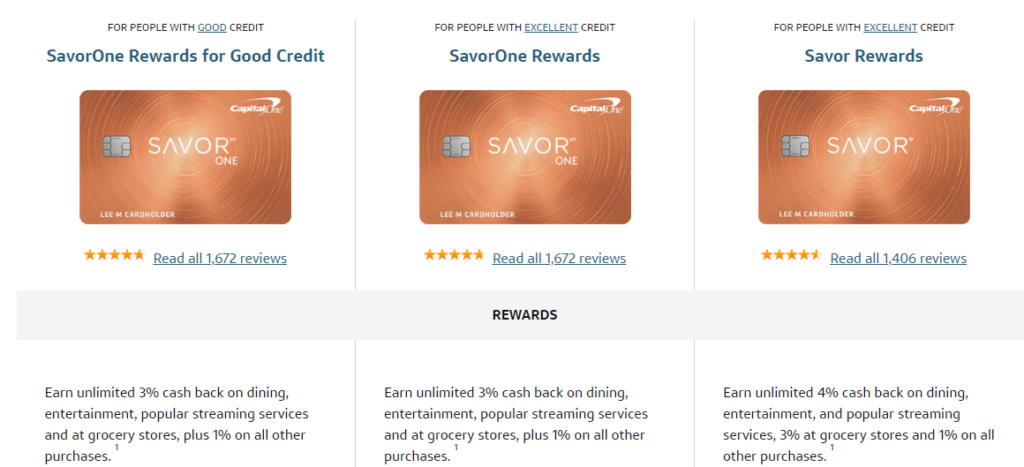

Not far behind is SavorOne Rewards From Capital One, a very similar product with a slightly less generous rewards program and no annual fee. See how the two compare.

| Savor Rewards | SavorOne Rewards | |

| 4% Cash Back | Dining, entertainment & streaming | None |

| 3% Cash Back | Grocery stores | Dining, entertainment, streaming & grocery stores |

| 1% Cash Back | Everything else | Everything else |

| Uber Benefits | Yes | Yes |

| Annual Fee | $95 | $0 |

Basically, if you dine out a lot and spend heavily on entertainment, Savor is the way to go. Otherwise, SavorOne is fine.

Note that there are actually two SavorOne credit cards: SavorOne Rewards for Good Credit and the original SavorOne card (for excellent credit).

Final Word

The Capital One Savor Cash Rewards Credit Card is one of a relative handful of credit cards that actively rewards dining out and eating in. It’s one thing home cooks and restaurant aficionados can agree on.

It’s not for everyone though. If you’re a fill-the-tank kind of eater, you might not spend enough on food to make this card worth your while. An airline or hotel rewards credit card could be a better fit. Only you can tell for sure what type of rewards scheme makes the most sense for you.

Pros

Earn up to 4% cash back (dining, entertainment & streaming)

Get 3% cash back at grocery stories (excluding Target® and Walmart®)

Excellent early spend bonus

Cons

Has an annual fee ($95)

Baseline cash back is mediocre (1%)

No bonus rewards on travel purchases