Real Estate

12 articles

The impacts of a mortgage appear as soon as you apply and continue until you sell or make your final payment. That’s why it’s important to understand exactly how homeownership affects your credit score and what you can do to minimize the potential negatives.

The worst part about foreclosure is losing your house, but the indirect financial fallout is pretty bad too. A foreclosure can cause your credit score to drop by 100 to 200 points, with much of the damage coming in the first two or three months after you first fall behind on your mortgage. If that’s

How much your apartment costs depends a great deal on where you live. Low-rent U.S. cities tend to be located in the Midwest, Mountain West, and South, where apartments remain affordable. Read on to learn the most affordable U.S. cities for renters to live in, and where you can find cheap housing.

Given the hefty upfront costs associated with purchasing a home, most young people begin their independent lives renting an apartment. As they build careers, save money, and start families, many choose to buy a home. On the other end of the age spectrum, homeowners nearing retirement may choose to sell their family homes, downsize, and become renters once

The age-old debate over the relative merits of renting or buying a home rages on. It’s doubtful that a definitive settlement is on the horizon. There are simply too many variables at play and too many unique factors affecting individual homeowners’ situations. But one thing is for sure: renting and homeownership both come with their fair share

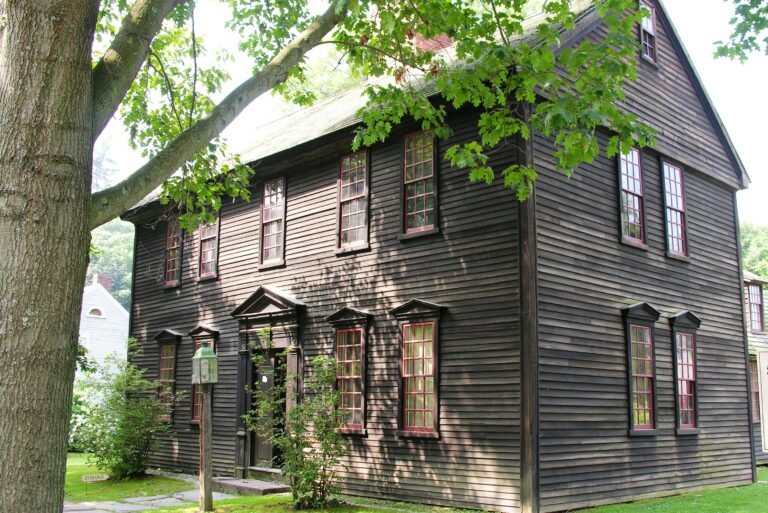

Older homes tend to feature a charm and character you just can’t find in new construction homes. But they also offer their share of problems. If you’re considering buying an older home, read on to learn the problems you might encounter, how to solve them, and why it might be worth doing so.

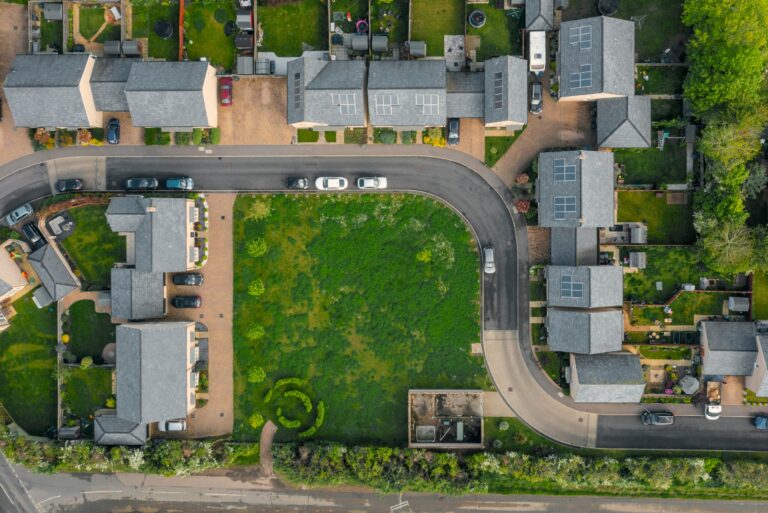

Buyer’s markets have relatively affordable prices, selling price discounts, and a comparatively slow pace of home sales. This is a list of the top buyer’s markets in the United States right now.

Relocating is an overwhelming prospect, even when the move is entirely voluntary. It’s that much more intense when you’re up against a deadline, like your first day at a new job or the start of the school year. Few endeavors demand as many rapid-fire decisions — or invite as much second-guessing. One thing you definitely

Your debt-to-income ratio is the percentage of your monthly income that goes toward debt payments. While the math is easy, knowing what to put in the formula isn’t as simple. Learn how to calculate your debt-to-income ratio to keep tabs on how attractive you are to lenders.

“I want to buy a rental property, but the numbers don’t work in the city where I live.” It’s a common conundrum for would-be rental investors. Affordability and returns on rentals in metropolitan coastal cities tend to be poor, yet that’s where many aspiring rental investors live. Fortunately, it’s easier than ever to buy rental

Want to transfer your house or investment property to a family member? Expect the legal question of how to deed a property to your children to quickly become a tax question about how to minimize gift taxes, capital gains taxes, and estate taxes. Learn how to navigate these complex issues.

It’s a big decision to join the military. Members of the Armed Forces face a slew of risks to their physical safety and psychological well-being. They make many trade-offs in their personal lives as well, from frequent moves to new towns around the United States to overseas deployments that challenge even the strongest families. To help offset

Trending stories

Explore Invest Money

You’re saving it. Now put it to work for your future.